What The Birth Of Crypto Can Predict For The Post-COVID-19 World

Tyler Durden

Mon, 05/25/2020 – 12:55

Authored by Max Skibinsky via CoinTelegraph.com,

The coronavirus outbreak may become the catalyst that will reveal the benefits of libertarian solutions and technology, such as cryptocurrency.

image courtesy of CoinTelegraph

We, as a society, are now experiencing a crisis of trust. The three pillars that we’ve had faith in all our lives — institutions, government entities and the media — have all failed us. From trusting financial institutions to guard our assets to expecting politicians to enact smart policies to hoping the media informs us on issues truthfully, we’ve entrusted these institutions to have the public’s best interest in mind and to provide crucial guidance in times of crisis. Instead of witnessing any of that, we have seen politicians, government agencies and the media fail catastrophically in the critical, early stages of the COVID-19 pandemic, with the few reasonable voices offering practical advice coming from Silicon Valley — insiders sounding “five-alarm fires” from their personal social media accounts.

As they say, history has a way of repeating itself, and if we’ve learned anything from the financial crisis of 2008 — which bailed out the wealthy banks and left a large swath of the population struggling and jobless — it’s that the centralized institutions put their own interests in front of ours.

The 2008 crisis destroyed the public’s trust in the banks and eventually led to the birth and proliferation of cryptocurrency. This genesis moment for cryptocurrency occurred, as it became evident that banks, and associated third parties, were unable to safeguard people’s assets. People wanted to permanently remove, on a structural level, any financial middlemen masquerading as “goodwill” actors and to control their own money and their own destiny.

There are similar patterns that we can identify between the fallout from the financial crisis of 2008 and the current crisis we’re living through — and how trust in all three pillars has all but disappeared nowadays.

During this pandemic, we’ve realized that:

-

Institutions have completely failed us. The Center for Disease Control and Prevention was not ready to react on any level. The World Health Organization was primarily concerned with China’s complacency rather than offering real help and guidance. The Food and Drug Administration’s policies were outright harmful to the American public, ranging from forbidding at-home testing to forcing local “COVID meetups” at hospitals.

-

The government and, in particular, politicians have failed. The federal government was clearly confused. At first, it tried to save pennies for airlines (keeping air travel to China open) that ended up costing trillions of dollars. It spread confusing and contradictory information; defunded agencies; and had no plans, no equipment, no strategy and no reliance on science or hard data. The completely non-partisan nature of this crisis made it especially damaging for politicians. The American public received a stark reminder that while politicians on both sides were busy with a ritualized Kabuki theater performance of mock political battles over the past few months, they paid absolutely no attention to the matters that became life and death factors for millions of people just a few weeks later.

-

The media has failed. Mainstream media completely missed the crisis and played it down in the first few months, fueling the storyline that the virus was “just the flu” and disseminating outright false and dangerous misinformation. The rapid and exponential growth of the pandemic offered a reality check far faster than the media is accustomed to, and authors of dangerously incompetent stories were faced with harsh accountability for the results of their “research” and “fact-checking” in a timeframe they never experienced in their professional careers. This resulted in the widespread mistrust of the media with its clear inability to inform the public, or even just having the discipline to research the correct answers in the first place.

Stemming back to its early days, the crypto industry has always had a hint of doomsday gloom around its narrative. After all, why would anyone need this marvel of a cryptographic peer-to-peer decentralized financial network if we can simply trust governments, media and institutions to just do their jobs well? As it turns out, our current reality is uncomfortably close to what cryptocurrency enthusiasts always feared they must prepare for in a dystopian future that is now our present day.

The need to replace legacy social systems based on blind trust with decentralized alternatives that are based on fundamental mathematics to empower the individual is now extremely clear. We can expect the natural reaction of the tech-savvy public to be similar to the last crisis: For every centralized institution that claims “we know what’s good for you so just trust us,” we’ll begin to see the emergence of a decentralized alternative that people will actually trust — not because they blindly delegate that trust, but because the “source code” of that distributed network and its rules of operations (oftentimes as the literal source code) will be visible to everyone in the network to review and improve upon.

The intertwined roles of fundamental cryptography and decentralization will quickly grow in our society once we get out of the immediate needs of dealing with this current crisis. After the dust settles, the outcome will be a second genesis moment for fundamental cryptography to power up many verticals shifting to distributed and decentralized alternatives. What will be the most interesting industries to put on the watchlist?

-

Education: The shift to online education and homeschooling will go from a light drizzle to a torrential downpour. As a side note, it will be an interesting moment in California politics when the teachers union’s interests for political self-preservation will come in direct confrontation with every parent’s desire for physical self-preservation. That will mean that teachers — who fully embrace the online-first experience and make internet classrooms work 10 times (if not a hundred times) better than their less tech-savvy peers — will need reputation and compensation rails to be built outside traditional educational structures. “Blockchains eat online education” might be the best answer for that challenge.

-

Media: The importance of independent media that can ring the alarm bell or shine a light on developing issues is now more apparent than ever. Unfortunately, such media exists only in our imaginations as fantasy heroes of the Pentagon papers style movies and books. The real media is a fading empire of failed corporations with a decaying business model that is trying to compete (and losing badly) with tech corporations for the same advertising dollars. Their employees are not heroes of the past but are, instead, an overworked and under-compensated workforce with a narrow short-term focus of content production for for-profit corporations. These legacy media organizations are allowing employees to produce a depth of coverage and attention span akin to that of a goldfish rather than prioritizing news in the public’s best interests. These organizations’ ability to be alerted, to research and to provide smart and timely science and data-based guidance is, frankly, zero at this moment.

We’re now entering a new era of self-reliance that incorporates finding our own trusted sources of information, compensating them outside of for-profit media models and bringing about a grassroots style of citizen-journalists that fully own their own broadcasting power. Instead of a few dozen major media outlets, we will follow thousands of experts who can provide deep and extremely specific coverage for any domain. Substack, Twitter lists and YouTube podcast stars are already filling that void. Adding cryptographic artifacts for reputation and compensation will only accelerate that trend.

-

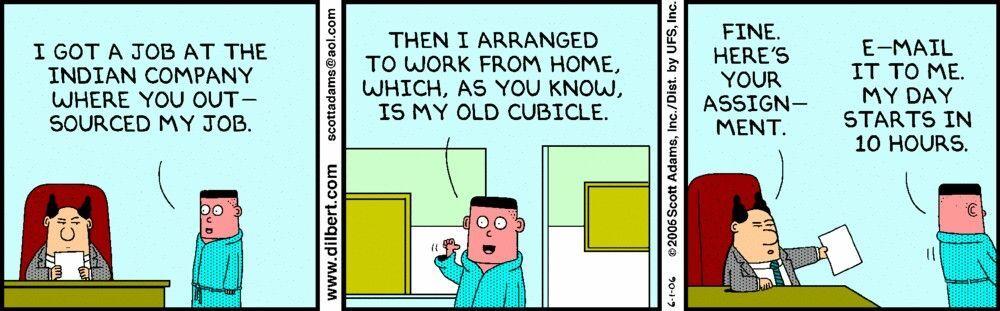

On-demand workforce: With COVID-19 likely becoming a seasonal malady alongside the regular cold and flu, remote work will become the default setting with a highly flexible workforce — not bound to any geographic locale — that will be instantly available for any specialized task. The “on-demand” workforce will become just the “workforce” in exactly the same way the “mobile phone” became just a “phone.” As always, distributed and decentralized trustless network corporations will want to see unforgeable proof of professional capabilities and past performances while professionals will want to receive guaranteed payment in undiluted assets (that might be radically different from colored paper printed by the host country). Both of these challenges flow natively into blockchain-based solutions. After a few years of adjusting to this new normal, we might see the modern workforce becoming similar to the vision laid out in classic cult hit Diamond Age by Neal Stephenson. Knowledge work will become simply something anyone can “log in” to from any place on the planet and at any time for as long as they are willing to contribute. This COVID-19 crisis might be just the forcing function that will make the sci-fi novel entirely real.

We have already started seeing the green shoots of progress that will define how society learns and evolves from this crisis. The biggest winner of all might be the philosophy of libertarianism that shuns large institutional solutions and prefers to bestow all the power on the technologically educated and empowered individual. This might be the catalyst we needed to shift public opinion toward libertarian solutions after seeing such an abject failure of legacy models.

This will usher in an age of reason based on science, research and, most of all, data and facts. Individuals joined in myriad reputational, professional and financial networks will be able to reach an online consensus and enact policies with speed and intellectual depth unseen by any previous generation. And that, perhaps, will be the most lasting positive change in the post-COVID-19 world.

* * *

Max Skibinsky is the co-founder and CEO of Vault12. Most recently, Max was an investment partner with Andreessen Horowitz where he focused on enterprise security and Bitcoin.

via ZeroHedge News https://ift.tt/3gnYW5g Tyler Durden