Submitted by Michael Snyder of The Economic Collapse blog,

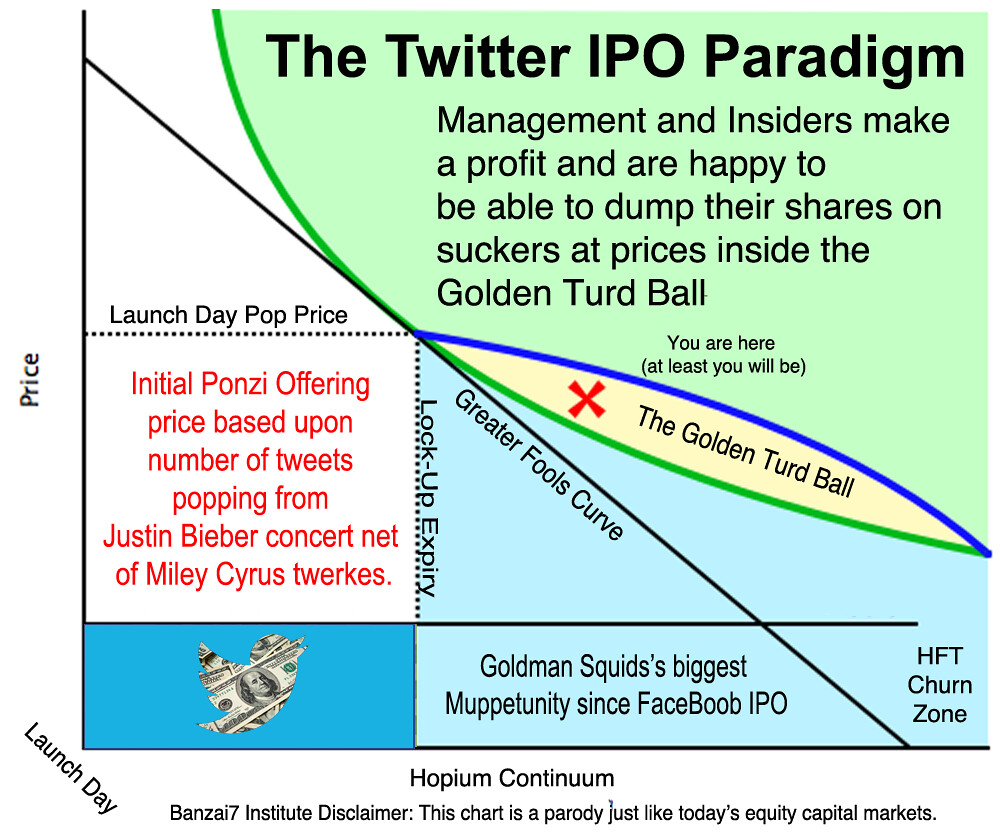

Shouldn't Internet companies actually "make a profit" at some point before being considered worth billions of dollars? A lot of investors laugh when they look back at the foolishness of the "Dotcom bubble" of the late 1990s, but the tech bubble that is inflating right in front of our eyes today is actually far worse.

For example, what would you say if I told you that a seven-year-old company that has a long history of not being profitable and that actually lost 64 million dollars last quarter is worth more than 13 billion dollars?

You would probably say that I was insane, but the company that I have just described is Twitter and Wall Street is going crazy for it right now. Please don't get me wrong – I actually love Twitter. On my Twitter account I have sent out thousands of "tweets". Twitter is a lot of fun, and it has had a huge impact on the entire planet. But is it worth 13 billion dollars? Of course not.

When it comes to the Internet, what is hot today will probably not be hot tomorrow.

Do you remember MySpace?

At one time, MySpace was considered to be the undisputed king of social media. But then something better came along (Facebook) and killed it.

It is important to keep in mind that Facebook did not even exist ten years ago. Yes, almost everybody is using it today, but will everybody still be using it a decade from now?

Maybe.

But the way that the financial markets are valuing these firms can only be justified if they are going to make absolutely massive profits for many decades to come.

Will Twitter eventually make a little bit of money?

Probably, as long as they get their act together.

In fact, Twitter should be making significant amounts of money right now if it was being run correctly.

But will Twitter ever make 13 billion dollars?

No, that simply is not going to happen. But that is what Wall Street says that Twitter is worth.

The utter foolishness that we are witnessing on Wall Street right now is so similar to what we saw back in the late 1990s. It is almost as if we have learned nothing from our past mistakes.

These days I keep having flashbacks of the Pets.com sock puppet. For those too young to remember, the following is a brief summary from Investopedia about what happened to Pets.com…

It's impossible to think of the first Internet era without thinking of the Pets.com sock puppet. He was everywhere and was nearly as well-known as the Geico gecko is today.

That familiarity, in part, persuaded many investors to lay down money in the company's February 2000 IPO (which was backed by Amazon.com). Pets.com raised $82.5 million – but nine months later it folded, due to major recurring losses. Part of the reason for that was aggressive advertising, but the company also lost money on virtually every item it sold. In the third quarter of 2000, Pets.com reported negative gross margins of $277,000. (The second quarter had seen a $1.7 million margin loss.) That same quarter (its last full quarter as an operating entity), the company lost $21.7 million on $9.4 million in revenue.

As for the puppet, he went on to shill for BarNone, which helps people with bad credit histories get car loans. He's still there today, front and center on that website.

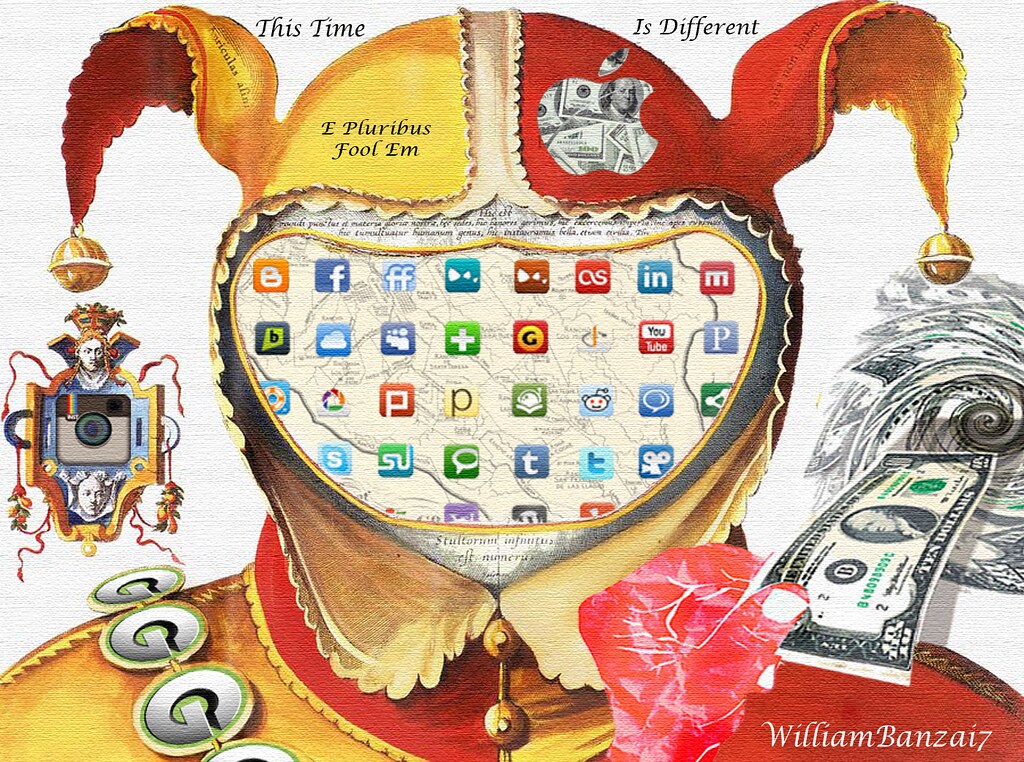

Everyone loves to laugh at the poor little sock puppet, but the truth is that the tech bubble that is inflating right now is far worse than the Dotcom bubble of the late 1990s. The following are 14 facts about the current tech bubble that will blow your mind…

#1 In just a few days, the Twitter IPO is expected to raise close to 2 billion dollars even though Twitter actually lost 64.6 million dollars last quarter and has a long history of not being profitable.

#2 It is being projected that after the IPO Twitter could have a market valuation of more than 13 billion dollars.

#3 Twitter is not expected to make a profit until 2015 at the earliest.

#4 According to CNBC, Pinterest is currently valued at 3.8 billion dollars even though it has never earned a profit.

#5 Yahoo paid more than a billion dollars for Tumblr even though Tumblr's revenues are so small that Yahoo is not even required to report them on financial statements.

#6 Snapchat, an Internet service that allows people to send out messages that "self-destruct", is supposedly worth 4 billion dollars. But it actually has zero revenue coming in, and many believe that it is essentially worthless as a money making enterprise. For one extensive analysis by a tech blogger, please see this article.

#7 The stock of Rocket Fuel, an online advertising company, is trading at about 60 dollars a share and it has a market valuation of about 2 billion dollars even though it has never made a profit.

#8 The stock of local business review website Yelp is up 241 percent this year even though it has never earned a quarterly profit.

#9 Fab.com just raised 165 million dollars from investors even though it recently laid off 44o employees.

#10 LinkedIn stock has risen in price by 136 percent since the 2011 IPO, and it is now supposedly worth more than 18 billion doll

ars.

#11 The head of engineering at Twitter, Chris Fry, got a 10.3 million dollar pay package when he joined Twitter last year.

#12 Facebook's VP of engineering, Mike Schroepfer, earned 24.4 million dollars in 2011.

#13 Office rents in San Francisco (where many of these tech companies are based) are now 23 percent higher than they were at the peak of the real estate market in 2008.

#14 Facebook stock is up close to 140 percent over the past 12 months and the company is now worth more than 120 billion dollars.

And I am certainly not the only one that is concerned that we are repeating the mistakes of the late 1990s…

“When you look at valuations and look at the lack of earnings and revenue, it seems to me much like the dot-com bubble,” said Matt McCormick, a money manager at Cincinnati-based Bahl & Gaynor Inc. who helps oversee $10.2 billion. “This market looks a little frothy and Twitter is the personification of a risky trade.”

In fact, as the Wall Street Journal recently noted, we have seen some of these tech stocks crash more than once during the Internet age…

"It's fascinating to me that today's mini-mania includes shares of Amazon, Netflix and Priceline that have previously peaked and crashed before—in some cases they've peaked and crashed twice before," says Darren Pollock, portfolio manager at Cheviot Value Management. "Stocks like these have again captured the imagination of speculators. We're skeptical that there is enough underlying intrinsic value to many of the highfliers to support today's prices."

So how long will it be until the current tech bubble implodes?

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/jQt3bWlcxGY/story01.htm Tyler Durden

![]()