Baby Yoda A Huge Hit As Disney Reports 26.5 Million Disney+ Subs, Smashing Expectations

Investors were eagerly looking forward to Disney’s results today, not so much for the actual earnings, but to see what Disney’s success was in grabbing streaming TV market share from Netflix and other established streamers such as Amazon for its fledgling Disney+ service, home of the streaming hit The Mandalorian (and baby Yoda). And Disney did not disappoint, reporting a whopping 26.5MM Disney+ subscribers, and smashing consensus expectations of 20.8 million, as the force appears to be very strong with the baby Yoda.

Additionally, Disney also reported that in Q1, it had 6.6 million ESPN+ subscribers, and another 30.4 million Hulu subscribers, as Disney is rapidly emerging as a significant competitor to Netflix, which this quarter reported 61 million domestic and 106 million international subs, however at the expense of $1.7 billion in cash burn in Q4 alone, whereas Disney is a solidly profitable and cash flow positive company.

What is surprising, however, is that despite the massive surge in Disney+ subs, Disney still missed on earnings, even if it beat on the top line, as per the following Q1 results:

- Adjusted EPS $1.53 vs. $1.84 y/y, estimate $1.46 (range $1.28 to $1.69)

- Media networks operating income $1.63 billion, +25% y/y, estimate $1.61 billion

- Revenue $20.86 billion, +36% y/y, estimate $20.81 billion (range $19.48 billion to $21.87 billion)

- Cable Networks revenue $4.77 billion, +19% y/y, estimate $4.49 billion

- Media networks revenue $7.36 billion, +24% y/y, estimate $7.13 billion

- Parks, experiences & consumer products revenue $7.40 billion, +11% q/q, estimate $7.37 billion

- Studio entertainment revenue $3.76 billion vs. $1.8 billion y/y, estimate $3.41 billion

- Direct-to-consumer & international rev $3.99 billion, +16% q/q, estimate $3.99 billion

- Broadcasting revenue $2.60 billion, +14% q/q, estimate $2.20 billion

- Broadcasting oper income $575 million, +53% q/q

- Studio entertainment operating income $948 million vs. $309 million y/y, estimate $966.0 million

- Cable Networks operating profit $862 million, +16% y/y, estimate $777.2 million

- Parks, experiences & consumer products operating income $2.34 billion, +69% q/q, estimate $2.33 billion

- Direct-to-consumer & international operating loss $693 million, -6.4% q/q, estimate loss $824.3 million

Commenting on the earnings, Disney CEO Bob Iger said “We had a strong first quarter, highlighted by the launch of Disney+, which has exceeded even our greatest expectations.”

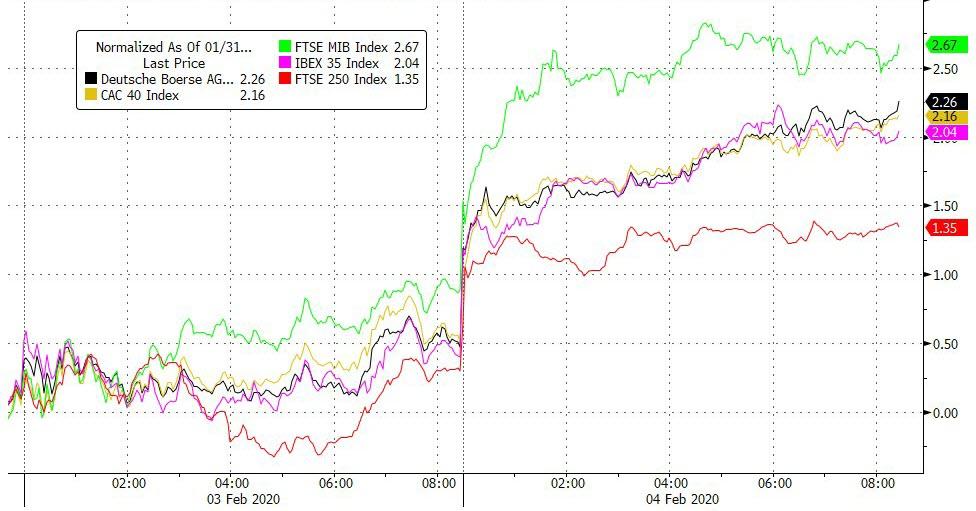

And while that may have been enough to boost the stock sharply higher in kneejerk response to the Disney+ number, as algos read the rest of the report and saw the somewhat disappointing bottom line miss, the stock is now red.

Tyler Durden

Tue, 02/04/2020 – 16:27

via ZeroHedge News https://ift.tt/2Ul8cie Tyler Durden