Western Media Coverage Of Russia As An Exercise In Propaganda

The notion of “fake news” has entered our vocabulary as a pejorative term for dissemination of bogus information, usually by social media, sometimes by traditional print and electronic channels which happen to hold positions contradicting the tenets of our conventional wisdom, i.e., liberal democracy. The term has been applied to Russian state owned media such as RT to justify denying such outlets normal journalistic credentials and privileges.

In this essay, I will employ the more traditional term propaganda, which I take to mean the manipulation of information which may or may not be factually true in order to achieve objectives of denigrating rivals for influence and power in the world, and in particular for denigrating Russia and the “Putin regime.”

The working tools of such propaganda are

-

tendentious determination of what constitutes news, which build on the inherent predisposition of journalism to feature the negative and omit the positive from daily reporting while they carry this predisposition to preposterous lengths

-

the abandonment of journalism’s traditional “intermediation,” meaning provision of necessary context to make sense of the facts set out in the body of a news report. In this regard, the propagandistic journalist does not deliver the essential element of paid-for journalism which should distinguish it from free “fake news” on social media and on the internet more broadly

-

silence, meaning underreporting or zero reporting of inconvenient news which contradicts the conventional wisdom or might prompt the reader-viewer to think for himself or herself. As a colleague and comrade in arms, professor Steve Cohen of Princeton and NYU, has said in his latest book War with Russia?: the century old motto of The New York Times “All the news that’s fit to print” has in our day turned into “All the news that fits.”

Demonstrations of the arguments I present here could easily fill a book if not a library shelf. However, I think for purposes of this essay, it suffices to adduce several examples of the three violations of professional journalism giving us a constant stream of propaganda about Russia and its political leadership by offering a few reports drawn from the very cream of our print and electronic media.

In particular, I have chosen as markers the Financial Times and the BBC. The use of propaganda methods in their coverage of Russia is all the more telling and damaging, given that in a great many domains these channels otherwise represent some of the highest quality standards to be found in reporting anywhere today and consequently enjoy the respect of their subscribers and visitors, who little suspect they could be so prejudicial in their coverage of select domains like Russia.

* * *

As 2019 drew to a close, many of our media outlets drew attention to two Russia-related anniversaries: the just celebrated thirtieth anniversary of the fall of the Berlin Wall with the retreat of Soviet armed forces from Eastern Europe that it touched off; and the soon to be celebrated twentieth year of Vladimir Putin’s hold on power in the Kremlin. Both subjects may be fairly called news worthy and so fully correspond to traditional journalistic values. What has been exceptional and unacceptable has come in the second category of violations listed above – lack of context.

Starting in October 2019, the BBC’s Moscow correspondent Steve Rosenberg did several programs dedicated to the fall of the Berlin Wall. During the Christmas to New Year’s period, the BBC aired one program which consisted of two parts. In the first half, Rosenberg considered the impact of the withdrawal of Russian forces from East Germany on the Russians themselves and interviewed the former chief of those forces, who explained at length how they “came home” to shocking living conditions in the provinces, how they were abandoned to their fate by their own government. The tone of the reporting was sympathetic to Russians’ hardships and it was good that their side of the story from the ground up was given the microphone. What implied criticism there was of the powers that be came from a patriotic source. However, the second half of the program was turned over to a certain Lydia Shevtsova, a very outspoken Putin-hater, formerly with the Carnegie Center Moscow, till she was finally booted out and moved to a more congenial and supportive think tank, Chatham House, in London, where her anti-Russian vitriol is encouraged and disseminated by her co-author, ex-British ambassador to Moscow Sir Andrew Wood. Among the gem quotations which Shevtsova delivered was the claim that Russia under Putin is a declining power which is capable only of disrupting the world order, a spoiler not capable of any creative or productive contribution. Of course, Shevtsova has a right to her opinions, however the BBC had an obligation to its audience to explain exactly who the lady is and, if they wanted to practice fair play, to offer an alternative interpretation of what Vladimir Putin’s Russia stands for on the global stage today. They did not do either. The result was pure propaganda not news and analysis.

As for violations in the categories one and two above, a very good example arose following the recent publication of a study performed by the Levada Center public opinion polling organization in Moscow during October which showed that “53 per cent of 18-to-24 year-olds wanted to leave the country.” This was written about by many of our news peddlers, including FT. The decision to feature this factoid and use it to support claims that the Putin regime’ is a failure fits well with tendentiousness of our news coverage. Meanwhile, nearly all coverage of that study, including in the Financial Times, offered no contextual information whatsoever, when the context was begging to be told.

The article in FT which carried the Levada Center findings was published on 9 January as “Generation Putin: how young Russians view the only leader they’ve ever known.” The remarks on Levada followed directly on another statement begging for context: “Youth unemployment in Russia is more than three times the rate of the total population, according to 2018 data, compared with just twice the rate in 2000.”

First, as regards those 53% would-be “leavers,” one might ask: and so, why don’t they just leave? Russia today is truly a free country: anyone other than convicted felons who wants a passport can get it, and get it rather quickly. And thanks to the efforts of their remarkably hardworking Ministry of Foreign Affairs, most of the world welcomes Russian travelers without a visa requirement. But for that matter, getting a Schengen visa for the EU is not so complicated either.

However, those 53% are, in fact, not going anywhere. They are just sounding off about their youthful disgruntlement with a world created and run by their parents.

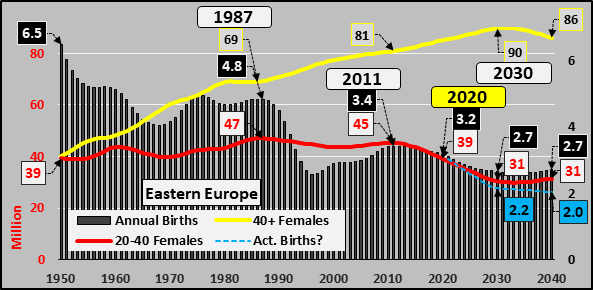

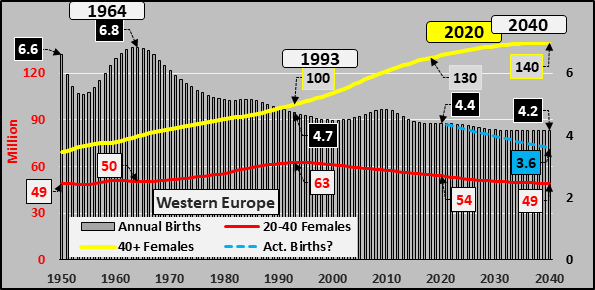

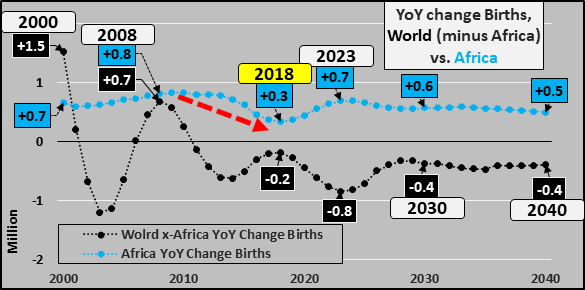

At the same time, as the Financial Times editorial board knows full well, young, middle-aged and even old have been leaving the Baltic States, Bulgaria, Romania and other former Soviet Bloc countries in droves, for the past thirty years up to the present day. That was the subject of an article published in the FT on the next day, 10 January 2020 under a title which speaks for itself: “Shrinking Europe.” The states I mentioned here have seen 25 and 30% loss of their population to citizens voting with their feet and departing the shrinking economies and personal prospects which result directly from deindustrialization and economic colonization by Germany and other founding Member States of the EU since 1991. The issue appears in the news now because, as the FT explains, “Andrej Plenkovic, the Croatian prime minister, has decided to elevate population decline to the top of his agenda as Zagreb assumes the EU’s rotating presidency.” Good for him! Now that the skeleton has finally come out of the EU closet, all the stories about Russia’s demographic crisis can be put in context – by those few who wish to do so.

Second, as regards unemployment in Russia today, I believe that similar ratios of youth unemployment to the general population unemployment can be found most everywhere in Western Europe if not in the world at large. The fact that this ratio has worsened comparatively in Russia since 2000 may be explained by the anomalous situation in Russia prevailing throughout the 1990s in step with the economic collapse that accompanied the transition to a market economy. Precisely the older generations, those over 40, were thrown into the street and their children or grandchildren were the first to be hired by the newly emerging industrial conglomerates, not to mention by Western multinationals settling in. What has happened since 2000 is merely a reversion to more normal distribution of employment and unemployment in the population as the Russian economy stabilizes.

Moreover, it would have been helpful had the author named the current level of youth and general unemployment in Russia. In fact, the general unemployment in Russia stands at something like 5%, so youth unemployment would be 15% by his reckoning. I assure you that there are many EU Member States that would be delighted to have similarly low unemployment rates. Here in Brussels the general rate has been over 20% for ten years or more, while youth unemployment has always been considerably higher.

Dear Reader!

For those who find my examples above too subtle to support my argument for egregious propagandistic treatment of Russia in our media, allow me to introduce violation number three, silence, in a way that should sweep away all objections to my thesis.

I draw your attention to an event that occurred in the past week about which you probably know nothing, or perhaps a wee bit from the odd man out reporting in the Wall Street Journal and a few other outlets. I am talking about the visit of Vladimir Putin to Damascus on Tuesday, 7 January. To their credit, the WSJ carried a short article in their 8 January edition, but went no further than to note this was the second visit by Putin since the Russians joined the fight in support of President Bashar Assad back in September 2015, turning the tide in the civil war his way. That is true, but only represents a tiny slice of what all our journalists, including the WSJ’s could have and possibly did learn from watching Russian state television on the 7th. What our media chose not to report was passed over in silence because it shows the complexity of Russia’s policy in the Middle East that includes but goes well outside the domain of pure geopolitics. This is so not least because of the date chosen for the visit, which happens to be Orthodox Christmas.

On the evening of the 6th, that is to say on Christmas eve, by the Russian Orthodox calendar, Russian state television broadcast live coverage of the Christmas service in the Christ the Savior cathedral in Moscow officiated by Patriarch Kirill, with prime minister Medvedev present on behalf of the Government. Then it cut to the service in St. Petersburg, where Vladimir Putin sat in the congregation, as is his custom. The commentator mentioned in passing that the Patriarch’s father, a parish priest, just happened to be the one who baptized Vladimir Putin as a child where they all lived, in the Northern Capital.

The next coverage of Putin on state television was from Damascus on the 7th, where he obviously arrived on a night flight from Petersburg. I did not see video coverage, perhaps because the journalist pool was very limited for security reasons. But still photos and reports on state television informed us that Putin had not merely held talks with President Assad on the Russian military base outside the capital, but had strolled together with him down the streets of Damascus, had visited the main church in the (still existing) Christian quarter of the city, had presented to the Patriarch of Antioch an icon of the Virgin and had also gone on to visit the city’s oldest and largest mosque.

What you have here is precisely the second line of justification for Russian presence in Syria alongside military/geopolitical reasons: resuming Russia’s 19th century role as protector of the Orthodox population in the Holy Land and the broader Middle East. A similar role was exercised back then by France on behalf of the Catholic populations, but that since has been totally negated by rampant secularism and multiculturalism in Western Europe.

It also has to be said that Putin’s visit to Damascus was back-to-back with other very high visibility political statements: his visit to Istanbul on the 8th for the official opening of the TurkSteam gas pipeline and for lengthy talks with President Erdogan that ended in a joint statement calling for a truce in the Libyan civil war for which Russia and Turkey support opposing sides; and his visit on the 9th to Russian naval exercises in the Eastern Mediterranean that included the launch of Russia’s latest hypersonic missiles, the reality of which U.S. and other Western experts have yet to acknowledge.

With this I rest my case on the unfortunate propagandistic behavior of our media which deprive the broad Western public of any chance to make sense of the most dangerous military and political standoff of our age.

* * *

Gilbert Doctorow is a Brussels-based political analyst. His latest book Does Russia Have a Future? was published in August 2017.

Tyler Durden

Fri, 01/17/2020 – 21:05

via ZeroHedge News https://ift.tt/2uapiEm Tyler Durden