Is The Fed Stuck With “Forever Stimulus”?

Tyler Durden

Sun, 11/15/2020 – 15:55

Authored by Lance Roberts via RealInvestmentAdvice.com,

I recently have discussed both the “Importance of Recessions” and how the ongoing “Rescues Ruining Capitalism.” However, while the data is clear that ongoing stimulus programs lead to weaker economic growth and a rising wealth gap, is the Fed stuck with “forever stimulus?”

Such was a point that Mohammed El-Erian recently made, stating:

“They are increasingly on what I call a no-exit paradigm.”

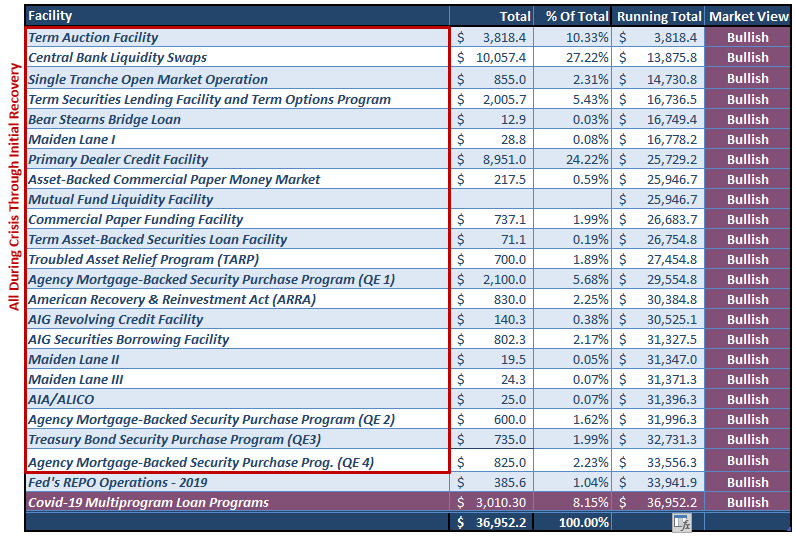

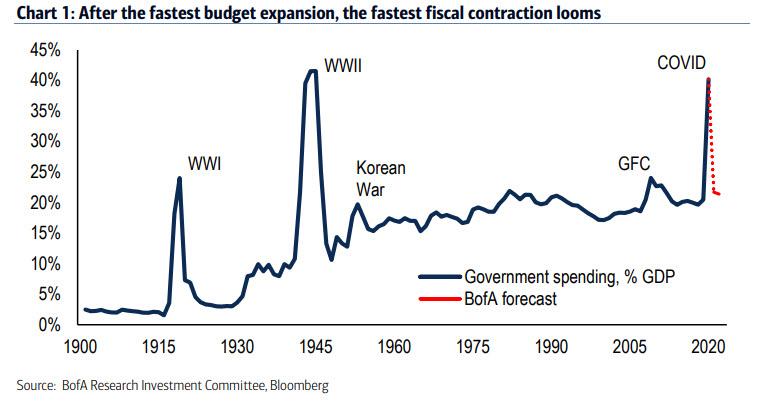

To understand the problem, we have to go back to the beginning. As we noted in our article on financial rescues, the bailouts and stimulus programs started in 2008 when the Federal Reserve intervened with the insolvency of Bear Stearns. They haven’t stopped since.

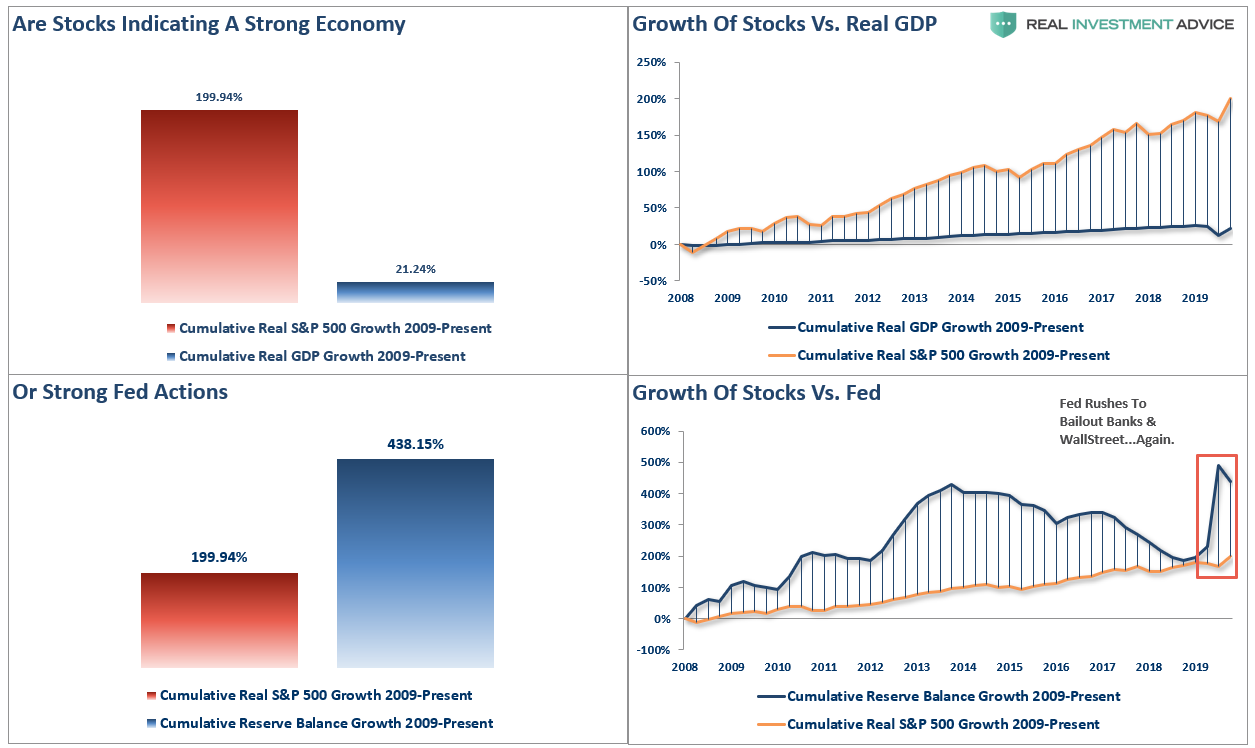

To date, the Federal Reserve, and the Government, have pumped more than $36 Trillion into the economy. As shown below, the amount of economic growth achieved has been minimal during that same time frame. (The chart is the cumulative growth of interventions compared to the incremental increase in GDP.)

What this equates to is more than $12 of liquidity for each $1 of economic growth.

Trapped

The trap the Federal Reserve has stumbled into is that it continues to require more interventions to sustain lower rates of economic growth. Whenever the Fed withdraws interventions, economic growth collapses.

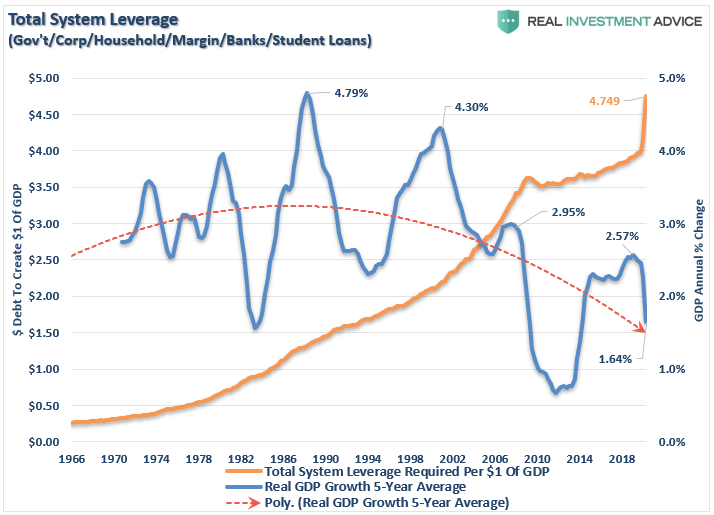

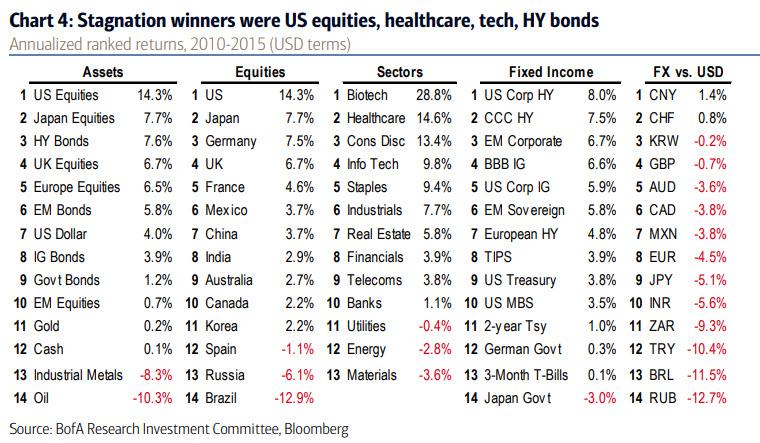

As shown, since the turn of the century, each economic cycle has failed to attain a higher rate of growth than previously. The Federal Reserve lowered interest rates to stimulate growth. However, after reaching the “zero bound,” the Fed engaged in expansionary monetary policy.

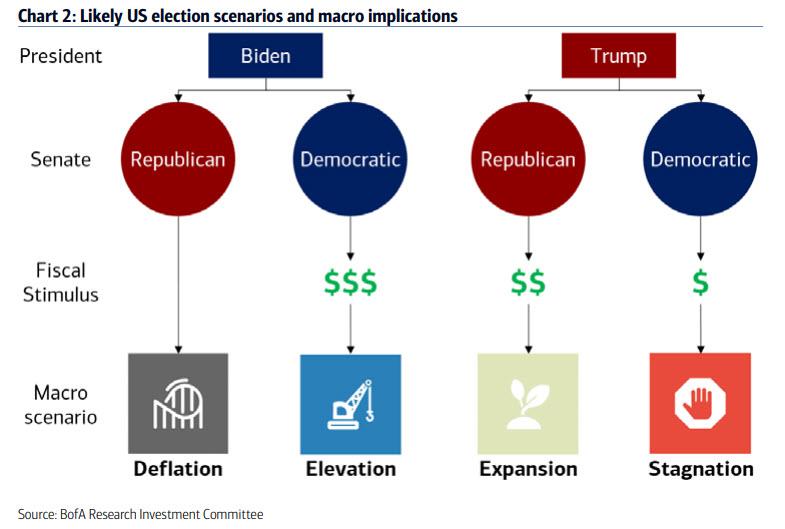

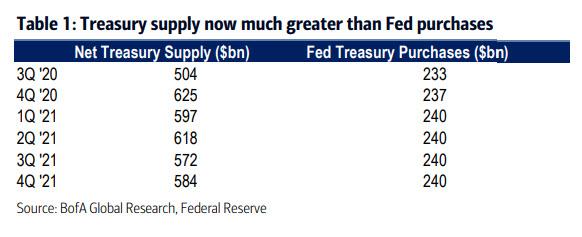

Such is why Fed Chairman Jerome Powell has repeatedly pressed for more “fiscal” support from Congress. Without more debt issuance, the Federal Reserve’s ability to “monetize” bonds to provide “monetary stimulus” to the markets is limited. In theory, boosting asset markets should increase consumer confidence and create a “trickle-down” effect on the economy.

Unfortunately, as shown below, this has yet to be the case. Since 2009, the raw increase in just the Fed’s balance sheet, excluding all the other interventions in the table above, was 438%. During that same time frame, the S&P 500 increased by 199.94% and GDP just 21.24%.

Again, while Jerome Powell continues to suggest “the recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side,” there is little evidence to support that statement.

Debts Are The Problem

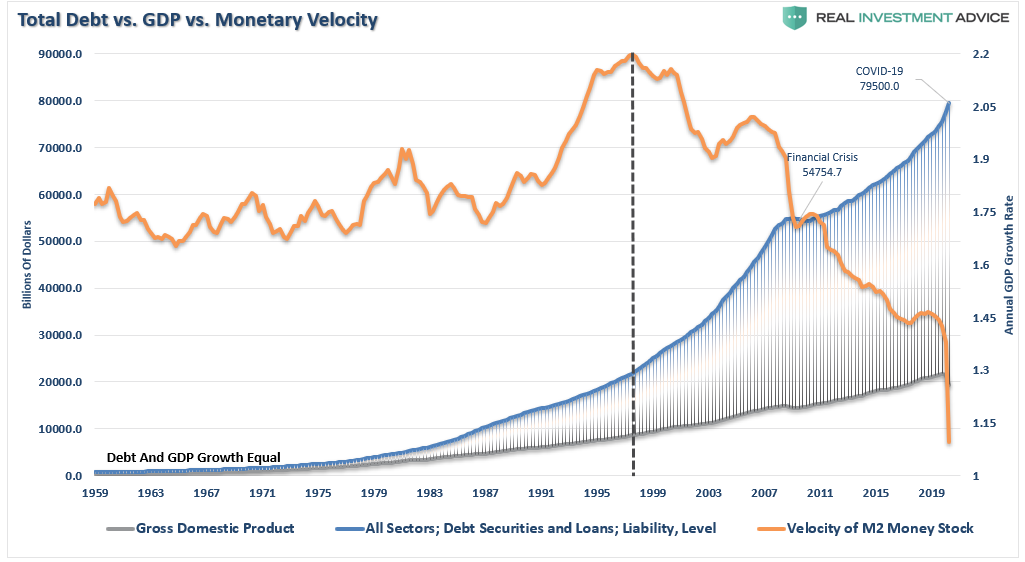

The question that plagues Central Bankers globally is why higher economic growth rates, and ultimately inflation, fail to appear.

“Instead, faced with slowing global growth and resurgent infections, the focus of policy makers at last week’s all-virtual International Monetary Fund and World Bank meetings was on more support for the world economy, not less. Central banks are pulling out the stops to do all they can, boosting financial markets with massive asset purchases and pushing government borrowing costs to record lows.” – Bloomberg

As previously discussed, there is a long historical correlation between increasing debts and lower economic growth rates.

“Unfortunately, higher levels of debt continue to retard economic growth keeping the Fed trapped in a debt cycle as hopes of “growth” remain elusive. The current 5-year average inflation-adjusted growth rate is just 1.64%, a far cry from the 4.79% real growth rate in the ’80s.”

“In 1998, the Federal Reserve “crossed the ‘Rubicon,’ whereby lowering interest rates failed to stimulate economic growth or inflation as the “debt burden” detracted from it. When compared to the total debt of the economy, monetary velocity shows the problem facing the Fed.”

As stated, this isn’t just a “Fed” problem. It’s a “global” problem.

No Exit

As stated, the Federal Reserve is in a trap from which there is no exit. As Former Fed Governor Randall Kroszner recently said:

“The big debts that governments are racking up are going to make it difficult for central banks to raise rates when they feel the need to do so because that will increase borrowing costs.”

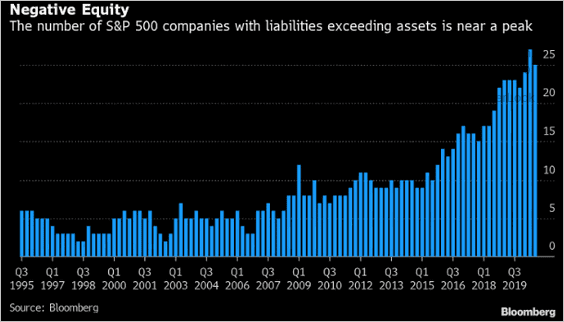

In an economy laden by $75 Trillion in debt, a record number of “Zombie” companies kept alive only by low borrowing costs, and a near-record number of companies with negative equity, higher rates are a “death knell.”

Furthermore, despite Wall Street’s demands to keep asset prices elevated, the Federal Reserve has allowed itself to become politicized by Congress, who allocated money to the Treasury to set up emergency lending facilities.

The Federal Reserve can’t withdraw the “life support” even though the support may be doing more harm than good in the long run.

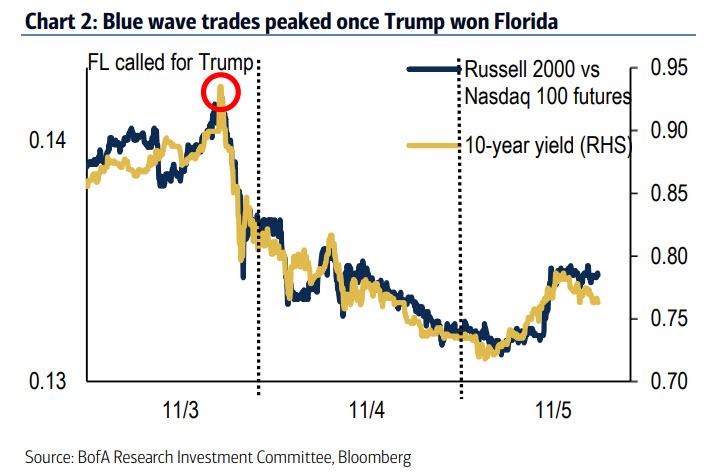

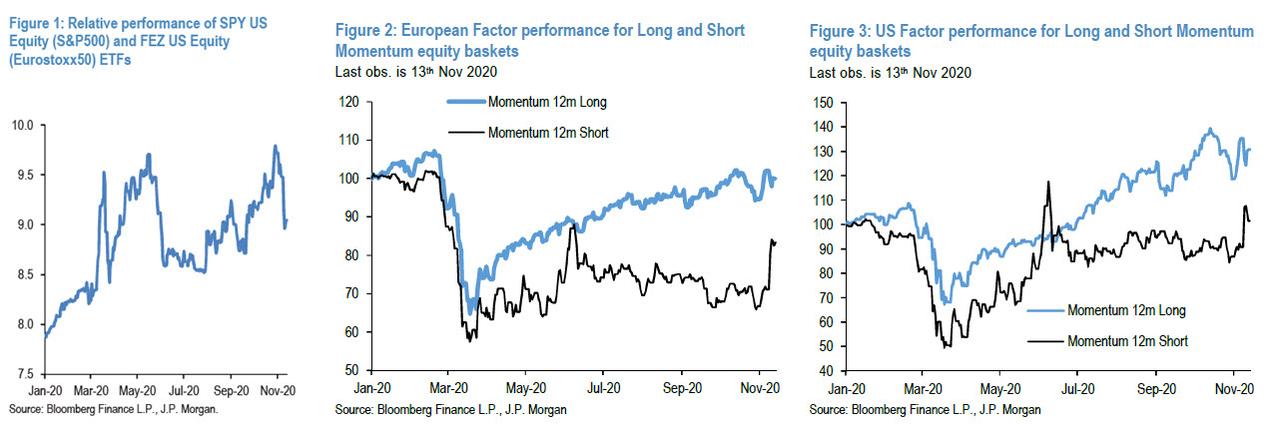

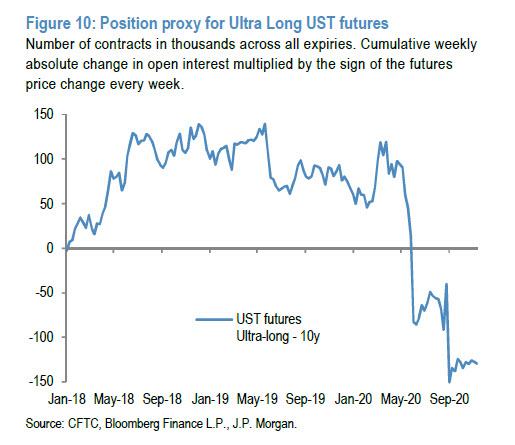

Markets Are Now Dependent On The Fed

“The Central Bank has conditioned the market to such an extent that every time the Fed tries to step back, the market forces them back in by selling off and tightening financial conditions.” – Mohammed El-Erian

Such explains the trap the Federal Reserve has gotten themselves. Even Former Bank of England policymaker Paul Tucker agreed that the financial markets have come to expect periodic support from central banks. Such is not surprising after years in which policymakers delivered just that.

“I wait, longing for a central banker to do for financial stability what Paul Volcker did for inflation, which is to break that psychology that you, the capitalist markets, are actually utterly dependent on the Federal Reserve and other central banks, propping up prices come what may,” – Paul Tucker

Such is the problem facing the Fed.

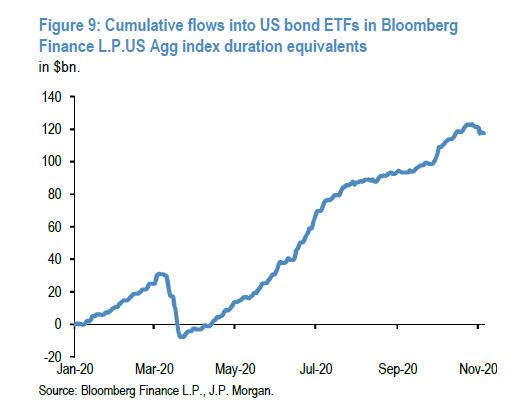

The debt deluge, and co-dependent financial markets, is leading to other potential consequences. The Treasury market is now so large that it may not function smoothly on its own during times of stress. Such was a point made by Fed Vice Chair for Supervision Randal Quarles.

“It is an open question of whether the Fed would have to keep buying Treasuries to aid the working of the market.”

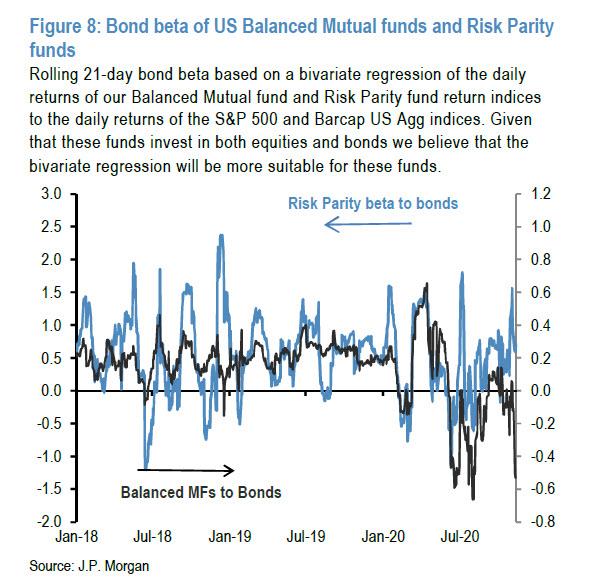

We know that the Fed is dependent on the financial markets, believing the “Fed” will provide support as needed. With the entirety of the financial ecosystem now more heavily levered than ever, the “instability of stability” is now the most significant risk.

The Paradox

The “stability/instability paradox” assumes that all players are rational, and such rationality implies avoidance of destruction. In other words, all players will act rationally, and no one will push “the big red button.”

The Fed is highly dependent on this assumption as it provides the “room” needed, after more than 10-years of the most unprecedented monetary policy program in U.S. history, to try and navigate the risks that have built up in the system.

The Fed is dependent on “everyone acting rationally.”

Unfortunately, that has never been the case.

The behavioral biases of individuals is one of the most severe risks facing the Fed. Throughout history, the Fed’s actions have repeatedly led to adverse outcomes despite the best of intentions.

-

In the early 70’s it was the “Nifty Fifty” stocks,

-

Then Mexican and Argentine bonds a few years after that.

-

“Portfolio Insurance” was the “thing” in the mid -80’s

-

Dot.com anything was an excellent investment in 1999

-

Real estate has been a boom/bust cycle roughly every other decade, but 2006 was a doozy.

-

Today, well, it’s pretty much everything tied to “debt.”

Risk concentration always seems rational at the beginning, and the initial successes of the trends it creates can be self-reinforcing. That is, until suddenly, and often without warning, it all goes “pear-shaped.”

The Single Biggest Risk To Your Money

“If the Fed and other central banks are constrained from scaling back emergency stimulus, the continued flood of liquidity could spur asset bubbles and even too-rapid inflation.” – Bloomberg

Such is already likely the case and underscores the single most significant risk to your investments.

In extremely long bull market cycles, investors become “willfully blind” to the underlying inherent risks. Or rather, it is the “hubris” of investors as they believe they are now “smarter than the market.”

Yet, the list of concerns remains despite being completely ignored by investors and the mainstream media.

-

Growing economic ambiguities in the U.S. and abroad: surging autos and housing against a backdrop of high unemployment.

-

Political instability.

-

The failure of fiscal policy to ‘trickle down.’

-

An important pivot towards easing in global monetary policy.

-

Geopolitical risks.

-

Deteriorating earnings and corporate profit margins.

-

Record levels of private and public debt.

For now, none of that matters as the Federal Reserve continues providing stimulus to the market. The problem comes when they can’t do more, or the markets demand more than the Fed can give.

That is the point where “instability” will exceed the grasp of Central Bankers.

via ZeroHedge News https://ift.tt/38MA1am Tyler Durden