December 13, 2013

Sovereign Valley Farm, Chile

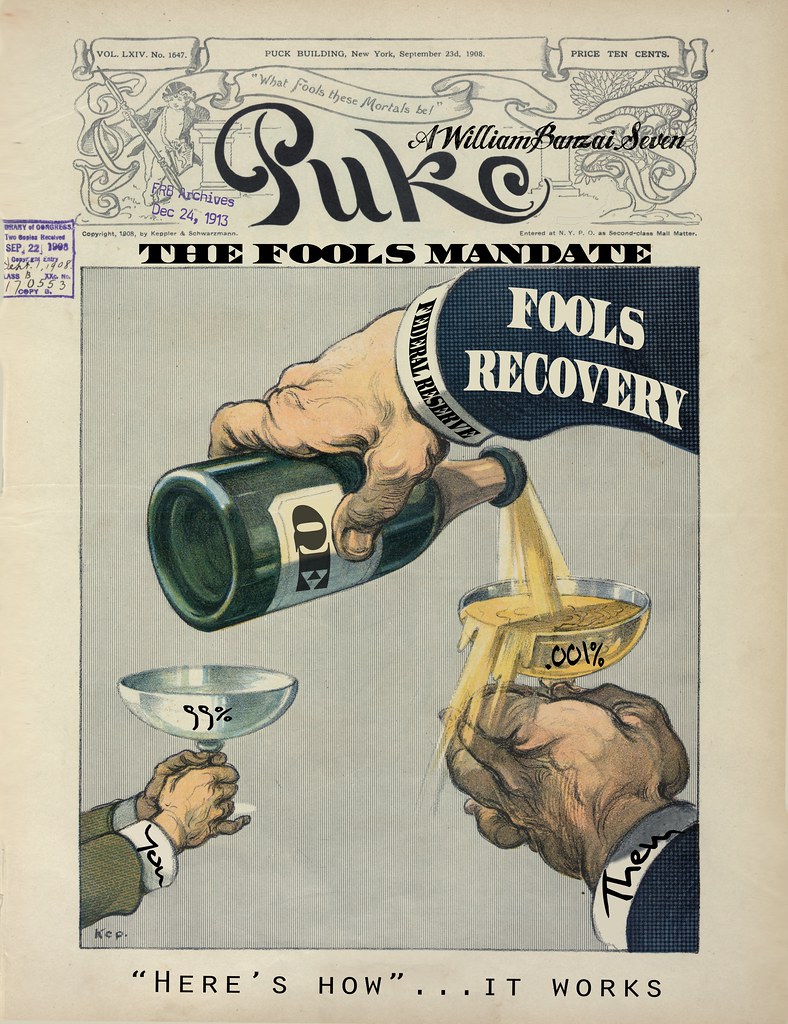

One of the things we talk about routinely in this column is the fraudulent nature of the global monetary system.

When you step back and look at the big picture, it seems ludicrous. We have essentially awarded totalitarian control of our money supply to a tiny banking elite.

And in controlling the money supply, they have the power to set or manipulate the price of just about everything on the planet.

I’m certain that at some point in the future, financial historians will look back with astonishment at how we could allow ourselves to be bamboozled like this. We have literally entrusted the entirety of our wealth, savings, and livelihoods to just a handful of people. It’s insane.

What’s even crazier is how few people really understand how this system works.

If anything, we’re told that there’s a crack squad of brilliant economists making decisions about things that are simply too complicated for us little people to understand. And we just have to trust them to be good guys.

As a regular reader of Notes from the Field, I’m guessing that you already understand that this monetary system is one of the most blatant, destructive scams in history. But chances are, you have a lot of friends and family who don’t get it.

This is always a tough nut to crack. People can be very intransigent in their ignorance. They’ve grown up for their entire lives hearing about how they live in a free country with the strongest currency and richest government in the world.

They’ve become so brainwashed that suggesting anything to the contrary is tantamount to blasphemy. And it can be very difficult to talk to them about the truth.

Fortunately the holidays are coming up. So if you’re thinking that you might want to educate some of the important people in your life, here are a few inexpensive gift ideas that might just transform someone’s entire worldview:

1) Book: The Creature from Jekyll Island.

G Edward Griffin’s investigation into the creation of the Fed really does read like a detective novel. At 600+ pages, it’s long. But it’s a real page-turner. And after finishing it, your loved ones won’t ever look at money, politics, or banking the same way ever again.

2) Book: End the Fed.

Written by none other than Dr. Ron Paul, End the Fed synthesizes historical analysis, common sense economics, and his own personal experiences from decades in Congress, all to argue one simple point– that the Fed is destructive and has utterly failed in its mission.

3) Movie: Money for Nothing.

This is my personal favorite, one I definitely recommend checking out. Even if you are up to speed on these concepts, I can almost guarantee that you’ll learn something.

Money for Nothing is a 90-minute documentary that was professionally and impeccably assembled by Jim Bruce and his all-star team.

The film is not only incredibly entertaining, their access to top former and current Fed officials was simply incredible– names like Volker, Yellen, Plosser, Fisher, Lacker, Poole, etc.

Money for Nothing is available for purchase (DVD or digital download) at www.MoneyforNothingthemovie.org

from SOVErEIGN MAN http://www.sovereignman.com/trends/truth-a-great-holiday-gift-idea-13296/

via IFTTT