Hedge Fund CIO: “The Biggest Market Player Is 15x Leveraged; That’s Why When It Starts Going Wrong, You’re Out”

Submitted by Eric Peters, CIO Of One River Asset Management

“Wanted to make sure you’re seeing this,” texted a PM from one of those multi-manager monstrosities.

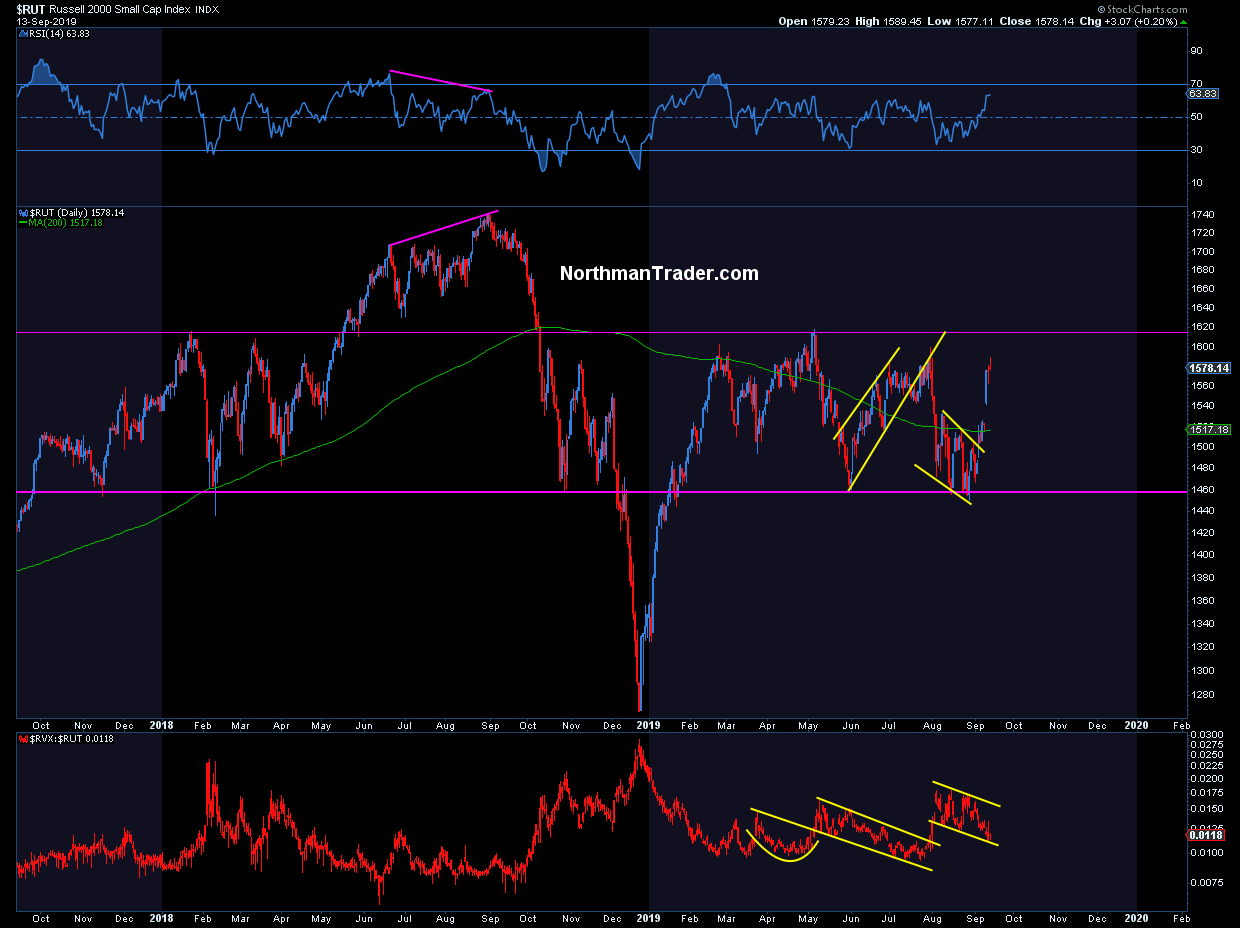

“8 standard deviation move in the Momentum Factor in 5-days,” he added. I heard his heart pounding all the way from Australia.

“Guys who defended positions in the Q4 selloff all got fired, so the message is real clear – when things start getting weird, take immediate corrective action.” And I imagined the quiet panic consuming firms that leverage their capital at multiples that would make a Lehman risk manager blush.

“I’m more convinced than ever that one of these days, this kind of 8 standard deviation event is going to crash the market,” he texted, having puked his position without the slightest idea why the move had even started.

- Factor Definitions (Momentum): Momentum is the empirically observed tendency for rising asset prices to rise further and falling prices to keep falling. For instance, it was shown that stocks with strong past performance continue to outperform stocks with poor past performance in the next period with an average excess return of about 1% per month. Momentum signals (e.g., 52-week high) have been shown to be used by analysts in their buy and sell recommendations. The existence of momentum is a market anomaly, which finance theory struggles to explain.

- Factor Definitions (Value): The value factor is based on a belief that stocks that are inexpensive relative to some measure of fundamental value outperform those that are pricier. the best-known work on the value factor was carried out by Fama and French in their 1992 paper (The cross-section of expected stock returns), which concluded that low price-to-book ratio was the most predictive definition of value. To this day, different definitions of value are favored by investors, including cashflows, price relative to earnings, dividend yield, and other company fundamentals.

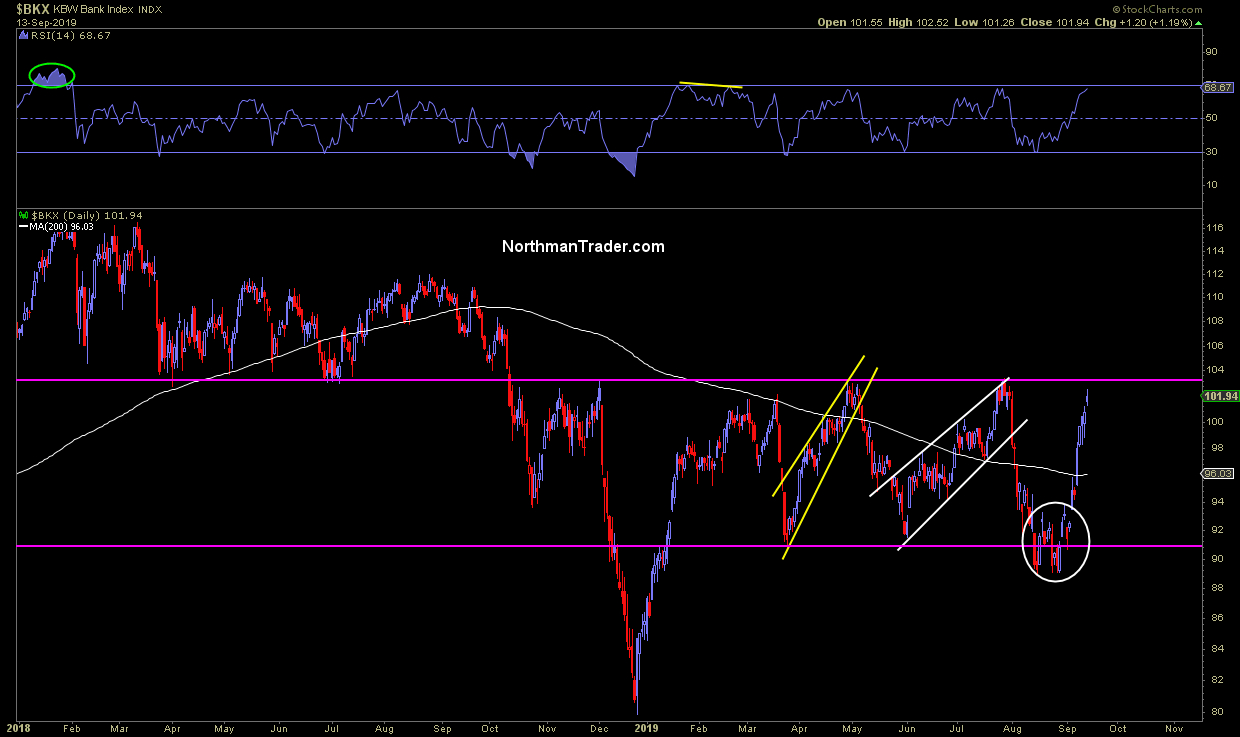

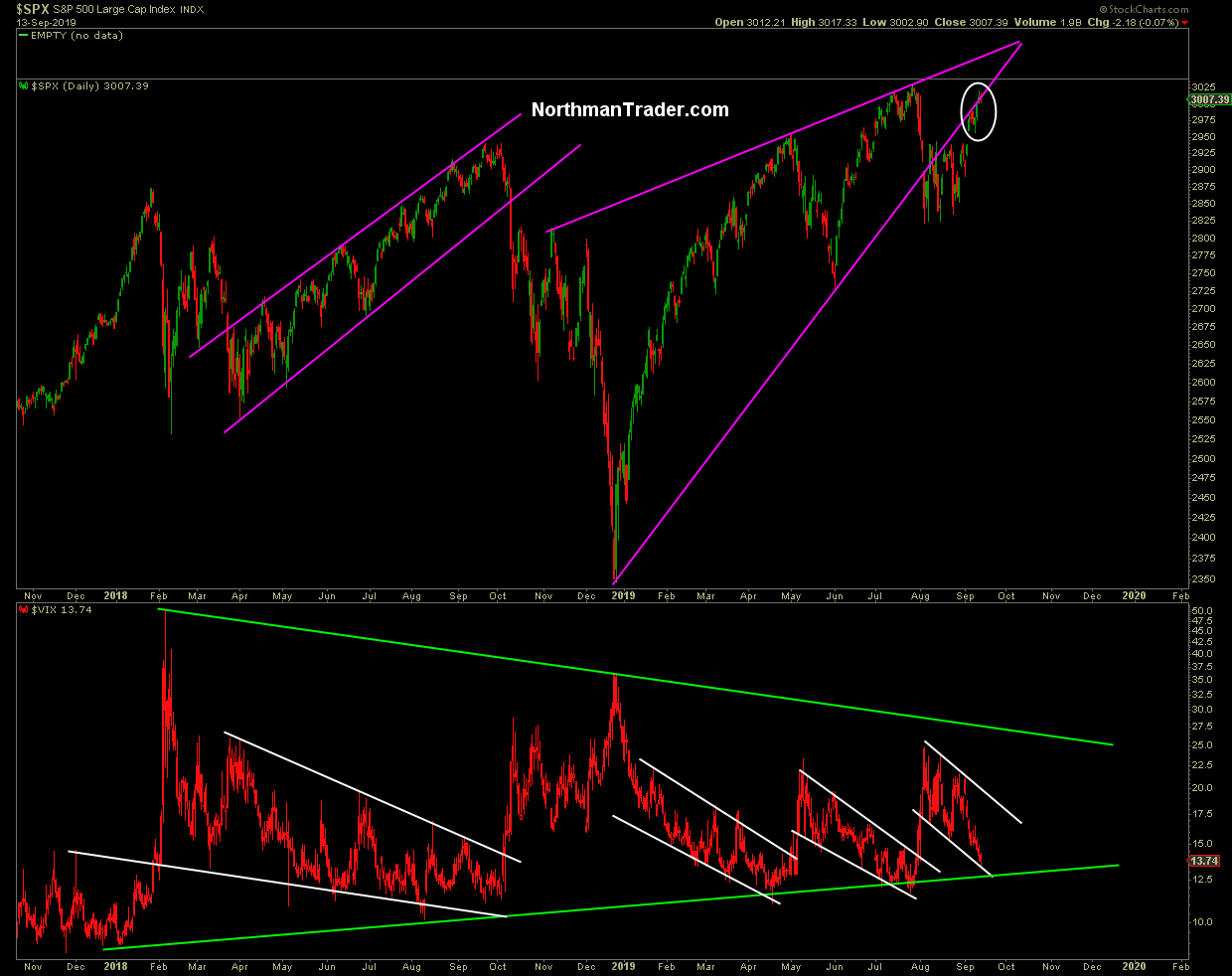

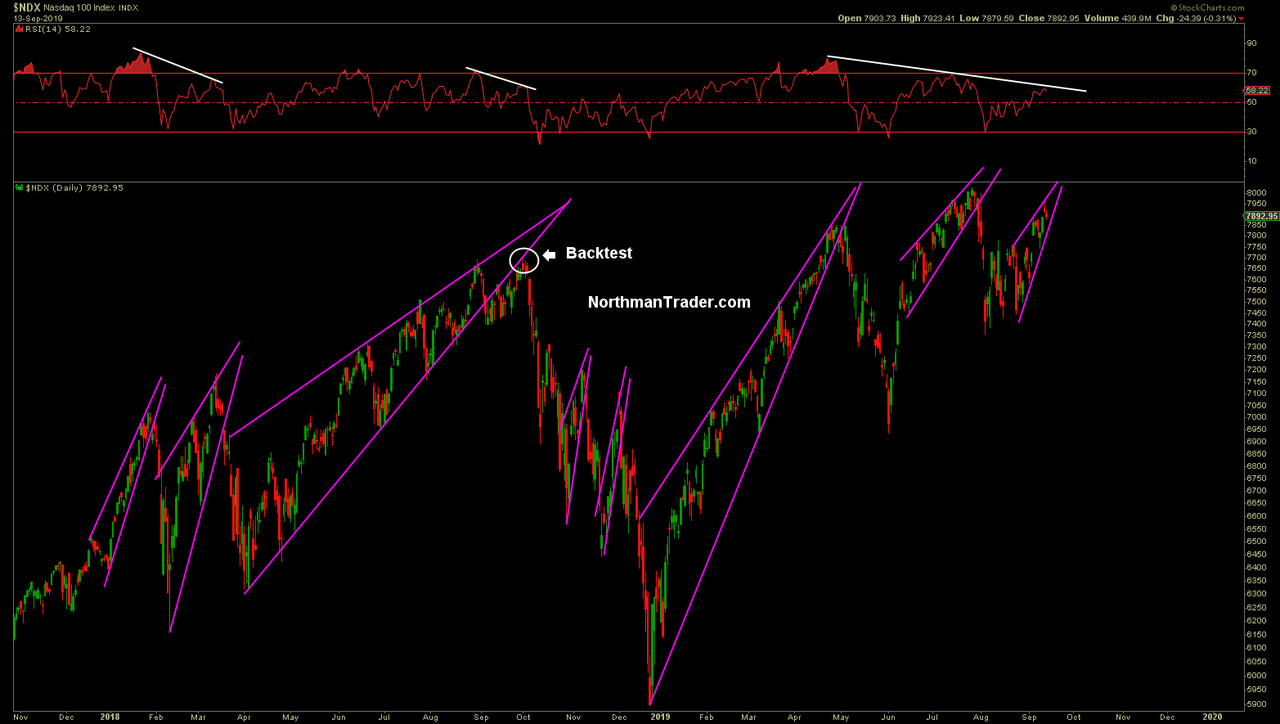

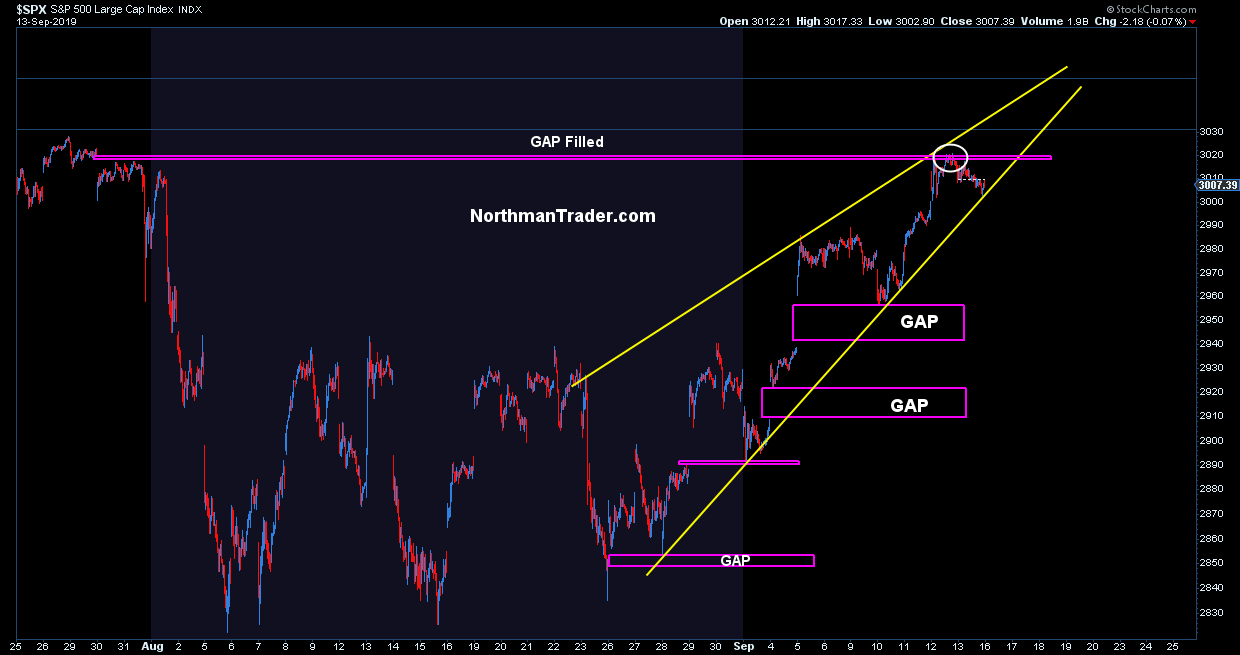

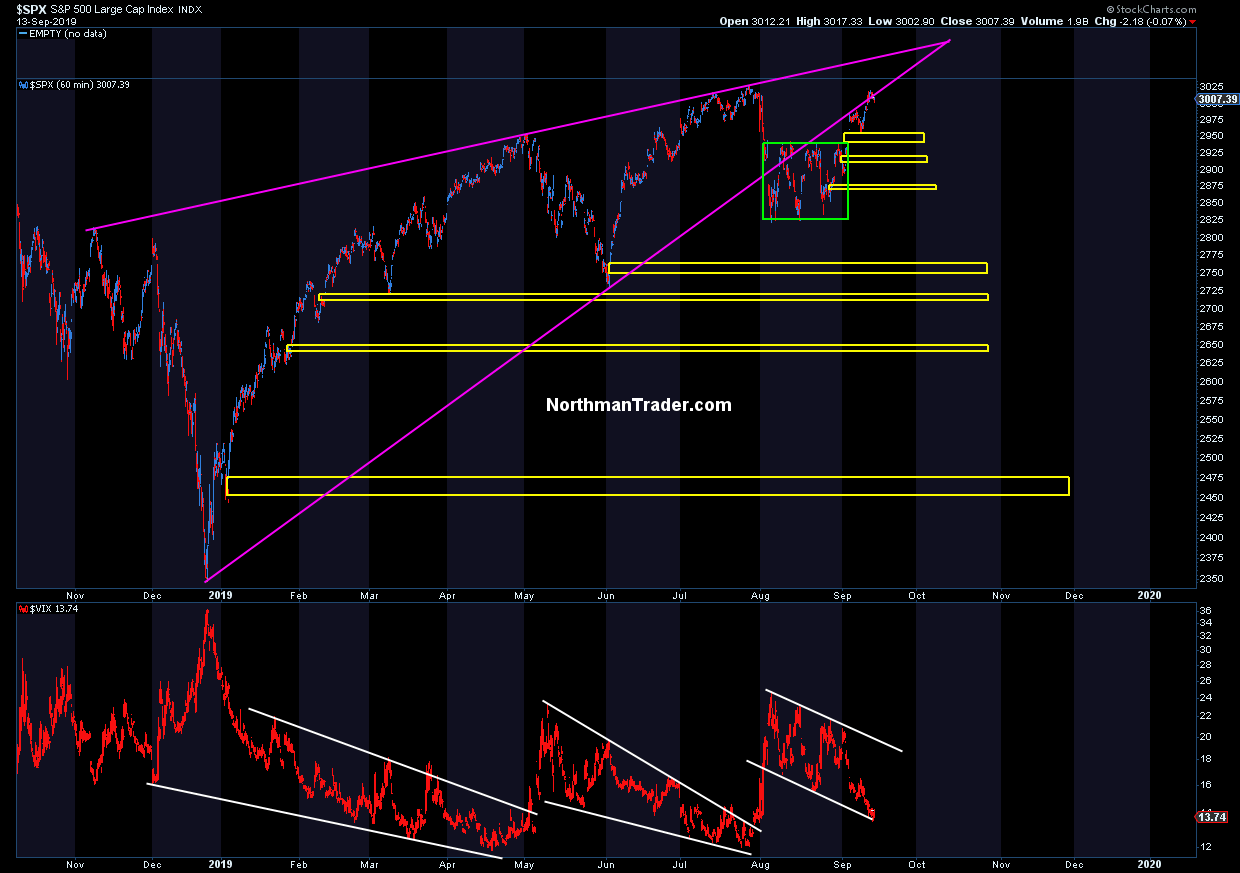

“There were early adopters,” he said. “Citadel was probably the foremost expert in style factors and for years they were playing the game with few real competitors.” We were discussing the carnage taking place beneath the market’s surface, with many guys losing their year, some losing their jobs – all in a week when the S&P 500 closed +1.0% and the VIX finished at 13.7.

“They leveraged the factor strategies and did very well. But over time their advantage got difficult to sustain. Then their traders scattered. Some started firms to compete.”

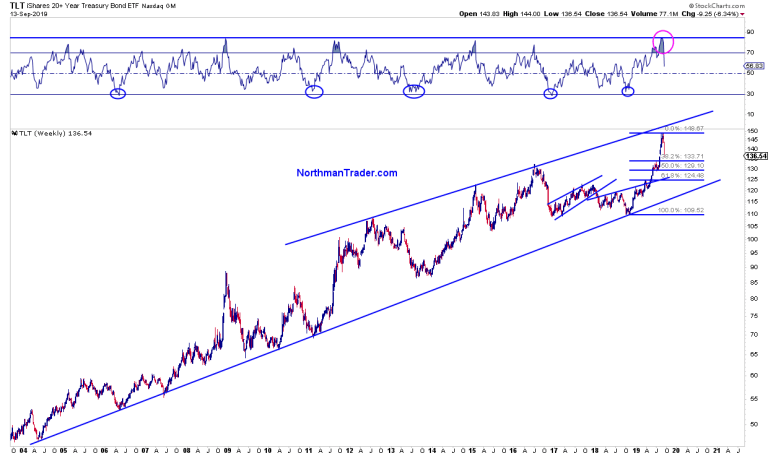

“The momentum factor had been on fire for 3-4 months,” he said. By early August it hit levels last seen at the Feb 2016 extreme. “A lot of guys figured it would reverse and fought it. But it kept going, then went into overdrive, it hit insane levels as people capitulated,” he said.

“Then it just reversed for no reason and it was madness-of-crowds time. It was not-everyone-gets-out-of-the-burning-theater-alive time. It was bank-run time. And then the momentum collapse spilled into the value factor. Which took off in the opposite direction.”

“When this kind of liquidation starts, there are two schools of thought,” he said. “There’s the ditch-everything school,” he said, having just ditched. “Then there’s the take-half-off-now-and-pray-it-comes-back school.” That’s where most guys got diplomas.

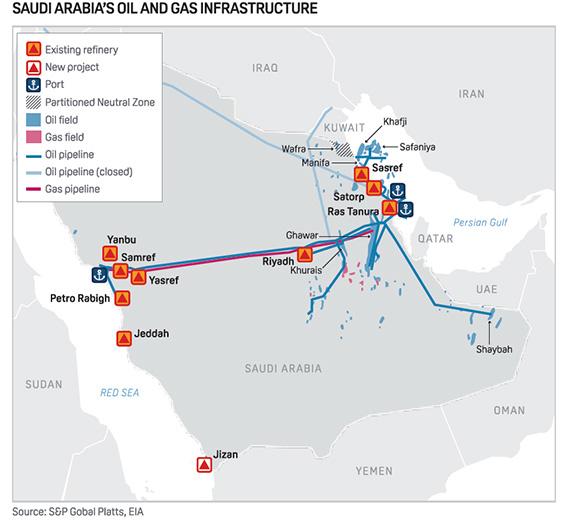

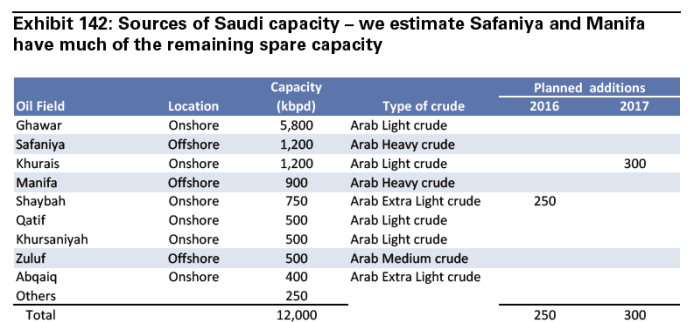

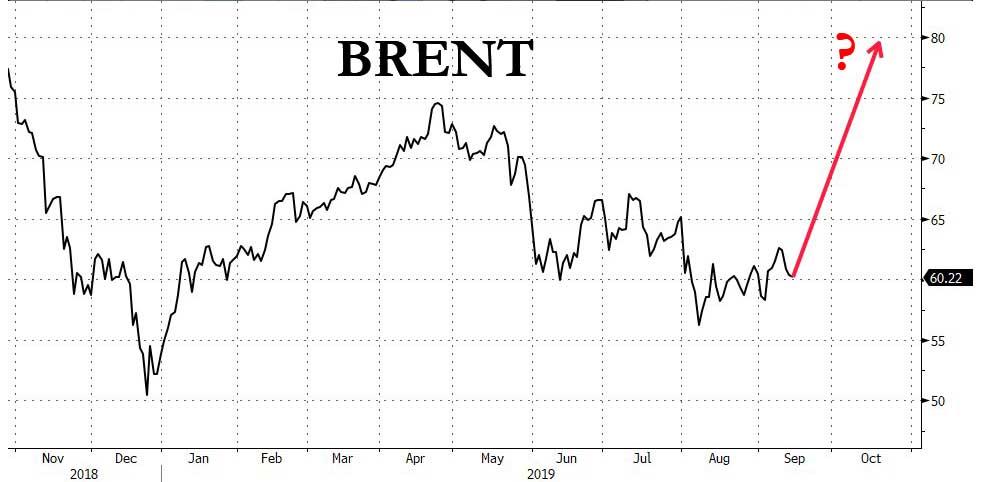

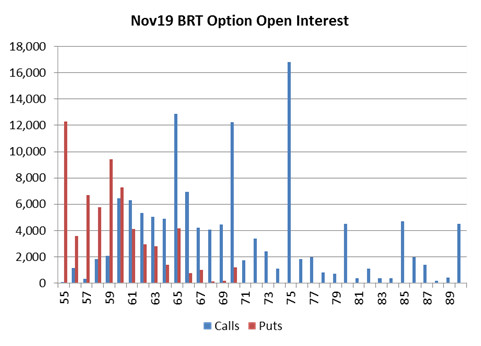

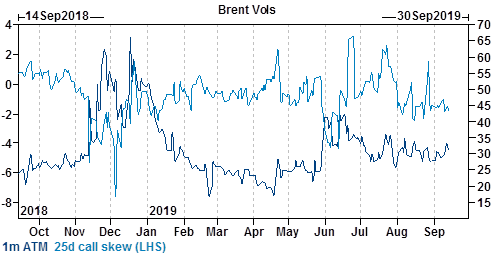

“But you end up taking off half the next day, then half again, and so on.” That’s what gives liquidations longevity. “Some think Value has underperformed Growth for so long that this unwind goes on for ages. I think it’ll look like 2016 which means it’s 60% over – and this attack on the Saudi refineries is going to wreak havoc on the factor trade Monday morning.”

“Let’s say they give me $500mm capital to trade,” he said. “I buy $500mm worth of stocks and sell $500mm worth, which makes me 1x leveraged,” he explained. “Multiply that leverage across all the equity traders here, then add all the rates traders and you find that the firm overall is 10x leveraged.” For each $1bln of capital, they hold $10bln of positions. The biggest player in the market is leveraged 15x. “When you have that kind of leverage you need to have tight stops. Which we all do. And that’s why when it starts going wrong, you’re out.”

Tyler Durden

Sun, 09/15/2019 – 16:56

via ZeroHedge News https://ift.tt/30kN0bs Tyler Durden