Authored by Irina Slav via OilPrice.com,

U.S. shale changed global oil markets. It shook the foundations of OPEC as the one single swing producer group.

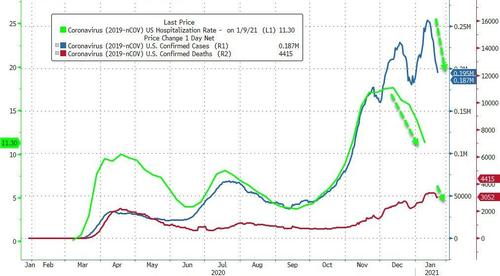

And last year, it crumbled under the weight of the pandemic that sent oil prices to all-time lows, including a short dip of WTI below zero. Now, shale is getting back on its feet, facing the temptation of production as prices rebound above $50.

Wood Mackenzie’s Vice Chair for the Americas, Ed Crooks, called it a siren song in a recent analysis. The shale boom happened because producers were chasing constant growth. It was this chase that catapulted the United States to the spot of the world’s largest oil producer, but it was also this chase that made the pandemic-caused slump in the shale patch quite spectacular.

Until about a month ago, most of U.S. shale was unprofitable, so producers stayed put—and probably wondered how they were going to keep paying the debts they’d accumulated while going for broke during the second shale boom. Now, at over $50 a barrel, a lot of shale oil is profitable again, at least according to the head of the International Energy Agency Fatih Birol.

But it’s not just him. Reuters earlier this week reported shale drillers have started hedging their future production at the current futures prices—another sign more shale oil is profitable at $53-54 a barrel.

Production remains subdued, for now. The national total averaged 11 million barrels daily as of the first week of January, unchanged on the previous week and down 2 million from a year earlier, according to the latest EIA weekly petroleum report. But the call of the siren could prove too tempting to resist.

The large producers are sticking to their cautious stance. As Pioneer’s president, Richard Dealy, told The Wall Street Journal last week, there is little motivation for production growth. The world does not seem to need more oil right now, he noted, so there is no reason to ramp up output.

The company’s CEO, Scott Sheffield, went further, saying during a webcast earlier this month that he did not expect U.S. shale to return to growth over the next few years.

“I never anticipate growing above 5% under any conditions,” Sheffield also said.

“Even if oil went to $100 a barrel and the world was short of supply.”

The shale major CEO explained this was because the service costs associated with adding more drilling rigs would undermine profit margins.

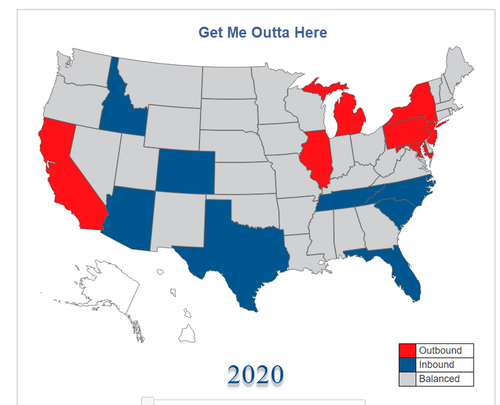

But these are the big operators. They can more easily afford to continue restraining production just like OPEC+ is doing. This might be more challenging for smaller companies with higher production costs and a lot of debt that needs to be repaid as banks grow cold to the fossil fuels industry and shale specifically due to its cash-burning habits.

OPEC recently said that it expected U.S. shale to rebound in the second half of this year, not least as a result of OPEC’s own efforts to control production amid the demand destruction wrought on the industry by the pandemic. Industry insiders also note the growing optimism among sector players.

Yet this optimism remains, on the whole, guarded. It may be a signal of a permanent change to how things are done in the shale patch: earlier this month, Concho Resources’ chief executive Tim Leach suggested the pandemic had changed the game for shale oil.

“For most of my career, we would reinvest all our cash flow and then show our success by how much we could grow our production,” he told Bloomberg.

“Well, that’s not how it’s going to work in the future.”

There is more than one reason for sticking up to a more disciplined approach to production control: shareholders want returns on their investments, not more barrels of oil, and banks want their loans repaid.

“Almost all the E&Ps would take more than 2.5 years to bring their debts down to a healthy level of about 20% gearing,” Wood Mac’s Ed Crooks said in his analysis, noting this would be true even if shale drillers kept production unchanged rather than growing it.

Indeed, there is very little motivation for production growth except the allure of higher prices. Yet this may vanish soon: forecasters are revising down their price projections for the medium term, expecting current price levels to linger. And while they may have made a big chunk of U.S. shale profitable, a lot of this chunk would be barely profitable and vulnerable to a drop below profitability that could happen at any moment.

There are simply too many factors that could weigh on prices, and that’s without even counting in Saudi Arabia’s trigger-happy habit of threatening to flood the market every time someone angers it.

The Biden administration could strike a new nuclear deal with Iran, for instance, which would automatically result in a flood of Iranian oil into the market. Or Libya could fix its pipelines and continue raising production. Or, for all we know about the coronavirus, there could be a resurgence of cases in China with the expected negative effect on demand. A guarded approach to production would be best for U.S. shale producers for now, regardless of how tempting the idea of ramping up may be.