Authored by Doug Kass of Seabreeze Partners Management,

This is my 19th year of compiling my Surprise List!

In 2020 (despite broad February-March weakness) equities rose faster, valuations expanded far greater, and interest rates fell sharper than the consensus expected. 2021 could be a year in which the S&P Index shows little movement in the first half of the year – but market pressures might mount over the last six months of 2021.

“In this age of infinite distraction, when the entitled elect themselves, the party accelerates and the brutal hangover is inevitable.”

— Dr. Michael Burry (he profited from “The Big Short”), 2012 UCLA Commencement Speech

“Never make predictions, especially about the future.”

— Casey Stengel (also short in stature)

“Those who are easily shocked should be shocked more often.”

— Mae West (she liked only two types of men — long and short)

“You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.”

— Legendary value investor Ben Graham (who in the short term recognized the market was a voting machine, not a weighing machine)

“Timid men prefer the calm of despotism to the tempestuous sea of liberty.” [Think: Central-bank intervention!]

— Thomas Jefferson (Founding father and long of stature)

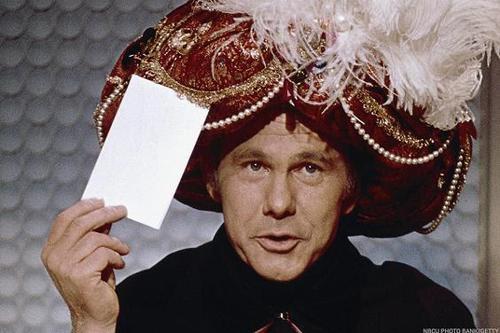

It’s that time of the year again! Time here on Monday morning for my 15 Surprises for 2021, which I’ll unveil in a bit.

I’ve never walked the same path in my investment career that others have found comfortable and I’m not going to start now. You see, I find beauty in a variant view. It’s satisfying intellectually, analytically and financially (at least when you’re correct). There’s something special about adopting a non-consensus view and watching it become reality despite protests from many corners. This notion forms the basis for my annual “15 Surprises” list.

The purpose of my annual list is to get readers to think more deeply about a variety of issues. As you read the installments to follow, it will become clear that my surprises this year are substantially out of consensus — more so than in any year I can remember. As The Dude says in The Big Lebowski: “Yeah, well, you know, that’s just, like, my opinion, man.”

By means of background and for those new to Real Money Pro, 19 years ago I set out and prepared a list of possible surprises for the coming year, taking a page out of the estimable Byron Wien’s playbook. Byron is a longtime friend of mine (and I am having dinner with him and Anita later this month). Byron originally delivered his list while chief investment strategist at Morgan Stanley, then Pequot Capital Management, and now at Blackstone. (Click here to read his “Surprises” list for 2020).

It takes me about four weeks of thinking and writing to compile and construct my annual list. I typically start with about 40 surprises, which are accumulated during the months leading up to my annual column on the subject. I cull the list to come up with my final 15 surprises. (Sometime I include also-ran surprises, as I did last year). The preparation of my list, as it was this year, often is not completed until the early hours before publication.

I often speak to and get input from some of the wise men and women that I know in the investment and media businesses (you can probably guess some of their names — two close ones and very smart buddies are with me in the list’s preparation in recent years. We call each other “the three stooges.”) My other go-to sources are two brilliant hedge hogger acquaintances from New York City and South Florida. I always have associated the moment of writing the final draft (in the weekend before publication) of my annual list with a moment of lift, of joy, and hopefully with the thought of unexpected investment rewards in the new year. This year is no different. I think this year’s list is pretty intriguing and many of the surprises have a good chance of occurring!

I set out as a primary objective for my list to deliver a critical and variant view relative to consensus that can provide alpha or excess returns. The publication of my annual list is in recognition that economic and stock market histories have proven that more often than generally thought, consensus expectations of critical economic and market variables may be off-base.

History demonstrates that inflection points are relatively rare and that the crowds often outsmart the remnants. In recognition, investors, strategists, economists and money managers tend to operate and think in crowds. They are far more comfortable being a part of the herd rather than expressing — in their views and portfolio structure — a variant or extreme vision.

It is important to emphasize that these are not forecasts. Rather, they are events with a greater than a 50% chance of occurring that are deemed deeper outlier events (with a probability of 20% or less) relative to consensus expectations. In other words, my Surprises are anti “Group Stink.”

Confidence is the most abundant quality on Wall Street as, over time, stocks climb higher. Good markets mean happy investors and even happier investment professionals.

The factors stated above help explain the crowded and benign consensus that every year seems to begin with, whether measured by economic, market or interest rate forecasts. But an outlier’s studied view can be profitable and add alpha.

Consider the course of interest rates and commodities in 2014, which differed dramatically from the consensus expectations. And consider my outlier view in late 2014 that the drop in oil prices would fail to help the economy and that OPEC would come close to dissolution and oil prices would plummet. An investor could have done quite well by following that message of avoiding energy stocks over the last few years. Or consider the value of my surprise that in 2019 the Federal Reserve would reverse its stance and cut rates, leading to a 2.25% yield on the 10-year U.S. note. That surprise was in marked contrast to the almost universal view that the Fed would tighten and interest rates would rise.

To a large degree, the business media perpetuate group-think and coddle investors, often into a false sense of security. Consider the preponderance of bullish talk in the financial press. All too often the opinions of guests who failed to see the crippling 2007-2009 drama are forgotten and some of the same (and previously wrong-footed) talking heads are paraded as seers in the media after continued market gains in recent years. Memories are short, especially of a media kind. Nevertheless, if a criterion for appearances was accuracy, there would have been few available guests in 2009-2010 qualified to appear on CNBC, Bloomberg and Fox Business Network.

As we began 2021, after more than 10 years of market and economic prosperity, the few secular investment bears remaining were often ridiculed openly by the business media in their limited appearances, reminding me of Mickey Mantle’s quote: “You don’t know how easy this game is until you enter the broadcasting booth.”

And then there was 2020! What a year it was!! But more on this later…

Abba Eban, the Israeli foreign minister in the late 1960s and early 1970s, once said that the consensus is what many people say in chorus but do not believe as individuals. GMO’s James Montier, in an excellent essay published several years ago, made note of the consistent weakness embodied in consensus forecasts:

“Economists can’t forecast for toffee … They have missed every recession in the last four decades. And it isn’t just growth that economists can’t forecast; it’s also inflation, bond yields, unemployment, stock market price targets and pretty much everything else … If we add greater uncertainty, as reflected by the distribution of the new normal, to the mix, then the difficulty of investing based upon economic forecasts is likely to be squared!”

Lessons Learned Over the Years

“I’m astounded by people who want to ‘know’ the universe when it’s hard enough to find your way around Chinatown.”

– Woody Allen

“Let’s face it: Bottom-up consensus earnings forecasts have a miserable track record. The traditional bias is well-known. And even when analysts, as a group, rein in their enthusiasm, they are typically the last ones to anticipate swings in margins.”

– UBS (Top 10 Surprises for 2012)

There are five core lessons I have learned over the course of my investing career that form the foundation of my annual surprise lists:

-

How wrong conventional wisdom can consistently be.

-

That uncertainty will persist.

-

To expect the unexpected.

-

That the occurrences of Black Swan events are growing in frequency.

-

With rapidly changing conditions, investors can’t change the direction of the wind, but we can adjust our sails (and our portfolios) in an attempt to reach our destination of good investment returns.

Again, it’s important to note that my surprises are not intended to be predictions, but rather events that have a reasonable chance of occurring despite being at odds with the consensus. I call these “possible-improbable events.” In sports, betting my surprises would be called an “overlay,” a term commonly used when the odds on a proposition are in favor of the bettor rather than the house.

The real purpose of this endeavor is a practical one — that is, to consider positioning a portion of my portfolio in accordance with outlier events, with the potential for large payoffs on small wagers/investments.

Since the mid-1990s, Wall Street research has deteriorated in quantity and quality due to competition for human capital at hedge funds, brokerage industry consolidation and reforms initiated by former New York Attorney General Eliot Spitzer. It remains, more than ever, maintenance-oriented, conventional and group-think — or group-stink, as I prefer to call it. Mainstream and consensus expectations are just that and, in most cases, they are deeply embedded into today’s stock prices.

It has been said that if life were predictable, it would cease to be life, so if I succeed in making you think (and possibly position) for outlier events, then my endeavor has been worthwhile.

Nothing is more obstinate than a fashionable consensus, and my annual exercise recognizes that, over the course of time, conventional wisdom is often wrong. As a society and as investors, we are consistently bamboozled by appearance and consensus.

Too often, we are played as suckers, as we just accept the trend, momentum and/or the superficial-as-certain truth without a shred of criticism. Just look at those who bought into:

-

The success of Enron;

-

The existence of Saddam Hussein’s nonexistent weapons of mass destruction;

-

The heroic home-run production of allegedly steroid-laced Major League Baseball players Barry Bonds and Mark McGwire;

-

The “financial-supermarket” concept at Citicorp, which was once the largest money-center bank;

-

The uninterrupted profit growth at Fannie Mae and Freddie Mac;

-

Housing’s “new paradigm” in the mid-2000s of non-cyclical growth and ever-rising home prices;

-

The uncompromising principles of former New York Governor Eliot Spitzer;

-

The morality of other politicians (John Edwards, John Ensign, Larry Craig, etc.);

-

The consistency of Bernie Madoff’s investment returns (and those of other hucksters);

-

The clean-cut image of Tiger Woods.

But enough of that rant.

How did I do last year?

White House Politics:

(When asked what he wanted to give thanks for during a press gaggle Thanksgiving Thursday, Trump responded), “for having a great family and for having made a tremendous difference in this country. I’ve made a tremendous difference in the country. This country is so much stronger now than it was when I took office that you wouldn’t believe it… And I mean, you see, but so much stronger people can’t even believe it. When I see foreign leaders they say we cannot believe the difference in strength between the United States now and the United States two years ago.”

– President Trump (Comments on Thanksgiving)

Policy:

“You only think I guessed wrong! … You fool! You fell victim to one of the classic blunders – the most famous of which is “never get involved in a land war in Asia” – but only slightly less well-known is this: Never go in against a Sicilian when death is on the line!”

– Vizzini, The Princess Bride

The Economy:

“The missing step in the standard Keynesian theory (is) the explicit consideration of capitalist finance within a cyclical and speculative context… finance sets the pace for the economy. As recovery approaches full employment… soothsayers will proclaim that the business cycle has been banished (and) debts can be taken on. But in truth neither the boom nor the debt deflation… and certainly not a recovery can go on forever. Each state nurtures forces that lead to its own destruction.”

– Hyman Minsky

The Markets:

“Every new beginning comes from some other beginning’s end.”

–Seneca the Elder

So, I said we’d be grading the surprises for 2020 that I unveiled a year ago.

Turns out I had a near average year relative to my historic percentages – with 40% of my Surprises were correct. (My worst hit rate was in 2013 when only 20% of my Surprises occurred. My best was over 60% in 2018).

But, more importantly, I had four of my first five (and most important rated Surprises) correct this year. In the case of the Presidential election, my forecasts for voter turnout, popular and Electoral College votes was eerily accurate.

As we entered 2020, most strategists expressed a constructive economic view of a self-sustaining domestic recovery, held to an upbeat corporate profits picture (abetted by the 2018 corporate tax rate reduction), there was a unanimous view that interest rates would climb and generally shared the view that the S&P 500 would rise in the range of 8% to 10%. As well all now know, the S&P Index rose by about 15% and interest rates fell hard as the world suffered under Covid-19.

Many readers of this annual column assume that my Surprise List will have a bearish bent (and to be sure, that was the case in the last few years and back in 2007-08). But I have not always expressed a negative outlook in my Surprise List and I often have positive (and out of consensus) things to say about individual companies and sectors.

Below is a report card (40% correct) of my 15 Surprises for 2020 (the surprise is in boldface and my analysis follows each surprise):

Surprise #1 Trump Popularity Falters Badly, the Progressive Wing of the Democratic Party Fails to Catalyze Voters, Biden Easily Wins the Presidency and Democrats Have a Clean Election Sweep (As Women and Millennials Show Up in Droves)… Voter Turnout rises by over +6% (from 2016) – most of the incremental change is captured by Biden who wins 50.7% of the popular vote compared with 46.3% for Trump – a plurality of over 6 million votes. (That compares to 48% for Secretary Clinton and 46% for President Trump in 2016 – a difference of 2.9 million votes). Senator Biden also wins a surprisingly large majority in the electoral college (304 to 234). After the election, there are violent demonstrations around the country by Trump supporters in mid- to late- November. Trump does little to squash or calm down the protests and instead holds a number of rallies against Democrats and the election results. In December, 2020, President Trump announces his plans to launch Trump TV. Sean Hannity leaves Fox News – assuming a duel role as CEO of Trump TV as well as the station’s chief commentator. Rush Limbaugh and several Fox News commentators join Trump TV… Biden was dismissed in the early stages of the Democratic primaries but beginning in South Carolina the President-elect’s fortunes turned. Biden ultimately received 306 electoral votes against Trump’s 232 votes (ALMOST EXACTLY THE 304 VOTES I EXPECTED). Voter turnout was indeed robust (turnout was 66.5% of eligible voters, highest since 1900) – with 20 million more votes in 2020 over 2016. Biden received 81 million votes (or 51% of the total and shattering President Obama’s 69.5 million votes) compared to Trump’s 74 million votes (47% of the total) – again, almost the exact percentages I projected 12 months ago! VERY RIGHT

Surprise #2 Disappointing Global Growth, Weakening Corporate Profits, a Fed Pivot and Political and Geopolitical Instability Produce a “Garden Variety” Bear Market in 2020… Though the Fed did not pivot there was a dramatic drop in global economic growth and in U.S. corporate profits. We had a Bear Market in 2020. VERY RIGHT

Surprise #3 The China Trade Deal Falls Apart, China’s Patience With Hong Kong Runs Out and There Is a Global Shortage of Protein… The trade war is reignited and tariffs are reimposed on China. Capital spending, consumer and business confidence falters. China doesn’t comply with “Phase One” of the trade deal which offers little more than purchasing needed agriculture products and fails to protect U.S. intellectual property. China’s patience in Hong Kong runs out and it takes action that sets off both a geopolitical and stock market crisis. China’s aggression ends any chance for a “Phase Two” trade deal. VERY RIGHT

Surprise #4 Watch Out Below! Automobile Industry Sales Plummet and Threaten the Domestic and Global Economies… Auto industry sales closed out 2019 at a 17.1 million SAAR rate for the month of December. SAAR fell to a 8.6 million rate within four months! VERY RIGHT

Surprise #5 With Draghi Gone, ECB Monetary Policy Abruptly Changes and Interest Rates Are Increased. VERY WRONG

Surprise #6 Despite Weakening Economic and Profit Growth the Federal Reserve Does Not Lower Interest Rates This Year. VERY RIGHT

Surprise #7 Berkshire Hathaway and Warren Buffett Surprise the Markets – On Several Fronts… Berkshire Hathaway, with over $130 billion of cash, acquires FedEx (for $55 billion) in a spirited bidding contest against Walmart (WMT) . There are several important catalysts to the transaction – Buffett understands FDX’s business and the deal would expand his scale in transportation – where he already enjoys a stronghold in rails with subsidiary Burlington Northern. Moreover, despite the recent Amazon issue, FedEx has a wide business moat with a vast distribution presence and a large fleet of vehicles. Finally, FedEx’ shares have been pummeled (-20%) because of a difficulty in adopting to digital commerce and the company could be purchased on the cheap at under 20x earnings…Berkshire makes two more large acquisitions – reducing its cash position by $100 billion to $30 billion. Fires in California grow entirely out of control, shutting down much of the power grid in California – and hobbling the state’s economy. President Trump does not come to the aid of the state until too much damage is done. But Buffett helps and provides bankruptcy financing by Pacific Gas and Electric (PCG) . While it is normally impossible to buy a regulated utility, at the request of regulators Berkshire ultimately takes control of the company. Contrary to being a “forever holding,” Berkshire unloads a portion of its Apple (AAPL) long investment after the stock becomes too large a percentage of its portfolio… Though Berkshire did sell down some of its Apple holdings the rest of the surprise was incorrect. VERY WRONG

Surprise #8 Goldman Sachs (In An Attempt To Expand Its Retail Presence) Acquires The Vanguard Group (with over $5.3 trillion of assets under management)… Goldman Sachs was quiet but Morgan Stanley acquired Eaton Vance. WRONG

Surprise #9 Stock Surprises Abound – Boeing, General Electric, Tesla, ViacomCBS, Comcast, Google, Facebook, Kohl’s, Ford, Square, Twitter, Federal Express, European Banks, U.S. Pharma/Healthcare and U.S… Most of these did not come to pass. WRONG

Surprise #10 The SoftBank Unraveling Spreads to Sand Hill Road WeWork isn’t the last failed unicorn that tries to IPO itself. The private values on a basket of money losing unicorns falls by over 30%… Venture capital becomes scarce. There are negative knock on effects throughout the Northern California economy. Late in the year Facebook (FB) , Alphabet (GOOGL) and Amazon (AMZN) begin to show the signs that a chunk of their revenue comes from venture based start-ups – their share prices suffer. Private equity does not escape the turmoil in venture capital… There was no “contagion.” WRONG

Surprise #11 A Well Known Trader\Investor Who Frequently Appears on Bloomberg, Fox Business and CNBC is Indicted By the SEC For Failure to Disclose His Transactions and Investment Positions In a Proper and Timely Manner… Didn’t happen but I see this in the future. WRONG

Surprise #12 A Large Sell-Side Brokerage Firm Abandons its Research Department Owing to Unbundling of Services and the General Lack of Profitability Associated With Their Efforts… Didn’t happen but I also see this in the near future. WRONG

Surprise #13 FANG(A) Gets Redubbed FAMG(A) With Microsoft Replacing Netflix… The competition from other streaming services causes Netflix (NFLX) to lose millions of domestic subscribers. The whole pricing power story unravels and market loses faith in the cash burning narrative. Netflix’s shares trade down to $200/share… Netflix signed up only 2.2 million new paid subscribers between July and September of 2020, its smallest quarterly increase since 2016, bringing the company’s total number of subscribers worldwide to just over 195 million – but it did not lose subs. The shares fell to $290 in March. WRONG

Surprise #14 Market Structure Haunts Our Markets Throughout the Year… The dominance of ETFs and quant strategies (e.g. risk parity) shows its ugly side…The 2019 movie is in reverse this year – the ETFs and quant products and strategies that delivered a recipe for the relentless advance last year are reversed and, with so many looking to exit, liquidity evaporates. ETF prices, in particular, exhibit greater volatility than the underlying constituent holdings. The dominance of passive strategies is threatened and active strategies begin to garner inflows after a lengthy period of losing market share. Over one quarter of the listed ETFs are delisted… A “Flash Crash” takes the S&P Index down by over -5% in one day. Volatility rockets to over 35 and stays elevated for most of the year… The February March decline in equities was unprecedented in time and magnitude. RIGHT

Surprise #15 A Credit-Related Event Causes a Market Liquidity Crunch as Covenant-Lite, Leveraged Loans, BBB-rated Downgrades All Pose a Potential Threat to Both the Debt and Equity Markets. Credit conditions tighten with more differentiation between CCC and BBB corporate and consumer credit. More companies fall out of CCC and out of BBB into high yield. VERY WRONG

* * *

Like Diogenes with his lantern, I am, again in 2021, a cynic looking for truth (and an honest investor) – as I engage in my annual assault on the consensus and “Group Stink.”

Last year I wrote:

“More than any year in the last decade, the contour of the U.S. stock market will likely be importantly influenced and shaped by politics and profits in 2020. Surprises in the political arena and in corporate profitability are my first two and most important deviations from the consensus. 2020 could be the year of mean reversion – a year of the vanishing Fed (and global central banker) put and a surprising turn in central bank policy (by the ECB), weakening global economic growth and less than expected corporate profits (again), political upsets (again), rising geopolitical risks (and global conflicts), a general recognition of the risks associated with untamed deficits and large debt loads and general market instability.”

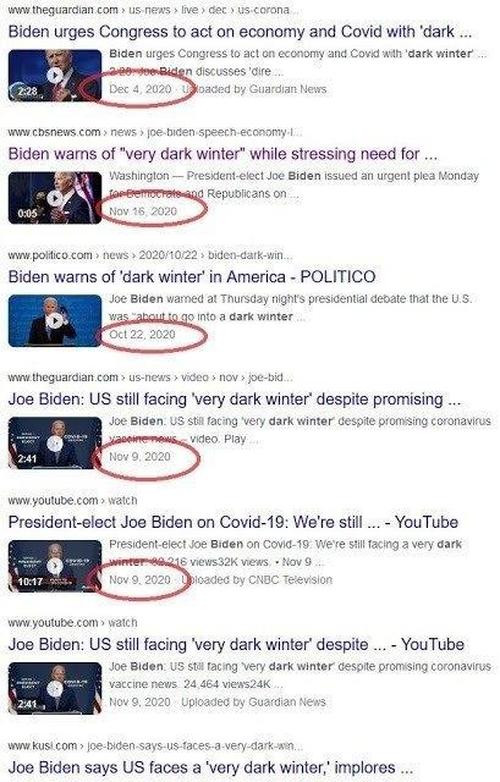

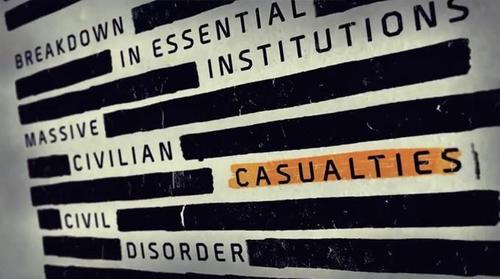

The politics of 2020 initially set the stage for the markets and the global economies but it was Covid-19 (and the policy responses) – a Black Swan and virus that no one expected – that framed the markets throughout the year. NO ONE expected the magnitude and swiftness of the recovery of the capital markets to all-time highs in December, 2020 as multiples reset higher based on the confidence in a hockey stick rebound to both domestic economic growth and in S&P profits in 2021.

However, in 2021 we may return to fundamentals and a year of the vanishing Fed (and global central banker) put coupled with some mean reversion (lower) in valuations. This year might mark the return of the hibernating “bond vigilantes” as inflation and interest rates also mean revert as a general recognition of the risks associated with untamed deficits and large debt loads lead to general market instability later in the year.

Remember, my Surprise List is not a set of forecasts. Rather, the List represents events that the consensus views as having a low probability of happening (25% or less) but, in my judgment, have a better than 50% chance of occurrence. In betting parlance this is called an “overlay.”

I would note a change in the format of my Surprise List this year, as, in the age of social media, attention spans are shrinking — so this year’s Surprise List will reflect this new reality (of fewer characters and less words) by being noticeably shorter than in the past two decades.

Here are my 15 Surprise for 2021:

Surprise #1 Tesla’s Stock Declines By Two Thirds – Elon Musk loses his liberal audience. Tesla’s mistreatment of customers, suppliers, employees, subsidy providers and safety regulators and the general population hits a wall. A movement to kick Tesla out of ESG Indices gains steam, as proponents give Tesla the lowest possible rating in S and G. The Chinese retaliate over Musk’s racist comments, where he blames Chinese drivers for a series of accidents. A high profile celebrity or athlete dies while using autopilot. Under new leadership, the National Highway Safety Administration (HTSA) orders recalls for suspension problems, computer screen failures, battery fires, sudden acceleration. Regulators put a stop to so called Full Self Driving due to predictable abuse. Tesla announces it will be transitioning its Fremont, California manufacturing to Austin, Texas in 2022, but after years of union busting, Austin workers vote to join the UAW. Meanwhile, Tesla’s market share collapses under an avalanche of new entrants. Rivian and GM (GM) beat the cybertruck to market with better products. VW (VLKAF) becomes the leading global manufacturer of electric cars. GM, Waymo and Zoox become the leaders in self-driving. Toyota (TM) demonstrates a solid state battery making them the leader in batteries. Tesla stock falls by almost -70% — Greenlight’s David Einhorn jokes that “it’s like an unannounced stock split.” John Bogle rolls over in his grave as “passive” investors lose most of their “investment” in Tesla. Congress conducts an investigation into Tesla’s inclusion in the S&P Index.

Surprise #2 Political Normalcy Is Not Obsolete and Biden is The Calm After the Storm – Biden breaks the party deadlock in Washington and governs with a centrist coalition of key Senators and Congressmen – to the frustration of the far left. There are several Republicans like Romney, Murkowski, Collins, Ernst, Perdue and Tillis that realize they have a ton of power (and control of the Senate) to support a centrist agenda. They join Democrat centrists including Warner, Bennet, Carper and Shaheen to drive a bipartisan agenda. There will be no bold Green New Deal (though a more moderate deal is delivered), confiscatory tax law changes, defunded police, mass forgiveness of student loans or single payor health. There will not be two new states or Supreme Court packing – even if the senate goes 50-50. There will be an infrastructure bill (with Green energy emphasized), changes to taxes on foreign corporate earnings, police reform, immigration reform and other attempts to reduce institutional racism, limited forbearance on hardship student debt, and fixes to Obamacare.

Surprise #3 Former President Trump No Longer Remains A Dominant Political Force in the U.S. – The Republican party comes to the realization that Trump is a liability at the same time the Democrats realize that the far left hurts their party. Trump proceeds with “Trump TV” (he is in “pre-production” already!). Launched in the spring, he recruits Sean Hannity, Roger Stone, Mike Flynn and Joe Kernen to become the enterprise’s primary commentators. By year-end it is clear that this is but another one of Trump’s multiple business failures and “Trump TV” closes almost before it started. Facing numerous lawsuits and a sweeping State of New York indictment, Donald Trump declares personal bankruptcy by year-end. There is no cliffhanger this time and, disgraced, Trump sells Mar A Lago and liquidates several of his other properties.

Surprise #4 Stocks Experience Their Least Volatility Ever in the First Half of 2021 and the Most Volatility Ever in the Second Half of 2021 – The S&P Index is tightly range bound between 3600-3800 over the first six months of the year – but, under the weight of regulatory assault of technology, and higher inflation and interest rates, falls to under 3300 later in 2021.

Surprise #5 Bottlenecks Multiply and Inflation Surges – There are bottlenecks everywhere in 2021 and inflation in places beyond financial assets. As the economy reopens, there are shortages of almost everything. Commodities boom, but so do service prices. It seems that prices of everything from shipping to manicures are on the rise. The infrastructure bill sends construction material prices through the proverbial roof. Pent up savings are unleashed in robust consumer demand. Concerts, sporting events reopen with limited capacity and tickets are in hot demand. Residential real estate (single and multi family) soar in price, as people put stimulus, the recovery and stock market winnings into real estate. By mid-year, even the badly manipulated CPI is running up +4%.

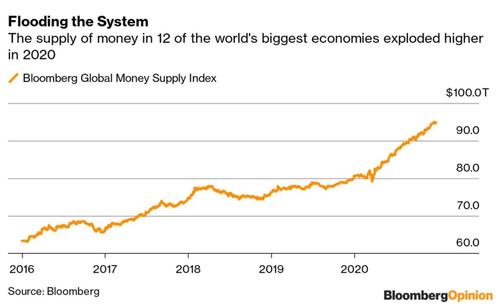

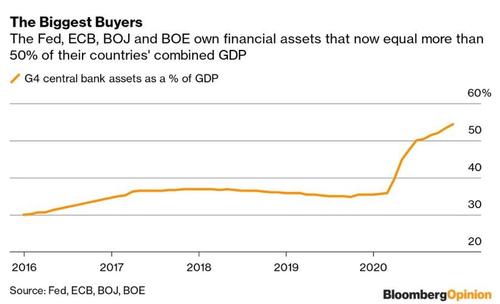

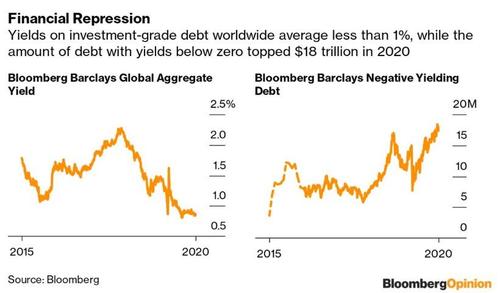

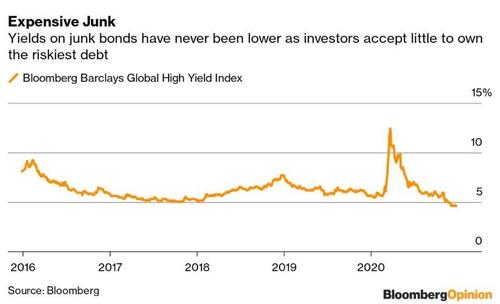

Surprise #6 Inflation and Interest Rates Rip Higher Leading to A Valuation Reset (Lower) For Equities in 2021 – At first, the bond market reacts “normally” to rising inflation. The 10 year yield breaks 2% (to the upside). The stock market has a late spring/early summer wobble in response to rising rates and the possibility that target inflation will force higher rates. A mid-year Treasury auction goes poorly. The Federal Reserve, faced with the dilemma of choosing between a lower stock market and higher inflation, chooses to accept higher inflation. The Fed announces a cap on the 10 year yield at 1.5% and expresses its willingness to do whatever it takes to enforce it. In effect, the Fed becomes the Treasury buyer of first resort. This sends stocks, commodities and most everything briefly higher (towards the upper end of the 3600-3800 S&P trading range) – except the dollar, which falls 10%-15%. Though temporarily ignored by infinite liquidity and easing financial conditions at all costs, it grows clear that Covid-19 spurred a dangerous leveraging up in the global economy that has been almost constantly in place since The Great Decession of 2008-09. Higher inflation and interest rates bring the “bond vigilantes” out of their long hibernation. Stocks fall by -15% over the last six months of the year as price earnings multiples contract in the face of the highest level of corporate defaults in over a decade (led by companies in the retail space and others that were already struggling prior to the virus). Credit spreads (now at record lows), widen dramatically, the CLO market collapses and private equity companies are among the worst market performers of the year.

Surprise #7 A Decline in the U.S. Dollar Spurs an Advance In Gold (to $3,000/oz) and a Ramp of +50% in Bitcoin (to $40,000) – But Silver Is The Big Winner As It Doubles to Over $50/oz – Over easy policy, excessive liquidity, higher inflation and a rapid rollout in the Covid-19 vaccine powers the prices of cryptocurrencies and precious metals higher. Silver, however, is the league leader as the rapidly rising demand for silver in industrial applications creates a supply crunch late in the year. Another challenge on the supply side for silver is that more than half of mined silver supply is a by-product of zinc, lead and copper mining, making it tough for miners to meet the surging excess proportional demand for silver. Precious metals and crypto currency prices peak in the third quarter.

Surprise #8 Congress Acts On the SALT Deduction – Congress either repeals the SALT deduction limit or raises the cap from $10,000 to $25,000. Centrist Ray McGuire wins the June Democratic primary for New York City Mayor and, upon his election in November initiates bold moves to revitalize NYC. Residents move back and housing activity and prices fall in the suburbs under the weight of those initiatives and stretched home affordability.

Surprise #9 The Fallout From Brexit Causes Trade and Other Chaos in Europe – Badly Shaking the UK and European Economies

Surprise #10 France’s Economy Approaches The Financial Brink – Weighed down by one of the worst debt to GDP ratios in Europe and sub zero interest rates, two of the country’s largest banks fail. In a desperate position, in which France actually faces systemic risk, the country begs for assistance from Germany in order to get the ECB to print enough currency to posture a bailout of France’s banking system. President Emmanuel Micron steps down.

Surprise #11 Broad Regulatory Actions Against Big Tech Results In A More Rapid Pivot From Growth to Value – FANG Becomes GATFAT! – Antitrust actions against Facebook (FB) , Alphabet (GOOGL) and Amazon (AMZN) become a genuine worry. In response to Derek Chauvin being acquitted in the George Floyd case, rioting ensues and the social media platforms are blamed for fanning the literal flames as Minneapolis is all but burned to the ground. The Rule 230 exemption is repealed. Meanwhile Europe begins imposing punitive taxes on U.S. internet giants. Finally, China retaliates to Biden continuing Trumps policy of going after Chinese companies with its own claims about Apple (AAPL) (illegal monopoly) and Tesla (TSLA) (unsafe cars). Google, Apple, Twitter (TWTR) , Facebook, Amazon and Tesla get redubbed GATFAT, as the impact of their prior overblown markets caps on portfolios is broadly felt by the Indexers and other investors.

Surprise #12 China’s Economy Sputters Under Massive Debts and Crackdown on Tech Giants – Leading To Some Moderation In Xi’s Policies

Surprise #13 Despite Strong 4Q2020 Performance, Bank Stocks Lead the Market in The First Half of the Year – As tech falters under the weight of an existential antitrust threat, financials prosper. Citigroup (C) trades at $75, Wells Fargo (WFC) and Bank of America (BAC) trade at $35 and JP Morgan’s (JPM) price approaches $140/share by the early summer.

Surprise #14 Goldman Sachs Goes Private In 2Q2021 – The announcement marks a high-water mark for equities in 2Q2021.

Surprise #15 Trump Is Barred From Twitter – Within one week after President-Elect Biden’s inauguration, Twitter suspends former President Trump’s Twitter account for tweeting false claims about the “stolen” Presidential election. Upon the news of the Twitter suspension announcement, Twitter’s shares fall by over -$7 to $8/share (or by about -15%) in one day. (The shares bottom in the high $30s, where I load up!)

* * *

Long GS (small), MS (small), GLD (large), AMZN (small), GOOGL (small), GM (small), GLD (large), C, JPM, WFC, BAC, XLF.

Short TLT, SPY (large), QQQ (large), AAPL, TSLA (large).