When will the U.S. labor market start to accelerate? That is the single most critical question for global capital markets, for it speaks directly to both economic growth and Federal Reserve monetary policy. But, as ConvergEx’s Nick Colas notes, just as important, however, is the question “Where do people actually want to work?”

Via ConvergEx’s Nick Colas,

In today’s note we address both topics with a range of Google Trends analysis, looking at what both employers and prospective employees plug into the ubiquitous online search engine. Key conclusions: there is no evidence of any faster pace of hiring, and the trend of hiring part time labor over full time is both strong (a 3:1 ratio) and accelerating. As far as where online interest in available jobs runs deepest, Google outpaces Facebook and Apple by over 2:1, but interest in working at Twitter just surpassed searches for “Work at Microsoft”. Stock markets clearly guide how a society allocates its intellectual capital, perhaps more than historical experience would indicate.

The good times in U.S. equities – and many other global stock markets – are undeniable, but it will be time to worry again soon enough. Rallies – such as the one we’re seeing at the moment – create future obligations. In this case, the +23% return for 2013, plus whatever we tack on between now and the end of the year, is essentially a promise of good news to come. Markets discount the prevailing view for growth in the economy and corporate earnings. And right now, the market weatherman is calling for sunny skies and fair weather for 2014.

The linchpin issue for global stock returns in 2014 centers on one group of people: the 11.3 million unemployed workers in the United States. That isn’t to dismiss those suffering from unemployment in Europe, for example, or elsewhere in the world. That 4.5% of the U.S. adult non-institutionalized population does, however play a critical role in the future returns for stocks globally. Here is why:

U.S. labor markets have been stuck in first gear since 2011, generating an average of only 170-180,000 jobs over the past 12 months. After natural population growth (100,000/month) that means only 70-80,000 jobs added, or 0.05% of the population.

The Federal Reserve has tried to juice the economy with Quantitative Easing, pushing capital into the financial system by buying Treasury and mortgage backed bonds. That has kept interest rates low, spurred the purchase of autos and homes, and helped give the U.S. the limited employment growth we mentioned above.

The ebbs and flows of the Fed’s commentary regarding QE – its ongoing duration and amount – have become heavily correlated with global equity returns. You don’t have to look any further than the June Fed press conference or the last FOMC meeting to prove that. Chatter about “Tapering” the QE program causes a pullback, while confidence that it will continue lifts risk assets higher. I am sure you can find academics or market watchers who will tell you this is just ‘Correlation’ and not ‘causation’. Feel free to listen to them, but don’t invest with them. Ever.

Given the anemic October employment report, the recent government shutdown, and concerns over the U.S. consumer, it seems unlikely the Federal Reserve will reduce its bond buying until 2014. That leaves stocks to rally into the end of the year. Easy peasy, right?

But then what? The U.S. economy and public companies will have to deliver on the implicit promise of record high stock prices with a combination of faster economic growth and better earnings. The connective tissue between those aspirations is incremental domestic job growth.

Can’t the Fed just keep lifting stocks higher with more QE, regardless of where the U.S. economy ends up? They can try, but there has been enough reporting on the opinions of the members of the Federal Open Market Committee for us to know that the Fed is growing concerned over the chance for a bubble in risk assets, including stocks. The world gives the U.S. a lot of collective slack because of its reserve currency status, but everything has a limit. As the Fed approaches a $4 trillion balance sheet ($3.8 trillion as of October 13, or 24% of GDP), policymakers know they are closer to the end of QE than the beginning.

That might all sound like bad news – QE is coming to an end, watch out below! – but it also makes U.S. stocks essentially a one-decision asset class. Job growth here simply has to get better. Maybe not today, maybe not tomorrow, but soon, and for the rest of our lives (spurious Casablanca quote there).

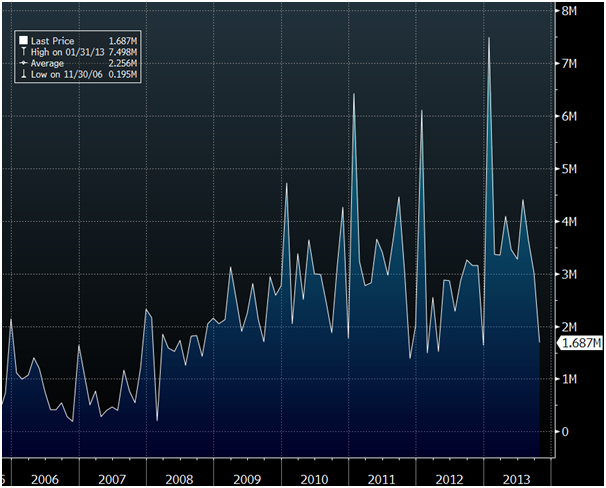

With that in mind, we turned to Google’s Trends product to give us a sense of where the U.S. labor market is heading. This free service allows you to see how many people have searched for a given phrase back to 2005 and also compare those search tallies with other phrases. With a global search market share of 67%, Google is as clear a window onto the soul of society as you will likely ever find. And, therefore, a good window into the soul of employer and employee alike.

Here’s what we found:

Search terms: “Hire workers” and “Fire workers”. Figuring that employers would search terms like “Hire” and “Fire” more than workers, we started with these simply keywords. More “Hires”

than “Fires” entered into the Google search box would be a good sign of hiring to come.

The Trends data supports that the U.S. jobs market is improving – “Hire workers” gets more searches than “Fire workers” and has since the beginning of 2011. The two still move closely together, however, indicating that there is little momentum in American labor markets.

Search terms: “Hiring part time” and “Hiring full time”. As of the most recent Jobs Report, 7.9 million Americans are stuck working part time when they would prefer to have full time employment. Department of Labor statistics show that the increasing reason for this “Part time recovery” is that these individuals could only find part time work, rather than being put on a part time schedule by their employer due to slack demand.

The Google Trends data shows the magnitude of the problem: searches for the phrase “Hiring part time” outnumber “Hiring full time” by 3:1. Google Trends allows you to see which U.S. states have the greatest number of searches for each term. The best states for “Full time hiring”: Texas, Missouri, North Carolina, and Georgia. “Hiring part time” is popular in South Carolina, Kentucky, and Alabama.

Simply put, there is a lot more interest on the part of employers to advertise part time jobs than full time employment, and the gap between the two is growing. Part time employment may serve to reduce the unemployment rate, but it will do less to improve consumer spending or confidence.

Search term: “Jobs for seniors”. If you want to see growth in the U.S. labor market, just focus on the AARP set. Those workers 55 and older have roped in the lion’s share of the jobs in the last year – 962,000 of th

e 1.3 million total positions added since September 2013.

Older Americans were early to the employment party in the current anemic economic recover, knowing that they would need to work even as they hit their golden years. The Trends data for “Jobs for Seniors” shows a distinct pickup in 2009 and has stayed at these elevated levels since then. Top states for the senior job search set? Ohio, Arizona, and (of course) Florida.

Search terms: “Jobs at Microsoft” and “Jobs at Twitter”. The Google Trends data is also useful for examining where people want to work. Microsoft, for example, has been a popular employment search-related query on Google since 2005, when the data begins. Twitter’s impending IPO has, for the moment, made the social media company a hotter employment ticket, however. The ratio of searches for employment at Twitter as compared to Microsoft was 75:60 last month.

Search terms: “Jobs at Google”, “Jobs at Facebook” and “Jobs at Apple.” Between these three, the number of queries by people search employment at landmark tech companies skews heavily to Google. Interestingly, this is not a new phenomenon. All the way back to 2005, the search engine company received multiple more interest in employment opportunities than either Facebook or Apple. The ratio even now is still healthily in Google’s favor: a Trends score of 71 for Google, versus 24 for Facebook and 21 for Apple.

In summary, we see two trends in this data:

U.S. stocks are getting a free pass as we close out 2013, lifted by performance chasing at the end of a strong year and little threat of Federal Reserve tapering. At the same time, 2014 is going to have to deliver some actual employment growth to support elevated stock prices. We don’t see any sign of that in the Google data.

As far as where people want to work, stock market chatter does seem to have an impact. It is easy to say that this is just performance chasing as well, with the hopes of easy millions from options and stock grants. Still, it also shows that equity markets influence where a society’s intellectual capital chooses to hang its collective hat.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/hfBZqBLv5fM/story01.htm Tyler Durden