Some Bad News From JPM: This Is What Happens After We Pass The Virus Peak

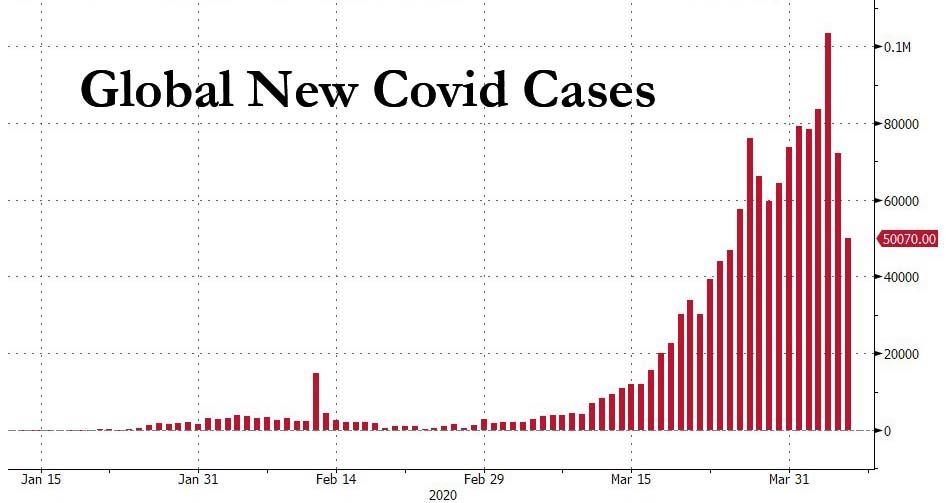

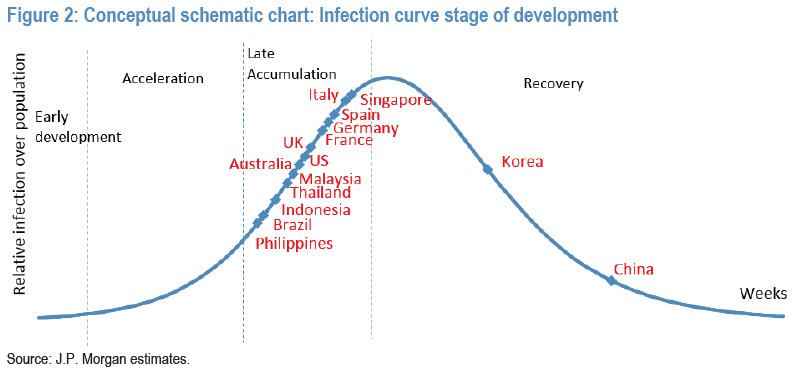

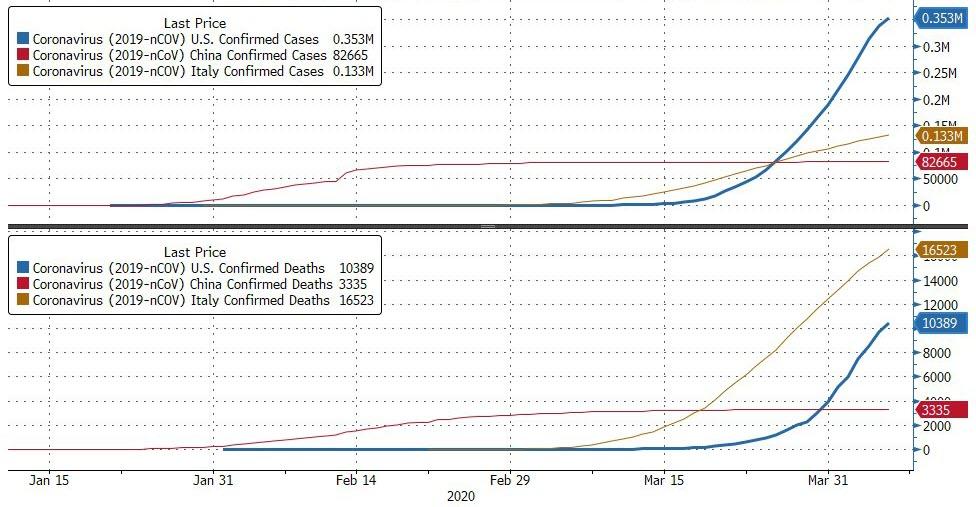

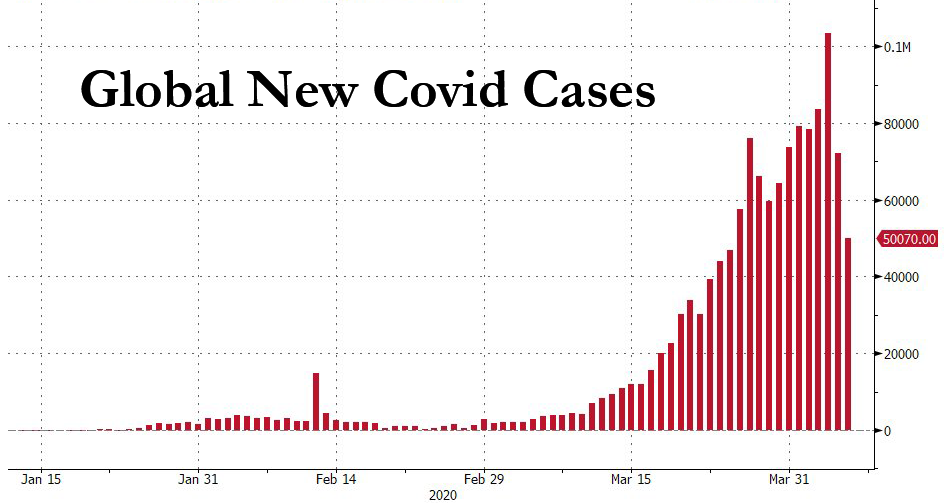

Yesterday, when giving an update on the global coronavirus infection curve, and highlighting where various nations currently reside on the curve, we said what has become conventional wisdom, namely that “with every passing day, the world – most of which is currently on lock down – gets closer to the infection inflection point, and as the updated “corona curve” chart shows, all the nations that were in the exponential rise phase (acceleration), are now moving into the stage of infection growth rate slowdown (accumulation), suggesting that a peak for most countries is now just a matter of time, at which point the number of new cases will start slowing down aggressively. This means that while US cases continue to soar, the light at the end of the tunnel is now visible.”

Some, such as JPMorgan’s delightfully permabullish quant Marko Kolanovic (who is so keen on giving flashbacks to his notes from x weeks ago, if not so much his “once in a decade” call to buy value/short low-vol stocks last July), ran with this data to its extreme conclusion, writing today that his models “have indicated that social distancing is working and that the apex of the pandemic will come sooner and require significantly less peak hospitalizations than projected by the models used by government officials at the time.”

In short, it’s all downhill from here on the corona-curve… literally, which is great news if that was all there is to it as every analyst-trader-amateur-epidemiologist jumps to conclude.

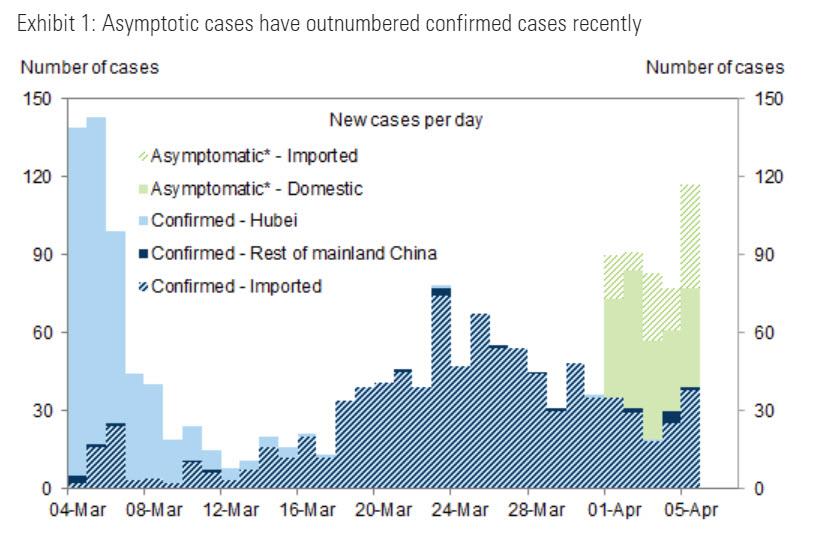

Unfortunately, it turns out that there is much more to it what happens next than “conventional wisdom” hot takes and amateur Wall Street virologists would have you believe, because in a separate not from a far more erudite JPM analyst – at least when it comes to coronavirus analysis – the bank’s MW Kim writes that the first apex is just the beginning, and then – as China is learning now as it reports the most new cases in a month…

… it gets much worse again as the second infection wave is unleashed, then the third, and so on.

So what’s really going on?

First let’s do the good news, which as JPM’s MW Kim notes, have to do with the slowdown in global infections which grew 62% w/w to 1,275,542, while infection growth momentum has slowed compared to ~95% w/w ten days ago.

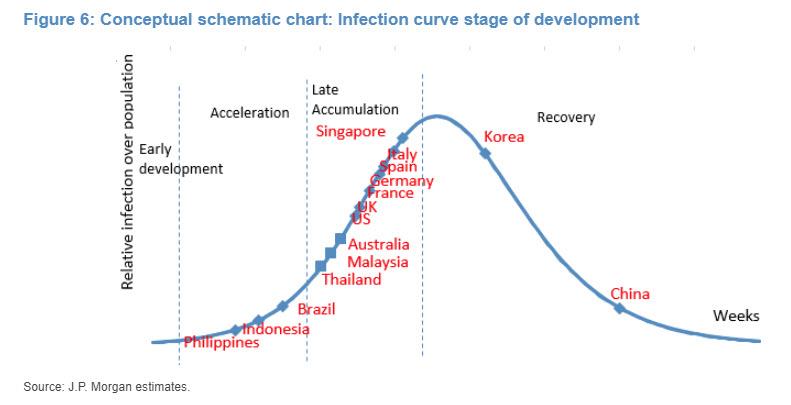

Furthermore, as we reported yesterday, several of the larger impacted countries are now in the slower infection growth rate accumulating stage (the latest curve chart as of this morning is shown below)…

… and JPM is optimistic that post Easter holidays, market focus could likely shift towards “infection peak”/ “recovery statistics” from the current ‘daily new additions’.

Now, and as is customary, are the not so good news: MW Kim cautions that his findings on COVID-19 so far include (1) the lack of a vaccine makes it difficult to clear the virus; (2) social distancing is an expensive strategy in terms of economic/ social cost perspective; (3) it may perhaps prove challenging to build popular acceptance of stricter social distancing for more than a month.

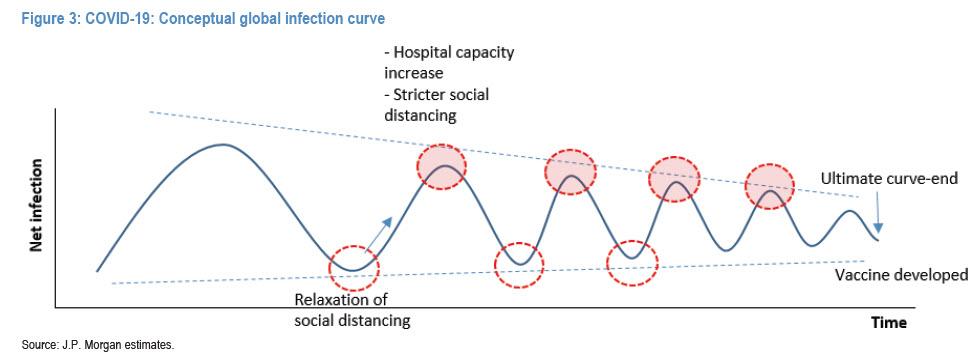

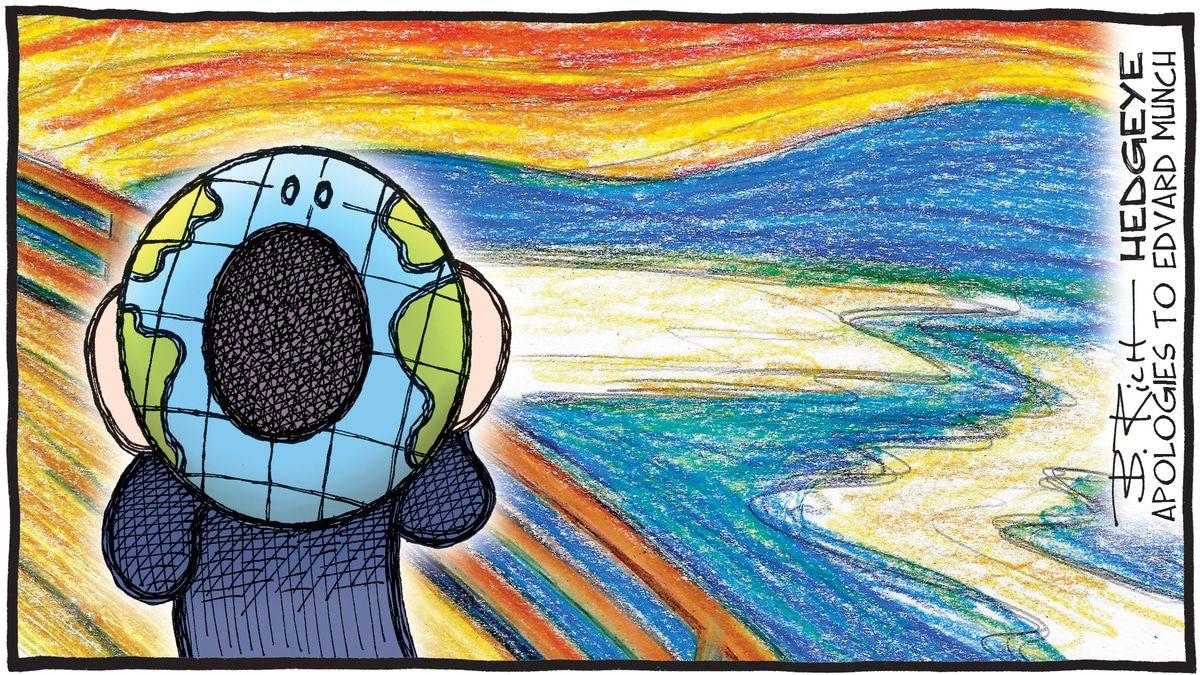

Therefore, and this is the key part, JPMorgan (at least the non-quant part of JPMorgan) “cannot rule out the possibility that global infection curves propagate secondary waves, shaped similar to seismic aftershocks until a vaccine is broadly available.”

Some more details from JPM on how and why “reducing new contacts” aka social distancing has been the primary containment strategy:

Most countries so far have taken the strategy of reducing the virus transmission rate in the community to slow the infection curve. We have proposed that COVID- 19 seems to have a higher basic reproduction number (Ro: 2) compared to the Spanish Flu (Ro: 1.5-1.8). Also, it could take 12-16 months for a vaccine to be under mass production. As a result, the spread of COVID-19 could potentially paralyze the hospital system in a short period. Majority of countries have implemented strong social distancing measures including city lockdowns to reduce the pressure on hospital capacities. This way, new contact with potential infection pool could be reduced which would lead to smaller new infection additions. Meanwhile, it allows time for governments to build up healthcare capacities such as intensive care units, which could then minimize the mortality risks.

So far so good, and social distancing does indeed show success. But, as JPM asks, the question is if authorities will face challenges in acceptance to extend strict social-distancing for longer periods (say over a month).

Therefore, the bank’s analyst cannot rule out the possibility that successive global infection curves form until a vaccine is broadly available. The strategy then may shift to society living with COVID-19, but minimizing infection scale/scope.

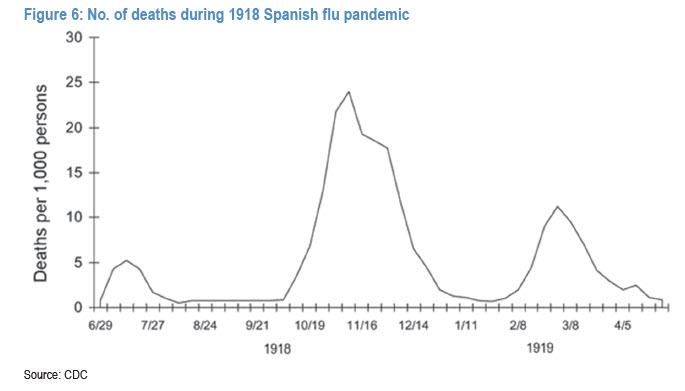

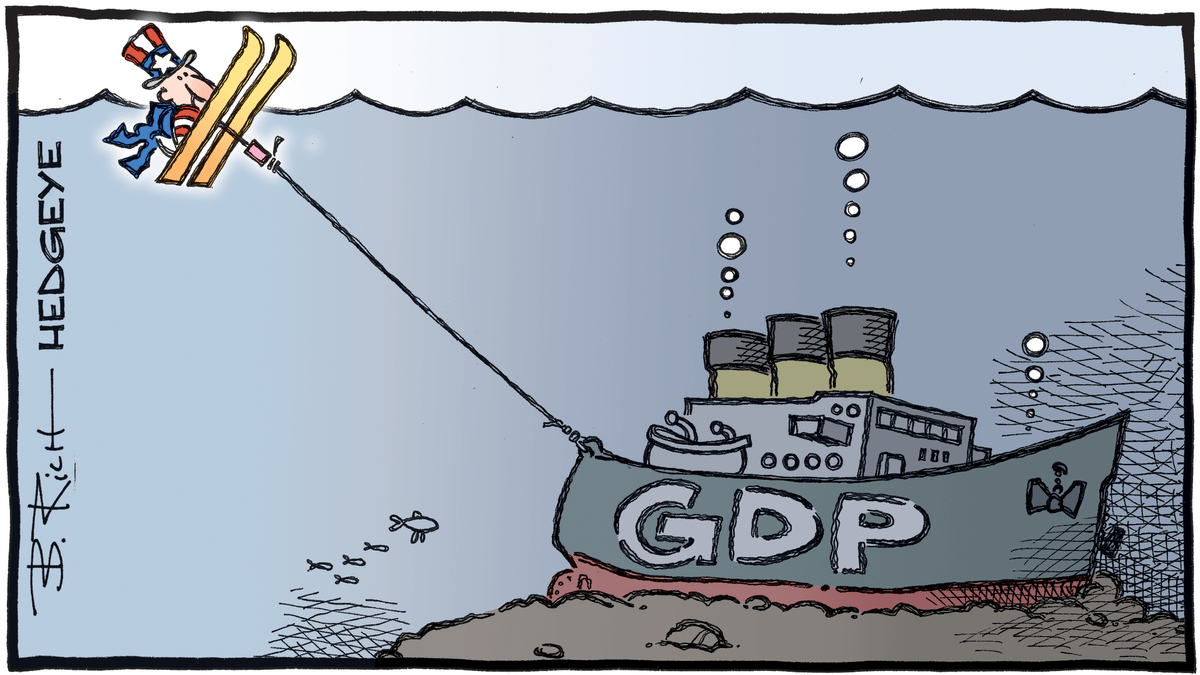

Which then brings us to the $64 trillion (roughly in line with global GDP) question: is the coming “second reinfection wave” going to be smaller or bigger, similar to the Spanish Flu pandemic, where deaths in the second wave were 5x greater than those from the first?

Here JPM believes that next waves could be at a smaller amplitude with lower mortality rate potential compared to the current first wave. This is due to (1) strong risk awareness among stakeholders; (2) faster government response potential at the infection tipping point; and (3) enhanced risk manual at the containment stage. However, even a substantially reduced amplitude of wave 2 (and 3 and 4), suggest that ongoing economic shutdowns will be recurring feature of life for quarters if not years!

The amplitude could be higher, however, a la the Spanish Flu pandemic, if it turns out that the life cycle of the coronavirus is far longer than assumed. As JPM notes, the COVID-19 infection life cycle could last for 4-5 weeks including a 2-week incubation period.

The bottom line, and somewhat counterintuitively, the sooner the world declares victory against the Wu Flu, the faster the general population will rush back into “social undistancing”, sparking countless new case clusters as the infection restarts from scratch, forcing authorities to re-establish social distancing once again, and so on, as the entire process repeats from square one.

Tyler Durden

Mon, 04/06/2020 – 16:55

via ZeroHedge News https://ift.tt/2ReHoh8 Tyler Durden