Dancing Through The Geopolitical Minefield

Tyler Durden

Thu, 07/02/2020 – 16:25

Authored by Charles Hugh Smith via OfTwoMinds blog,

The elites dancing through the minefield all have plans, but how many are prepared for the punch in the mouth?

Open any newspaper from the past 100 years and you will soon find a newsworthy geopolitical hotspot or conflict. Geopolitical conflict is the default setting for humanity, it seems, but it does feel as if the minefield of geopolitical rivalries and flashpoints has been thickly sown and many of the players are dancing through the minefield with a worrisomely cavalier confidence that they won’t step on mine, i.e. bad stuff only happens to the other players.

The global minefield includes these dynamics:

1. The grinding collision of geopolitical tectonic plates: spheres of influence, soft and hard power projection, border conflicts, etc.

2. The urgency sparked by the pandemic to take advantage of rival’s vulnerabilities and the countering urgency to defend one’s key borders/interests.

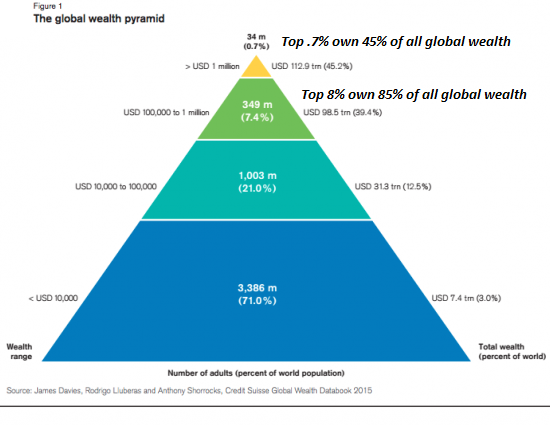

3. The destabilizing forces of elite dominance and wealth inequality within nation-states encourage elites to seek external distractions.

In this context, it’s interesting to review Edward Luttwak’s three stages of Empire. Luttwak’s The Grand Strategy of the Roman Empire sketches out three stages of Empire that apply equally well to elites within nation-states. In other words, elites can be said to have conquered their domestic masses politically, socially and economically, much as imperial elites conquer other nation-states.

Luttwak describes the first stage of expansion thusly:

“With brutal simplicity, it might be said that with the first system the Romans of the republic conquered much to serve the interests of the few, those living in the city–and in fact still fewer, those best placed to control policy.”

The second stage spread the benefits of Empire much more broadly:

“During the first century A.D., Roman ideas evolved toward a much broader and altogether more benevolent conception of empire… men born in lands far from Rome could call themselves Roman and have their claim fully allowed, and the frontiers were efficiently defended to defend the growing prosperity of all, and not merely the privileged.”

The third stage is one of rising inequality:

“In the wake of the great crisis of the third century, the provision of security became an increasingly heavy charge on society, a charge unevenly distributed, which could enrich the wealthy and ruin the poor. The machinery of empire now became increasingly self-serving, with its tax collectors, administrators and soldiers of much greater use to one another than to society at large.“

That line describes the global situation rather neatly. Geopolitical blocs, alliances, nation-states with imperial pretensions and nation-states with regional power ambitions are all in a land-rush frenzy to extend and consolidate their influence and power by any means available: financial, trade, diplomatic, soft power (cultural imperialism, etc.) and hard power (military forces) before the inherent internal instability of their elites’ dominance catches up with them.

Understood in this way, we can understand the geopolitical minefield as the conflict ground of various national and regional elites. What better way to distract restive, exploited and increasingly impoverished home populaces than to whip up a conflict with neighboring rivals / “enemies”?

In the run-up to events that unexpectedly spiral out of control, elites are over-confident about their ability to control the situation and “naturally” come out on top of any conflict. Hence they are dancing through the minefield, confident that they will magically miss all the mines, even the ones that cannot be detected.

Recall that the elites at the outbreak of the American Civil War and World War I were confident the war would be over in a few months. An overweening confidence in one’s ability to manage fast-moving crises is the ultimate hubris, and elites are prone to this hubris due to the apparent ease of extending their power and wealth in their domestic economies and political orders.

The odds of miscalculation increase exponentially as the number of players dancing through the minefield increases. As Mike Tyson so sagely observed, “Everyone has a plan until they get punched in the mouth.” The elites dancing through the minefield all have plans, but how many are prepared for the punch in the mouth?

* * *

My recent books:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via ZeroHedge News https://ift.tt/3gjVgkd Tyler Durden