David Einhorn Smells Blood, Unveils A “Host Of New Questions” For “Fraud” Elon Musk

While Musk may have much bigger headaches on his hand following his bizarre “unvetted” tweets from this morning which as even Musk reportedly admitted were in violation of his SEC settlement, in the latest letter to investors published today by Greenhorn’s David Einhorn, the hedge fund billionaire – smelling blood not to mention various mind-altering drugs emanating from Musk’s twitter feed – tripled-down on his years-long feud with the Tesla CEO (as a reminder, last November Einhorn accused Tesla, and by implication, of “significant fraud”), and one day after an Einhorn tweet questioned Tesla’s “suspect” accounts receivable and income statement over the same concerns we first laid out on Wednesday, and hammering Tesla stock (which as even Elon Musk agrees is “too high“), the billionaire hedge fund manager unloaded on Tesla in his letter, repeating many of the same questions he has asked previously (without getting an answer) and making Musk’s job of lowering TSLA price even easier.

Below we have excerpted the key parts from Einhorn’s letter discussing Greenlight’s persistent Tesla short (which is not an outright stock short, but as we now learned, a put spread):

The TSLA melt-up from $418 at year end to a high of $969 on February 4 caused only a moderate loss, as much of our short position was structured in put spreads. Considering our continued negative view of the company, we did a good job maintaining a large exposure to our thesis working while avoiding a large loss in the parabolic move higher.

However, in the subsequent market decline, we would have expected to be rewarded in our TSLA puts. TSLA does not have a conservative balance sheet and has all kinds of exposure to the current crisis. Luxury car sales of all types are likely to collapse in a recession. We won’t know right away because TSLA’s plant is closed and the company can claim (without seeing the irony) that demand currently exceeds supply.

The closing of the factory is also inopportune because TSLA still enjoys a window in which its Model 3 and Model Y face limited global competition. The window is beginning to close, as TSLA has already lost a lot of share in Europe’s electric vehicle market. By next year, the U.S. market should become similarly competitive.

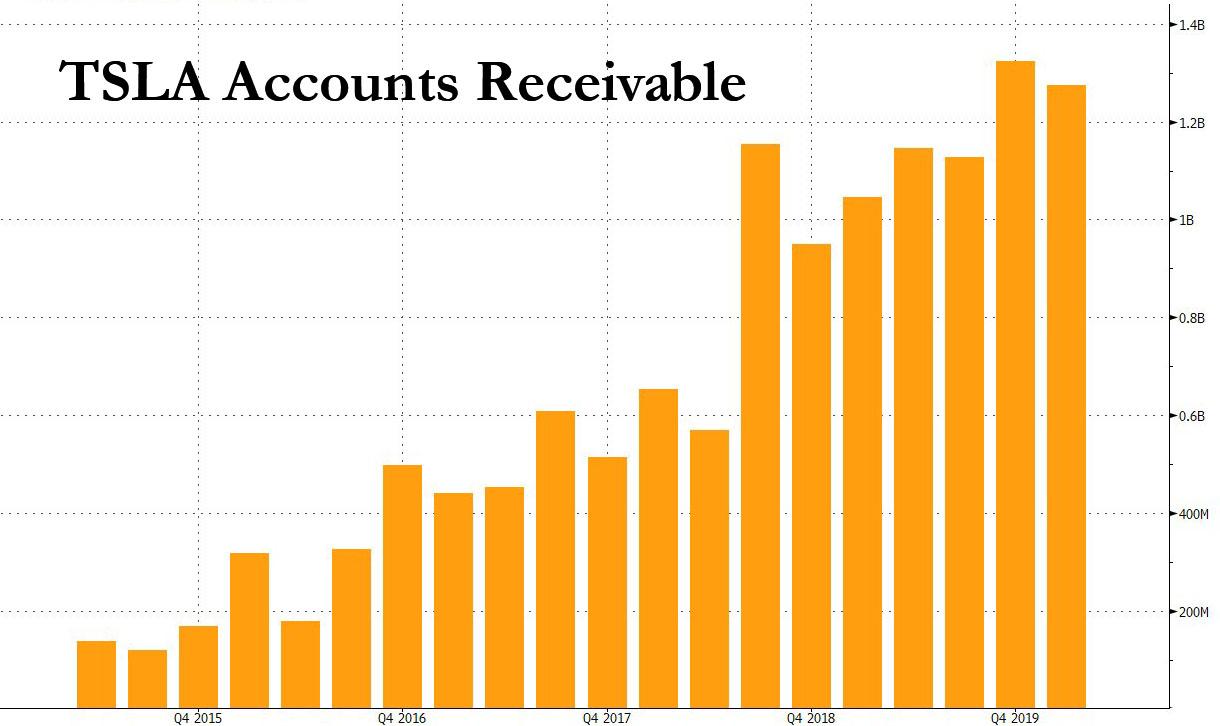

The first quarter (announced Wednesday) raised a host of new questions. For the last several quarters, TSLA has carried accounts receivable balances that are difficult to reconcile with its business model – where customers pay before taking delivery.

TSLA has given multiple and contradictory explanations. The most recent version claimed that it takes a few days for payments to clear the banks and a little longer to arrive from Europe. TSLA also claims that because sales are crammed into the end of the quarter, it matters whether a quarter ends on a weekday. The first quarter ended on a Tuesday and unlike prior quarters, TSLA sales were not crammed into the last week of the quarter due to the pandemic. Had TSLA’s prior explanation been correct, days sales outstanding (DSO) should have plunged. Instead, they rose (TSLA claims that part of this came from sales of regulatory credits in the first quarter, “most” of which had not been collected. Even adjusting for this, DSO did not plunge as one might have expected). The receivables remain a source of mystery. To the extent they exist, it is unlikely that they are explained by TSLA’s responses.

TSLA now produces in two factories, which has increased its overhead costs, while utilization rates are down significantly in Fremont. Despite an adverse product mix, the launch of the Model Y, shutdowns at its factories and currency headwinds, TSLA only had a modest decline in auto gross margin (excluding regulatory credit sales) for the quarter. Given the circumstances, this is hard to explain. Moreover, TSLA opened its factory in China while still somehow reporting reduced depreciation and SG&A expense sequentially. None of this makes sense to us and casts doubt on TSLA’s income statement.

TSLA is not a “growth” stock; rather it is a “story” stock. Even as TSLA furloughs its manufacturing workers, fires part of its salesforce, cuts everyone else’s salary, and renegotiates its rents with landlords, Elon Musk is days away from a nearly $1 billion option bonus due to TSLA sustaining an inflated stock price.

The TSLA “story” has resonated strongly with ESG investors. Relating to Governance, the insurance industry seems to get the joke. TSLA seemed unable to obtain D&O insurance on commercially reasonable terms. The Directors are now being insured by Musk. This creates an obvious conflict of interest that cripples the Directors’ ability to curtail Musk’s behavior – as he can now threaten that if the Board brought him down, the insurance may not have value. Making the Directors so beholden to Musk by definition makes them not independent (The Board, of course, proclaimed that it still judges itself to be independent. Of course, having a majority of independent directors is a NASDAQ listing requirement, and having independent directors was also part of the SEC settlement over Musk’s tweeting. The SEC or NASDAQ will probably not notice in the middle of the pandemic).

Musk’s overhyped response to the pandemic echoes his behavior in previous crises, and is little different from his fake promises to his customers. For example, for the last three years TSLA has sold a vaporware add-on called “full self-driving” for thousands of dollars. A year ago, Musk claimed that when the company’s software was “feature complete,” it could begin to enable TSLA cars to operate as autonomous “robotaxis” starting in mid-2020. On the fourth quarter of 2019 conference call, Musk admitted that “feature complete just means like it has some chance of going from your home to work let’s say with no intervention.” However, with TSLA’s stock price on the edge of vesting Musk with a windfall, he recently used Twitter to double down on the “robotaxi in 2020” narrative.

President Trump has called Musk a “genius” who “needs to be protected,” which is strange since TSLA is shifting its manufacturing to China. The President hasn’t seemed to mind… yet. This could be TSLA’s undoing, as its story increasingly depends on China for both cheaper manufacturing as well as consumer demand, against a backdrop of deteriorating relations between the two countries. TSLA shareholders are assuming enormous political risk in betting on the “TSLA in China” thesis.

Perhaps Musk’s flippant behavior around the pandemic – endangering his workforce and calling the government response “fascist” – will reveal his true nature to broader society and be reflected in the share price. Historically, stock promotions like this tend to unwind in economic down-cycles. TSLA advanced 25% in the first quarter and another 49% in April, bringing its year-to-date return to 87%

And now, to the sheer fury of all those gullible investors who bought into Tesla’s $2 billion equity offering at $767/share on February 14, none other than Elon Musk agrees with David Einhorn.

Tesla stock price is too high imo

— Elon Musk (@elonmusk) May 1, 2020

Tyler Durden

Fri, 05/01/2020 – 16:19

via ZeroHedge News https://ift.tt/3bYCrl8 Tyler Durden