The United States & The European Union Have Failed The Audit Of Pandemic

Authored by Martin Sieff via The Strategic Culture Foundation,

Major patterns of the global coronavirus (COVID-19) pandemic are now all too clear: But the patterns that have emerged are never discussed in the 24/7 American Mainstream Media (MSM) and its European liberal wannabe cheerleaders led by the always ineffable BBC in Britain.

The right-wing old Reagan imperialists and fundamentalists continue to endlessly proclaim that the crisis has mortally wounded China’s standing in the world; That is simply a lie.

The same voices continue to witlessly proclaim the superiority of American exceptionalism in the face of the mounting tsunami wave of evidence to the contrary. They will endlessly continue do so in the Kingdom of the Mad and the Asylums of the Delusional Insane.

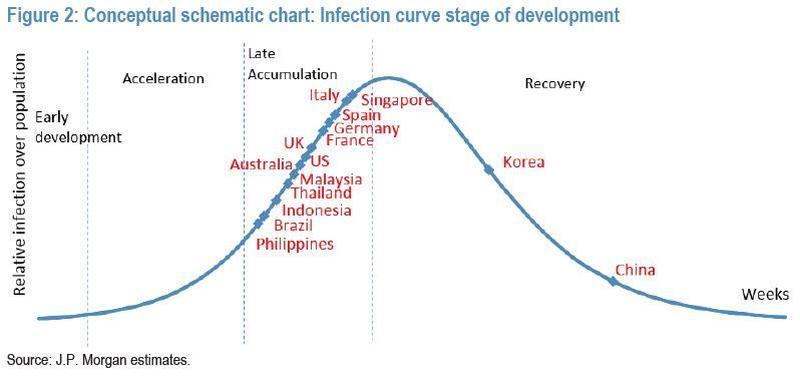

The clear facts are these: First, China’s crackdown got its pandemic crisis under control – impressively fast.

The reaction to this great achievement, as that great Healer Doctor Sigmund Freud warned us – has been denial: For China;s centralized form of government “cannot” ever succeed according to both the conservative right and liberal fake left in the United States.

Therefore China’s figures are conveniently being denied. Its data has become in the words of the brilliant American (indeed he was a New Yorker) iconoclastic questioner of all Conventional Wisdom Charles Fort a century ago “damned.”

That is to say, facts that are “damned” because they contradict and disprove prevailing absurd paradigms of belief that falsely and fashionably masquerade as scientific truth.

Russia’s achievement must also be ignored. As I have noted before, it was the very success of the crazed Russia-hating liberals in the Democratic Party and all their “me-too!” Republican wimp allies in Congress in imposing such swingeing economic sanctions on Russia that protected and saved the Russian people.

Contrast the paucity of COVID-19 cases in Russia so far with the disasters sweeping Italy, Spain, France and Germany in the European Union as well as Britain: By cutting Russia out of the global free trade system at least since 2014, her Western liberal enemies have only insulated and protected the Russian people from the inexorable consequences of Universal Free Trade and Open Borders.

What I call the Audit of Pandemic is delivering a death blow to the already disintegrating European Union.The institutions of Brussels, Luxembourg and Strasbourg are dissolving before our eyes. Their Proud Tower, 75 years in the building is collapsing. “Thou art weighed in the balance and found wanting.”

Judgment is also coming on the antiquated political system of the United States. As I write (obviously the figures change everyday) the Coronavirus Resource Center at Johns Hopkins University lists 331,000 cases of the virus in the United States as opposed to only 81,000 in China.

What this really means is that the venerable US federal system simply cannot handle the threat of pandemic in a modern mass society.

Liberals scapegoat President Donald Trump for this but his hands are tied. It is the policies of state governors and city mayors, especially on the ultra liberal East and West Coasts and in such teeming unregulated urban centers as Detroit, Chicago, Boston and New Orleans, that are directly responsible for this catastrophe. The biggest urban center – New York City – is the most hard hit of all.

Out of lemons, make lemonade: The Deep State and Mainstream Media are now trying to create yet another absurd and fraudulent liberal national leader out of this sordid mess. Where ludicrous toy-men “Beto” O’Rourke and “Pete” Buttigieg and the Feminist Knight Elizabeth Warren failed to strike any spark whatsoever, “America ‘s Governor” – the complacent and downright creepy Andrew Cuomo is being marketed – as a new heroic figure.

Yet no state and no major US city failed to prepare for the pandemic as egregiously as Cuomo did. At least, the cowardly and useless Mayor of New York City Bill De Blasio had a fig leaf of shame to keep a low profile through the pandemic, Cuomo is milking his own shameful criminal incompetence for all he can.

The Democratic National Committee would love to replace old Joe Biden now that he has served his purpose in blocking Bernie Sanders with the infinitely more pliable and preferable Cuomo, as Joaquin Flores has rightly pointed out on this platform.

My own observation is that all the 60 million mindless American liberals who revere every sentence in the New York Times, the Washington Post and on MSNBC and CNN as coming straight from the teats of their feminized “god” are swallowing all the latest fawning lies about Cuomo with their full, brainless glee. Dostoevsky’s Gadarene Swine have found yet another cliff to jump off.

However, in the real world, the crisis is exposing the bankruptcy of the US federal system.

It is not the federal government or the US armed services that have failed here: It is the individual US states, primarily on the East and West Coasts. They have blocked any centralized, coherent national response at every step.

The ludicrous Sanctuary Cities remained obsessed with bringing in millions of illegal immigrants. Yet those people, by their own adult choices defy and deny established laws of the country they are invading. And they have spread the disease like wildfire. Outbreaks of the virus and rapid spreads of it are worse by a vast margin all the metropolitan centers that proudly practice sanctuary policies.

Such illegals are the least likely to respect voluntary restrictions on travel. They are also most likely to abuse such freedoms regardless of the dangers they pose to all others.

In protecting these Illegals at all costs, the wealthy, comfortable liberals in the US suburbs and cities have violated the most fundamental basis of John Locke’s Social Contract: The obligation for society to defend its own members from outside predators.

The EU is now obviously collapsing before our eyes while the United States teeters on the Tipping Point of total disintegration. Russia and China will emerge from this crisis as world leaders in responsible social policies far more rapidly than anyone imagines.

Tyler Durden

Fri, 04/10/2020 – 03:00

via ZeroHedge News https://ift.tt/2xikJd6 Tyler Durden