Today’s AM fix was USD 1,317.00, EUR 962.09 and GBP 813.16 per ounce.

Yesterday’s AM fix was USD 1,308.50, EUR 959.87 and GBP 813.09 per ounce.

Gold climbed $40.20 or 3.14% yesterday, closing at $1,319.70/oz. Silver rose $0.53 or 2.49% closing at $21.80. Platinum jumped $44.84 or 3.2% to $1,432.74/oz, while palladium soared $23.50 or 3.3% to $737.50 /oz.

COMEX Gold In U.S. Dollars and Volumes – October 17

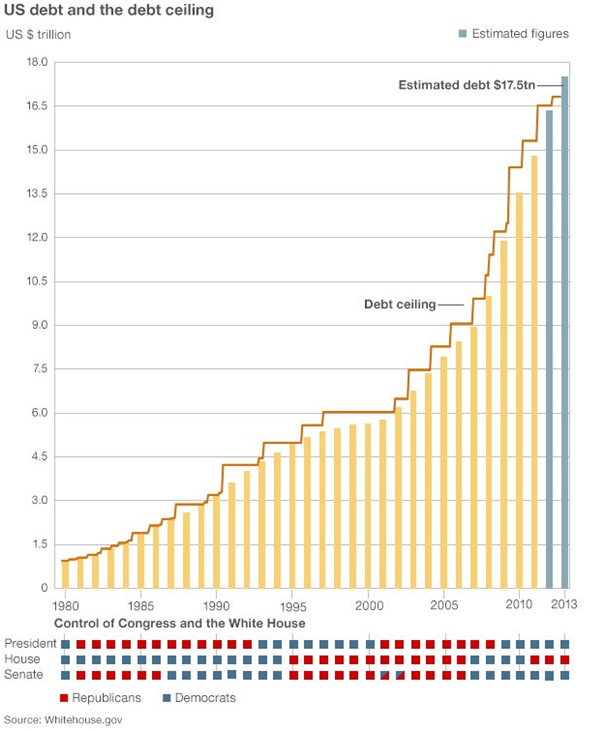

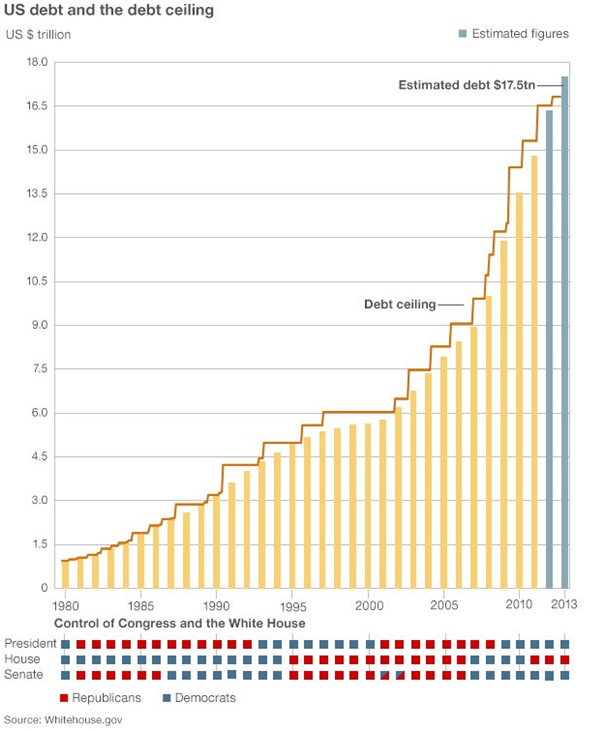

Gold is 3.5% higher for the week and headed for its best weekly gain in two months due to concerns about the latest episode of fiscal “can kicking” in Washington after U.S. politicians reached another temporary budget deal.

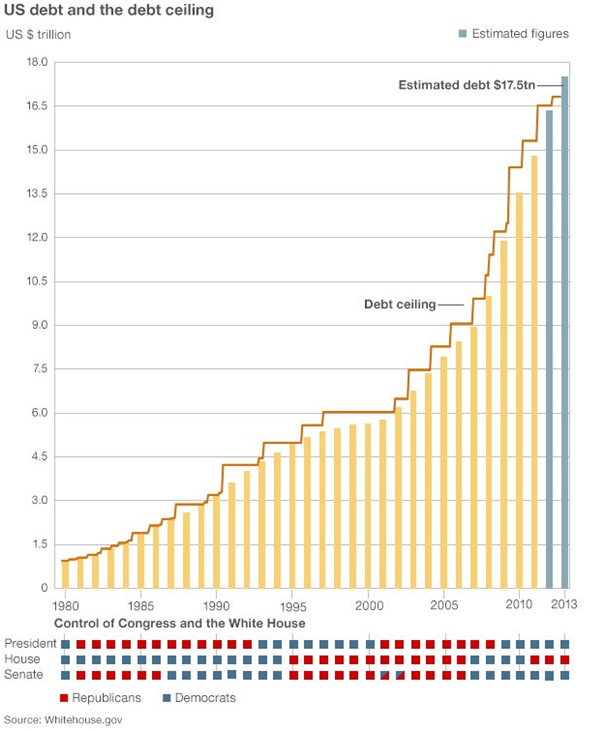

Besides the extension in the U.S. debt ceiling, gold also got traction after the increasingly influential Chinese credit rating agency, Dagong, downgraded the U.S.

The move higher was encouraging as it was on high volume with broad based buying seen.

During the gold surge COMEX gold saw volumes at 80% above the 100 day average for this time.

Physical buyers were evident too as the uncertainty of recent weeks came to a close … for now.

U.S. politicians have set the stage for another standoff as soon as January as the deal reached earlier this week only lasts until early next year. This will support gold and lead to continued safe haven buying.

Gold in USD and Debt Ceiling – Quarterly, 1933-2013 (Bloomberg)

Premiums in China and India remained robust overnight. Shanghai premiums are at $18 over spot and in Mumbai premiums remain extremely high near record highs at $100 per ounce.

Bullion premiums in western markets have not seen any movement due to the recent slowdown. Gold bullion bars (1 oz) are trading at $1,377.52/oz (up from $1,335.25 last week) or premiums of between 3.75% and 4.5%, and gold bars (1 kilo) are trading at $43,864/oz (up from $42,602 last week) or premiums of between 3% and 3.5%.

Gold and Silver in USD and Debt Ceiling – Quarterly, 2000-2013 (Bloomberg)

The fact that gold forward offered rates have gone negative this week and remain so today suggests there remains difficulty in sourcing large London Good Delivery bars in volume which will be supportive of gold.

Reuters Precious Metals Poll (Q4, 2013)

1. Reuters: Where do you expect gold prices to end this year?

GoldCore: We expect gold prices to end 2013 around the $1,450-1,550/oz. This would be a gain of between 10% and 17%.

2. Reuters: What will bring gold prices out of the overall downtrend we’ve seen so far this year?

GoldCore: Significant physical demand from Asia, especially from China and official sector foreign exchange diversification.

Also, the risk of a continuing debt crisis in the U.S. and a re-emergence of the Eurozone debt crisis should lead to safe haven diversification in western markets.

3. Reuters: Do you see further systemic risk to the euro-zone having an impact?

GoldCore: Yes. Much of the Eurozone remains a basket case with Portugal, Spain, Italy and of course Greece very susceptible to a new sovereign debt crisis and bail-ins which will lead to renewed contagion risk.

Japan and the UK have their severe fiscal challenges.

4. Reuters: How will demand for silver, platinum and palladium be affected by the wider macroeconomic picture?

GoldCore: All precious metals now have favourable supply demand characteristics and we believe that diversification and even small allocations to silver, platinum and palladium should propel prices higher. In the event of a severe deflationary event or a global Depression, the PGM metals would be vulnerable as would silver to a degree but gold would benefit due to safe haven demand for an asset that cannot default, be “bailed-in” or go bankrupt.

Gold Is A”Reserve Of Safety” – Draghi of ECB

Dr. Mario Draghi, former Governor of the Bank of Italy and the current President of the European Central Bank (ECB), during an open forum at Harvard’s Kennedy School of Government, answered a question about gold and why central banks want gold and what value it offers.

Larry Summers, also in attendance, introduced Draghi and expressed his belief in Draghi’s having “saved the European continent in 2012.”

Tekoa Da Silva, Bull Market Thinking Question:

Dr. Draghi what are your thoughts on gold as a reserve asset, you have the central banks like China and Russia increasing their reserves especially in the last 10 years, Germany for example asking for its holdings back from New York, it doesn’t offer any income unless its leased, why do you think they would want that and what value do you think it will offers in your opinion?

Mario Draghi, ECB. Answer:

“Well you’re also asking this to the former Governor of the Bank of Italy, and the Bank of Italy is the fourth largest owner of gold reserves in the world, which is out of all proportion to the size of the country. But I never thought it wise to sell it, because for central banks this is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries it gives you a value-protection against fluctuations against the dollar, so there are several reasons, risk diversification and so on. So that’s why central banks which have started a program for selling gold a few years ago, substantially I think stopped…most of the experiences of central banks that have leased or sold the stock of gold about ten years ago, were not considered to be terribly successful from a purely money viewpoint.”

Tekoa Da Silver of Bull Market Thinking (see commentary) summed up the view of Draghi and the ECB on gold quite well:

“A key takeaway from Draghi’s commentary should be the point that while many still debate the value of gold as an asset class, and whether or not it remains in a bull market—central banks are quietly accumulating the metal in ton-sized increments, and as Draghi implied, with plans of never selling it.

When the president of a banking organization which arguably controls trillions of dollars (or euros in this case), indicates it to be “unwise” to sell core gold holdings—what more needs to be said for the individual? Can we not all, “Be our own central bank”, as economist Marc Faber is known for having stated?

Gold in USD and Debt Ceiling – 2011 (Bloomberg)

U.K. Gold Exports to Switzerland Fell in August From Record Levels

U.K. gold exports to Switzerland fell in August. Exports were 98.5t, down from 120.1t in July and the lowest since record levels seen in February, Macquarie says.

Exports to Hong Kong and UAE, next largest destinations, also fell from record levels.

‘Reduced level of exports is in line with lower outflows from gold ETFs in July, supporting our theo

ry that the U.K.’s exports in 2013 have been of sold ETF gold, which is being sent to Switzerland for transformation into bars and other products conducive to Asian consumers or possibly to be vaulted there instead’.’

Russian Launches Physically Backed Gold ETF On Irish Stock Exchange and Moscow Exchange

Russia’s first gold-backed exchange-traded fund has been launched as part of a bid to turn Moscow into an international financial centre.

The FinEx Physically Held Gold ETF fund has been listed on the Irish Stock Exchange and cross listed on the Moscow Exchange, tracks the gold price as calculated using the London Gold Fixing Price, FinEx said. Shares will be available in U.S. dollars but also traded in Russian roubles.

Moscow Exchange, Russia’s stock exchange, plans to launch spot trading in gold and silver this month. Russia’s over-the-counter market in gold is currently dominated by large banks such as Sberbank and VTB .

U.S. Mint October Gold-Coin Sales Exceed September Total

The U.S. Mint’s sales of American Eagle gold coins have reached 22,000 ounces so far this month, according to figures from the Mint’s website. Sales totaled 13,000 ounces in September.

The American Eagle 1 ounce Silver bullion coin is the official U.S. national silver bullion coin, and is the world’s most widely sold 1 oz silver coin. Everything you need to know about the world’s most popular silver bullion coin – download your comprehensive guide to the American Silver Eagle here.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/w7RiK-aza90/story01.htm GoldCore

Today’s AM fix was USD 1,317.00, EUR 962.09 and GBP 813.16 per ounce.

Yesterday’s AM fix was USD 1,308.50, EUR 959.87 and GBP 813.09 per ounce.

Gold climbed $40.20 or 3.14% yesterday, closing at $1,319.70/oz. Silver rose $0.53 or 2.49% closing at $21.80. Platinum jumped $44.84 or 3.2% to $1,432.74/oz, while palladium soared $23.50 or 3.3% to $737.50 /oz.

COMEX Gold In U.S. Dollars and Volumes – October 17

Gold is 3.5% higher for the week and headed for its best weekly gain in two months due to concerns about the latest episode of fiscal “can kicking” in Washington after U.S. politicians reached another temporary budget deal.

Besides the extension in the U.S. debt ceiling, gold also got traction after the increasingly influential Chinese credit rating agency, Dagong, downgraded the U.S.

The move higher was encouraging as it was on high volume with broad based buying seen.

During the gold surge COMEX gold saw volumes at 80% above the 100 day average for this time.

Physical buyers were evident too as the uncertainty of recent weeks came to a close … for now.

U.S. politicians have set the stage for another standoff as soon as January as the deal reached earlier this week only lasts until early next year. This will support gold and lead to continued safe haven buying.

Gold in USD and Debt Ceiling – Quarterly, 1933-2013 (Bloomberg)

Premiums in China and India remained robust overnight. Shanghai premiums are at $18 over spot and in Mumbai premiums remain extremely high near record highs at $100 per ounce.

Bullion premiums in western markets have not seen any movement due to the recent slowdown. Gold bullion bars (1 oz) are trading at $1,377.52/oz (up from $1,335.25 last week) or premiums of between 3.75% and 4.5%, and gold bars (1 kilo) are trading at $43,864/oz (up from $42,602 last week) or premiums of between 3% and 3.5%.

Gold and Silver in USD and Debt Ceiling – Quarterly, 2000-2013 (Bloomberg)

The fact that gold forward offered rates have gone negative this week and remain so today suggests there remains difficulty in sourcing large London Good Delivery bars in volume which will be supportive of gold.

Reuters Precious Metals Poll (Q4, 2013)

1. Reuters: Where do you expect gold prices to end this year?

GoldCore: We expect gold prices to end 2013 around the $1,450-1,550/oz. This would be a gain of between 10% and 17%.

2. Reuters: What will bring gold prices out of the overall downtrend we’ve seen so far this year?

GoldCore: Significant physical demand from Asia, especially from China and official sector foreign exchange diversification.

Also, the risk of a continuing debt crisis in the U.S. and a re-emergence of the Eurozone debt crisis should lead to safe haven diversification in western markets.

3. Reuters: Do you see further systemic risk to the euro-zone having an impact?

GoldCore: Yes. Much of the Eurozone remains a basket case with Portugal, Spain, Italy and of course Greece very susceptible to a new sovereign debt crisis and bail-ins which will lead to renewed contagion risk.

Japan and the UK have their severe fiscal challenges.

4. Reuters: How will demand for silver, platinum and palladium be affected by the wider macroeconomic picture?

GoldCore: All precious metals now have favourable supply demand characteristics and we believe that diversification and even small allocations to silver, platinum and palladium should propel prices higher. In the event of a severe deflationary event or a global Depression, the PGM metals would be vulnerable as would silver to a degree but gold would benefit due to safe haven demand for an asset that cannot default, be “bailed-in” or go bankrupt.

Gold Is A”Reserve Of Safety” – Draghi of ECB

Dr. Mario Draghi, former Governor of the Bank of Italy and the current President of the European Central Bank (ECB), during an open forum at Harvard’s Kennedy School of Government, answered a question about gold and why central banks want gold and what value it offers.

Larry Summers, also in attendance, introduced Draghi and expressed his belief in Draghi’s having “saved the European continent in 2012.”

Tekoa Da Silva, Bull Market Thinking Question:

Dr. Draghi what are your thoughts on gold as a reserve asset, you have the central banks like China and Russia increasing their reserves especially in the last 10 years, Germany for example asking for its holdings back from New York, it doesn’t offer any income unless its leased, why do you think they would want that and what value do you think it will offers in your opinion?

Mario Draghi, ECB. Answer:

“Well you’re also asking this to the former Governor of the Bank of Italy, and the Bank of Italy is the fourth largest owner of gold reserves in the world, which is out of all proportion to the size of the country. But I never thought it wise to sell it, because for central banks this is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries it gives you a value-protection against fluctuations against the dollar, so there are several reasons, risk diversification and so on. So that’s why central banks which have started a program for selling gold a few years ago, substantially I think stopped…most of the experiences of central banks that have leased or sold the stock of gold about ten years ago, were not considered to be terribly successful from a purely money viewpoint.”

Tekoa Da Silver of Bull Market Thinking (see commentary) summed up the view of Draghi and the ECB on gold quite well:

“A key takeaway from Draghi’s commentary should be the point that while many still debate the value of gold as an asset class, and whether or not it remains in a bull market—central banks are quietly accumulating the metal in ton-sized increments, and as Draghi implied, with plans of never selling it.

When the president of a banking organization which arguably controls trillions of dollars (or euros in this case), indicates it to be “unwise” to sell core gold holdings—what more needs to be said for the individual? Can we not all, “Be our own central bank”, as economist Marc Faber is known for having stated?

Gold in USD and Debt Ceiling – 2011 (Bloomberg)

U.K. Gold Exports to Switzerland Fell in August From Record Levels

U.K. gold exports to Switzerland fell in August. Exports were 98.5t, down from 120.1t in July and the lowest since record levels seen in February, Macquarie says.

Exports to Hong Kong and UAE, next largest destinations, also fell from record levels.

‘Reduced level of exports is in

line with lower outflows from gold ETFs in July, supporting our theory that the U.K.’s exports in 2013 have been of sold ETF gold, which is being sent to Switzerland for transformation into bars and other products conducive to Asian consumers or possibly to be vaulted there instead’.’

Russian Launches Physically Backed Gold ETF On Irish Stock Exchange and Moscow Exchange

Russia’s first gold-backed exchange-traded fund has been launched as part of a bid to turn Moscow into an international financial centre.

The FinEx Physically Held Gold ETF fund has been listed on the Irish Stock Exchange and cross listed on the Moscow Exchange, tracks the gold price as calculated using the London Gold Fixing Price, FinEx said. Shares will be available in U.S. dollars but also traded in Russian roubles.

Moscow Exchange, Russia’s stock exchange, plans to launch spot trading in gold and silver this month. Russia’s over-the-counter market in gold is currently dominated by large banks such as Sberbank and VTB .

U.S. Mint October Gold-Coin Sales Exceed September Total

The U.S. Mint’s sales of American Eagle gold coins have reached 22,000 ounces so far this month, according to figures from the Mint’s website. Sales totaled 13,000 ounces in September.

The American Eagle 1 ounce Silver bullion coin is the official U.S. national silver bullion coin, and is the world’s most widely sold 1 oz silver coin. Everything you need to know about the world’s most popular silver bullion coin – download your comprehensive guide to the American Silver Eagle here.

![]()

![]()