Welcome To The Greater Depression

Authored by Doug Casey via InternationalMan.com,

There are a lot of questions people are asking themselves today. Among them: How serious is this economic downturn likely to be? How long will it last? How can it be ended? Whose fault is it?

The answers to these questions being given by pundits, economists, money honeys, and politicians are, almost without exception, totally incorrect. This is most unfortunate because it means the actions taken by the US (and, it appears, every other government in the world) are not only going to be ineffective but counterproductive.

For years, I’ve predicted something I’ve called the Greater Depression. I’ve seen its arrival as being completely inevitable. Only its exact timing was in doubt.

So let me be as clear as I can be about what’s going on in the world right now.

I believe this is it.

We’ve entered a downturn that is going to be longer, deeper, and different than the unpleasantness of 1929-1946.

I sincerely hate to stick my neck out by saying that. Clearly, the longest trend in existence is the Ascent of Man, and it’s usually a mistake to buck any trend; the trend is your friend. But no trend rises like a straight line. That said, it seems to me this is going to be a really, really serious correction – I suspect, the worst since the start of the Industrial Revolution.

You’re going to be bombarded by a barrage of misinformation, misinterpretations, wishful thinking, and snake-oil economics over the next few years. It’s critical that you rationally decide exactly what is happening and why.

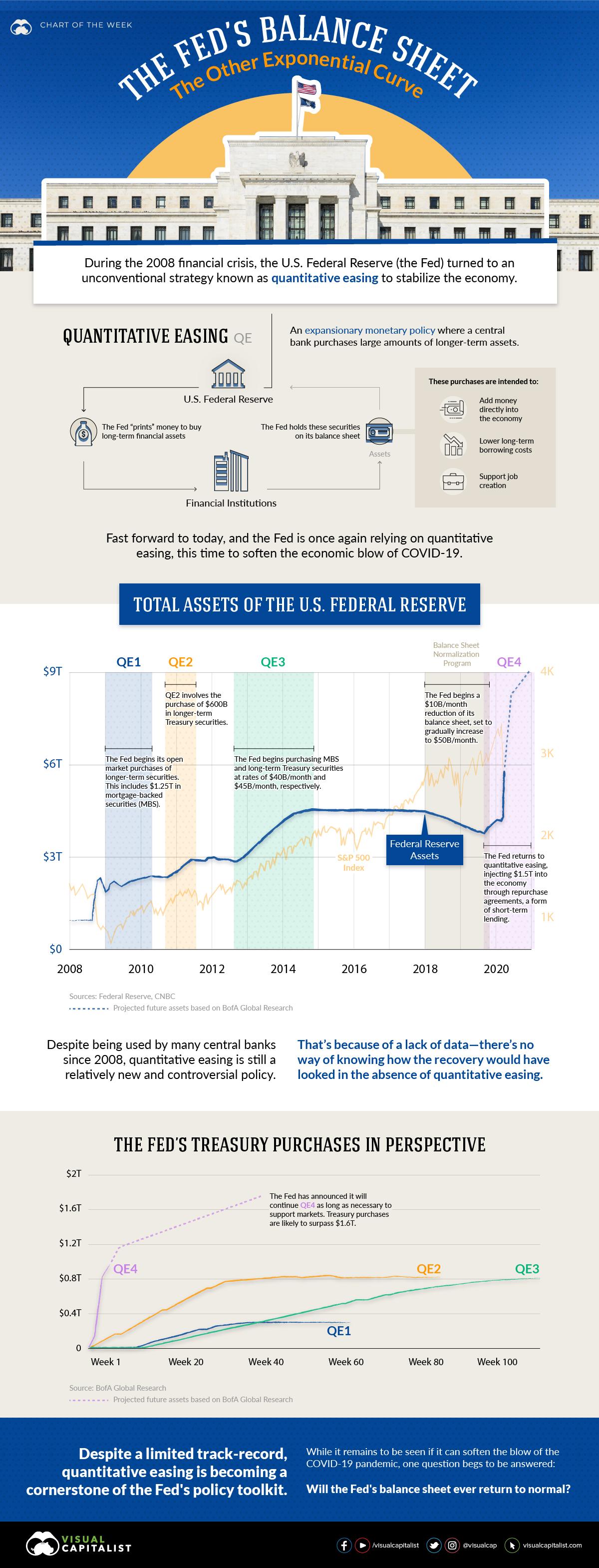

My answer, in brief, is that the Greater Depression is almost entirely due to the intervention of government into the economy. The current hysteria over CoronaVirus is simply the pin that broke the bubble. In any event, State intervention takes three forms – taxation, regulation, and currency inflation – all of which are disastrous.

But of these, inflation is likely the worst, since it’s not only an indirect form of taxation, but it causes the business cycle, and that results in huge distortions in the ways people produce and consume, and causes huge misallocations of capital.

The best general definition of depression is: a period of time when most people’s standard of living drops significantly.

What you’re looking at is the Greater Depression. This isn’t a drill or an academic exercise woven out of airy fabrics.

Why the Depression is Happening

The physical world is unlikely to be changed much by the Greater Depression, but the way people relate to the world will change a great deal.

A real-estate collapse doesn’t mean buildings will tumble – but their prices will, and their owners may change.

A corporation’s bankruptcy doesn’t mean that the factories or technology it owned will vanish; they will become the property of a different corporation.

A government default on its bonds doesn’t mean the country (which is not at all the same thing as the government) is bankrupt. It just means that those who held the bonds are poorer and those who otherwise would have been taxed to pay the bonds are richer.

In other words, all the real wealth will still be there, but its ownership will change. And some commodities will become more (or less) valuable relative to other commodities.

The people who wind up wealthy as the Greater Depression unfolds will, predictably, be those who understand what’s going on. A grasp of the business cycle is essential to that understanding.

The business cycle is the phenomenon of boom and bust caused by inflation. It has been labeled as one of capitalism’s “internal contradictions” since the time of Karl Marx, but it is in fact the work of government. In a pure laissez-faire economy, the business cycle would not exist because there could be no politically driven inflation.

How does inflation cause the business cycle and, in turn, a depression? Let’s perform an autopsy.

Stage One: Inflation and Boom

Suppose that the city of Santa Monica, California, is an independent nation.

People are producing and trading to get what they want and need out of life. With no welfare, everyone is forced to work to support himself. The government concerns itself with maintaining the police and the courts and pretending that its little army keeps the rest of the world at bay.

Life is mellow, and the weather is good.

Let’s further suppose that the re-election campaign strategist for some local politician persuades some of the government’s economic advisors that Santa Monica is not as prosperous as it ought to be.

The economists opine that because there is a pool of “unemployed” (recent graduates, bored retirees, fire-ees, and recent job quitters), the economy suffers from a lack of consumer demand.

Creating demand seems like a good idea, so the government credits the bank account of every Santa Monican with $10,000.

The picture changes rapidly. Although there is no more wealth, there is a lot more money, say 20 percent more.

Everyone feels, and starts acting, much richer. They spend more. The economy is “stimulated.”

We’ll follow the fortunes of the swimming-pool industry, although every business in Santa Monica would have a similar tale.

The first business to prosper because of the government’s new monetary policy might be the telephone company, because all the phone lines are jammed with citizens trying to call the local swimming-pool company to place an order.

Believing that their ancient “reach out and touch someone” marketing campaign is finally catching on, phone company executives make plans to put in more lines and hire more operators.

But the telephone company’s expansion isn’t nearly as dramatic as that of the swimming-pool company, which is soon swamped with orders. Its owner is gratified that the market is finally rewarding his skills. It never occurs to him that the government’s actions might be causing a temporary upsurge in demand.

In any event, he raises prices to take advantage of the increased demand and then runs down to his bank to borrow some money for expansion.

The suppliers of swimming-pool materials, such as concrete, copper pipe, and earthmoving equipment, also go out and borrow money to expand.

Because the banks have just taken in billions of dollars, courtesy of the government, they have plenty of money to lend, and at very low rates.

“Interest” is the rental price of money, and with money in such ample supply, the price drops. Like any other businessmen with excess inventory, the bankers have a “special” on money.

All the expanded companies need new workers but have trouble getting them, since everyone willing to be is already employed.

To induce workers to change jobs, the pool suppliers offer higher wages. Late-night television is filled with ads for schools who will train people to drive heavy equipment, pour cement, and lay pipe to take advantage of those great new jobs.

Meanwhile, all this activity hasn’t escaped the notice of budding entrepreneurs. Soon the family leisure vans and custom surfboards are put up as collateral for loans to start new swimming pool companies.

Bankers are eager to oblige, since they now have so much money on deposit and can only make profits by lending it out.

Stockbrokers, seeing a new growth industry, raise millions from eager investors with an unexpected $10,000, and float new issues.

Business is excellent, and many millionaires are made overnight.

A new class of swimming-pool construction millionaires emerges. They and their highly paid employees drive Ferraris and wear Armani suits, gold chains, and silk shirts.

Merchants draw down their cash reserves to stock up on inventory to cater to them.

Many people liquidate their savings to move into bigger houses (the banks have loads of money for mortgages), and the real-estate market moves up. So does the stock market, since companies everywhere are expanding.

With wages and profits up and stocks and real estate adding value daily, most people tend to work less and play more.

A “new era” appears to have arrived, with universal prosperity and a higher standard of living for all. It looks like the economists were right, and a little inflation is a good thing.

So far, it’s a pretty picture.

But this is a game, like the “What’s wrong with this picture?” puzzles we used to have in grade school. This is where it pays to have the skills of an economist. The immediate and direct effects of the government’s inflation certainly seem good, but what are the delayed and indirect effects?

The folks in the government have little concern for delayed effects, even assuming some spoilsport points them out. The problems are in the future – after the next election. And since long-term effects are indirect, they are easy to blame on something or someone else.

The perceived benefits of inflation, however, are not only very clear, they’re in the here and now. Moreover, the “economists” say “fine tuning” may extend the boom indefinitely.

So the government will probably fail the “What’s wrong with this picture?” test that a six-year-old would pass. But let’s find out.

Stage Two: A Slowdown

After a while, everyone who wants a swimming pool has placed an order, and sales taper off.

Furthermore, people have started to notice a disturbing trend: prices around town have been moving up. The “economists” have neglected to mention that prices always rise when the supply of money increases without a corresponding increase in the supply of goods and services.

But what about all the new pools and other items? Aren’t they the goods and services that the inflation made possible?

Yes, but no new wealth has been created, just different – and more visible – types of wealth.

Everyone who got into the swimming-pool business was doing something else before, something that he’s not doing now. Even though everyone’s standard of living has gone up in some obvious ways, it’s already started dropping in other ways. All those new heavy-equipment drivers used to be parking cars, pumping gas, and washing dishes. Their ex-employers have found out that no one wants to work at menial jobs. Good help has become hard to find. Perhaps they can import a lot of Mexican labor.

If the government’s inflationary gift to the people has increased the money supply by 20 percent, then prices in general have increased by 20 percent.

The price inflation will be uneven, however; not all prices will increase by the same amount. The prices of some particularly desirable goods – like swimming pools, the water to fill them, and the big houses new millionaires can suddenly afford – now cost much more.

A few things may actually drop in price, like the rice and beans that only poor people eat. The demand for them has decreased, since poor people are trading up to chicken and beef, which hit new highs.

It is impossible to get a plumber to fix a leak in a home, perhaps because his time is much more valuable subcontracting to a pool-piping entrepreneur.

The rare doctor who once made house calls no longer will; he has made millions investing in newly floated swimming-pool company stock.

Babysitters now start at $25 an hour, for a minimum of four hours. And interest rates are starting to head up, since people have exhausted their savings and will not save more unless they get an “inflation premium” – higher interest rates to compensate for the debasement of the currency – on their capital.

In fact, lots of subtle distortions are filtering through the economy.

Some people who spent their $10,000 to buy a swimming pool are finding that demand has driven the price of water way up and they cannot afford to fill their pools; nor can they afford to maintain them with higher-priced labor.

And since most people are consuming more and producing less, as people do when they feel wealthier, there is less wealth than there was before the magic of monetary policy transformed the way their world worked.

Santa Monicans acted in ways they wouldn’t have if the government had not created all the new money. Inflation has encouraged them to produce things they would not have (like swimming pools) and not to consume things they would have before (like rice and beans).

The inflation also has encouraged an over-allocation of capital to inventories of luxury goods. Even though a lot of people have fine new pools, the standard of living has gone down in subtle ways.

Stage Three: Full Recession

Soon there is a rapid decline in new orders to the many pool companies now in business.

Bankers and brokers had not realized that an economy that could support only one pool company before the boom might have trouble supporting twenty a short time later.

In fact, less demand exists now than before, when only one company operated, since many sales have been stolen from the future.

The companies have to start laying off employees; many have trouble repaying their bank loans.

The telephone, copper, and cement companies feel the ripple effect, as do the Ferrari and gold-chain dealers, and the stock market collapses. Doctors fret as their swimming-pool stocks plummet.

The Santa Monica economy is experiencing a recession. A recession follows an inflationary boom when the market tries to readjust to normal patterns of supply and demand.

It’s a painful period when the free market corrects the misallocation of resources encouraged by government inflation.

People have more of some consumer products than ever, and there is more plant capacity to produce those products, but few people are as well off as they were before the inflation. They’re actually less well off than if the government had only taxed them.

Taxes alone would not have led people to think they were richer than they really were; there would be much less need for bankruptcy lawyers.

It is a paradox that even though the artificial boom caused many problems (however much fun it was at the time), the recession actually has many positive aspects.

Consumers cut back on spending, so they are again building up savings.

Businesses lower prices to induce consumers to buy.

Workers, afraid of losing their jobs, work harder (that is, increase productivity).

Companies (and workers) that cannot give consumers what they want at prices they can afford are forced to improve the way they do business.

And citizens who were prudent during the boom have numerous bargains to choose among.

Whether the recession becomes a depression is largely up to the government, which should admit that its effort to stimulate the economy was a stupid idea; the government hasn’t raised the general standard of living, just changed people’s patterns of production and consumption. It actually reduced the overall level of prosperity.

At this point the government should exit the scene, let the swimming-pool companies go bankrupt, allow the banks’ shareholders to eat their loan losses, and permit the would-be tycoons to go back to parking cars and pumping gas.

But doing this would make politicians immensely unpopular, and they would have to find a new line of work after the next election.

Besides, if they play it right, the crisis can be turned into an opportunity to increase their power and prestige. And of course, their economic advisors have plenty of “new ideas” for “change.”

Stage Four: Recovery

No politician wants to be blamed for a recession.

Moreover, strong vested interests are at work to keep the swimming-pool boom going. In private, businessmen make it clear that any incumbent failing to support the industry can forget about campaign contributions.

The Association of Swimming Pool Contractors declares that it would be “economically disastrous and a criminal disregard of their sacred public trust” for government officials to let the industry collapse.

The Santa Monica Water Authority suggests it would be in the public interest for the government to subsidize water so people can afford to fill their pools, and children can get daily exercise by swimming in them.

It is clear that not just the economy but the nation’s health and youth are at stake. The Silk Shirt and Gold Chain Retailers Association proclaims: “The city can never recover from the blow if the pool industry is allowed to fail.”

The bankers point to losses their depositors may have to take, and the Santa Monica Pool Supplies Association recommends tax credits for pool equipment as a cost-effective way to get the economy moving again. All the workers agree; they have no interest in pay cuts or unemployment.

A deflation could easily happen. Many borrowers could default on millions in bank loans, and much of the money supply could be wiped out.

The stocks and bonds of failing companies would become worthless.

As people scramble for money to keep the doors open, interest rates move up sharply. Even with the millions of new dollars in circulation, there’s a shortage of cash.

Everyone is screaming at their elected representatives to bring back prosperity and the good old days.

The screaming isn’t about “theoretical” issues, like whether the government should have had the ability to manipulate the money supply, or how a gold standard (that would have prevented the boom and bust in the first place) might best be established; those issues are considered irrelevant because they won’t solve the immediate problem.

What economic pundits suggest, instead, is more stimulation.

Since the currency has lost 20 percent of its value, it will take $12,000 of “stimulus” per person to achieve the same effect that $10,000 achieved in the first cycle.

The injection of new money drives down interest rates, reliquifies the markets, and heads off a deflation.

Seeing how close they came to the precipice, the pundits suggest a “safety net” so it won’t happen again. This would include unemployment insurance, so workers won’t have to worry about quickly getting new jobs at wages lower than they would like; bank deposit insurance, so no one has to worry whether his bank is prudently managed; some government agencies to help business, and some others to ensure business does not abuse that aid.

Perhaps an industrial policy to coordinate the economy and make sure business and labor do not make the same mistakes they made in the last boom. All this can be financed by borrowing, which is much less painful than taxes. It will all suck a tremendous amount of wealth out of productive sectors of the economy, but no one really cares because investors can pad their portfolios with government bonds.

A full business cycle has been completed: stability, followed by inflationary expansion, slowdown, and deflationary contraction. The contraction will be called a recession if the government acts quickly and reinflates the money supply in time to prevent complete collapse.

It will be called a depression if the government decides not to act, acts too late, or acts with too little reinflation.

In other words, it will be a depression if the government allows the economy to cleanse itself of the distortions that have occurred due to earlier government intervention and inflation; it will be a recession if the government steps in before the liquidation is complete.

Subsequent Cycles

Even if the government does act, it cannot undo the past.

People have experienced inflation. They are therefore much less willing to save money and far more eager to borrow to take advantage of its loss in value. Interest rates go up, as both savers and borrowers allow for the risk of future price inflation.

Businessmen and consumers start planning for higher prices. Some businesses hire economists to second-guess the gyrations of the economy and retain lobbyists to argue for their “fair share” of further government spending.

Everyone saw the fortunes made during the inflationary boom and also saw that the government had the power to prevent a collapse, so many people are willing to speculate on the inflationary trend continuing. Some take courses on buying real estate with “no money down.”

People feel richer than ever, consumer confidence hits new highs, and most investment is directed to cater to these different, and higher, levels of consumption. There are more construction companies, more big houses, more long lunches to celebrate.

The longer this goes on and the more business cycles the economy goes through, the more convinced people will become that the government not only can but should “manage” prosperity.

The distortions in the economy harden and set. More and more capital is allocated to activities that would be deemed silly were it not for government policy. Where once it was inconsequential, the government eventually becomes the major force in the economy. People plan their lives around what it will or won’t do.

But the economy becomes more heavily burdened with each business cycle, as more debt is accumulated. When later recessions hit, business finds itself stuck with more spare inventory and plant capacity and has to lay off even more workers.

Later recessions find both businesses and consumers deeply in debt, with no savings to rely on during hard times.

If the government had ended the game the first time around, the economy would have had only a sharp, but brief depression, like those that occurred before World War I.

The longer the process continues, the more severe the eventual outcome.

After a while, people start to see both inflation and recession at the same time.

Despite the presence of more luxury cars, houses, and restaurants than ever, the quality of life for middle and lower income classes is fading, as are hopes for the future.

The government has put itself in the position of driving a fast car with a sticky throttle. If it stamps on the brakes to slow it down, the car will spin; if it doesn’t, the car will run off the road.

Of course, the driver wants neither to happen, so he attempts to use moderation, stepping on the brakes but releasing them before the car spins. The ride inevitably gets wilder and crazier.

First to 10 mph, then back to 5 mph. Then to 20 mph, and back to 10 mph. To 40 mph, with a disinflationary bust back to 30 mph.

In the early ‘70s, the inflationary gas took the roadster up to 100 mph, and the 1974-1975 recession dropped it back down to 75 mph.

Re-stimulation took it up to 120 mph by 1980, and it has been careening about the road to the alternating exhilaration and terror of the passengers. Now the roadster (the economy) is approaching a spin on the edge of a cliff. If it survives, the next escalation will be to 160 mph, on a mountain road.

Beyond Santa Monica

If the problem were limited to the People’s Republic of Santa Monica, a small place, residents could easily move to surrounding areas to rebuild their lives, and there would be lots of outside capital available.

But the United States is the largest economy in the world, so the solution will not be that simple.

Worse, the US dollar is the world’s reserve currency; it constitutes most of the foreign exchange reserves of the majority of other countries. What happens to the dollar has direct bearing on what happens to other currencies. And what happens to the US economy is critical to what happens to every other economy in the world.

If US citizens were unable to buy Japanese cars and electronics, the Japanese would have massive unemployment, along with a real collapse of their economy. They would then be unable to buy goods they now buy from the United States, leading to even bigger problems. The situation could, and probably would, move out of control.

The situation is really much worse than the example presented in the story about Santa Monica. It would be bad enough if the government inflated only by crediting everyone’s account. That would propel a business cycle, but there would not be any special beneficiaries.

Instead, the government raises money by borrowing. It sells bonds to the public. The Federal Reserve honors the government’s checks, used to repay the bonds, by increasing the depositors’ reserve balance – like handing out poker chips.

The government borrows dollars and repays the debt with poker chips, trading them for real wealth at face value.

This process drains resources from the private sector, to the benefit of well-connected special-interest groups. The government doesn’t distribute the money it borrowed equally, or even randomly.

Its beneficiaries receive federal grants, loans, and purchase orders. They can spend dollars at close to their old value, before the money starts filtering down through society, raising prices.

They are the groups close to the government: Big Business, Big Labor, and the establishment in general. They differ on details of personality and policy, but ardently support the system as it is, with money, rhetoric, and influence.

Politics is the critical driving mechanism of this process. Considering that the US groups in control of the political process have a vested interest in the status quo, it is problematical to look to politics for change.

The change we’re likely to see will depend on whether the forces of inflation or deflation win out. Hence, it is a choice not between prosperity and depression, but between an inflationary and a deflationary depression.

* * *

The biggest financial bubble in human history has popped… and the coming financial volatility will be unlike anything we’ve ever seen before. It will be an increasingly dangerous time for retirees, savers, and investors. That’s precisely why NY Times best-selling author Doug Casey and his team just released a pressing new report, Surviving and Thriving During an Economic Collapse. Click here to download the free PDF now.

Tyler Durden

Sat, 04/11/2020 – 22:20

via ZeroHedge News https://ift.tt/2y9vQVE Tyler Durden