Submitted by Guy Haselmann, founder of FETIgroup.com

Introduction

As the pandemic dissipates, businesses open and individuals come out of hibernation, our world will be forever changed. Time at home has allowed for self-reflection. New behaviors will be adopted by individuals and businesses alike. Relationships between neighbors, employees and employers, and citizens and their governments will be transformed. Some bonds will be made stronger, but in other cases, particularly where frailties of system or leadership ineptitudes have been exposed, anger and resentment will reign.

Some shifts in relationships and personal behavior will be immediately noticeable, while others will evolve more slowly over time. High indebtedness and unfavorable demographics will be drags on economic activity and markets for decades to come, while also influencing politics and global security. A movement toward de-globalization will cultivate a lowering of international trade with destabilizing geopolitical results. At the highest level, material shifts to geopolitical considerations and away from Ricardian ones will change world order and the course of history. These will impact every person and institution on the planet.

2020 vs. 2008

In a nutshell, 2008 was a fixable financial crisis brought on by too much debt. The 2020 crisis is a health crisis riddled with unquantifiable uncertainties that has spilled over into human psychology, politics, global economies and markets.

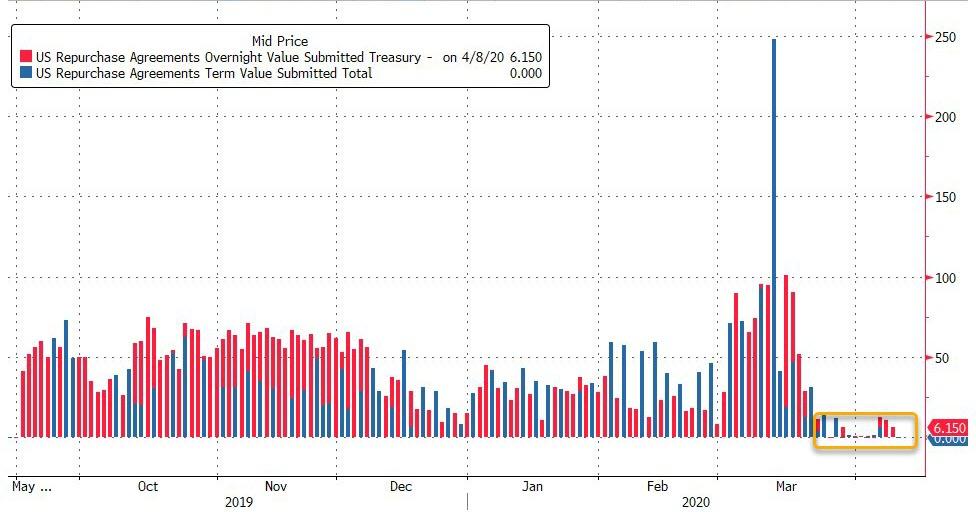

Comparing these crises has major flaws. In 2008, markets stopped functioning properly when interbank lending froze due to securities (e.g., CDOs) held in hidden off-balance sheet Special Purpose Vehicles (SPVs). A trillion dollars of collective SIVs made banks question the credit quality and magnitude of loses, hence the balance sheets, of counter-party banks. As bank lending seized, other markets were impacted in a classic market contagion scenario. TARP money and numerous market liquidity facilities set up by the Fed were funneled to financial markets to unclog the markets clogged plumbing.

The responses to 2020’s health crisis are wider and consist of global draconian measures (e.g., “stay at home” orders) that are directly impacting every economy, business and person on the planet. The virus and responses to it have happened with unprecedented speed and scope. Dusting off the 2008 alphabet soup of liquidity facilities has and will certainly help markets function better in the short term, but unlike in 2008, they do not solve today’s health crisis or broader underlying economic problems. They do little to replace lost income, fix balance sheets, prevent insolvencies, rebuild trust, or restore supply chains.

Rightly, today’s stimulus money is mostly trying to flow more toward main street than financial markets. This is critically important and will help quell social unrest. However, when the government controls the means of income distribution, degrees of freedom for individuals and businesses will plummet. Underlying tensions will simmer and perpetually rise like the heat in a pressure cooker.

Getting money to individuals and SME’s — to where it is needed the most — is an enormous undertaking by itself and will take time. Money is desperately needed, but, unfortunately, a good deal of the fiscal stimulus is in the form of low-cost loans. Does a world already saturated in debt need new loans?

The complexities of the government going directly to Main Street means tens of millions of loans or touch points which in turn means more room for fraud, trickery and skullduggery. A “V-shaped recovery” and “business as usual” will simply not occur when the economy opens back up.

Demographics

Baby boomers are defined as those born from 1946-1964 (middle year of 1955). Looking at the average age of baby boomers during the last three major stock market declines (2001, 2008, 2020) result in dramatically different ages which should mean different reactions – all else being equal. The average age was 46, 53, and 65 respectively. A 65-year old investor invests differently than a 46 year investor, especially when confronted with a huge wake-up call.

The developed world is aging rapidly. Age plays a part in how a person participates in society, how they vote and invest, and whether they are a net contribution or draw on the economy. The ratio of working age people relative to number of retirees matters. This is particularly true in the U.S. with an enormous amount of unfunded liabilities; $140 Trillion+ in pensions, social security and Medicaid alone. Most of the large developed world has poor demographics.

Wars, particularly the two world wars, played a significant role in the demographic make-up of many countries. It skewed generational populations. Japan now has one of the oldest societies in the world and it also has a rapidly falling population. While the country has full-employment as a result, it has had low and limited GDP growth and zero inflation for almost 30 years. The global impact Japan is still playing out.

Germany is in equally bad shape. Germany’s boomers did not have many children and they lost 8 million men fighting the two world wars. A shortage of working age men negatively impacts a country’s means of production and level of consumption. This materially impacts Germany further due to its huge dependency on exports. A world that is de-globalizing magnifies the damage to Germany’s outlook. When demographics shift toward an extreme an entire country is destabilized.

The pandemic could not come at a worse time for the European (Dis)Union due to Germany’s financial role in keeping it together. Will Germany backstop Italian debt or that of other countries most impacted by the coronavirus and global recession? Will Germany’s own troubles lead to a two-tier EU and Euro: A North vs. South? Will the refugee problem cause Europe to close its borders, one to the other? Will that be the vanguard of a dismantling of the EU and the Eurozone?

China’s demographics are also problematic. Since 2000, China’s GDP has expanded 4X, but over the same period its debt has expanded 24X. Spending $6 of debt to achieve $1 of GDP growth is unsustainable. To keep the peace, particularly amongst many diverse cultures, Beijing leaders must continually improve the lives of its people. China has insufficient natural resources to be self-sufficient and lacks enough domestic demand to power its economy. A deglobalizing world has huge ramifications for China. (Japan, Germany and China are only a few examples)

Individual Behavior

The extraordinary and sudden shutting of economies and business doors have led to a plummeting of revenue and income, and skyrocketing of unemployment. These will forever change behavior and psychology. When crises occur, typically the exit is through a different door than the entrance.

Too much complacency had settled in for investors and in people’s daily life. Too many people and businesses either recklessly forgot, didn’t have the means, or choose not to “save for a rainy day”. As a case in point, two weeks after “stay at home” orders were imposed there have been news reports of a 4-mile long car line at a food bank in Pittsburgh.

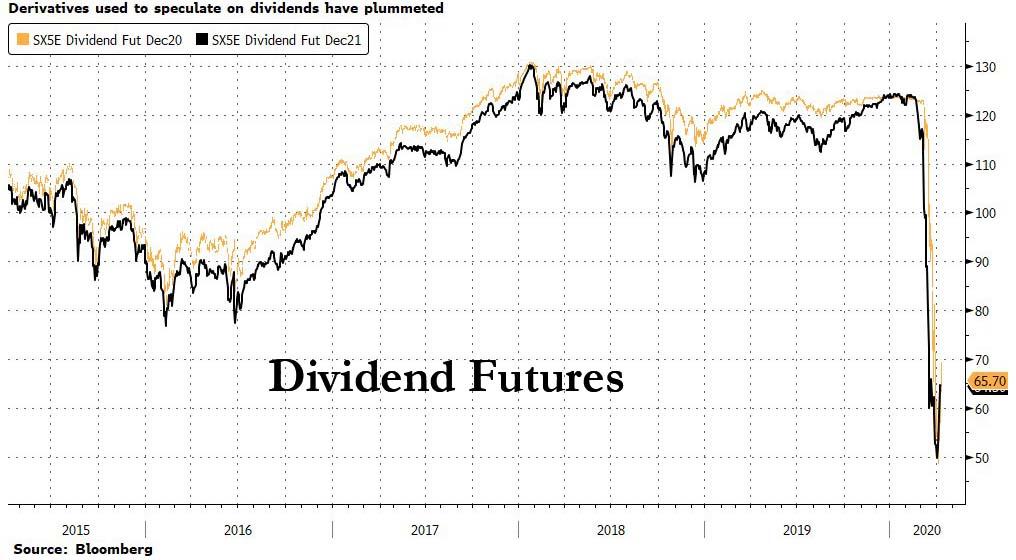

In the future, individual savings will be higher and consumption will be lower. Due to regulatory reasons and reputational perceptions, businesses will think twice about issuing debt or using free cash flow, in order to buyback shares.

As the economy opens again for business, will people travel as much by air, or vacation on cruise ships? Will people work from home more often? Will they frequent restaurants as often? Will they go to theaters as frequently or watch streamed entertainment at home instead? Are people more likely to cook at home or cook pre-assembled delivered meals ? The list of questions here are endless and important. The answers will frame the future.

De-Globalization

The benefits of globalization over the past 30 years are too vast to list or quantify. Yet, the extent of globalization likely peaked a few years ago. Last year, as a matter of fact, was only the third time in 40 years that total global trade fell. Nationalism is on the rise; refugee populations continue to increase and so does impulses toward protectionism. Geopolitics are ascendant. As countries contend with record high debt levels and challenges to economic growth, they will drift further toward placing their own needs above that of global cooperation. It may even be every country for itself, and damn globalization.

Globalization has been about economic efficiencies driven by the (proven) Ricardian ‘Theory of Comparative Advantage’. Yet, the coronavirus dramatically damaged the complex web of interconnected global supply chains. The extend of this was outlined in my paper, “Coronavirus: A Catalyst for System Failure”. It was further damaged by demand destruction from global “stay at home order”.

As economies come back on-line, a whole new recalibration will occur as priorities and preferences become reconfigured. Mining, production and manufacturing for critical goods will take precedence over cost efficiencies. A few examples:

- N95 mask production moved almost exclusively to China when they could be produced there for 2 cents or 50% less than the cost elsewhere.

- Mines in Nevada that harvested rare earths were closed when China could produce them cheaper.

- Rare earths are used in electronics like flat-screen TVs and heavily by our military. Should the US military be dependent on China for rare earths just as China itself is becoming more militaristic?

- Several key pharmaceutical drugs and other critical product will likely move from overseas production to US shores.

Bottom Line: The Coronavirus exposed many vulnerabilities. Going forward, governments and businesses will rethink the means of production and global trade. The choice will be less about economic efficiencies and more about resilience. National and geopolitical imperatives will dominate economic imperatives.

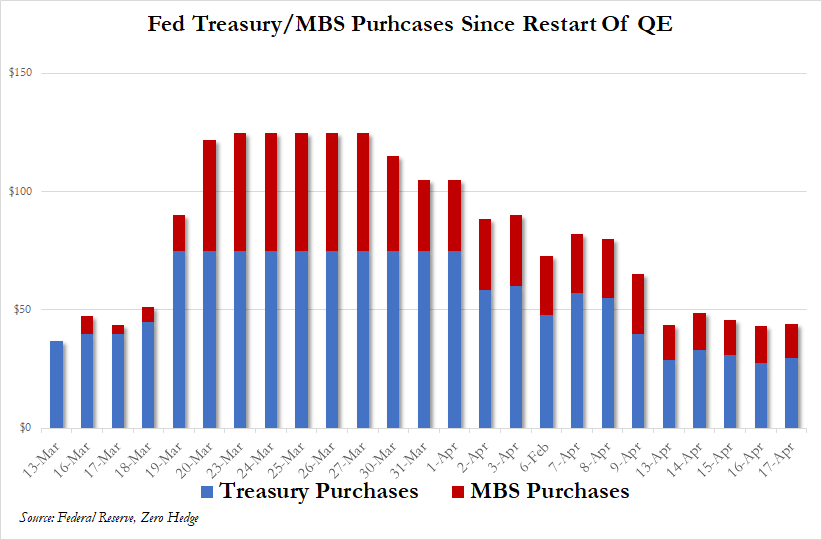

Fed “Unlimited”

The Fed was acting like a Finance Ministry well before the coronavirus struct. The newest blurred lines between the Treasury and Fed, and between monetary and fiscal policy, has emboldened the Fed even further. The old Fed term “forward guidance” was a way for the Fed to manipulate markets and investor psychology without taking direct action. Today the Fed uses the word “unlimited” to try to scare investors and risk assets higher. They both believe that due to the Fed’s unique accounting standard and the Treasuries printing press that “unlimited” is a choice. It is not!

Certainly the US enjoys a unique and enormous privilege by having the world’s reserve currency. Valery Giscard d’Estaing called it “an exorbitant privilege”. Yet, abusing this privilege via an overheating dollar printing press has consequences. Supply and demand matter – just ask Weimar Republic, Venezuela, and Zimbabwe.

In March 2019, I wrote a paper called, “Dangers of Dollar Debasement” that took a deeper dive into this topic and calls for MMT (Modern Monetary Theory). I wrote about the ‘Triffin Dilemma’ outlined by economist Robert Triffin in the 1960’s. The dilemma suggests that a reserve currency faces two simultaneous but opposite incentives of running a balance of payments deficit and surplus at the same time. A deficit is necessary to provide liquidity to other countries for world trade and for other countries in need of foreign exchange reserves. However, a chronic deficit, in turn, undermines confidence in the USD, so a surplus is warranted.

The US today has to print enough dollars to help both domestic money shortages and US financial markets, and enough for the rest of the world as well. This is important because foreigners issued enormous amounts of debt denominated in USD in recent years. There is over $15 Trillion in USD denominated corporate debt maturing in the next 3 years; 25%+ of this total in 2020. The dollar today is at a record high against all other fiat currencies (the only exceptions are CHF and JPY). A soaring dollar means that those issuers have rising liabilities relative to their assets. U.S. dollar denominated debt must be serviced with U.S. dollars. Going forward, foreigners will not make that mistake again.

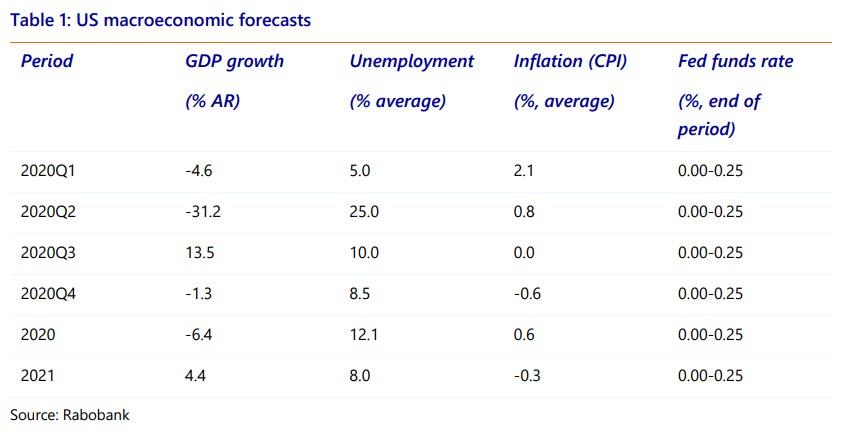

Despite the US having record amounts of ever-growing debt and deficits as far as the eye can see, the USD has remained the world’s currency simply because there is no other alternative. But the faith in the USD will slowly decline over time as a result of policies today and over the last decade. International trade will find a means of exchange away from a USD base. The US will slowly struggle to underwrite its colossal debt obligations. Deflation will likely be an issue in 2020, but 1970’s stagflation will likely be the result and the challenge in 2021 and beyond.

Bretton Woods No More

The US has lost interest in being the world’s policeman. Attitudes and action have been turbo-charged under a Trump presidency. The Bretton Woods agreement that established the modern world order and the USD as the world’s currency is fracturing. In return for the privilege of issuing the world’s reserve currency (in which 60%+ OF international trade is transacted) the US has provided security and military might. For instance Germany and Japan have been protected without maintaining much a military. Providing safe shipping lanes for global trade has helped power globalization and peace for almost all nations.

As mentioned earlier, nationalism is on the rise. Trump’s motto is MAGA (Make America Great Again). A few years ago, the shale revolution made the United States energy self-sufficient and a net exporter of energy. We are one of the few countries in the world capable now of being totally self-sufficient in regards to food security, energy and other essential products. This means that we don’t need to offer as much protection across the world.

Former energy needs made the US dependent on oil exporters like Canada, Mexico, Venezuela, and Saudi Arabia. That Saudi Arabia is a strong counter balance to Iran is important, but our former dependence on oil is what has maintained our relationship with Saudi Arabia. There must have been a good reason, after all. Saudi Arabia is a brutal dictatorial regime brimming with human rights violations. Is the US shale industry the reason why the Saudi’s imploded the price of oil? Most likely. Although this time they may have turned their sights on Russia, the other large oil exporter in the threesome.

Bottom line: The US is pulling back from its role in the world. Countries will be more vulnerable internally and externally. Ethnic group uprisings will occur. Border disputes will arise. Key shipping lanes will be under attack by adversaries and pirates. Regional trading blocs will develop that shut others out. The world is set to become an inherently more unstable place.

Please visit the “Library” tab at FETIgroup.com for other papers, including the ones mentioned in this note.