Covid-19 & The Sun: A Lesson From The 1918 Influenza Pandemic

Authored by Richard Hobday via Medium.com,

Fresh air, sunlight and improvised face masks seemed to work a century ago; and they might help us now.

When new, virulent diseases emerge, such SARS and Covid-19, the race begins to find new vaccines and treatments for those affected. As the current crisis unfolds, governments are enforcing quarantine and isolation, and public gatherings are being discouraged. Health officials took the same approach 100 years ago, when influenza was spreading around the world. The results were mixed. But records from the 1918 pandemic suggest one technique for dealing with influenza — little-known today — was effective. Some hard-won experience from the greatest pandemic in recorded history could help us in the weeks and months ahead.

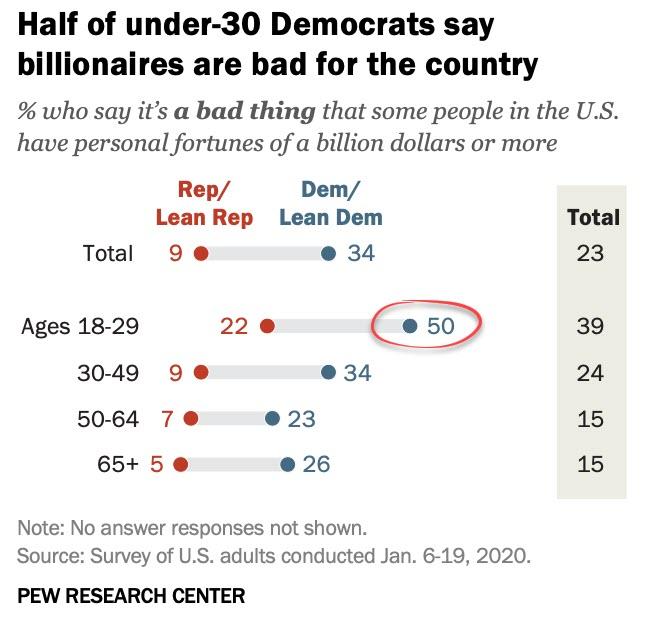

Influenza patients getting sunlight at the Camp Brooks emergency open-air hospital in Boston. Medical staff were not supposed to remove their masks. (National Archives)

Put simply, medics found that severely ill flu patients nursed outdoors recovered better than those treated indoors. A combination of fresh air and sunlight seems to have prevented deaths among patients; and infections among medical staff. There is scientific support for this. Research shows that outdoor air is a natural disinfectant. Fresh air can kill the flu virus and other harmful germs. Equally, sunlight is germicidal and there is now evidence it can kill the flu virus.

`Open-Air’ Treatment in 1918

During the great pandemic, two of the worst places to be were military barracks and troop-ships. Overcrowding and bad ventilation put soldiers and sailors at high risk of catching influenza and the other infections that often followed it. As with the current Covid-19 outbreak, most of the victims of so-called `Spanish flu’ did not die from influenza: they died of pneumonia and other complications.

When the influenza pandemic reached the East coast of the United States in 1918, the city of Boston was particularly badly hit. So the State Guard set up an emergency hospital. They took in the worst cases among sailors on ships in Boston harbour. The hospital’s medical officer had noticed the most seriously ill sailors had been in badly-ventilated spaces. So he gave them as much fresh air as possible by putting them in tents. And in good weather they were taken out of their tents and put in the sun. At this time, it was common practice to put sick soldiers outdoors. Open-air therapy, as it was known, was widely used on casualties from the Western Front. And it became the treatment of choice for another common and often deadly respiratory infection of the time; tuberculosis. Patients were put outside in their beds to breathe fresh outdoor air. Or they were nursed in cross-ventilated wards with the windows open day and night. The open-air regimen remained popular until antibiotics replaced it in the 1950s.

Doctors who had first-hand experience of open-air therapy at the hospital in Boston were convinced the regimen was effective. It was adopted elsewhere. If one report is correct, it reduced deaths among hospital patients from 40 per cent to about 13 per cent. According to the Surgeon General of the Massachusetts State Guard:

`The efficacy of open air treatment has been absolutely proven, and one has only to try it to discover its value.’

Fresh Air is a Disinfectant

Patients treated outdoors were less likely to be exposed to the infectious germs that are often present in conventional hospital wards. They were breathing clean air in what must have been a largely sterile environment. We know this because, in the 1960s, Ministry of Defence scientists proved that fresh air is a natural disinfectant. Something in it, which they called the Open Air Factor, is far more harmful to airborne bacteria — and the influenza virus — than indoor air. They couldn’t identify exactly what the Open Air Factor is. But they found it was effective both at night and during the daytime.

Their research also revealed that the Open Air Factor’s disinfecting powers can be preserved in enclosures — if ventilation rates are kept high enough. Significantly, the rates they identified are the same ones that cross-ventilated hospital wards, with high ceilings and big windows, were designed for. But by the time the scientists made their discoveries, antibiotic therapy had replaced open-air treatment. Since then the germicidal effects of fresh air have not featured in infection control, or hospital design. Yet harmful bacteria have become increasingly resistant to antibiotics.

Sunlight and Influenza Infection

Putting infected patients out in the sun may have helped because it inactivates the influenza virus. It also kills bacteria that cause lung and other infections in hospitals. During the First World War, military surgeons routinely used sunlight to heal infected wounds. They knew it was a disinfectant. What they didn’t know is that one advantage of placing patients outside in the sun is they can synthesise vitamin D in their skin if sunlight is strong enough. This was not discovered until the 1920s. Low vitamin D levels are now linked to respiratory infections and may increase susceptibility to influenza. Also, our body’s biological rhythms appear to influence how we resist infections. New research suggests they can alter our inflammatory response to the flu virus. As with vitamin D, at the time of the 1918 pandemic, the important part played by sunlight in synchronizing these rhythms was not known.

Face Masks Coronavirus and Flu

Surgical masks are currently in short supply in China and elsewhere. They were worn 100 years ago, during the great pandemic, to try and stop the influenza virus spreading. While surgical masks may offer some protection from infection they do not seal around the face. So they don’t filter out small airborne particles. In 1918, anyone at the emergency hospital in Boston who had contact with patients had to wear an improvised face mask. This comprised five layers of gauze fitted to a wire frame which covered the nose and mouth. The frame was shaped to fit the face of the wearer and prevent the gauze filter touching the mouth and nostrils. The masks were replaced every two hours; properly sterilized and with fresh gauze put on. They were a forerunner of the N95 respirators in use in hospitals today to protect medical staff against airborne infection.

Temporary Hospitals

Staff at the hospital kept up high standards of personal and environmental hygiene. No doubt this played a big part in the relatively low rates of infection and deaths reported there. The speed with which their hospital and other temporary open-air facilities were erected to cope with the surge in pneumonia patients was another factor. Today, many countries are not prepared for a severe influenza pandemic. Their health services will be overwhelmed if there is one. Vaccines and antiviral drugs might help. Antibiotics may be effective for pneumonia and other complications. But much of the world’s population will not have access to them. If another 1918 comes, or the Covid-19 crisis gets worse, history suggests it might be prudent to have tents and pre-fabricated wards ready to deal with large numbers of seriously ill cases. Plenty of fresh air and a little sunlight might help too.

Tyler Durden

Sun, 03/15/2020 – 23:10

via ZeroHedge News https://ift.tt/33iJ7XG Tyler Durden