While the US was closed for President’s Day holiday, the European rally sputtered on Monday ignoring a renewed surge higher in Chinese stocks following a record credit injection, and on Tuesday a “sea of red” in global markets has returned, as US equity futures slumped dragged lower by European banks following a mixed session in Asia as investors appear unable to go for even one day without fresh “hope” on US-China trade talks, while the dollar climbed, snapping a three-day decline, and Treasuries edged up before U.S.-China trade talks resume in Washington.

Global markets were struggling for direction after a slow start to the week and with a fresh round of Sino-U.S. trade talks, this time in Washington, being held later, as stocks traders were largely happy to keep their powder dry.

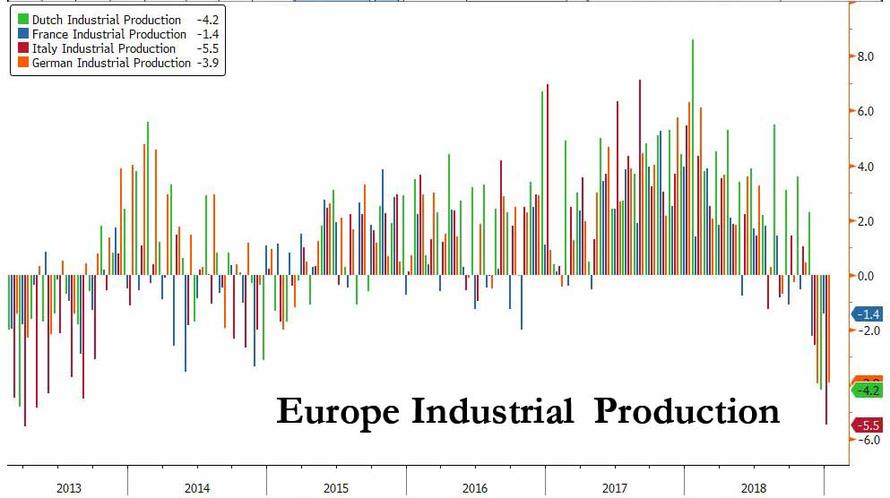

Europe’s Stoxx 600 retreated after two days of gains, led lower by banks following disappointing earnings from HSBC Holdings, while weak macro data has sent increasingly dovish signals from the region’s central bank. HSBC – Europe’s biggest bank – saw its shares tumble as it missed forecasts due to slowing growth in its two home markets of China and Britain. HSBC’s U.K. shares follow their Hong Kong peers lower after worse-than-expected results, with the stock sliding as much as 4.6% and the biggest decliner on the FTSE 100 Index. The Stoxx 600 Banks index down as much as 1.7%, with banks the worst performing industry group on Tuesday.

The results spoke to a wider problem for European banks, which are struggling to return to growth after a decade of post-crisis restructuring due to a worsening global economic outlook.

In addition to poor earnings from Europe’s largest bank, the sector is facing is facing additional headwinds due to receding hopes for any quick interest-rate rise after ECB chief economist Peter Praet said officials could push back plans to raise rates as a first response against a deeper downturn

Automakers were also under pressure as the European Union vowed prompt retaliation if the U.S. imposes tariffs on imported vehicles.

Earlier in the session, Bank of Japan Governor Haruhiko Kuroda unexpectedly told parliament the central bank would consider extra monetary easing if required, helping lift the Topix index and send the yen lower, even as shares in China were little changed as equities in Hong Kong dropped after Monday’s blockbuster gains. Japan’s Nikkei nudged up 0.1 percent after holding flat for most of the day. Australian shares climbed 0.3 percent to a 4-1/2 month peak, after gaining over 8 percent so far this year, partly on expectations the central bank could ease policy to temper pressure on growth. Chinese shares slipped into the red though after surging in the previous session, with the blue-chip index off 0.2 percent.

China Vice Premier Liu He will visit Washington for trade talks on February 21st-22nd, while there were comments from White House Press Secretary Sanders that trade meetings with China in Washington D.C. will begin today and that higher-level talks which will be led by USTR Lighthizer are to begin on Thursday. Furthermore, trade talks are said to focus on needed structural changes in China which impact trade, as well as China’s pledge to buy a substantial amount of goods and services from the US.

Despite today’s muted action, Chinese shares have risen rapidly so far this month, with MSCI’s China A shares index up 6.5%, by far the best performance among major markets despite China’s weakening economy. Additionally, investors are now seen returning to riskier asset markets after the U.S. Federal Reserve signalled earlier this year it could halt rate hikes in light of U.S. economic softness.

“In the last week, it seems like global central banks have started a possible process of monetary easing,” Bank of America-Merrill Lynch strategist Ajay Singh Kapur said in a note. “If so, this would be very positive for Asia/EM stocks,” Kapur said.

Across the Pacific, contracts on the Nasdaq, Dow and S&P 500 edged lower as traders kick their heels before the next round of trade talks between America and China. Italian bonds fell while most European notes climbed.

With earnings season coming to an end, the latest minutes from the FOMC and ECB due this week and U.S. President Donald Trump weighing an extension of the deadline for a trade deal with China, investors have plenty to digest. Uncertainty over the outlook for global growth hangs over everything, and traders will be hoping for some good news from the world’s two largest economies when talks resume in Washington on Tuesday.

“There is a recession coming,” Steen Jakobsen, the chief economist at Saxo Bank said in an interview on Bloomberg Television with Anna Edwards. He reckons markets are too optimistic on a trade deal between the U.S. and China. “There will by some Pyrrhic victory for the two sides to claim and extend the timeline, but in terms of material impact, no,” he said.

Overnight, President Trump said US is seeking a peaceful transition of power in Venezuela but added that all options are open.

EU Commission President Juncker said Trump gave his word there wouldn’t be tariffs on European cars for the time being; if Trump breaks the promise, EU will break its promise to buy more soy and LNG; according to Stuttgarter Zeitung. European Commission President Juncker says if UK requested extension of talks, no one in Europe would oppose it; adds he has no timeframe for length of extension.

In FX, the Bloomberg Dollar Spot Index climbed, snapping a three-day decline, and Treasuries edged up before U.S.-China trade talks resume in Washington. The euro broke a tight range and dropped as much as 0.3% to 1.1276 after more talk of ultra-cheap ECB bank loans, as the Bloomberg dollar index index climbed to fresh day high. The Australian dollar swung to a loss after the nation’s central bank reaffirmed mounting concerns over consumer spending.

The pound followed suit as Margaritis Schinas, a spokesman for the European Commission, said the EU won’t reopen the U.K.’s withdrawal agreement and won’t accept a time limit on the Irish border backstop despite a report that showed U.K. wages were growing at their fastest pace in a decade. The yen had slipped to 110.70 per dollar after Japan’s central bank governor had said it could redeploy stimulus if the yen’s relative strength this year hurt the economy and inflation prospects.

“Stokkie (dollar vs Swedish crown) is off to the races,” said TD Securities’ head of global research, Richard Kelly. “You had especially weak inflation and as you see (from the yen and euro) it comes against this backdrop of central banks becoming more dovish again,” although he also said that bond markets has seen far less reaction to the Swedish data.

In commodities, oil prices were mixed, with Brent futures off 29 cents at $66.21, although that was not far from Monday’s $66.83 which was the highest since mid-November. U.S. crude futures added 21 cents to $55.8. The precious metals market was more animated, with palladium surging to a record high of $1,471.0 per ounce as stricter emissions standards are seen increasing demand for the auto catalyst metal. Gold held around $1,323.66 per ounce after earlier rising to a near 10-month high of $1,327.64 too.

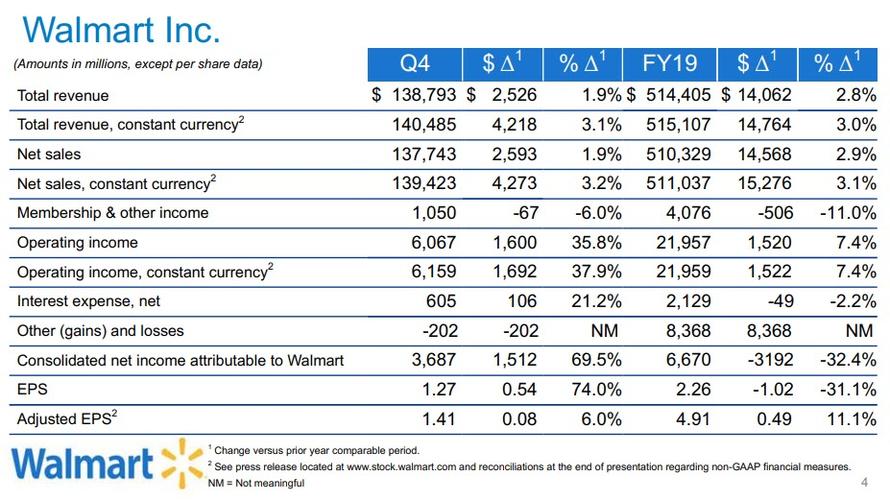

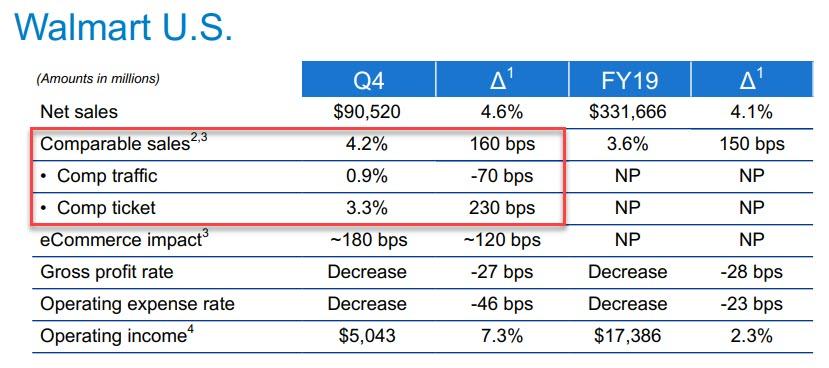

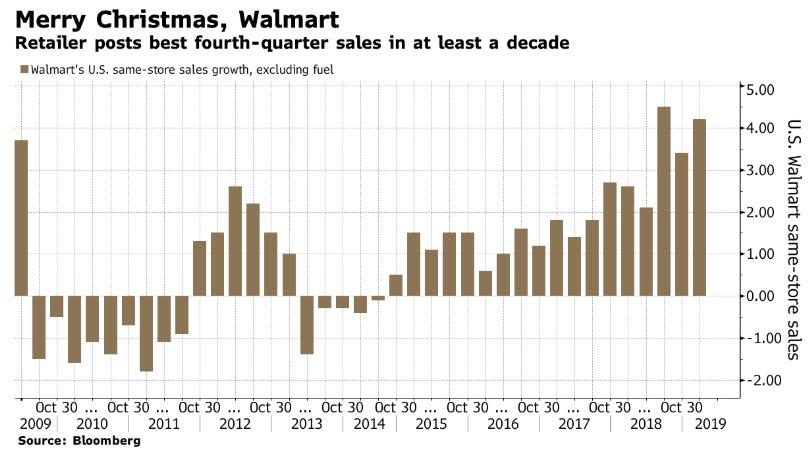

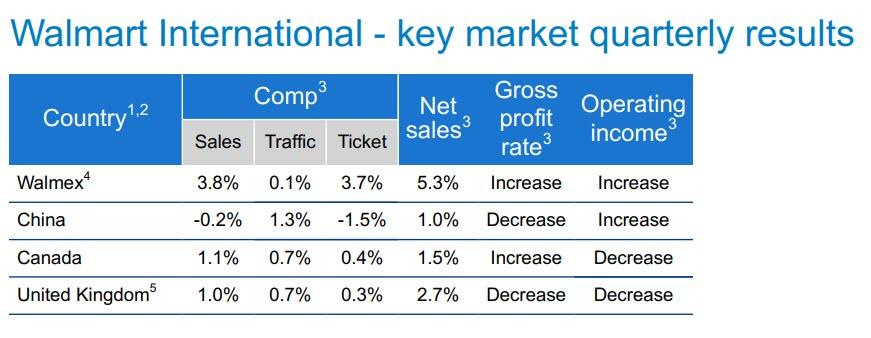

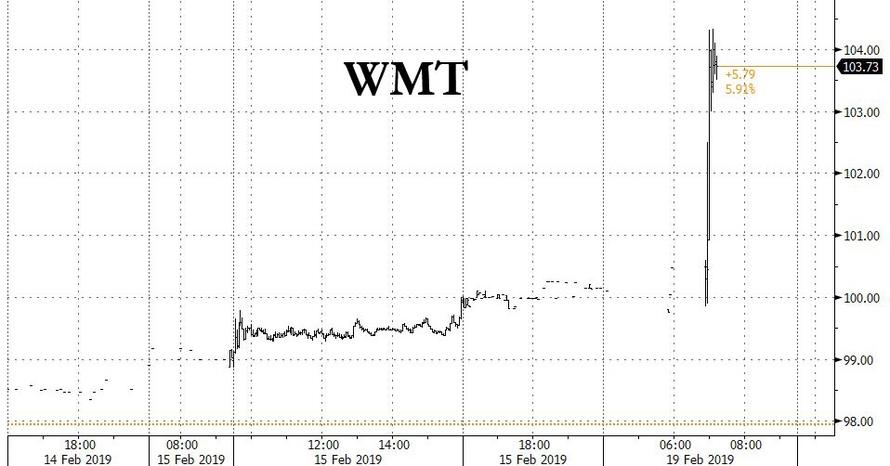

Expected data include NAHB Housing Market Index. Ecolab and Walmart are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.2% to 2,772.50

- STOXX Europe 600 down 0.4% to 368.32

- MXAP down 0.1% to 157.11

- MXAPJ down 0.3% to 512.60

- Nikkei up 0.1% to 21,302.65

- Topix up 0.3% to 1,606.52

- Hang Seng Index down 0.4% to 28,228.13

- Shanghai Composite up 0.05% to 2,755.65

- Sensex down 0.3% to 35,394.88

- Australia S&P/ASX 200 up 0.3% to 6,106.88

- Kospi down 0.2% to 2,205.63

- German 10Y yield fell 1.9 bps to 0.091%

- Euro down 0.03% to $1.1308

- Italian 10Y yield fell 3.2 bps to 2.407%

- Spanish 10Y yield fell 1.5 bps to 1.212%

- Brent futures down 0.4% to $66.26/bbl

- Gold spot up 0.2% to $1,329.52

- U.S. Dollar Index little changed at 96.90

Top Overnight News

- U.K. and European officials are working on a new legal text for the most contentious part of the Brexit deal, but time is running out for Prime Minister Theresa May to persuade a fracturing Parliament to unite behind her plan

- Italy’s bonds are enjoying a period of relative calm while Spanish politics hogs peripheral euro-area headlines. But the market’s sense of stability looks increasingly fragile as risks mount with the economy in recession, a widening budget deficit and the threat of a rating downgrade

- The European Central Bank’s chief economist added to the chorus of policy makers signaling concern on the economic slowdown, saying officials could push back plans to raise interest rates as a first response against a deeper downturn

- Chinese and U.S. trade negotiators will start the next round of talks this week in Washington, after discussions in Beijing last week that President Donald Trump called “very productive.”

Asian stocks were mixed as the region struggled for firm direction following yesterday’s rally and after a non-existent lead from the US which was shut for President’s Day. ASX 200 (+0.3%) was positive with the index led higher by outperformance in the tech and financials sectors, although consumer staples and healthcare were on the other end of the spectrum amid losses in Coles and Blackmores due to weak earnings. Elsewhere, Nikkei 225 (+0.1%) just about remained afloat with price action largely reflecting jittery trade in the domestic currency, while Hang Seng (-0.4%) and Shanghai Comp. (U/C) were indecisive as focus remained on US-China trade discussions which will resume today before the higher level talks on Thursday, and with some disappointment from a miss on HSBC earnings. Finally, 10yr JGBs were initially softer amid a pullback from the prior day’s gains and with demand suppressed by the mild upside across stocks, although prices later recovered after firmer results at the 20yr JGB auction. China Vice Premier Liu He will visit Washington for trade talks on February 21st-22nd, while there were comments from White House Press Secretary Sanders that trade meetings with China in Washington D.C. will begin today and that higher-level talks which will be led by USTR Lighthizer are to begin on Thursday. Furthermore, trade talks are said to focus on needed structural changes in China which impact trade, as well as China’s pledge to buy a substantial amount of goods and services from the US

Top Asian News

- PBOC Rate Cut Bets Have China Analysts Asking ‘Which Rate?’

- Kaisa Group Dollar Bonds Rally to Highest Level in Nine Months

Major European indices are mostly lower after trading choppily this morning, taking the lead from a directionless Asia session [Euro Stoxx 50 -0.6%]. The FTSE 100 (-0.6%) is weighed on by poor performance in HSBC (-4.0%) following their earnings; the Dax (-0.2%) is outperforming its peers bolstered by Wirecard (+4.5%) and Heidelberg Cement (+3.4%) following Bafin prohibiting new/extending shorts yesterday and a Q4 revenue beat respectively. Sectors are broadly in the red, with some underperformance in banking names, weighed on by the aforementioned HSBC who carry around a 2% Stoxx 600 weighting; and are the largest banking component. Other notable movers include, Danone (-0.7%) who are in the red in-spite of a beat on their sales, with some analysts highlighting weaker than expected margins. Automakers, such as Volkswagen (-0.9%) and Daimler (-1.0%) are in negative territory after EU Commission President Juncker stating that US President Trump gave his word that there wouldn’t be tariffs on European cars for the time being; alongside the EU agreeing to cut new truck CO2 emission levels by 30% before 2030.

Top European News

- U.K. Wage Growth Fastest Since 2008 Amid Labor Shortages

- VW Wins Appeal in German Suit Over Diesel Emissions Scanda

- Danske Bank Watchdogs Get Drawn Deeper Into European Probe

- Sweden’s Krona Slumps Most in Eight Months After Inflation Slows

- Siemens, Fortum Join Europe’s Jumbo Corporate Bond-Deal Dash

In FX, the Swedish Crown has slumped in wake of much softer than expected inflation data, and a slump in housing starts that together raise valid question marks over the Riksbank’s relatively confident outlook on the domestic economy and CPI/CPIF remaining close to target. On that note, Governor Ingves is due to speak later today and will get a chance to comment, as Eur/Sek spikes from sub-10.5000 through several chart resistance levels and only a whisker away from offers said to be lined up at 10.6000.

- AUD/NZD – Very volatile trade overnight on the back of latest RBA minutes that initially underpinned the Aud on confirmation of no likelihood of a change in policy rates for some time (so no ease in the offing), but then underlined the shift to a more neutral stance and highlighted significant risks to the economic outlook. Aud/Usd retreated swiftly in response and is currently holding just above 0.7100, while the Kiwi has been dragged down in sympathy as the cross remains just above 1.0400, with Nzd/Usd hovering around 0.6825 vs just a few pips short of 0.6900 on Monday.

- JPY/CAD – The next worst G10 performers, as Usd/Jpy grinds back up into a higher range and closer to 111.00 again amidst dovish rhetoric if not firm or official guidance from BoJ Governor Kuroda (mulling more accommodation if Jpy strength weighs on growth and hampers efforts to achieve the 2% inflation target, which has already proved extremely elusive of course). The headline pair is now probing 110.80, but could be held back by decent option expiry interest at 110.60 (1 bn). Meanwhile, the Loonie remains anchored around 1.3250 vs its US counterpart, eyeing crude to see whether prices push further ahead or consolidate around 2019 peaks.

- GBP/EUR/CHF – All narrowly mixed and pretty flat vs the Dollar that has edged up from yesterday’s lows (DXY close to 97.000 at one stage), with Cable maintaining 1.2900+ status, albeit just, awaiting more Brexit developments/headlines following a solid if not quite as upbeat as forecast UK labour market report. Similarly, the single currency is clinging to 1.1300 and showing resilience in the face of yet more dire Italian data, perhaps drawing a degree of encouragement from a more mixed ZEW survey, while the Franc is still chipping away at recent losses and inching through 1.0050 after a wider Swiss trade surplus.

- EM – More depreciation for the likes of the Rand and Lira, but the pressure and spotlight may switch somewhat to the Real later given political jitters due to the dismissal of a key aide to President Bolsonaro and potential adverse repercussions for pension reform. For reference, Usd/Brl settled around 3.7330 on Monday.

In commodities, the energy complex is ultimately flat-to-lower on the day thus far, with WTI (+1.0%) little changed net-net after missing a price settlement yesterday due to the President’s Day holiday over in the States. The holiday has also delayed the release of the API weekly inventory release by a day. In terms of macro themes for the complex, eyes remain on whether the OPEC-led supply curbs will ultimately ease glut concerns against the backdrop of 5 consecutive weeks of record-high US crude output. Furthermore, sources stated today that Saudi are mulling diminishing exports of Arab extra-light crude to the Asia region from March. The sourc es added that the move has improved demand in Abu-Dhabi’s Murban and Das in Asia’s spot market. Elsewhere, spot gold (+0.2%) is on the front foot and hovers near 10-month highs despite a rise in the USD as demand for the yellow metal grows ahead of the widely-anticipated dovish FOMC minutes tomorrow. Meanwhile, Shanghai aluminium fell following Malaysia announcing it will not extend a prohibition on mining bauxite when it expires on March 31st, with some noting it’ll potentially reduce costs in the aluminium supply chain for China.

US Event Calendar

- 8:50am: Fed’s Mester Speaks on Economic Outlook and Monetary Policy

- 10am: NAHB Housing Market Index, est. 59, prior 58

DB’s Jim Reid concludes the overnight wrap

With US markets shut, it’s been a predictably quiet last 24 hours. One of the few talking points yesterday though was the differing views on whether or not the US government would be forced to make public the results of the S232 report on the investigation of the national security risk posed by imported cars. There appears to be differing opinions on if the government has to make the findings public with some confusion around the legal language. With US markets open again today though, if the government is forced to make the findings public then in theory we would find out today, although Axios did quote a source yesterday as saying that “the White House was in favour of keeping the findings private so that Trump could have it in his back pocket as a threat”. So it remains up in the air.

In any case Trump had 90 days from receiving the report to decide on whether or not to take further action. His Twitter account has so far remained dormant on the subject too which is perhaps a positive sign right now insofar as not wanting to raise tensions across the pond. The only comment we’ve heard from the European Commission was Juncker saying in an interview with Germany’s Stuttgarter Nachrichten that “Trump gave me his word that there won’t be car tariffs for the time being” and that “I regard this promise as reliable”. He also said that “should he break his word we won’t feel bound to our promise either to buy more US soy and liquid gas”. We’ve heard a similar comment from Japan’s economy minister Motegi, who said that the US won’t apply higher tariffs on imports of Japanese cars and auto parts so long as negotiations toward a trade deal continue. One to watch.

Speaking of tariffs and trade, White House Spokeswoman Sanders said overnight that the US-China trade negotiations are set to begin today while, China’s Commerce Ministry released a statement saying that China’s Vice Premier Liu He will travel to DC on February 21-22 for meetings with Lighthizer and Mnuchin. In the meantime, Steve Censky, the US Department of Agriculture’s deputy secretary, said yesterday that talks are picking up pace ahead of the March 1 deadline, “but we still have ways to go.”

As for markets, well bourses in Asia have been a bit directionless overnight with the Nikkei (+0.21%) up while the Hang Seng (-0.36%), Shanghai Comp (-0.21%) and Kospi (-0.13%) are down having erased earlier gains. Elsewhere, futures on the S&P 500 (-0.01%) are trading flat. Meanwhile there’s been some focus on the BoJ where Governor Kuroda sounded a touch dovish in his address to parliament, saying that the BoJ will consider extra easing to hit price targets if needed while adding that additional easing could also be considered due to moves in the Japanese yen if they impact economy and prices. However, he added that all decisions will be taken after carefully examining policy benefits and costs. JGBs have rallied a bit after the comments, and are now trading at -0.035%. The Yen is back to flat after trading a bit stronger in the early going.

Those moves follow a low-volume inspired but mildly positive day for risk assets in Europe yesterday. The STOXX 600 initially spent an hour or so in the morning trading in and out of the red but eventually closed up +0.23% for its fifth daily gain in the last six days. That also means that the index is now up +9.52% for 2019 so far which is the best start to a year since 2015 and in fact the fifth best – out of 33 – since the index started back in 1987. As for other markets yesterday, the DAX (-0.01%) lagged a bit further behind however European Banks (+0.91%) continue to reap the rewards from Friday’s TLTRO comments. That’s now +5.25% from the Friday morning lows for the index while Greek Banks were up +6.20% yesterday and the most since early December after Greece’s government submitted a plan to the Commission to speed up bad-loan disposals.

There was also a marginal outperformance for the FTSE MIB (+0.58%) and IBEX (+0.35%) while the same was true in bond markets where 10y BTPs closed 3.1bps lower and Bunds 0.7bps higher – with little follow through from the ECB Governing Council member Villeory’s comments about a “significant” slowdown of the European economy. That puts the spread between the two at 266bps and the lowest in two weeks. Post Villeroy’s comments we also heard from Praet who added that “if the Euro Area economy were to slow more sharply, we could adapt our forward guidance on interest rates and this could be complemented by other measures”. Praet also called TLTROs a “very useful tool” in the past.

Elsewhere in markets, HY credit spreads finished 4.4bps tighter in Europe which now makes them 65bps tight from the January wides. Speaking of credit, yesterday we published a short note looking at trends around liquidity premiums in the EUR and USD HY markets. See this link for the full report.

In other news, here in the UK it was a better day for Sterling (+0.27%). That seemed to partly reflect the Times article suggesting that progress was being made on legally binding assurances on the Irish backstop, albeit one that was light on specifics. Less relevant but nonetheless headline grabbing all the same was the announcement of 7 MP resignations from the Labour party yesterday. The resignations are unlikely to have much of a read-through from a Brexit perspective however there is the possibility for wider ramifications insofar as it may reduce Corbyn’s chances of receiving a majority at the next general election.

Before we wrap up, a quick mention that yesterday we published a report that forecasts CAPE valuations for US and European stock markets. CAPE is set to drop significantly this year as 2009’s terrible earnings roll-off, however, several factors are coalescing that could pull down earnings from their historically-high levels. That means CAPE may not fall as much as the market expects. See the report here .

To the day ahead now, which this morning kicks off here in the UK with December and January employment stats due out. The consensus expects a small one-tenth of a percent pick up in earnings to +3.4% while the unemployment rate is expected to hold steady at 4.0%. Shortly after that we get December construction output data for the Euro Area before the February ZEW survey is due in Germany. In the US, the only data due out this afternoon is the February NAHB housing market index reading. Away from that we’ve got the first Fed speaker of the week when Mester speaks this afternoon on the economic outlook and monetary policy. The ECB’s Guindos and Praet are also due to speak at separate events today while the EU general affairs council gathers to discuss the 2019 budget and March summit agenda.

via ZeroHedge News http://bit.ly/2IwPdx0 Tyler Durden