Authored by Jim Quinn via The Burning Platform blog,

“The Truth, when you finally chase it down, is almost always far worse than your darkest visions and fears.” ~ Hunter S. Thompson

I think Hunter S. Thompson is being proven right by revelations becoming obvious daily. I’m a natural skeptic, so I rarely believe anything I’m told without verifying facts, analyzing data and understanding the motivation of those making declarations and assertions.

For most of my life I thought I generally understood how the world worked.

Doubts about my understanding began to creep into my mind between 2000 and 2008, as I watched my government cover-up the truth about 9-11, use it to institute an Orwellian surveillance state through the Patriot Act, invade Iraq based upon a false narrative of WMD and links to 9/11, and watching those controlling the Federal Reserve create the dot.com bubble and follow it up with a housing bubble – all done to benefit Wall Street banks, billionaires, connected politicians, and Deep State apparatchiks.

The national debt was $5.6 trillion in 2000, the budget was as close to balanced as it had been in decades, the defense budget ($300 billion) was at decades low as there was no major conflicts in the world, and term limits were still a legitimately discussed election issue. If someone was told on January 1, 2000 that in 2021 the national debt was going to hit $30 trillion, with annual deficits of $3 to $4 trillion, a defense budget of $750 billion as war looms on the near-term horizon, and all semblance of governing through legislation to benefit the citizenry had dissipated, they would have laughed, accused you of being a conspiracy nutjob, and said the nation would be a hyperinflationary banana republic with 50% interest rates if any of that came to pass. The truth is always far worse than your darkest visions and fears.

What has occurred in the last year has befuddled me, as the level of treachery, deception, disinformation, and false narratives has reached excessive elevations, indicating a sense of urgency and desperation by those wielding power over society. It has been depressing and frustrating to witness the level of obedient compliance by the majority of frightened sheep in this country, with complete subservience to authoritarian dictates of their overlords.

The extremeness of the response to a bad annual flu virus leads me to believe the truth behind what has happened and is happening is far worse than most can conceive or comprehend. The level of pure malevolence and disregard for humanity exhibited by the despots wielding power over our political, economic, medical, and social structures has pushed the country to the edge of civil chaos, calculated political pandemonium, global conflict, and unavoidable debt manufactured financial collapse.

Sometimes I find myself wondering whether I’m the crazy one for not believing a piece of cloth will protect me from catching a flu virus with a 99.8% survival rate, or not voluntarily allowing a Big Pharma corporation, with no liability for the consequences of its experimental gene therapy, to treat me as their animal test subject to increase my survival chances to 99.85%, or questioning why I need to wear a face diaper because I can catch the virus while walking to my restaurant table but not once I sit down, or why six foot distancing is safe but 5 foot distancing is dangerous. Why are the predictions of doom by “experts”, which never come true, overlooked and disregarded by the corporate fake news media?

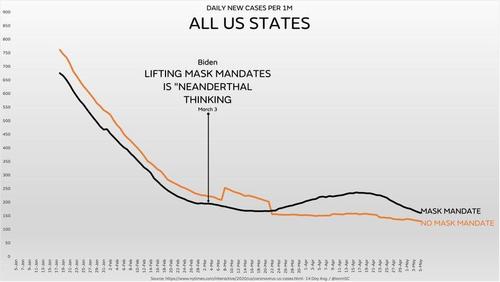

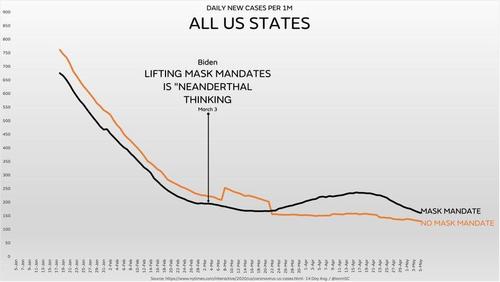

Why did Dementia Joe call the governors of Texas, Florida, and Mississippi Neanderthals six weeks ago for ending mask mandates and this week he ended the mask mandate for the entire country? I thought he followed the science. But it appears raging inflation, a terrible jobs report due to his policy of paying people not to work, a hemorrhaging border crisis, gas pipelines proving to be somewhat important, the Middle East exploding, and his woke executive order agenda being ridiculed on a daily basis, convinced Joe’s handlers to distract from his 100 days of disaster by reversing the ridiculous Covid restrictions and sending the Covid cult into convulsions of fury.

Their pathetic lives of mask virtue signaling, twitter haranguing, and vaccination shaming are about to be invalidated, as a return to normalcy will relegate the Biden brigade to their previous status of inconsequential drones on Facebook posting pictures of their nine cats.

What little faith I had in humanity after this past year of cowardly compliant obedience to totalitarian governmental dictates and proclamations, was fully extinguished this weekend while making an early morning stop at Wal-Mart. The Biden administration’s sudden reversal on masks, after fear mongering and preaching doom for months, immediately led to Trader Joe’s, Costco and Wal-Mart announcing no more masks required to enter their stores, with an unenforceable caveat about being vaccinated. After a year of mask mandates, I pondered whether I should enter the Wal-Mart like this fine gentleman.

But I just sauntered in like everyone else, expecting to see dozens of other unmasked Americans breathing fresh air, thankful to be free of those disgusting face diapers which have done ABSOLUTELY NOTHING to reduce the spread of this over-hyped annual flu with a scary name and largest marketing campaign in history. Instead, I witnessed dozens of masked sheep still following orders even after those orders had been rescinded by their self-appointed science shepherds.

An overwhelming feeling of disgust swept over me, as I only witnessed two other sensible human beings out of the hundred or so roaming the aisles. My disappointment with the vast majority of citizens in this country has now reached all-time lows. I am chalking it up to a new version of PTSD, in the era of covid hysteria, PMSD (Post-Mask Stress Disorder). A large portion of the populace have developed a mental illness, purposely provoked by their own lying government and authoritarian politicians. This entire scam has been a lesson in abuse, fear propaganda, lies, false appeals to science, and censorship of the truth.

There are now millions of sheep who do not know how to readjust to reality and lose the masks, which convinced them they were brave, noble and “in this together”. Trying to use facts and reason to convince these people masks never worked and their chances of dying from this flu were no higher than the annual flu is a useless endeavor. The Covid Cult cannot let go of their mask virtue signaling because they will lose that feeling of superiority and arrogance towards the unmasked masses.

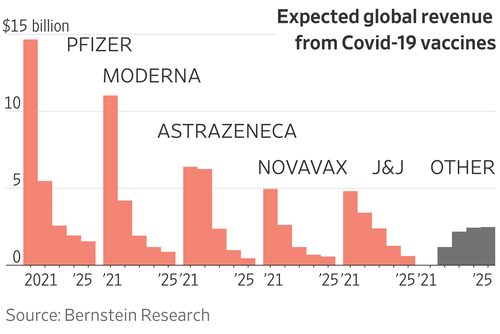

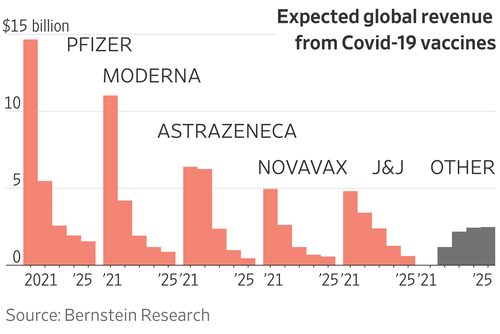

The loss of this covid cudgel is being rapidly substituted with these Big Pharma multi-billion-dollar profit generating experimental gene therapies, disguised as vaccines. They desperately want to condescendingly force the jab upon everyone and force vaccine passports upon the masses as their new virtue signaling badge of compliant obedience. After spending tens of billions of your tax dollars on a vaccine marketing campaign, employing famous athletes, Hollywood influencers, medical “experts”, and non-stop TV commercials, only 37% of the American population is fully vaccinated. It has been a gigantic FAIL.

Everyone who wanted to be vaccinated, is vaccinated. They have resorted to cash payments, million-dollar lottery prizes, free donuts, free burgers & fries, and a multitude of other bribes to get the jab. Now they are falling back on the totalitarian methods used during the lockdown. Get the jab or wear a mask forever threatens Dementia Joe. Colluding with corporations and schools to force employees and children to get the jab. Threatening to impose vaccine passports to travel, enter sports and concert arenas, and to generally cancel the non-vaccinated. It is failing.

With only 37% of the public sheeplike enough to get the jab, any “woke” business that continues to invoke mask mandates or require proof of vaccination will find their profits dissipate faster than Trump’s lead in swing states at 3:00 am. If you were to believe the fake news media and government drones, you would believe the majority have been vaccinated and the “anti-vaxxers” were a crazy conspiracy theorist minority. As with most things being fed to you daily, this is a big fat lie. The rational, resistant (not hesitant), critical thinking MAJORITY are done with this scamdemic. Biden and his handlers are being forced to throw in the towel, for now.

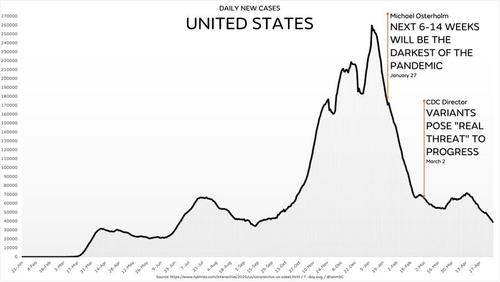

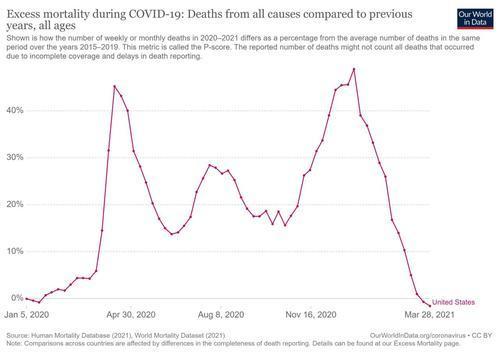

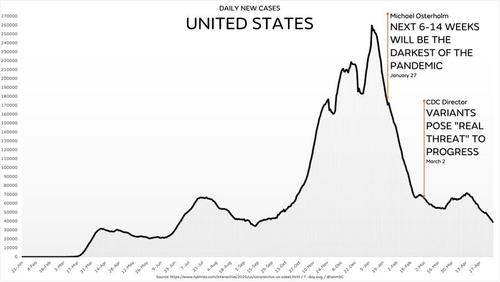

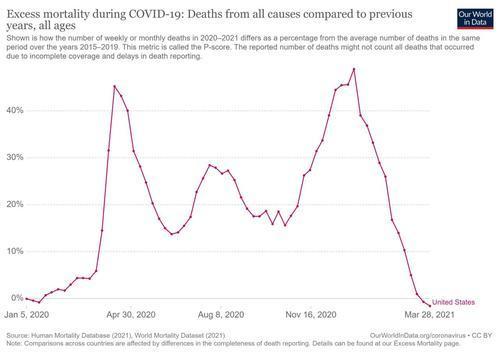

The propaganda press polluters of the truth are still selling a completely false narrative about the vaccines being the reason cases, hospitalizations and deaths have plummeted since January 1 of this year. The excess mortality rate in the country is now back below the averages from 2015 – 2019. The crash in death rates occurred while less than 15% of the population had been vaccinated. The bloviating about needing 70% of the population vaccinated to stop the pandemic is complete and utter bullshit.

Masks never protected anyone from infection and the vaccine is unnecessary to resume normal life. This flu follows the same infection pattern as the annual flu (which mysteriously disappeared from the globe in 2020-21) and has run its course. Vaccine rates per state are showing ZERO impact on the downward trend of cases and deaths. They are falling and have been falling with or without the vaccine.

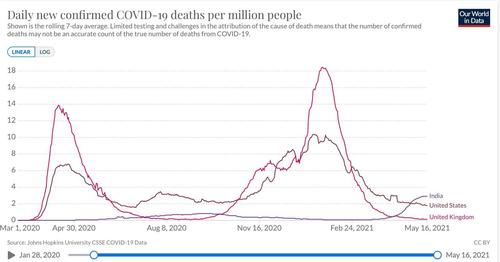

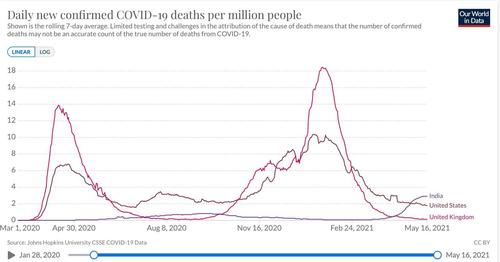

The India variant and “surge” fear mongering has fallen on deaf ears as their death rate per 100,000 is only a fraction of the U.S. and U.K. These propaganda tactics have worn out their welcome. Very few are believing the feckless mainstream media miscreants. Their ratings are lower than whale shit.

No matter how hard they try to reinstall the fear, enough people are tired of this farce to derail further attempts at lockdowns, mask mandates and vaccine passport requirements. Every day with declining cases, vaccination rates, and deaths makes it harder for the Covidian cult medical tyrants to pretend there is a national emergency. Their sense of desperation is palpable. This sense of desperation is seen in their attempt to force this experimental therapy on children and their complete lack of concern or acknowledgement of the hundreds of thousands of adverse reactions and thousands of deaths attributed to their gene therapy experiments on human guinea pigs.

These medical experts and doctors seem to have forgotten the first rule of their Hippocratic Oath – DO NO HARM. More likely, they sold their souls to Big Pharma for big bucks. The science says 1 in 300,000 of children under 18 will die from Covid but based on actual data 3 in 300,000 will die from the vaccine. They are pushing these vaccines on children for profits, not for health reasons. Always follow the money.

I believe Solzhenitsyn’s famous quote about “how we burned in the camps later” regarding what would have happened if they resisted and killed their oppressors when they had the chance will be restated years from now when the long-term consequences of these experimental gene concoctions are felt by the children forced to participate in this evil experiment. If we had only resisted.

This is communism in a new repackaged marketing campaign, where Bernays’ propaganda techniques have been perfected through technological mind manipulation by Big Government conspiring with Big Tech and Big Business. The tripe of political correctness, wokeism, anti-racism, cancel culture, and fear of the annual flu has been taken to a level never seen before. Theodore Dalrymple captures the essence of this new communism.

“Political correctness is communist propaganda writ small. In my study of communist societies, I came to the conclusion that the purpose of communist propaganda was not to persuade or convince, not to inform, but to humiliate; and therefore, the less it corresponded to reality the better. When people are forced to remain silent when they are being told the most obvious lies, or even worse when they are forced to repeat the lies themselves, they lose once and for all their sense of probity. To assent to obvious lies is in some small way to become evil oneself. One’s standing to resist anything is thus eroded, and even destroyed. A society of emasculated liars is easy to control. I think if you examine political correctness, it has the same effect and is intended to.” ― Theodore Dalrymple

Dalrymple is correct in pointing out how these modern communists use humiliation and shaming to ram their false narratives and authoritarian agendas down our throats through the power of fake news media and the Silicon Valley social media censorship tyrants. They blatantly flog provably false narratives through their media mouthpieces, disguised as impartial journalists, medical experts, university professors, and anyone the masses might look up to. Those who knowingly assent to these obvious lies have become just as evil as those telling the lies.

The lies have been piled high in the last year as the annual flu was weaponized to cover-up the disintegration of our financial system and as a means to fraudulently conduct a coup against a president; the deaths of two black law breakers were utilized to usher in the colossal lie of systematic racism bought into by woke corporations and college campuses across the world; a clearly stolen election was declared honest by those controlling the narrative; lockdowns and masks were pronounced to be the only way to slow the spread even though all data refutes those assertions; an armed insurrection (with no arms) lie on January 6 has been used to wall off Washington DC and sell the big lie of white supremacy being a threat to the republic; the Federal Reserve creating trillions out of thin air and pumping it into the pockets of billionaires and Wall Street fat cats has not created raging inflation and an all-time high in wealth inequality according to the talking heads on CNBC and the rest of the fake news media complex; emergency use authorized vaccines were the only solution to a flu that doesn’t kill 99.8% of those infected, even though ivermectin and hydroxychloroquine have proven to be effective and safe in combating covid; and lastly these vaccines have been declared safe even though they are killing and maiming thousands and no one knows the long term effects on those who have chosen to be their lab rats.

We have become a society of emasculated liars, purposely deceiving ourselves because we are too cowardly to admit we have been had by those ruling over us with an iron fist. As a society we have decided resistance is futile and if we go along to get along, we will still be allowed to subsist, play with our techno-gadgets, and be sent stimmy checks, welfare payments, and be granted the ability to pay for stuff we cannot afford on credit. The willfully ignorant have chosen to become debt slaves and obey their masters, rather than resist tyranny and demand their independence from this dystopian nightmare we are currently living under.

We continue to elect corrupt politicians and willingly follow the orders of traitors, crooks, and despots, so we have become collaborators, rather than casualties. As a society we do not want the responsibility of freedom and have gladly exchanged our liberties for the illusory chimera of security. Those controlling the levers of power have taken advantage of this cowardly trait to abscond with the nation’s wealth and keep the masses in constant fear of new bogeymen (terrorists, white supremacists, flu viruses, and now aliens).

As I observe what is happening over the last week or so, I fall back on the words of the patron saint of sanity in a world gone mad.

Everything our government tells us every day is a lie. Biden’s sudden reversal on masks, supposedly based on science, is a lie. The story about the DarkSide Russian hackers shutting down the Colonial pipeline is a lie. It is just as likely it was done by the CIA. If a pipeline can be hacked then voting machines can be hacked, but they continue to lie about that. Anyone with critical thinking skills knows this virus came from a Wuhan bio-lab, which was funded by Fauci to develop these gain of function viruses. Fauci lied to Congress and has lied to the American public since February 2020 about masks, lockdowns, risks, and vaccines. They are lying about vaccine effectiveness and risks.

Every time Jerome Powell or one of his Fed cronies opens their mouth, they are lying. Anyone with any financial acumen knows stock, bond, crypto, housing, and virtually all markets are experiencing the biggest bubble in world history, but the financial “experts” tell you to buy before it is too late. They are lying because they are paid handsomely to do so. Lies about the selfie insurrection in the Capitol continue unabated. Biden and his handlers have been lying about their man made purposeful border crisis. Lies about Dominion voting machines and rigged election results are perpetrated by the paid hacks on CNN, MSNBC and even Fox, every day. The lies will continue until morale improves, or the ruling class can abscond with another trillion or so.

This pandemic is over. It has served its purpose to those in power. Biden is now playing the part of President Snow in Hunger Games by giving the plebs a little hope. Dangling the return to relative normalcy in exchange for being jabbed with their DNA altering cocktail is the latest narrative being peddled to the sheep. Many have or will make that trade. But, as of now, the majority are not falling for it. My hope is the spark is not contained and that good men and women do not stand idly by while evil continues to flourish. It is time for decent human beings to stand up and be counted and not allow a darkness to settle upon this nation, ushered in by the likes of Gates, Schwab, Soros, Obama, Biden, Bloomberg and their ilk.

The ruling class would prefer a Hunger Games plot where they continue to pit groups against each other: blacks versus whites, masked versus un-masked, vaxxed versus unvaxxed, liberal versus conservative, men versus women, modestly rich versus poor, taxed versus untaxed, and neighbor against neighbor. They want us fighting each other so we do not realize they are the true enemy.

This entire plandemic was a test to see how far they could push us before we pushed back. As a nation, we failed the test miserably. They are loosening the reins for now, but they now know they can force the masses to cower and beg for safety and security. They are supremely confident they can easily manipulate the masses, based once again on using the Big Lie method.

Recent developments make me suspicious something big is happening and the narrative is going to take a dramatic turn. First the take down of Cuomo by a previously fawning press and now the man who bankrolled the pandemic, creepy Bill Gates, is in the process of being taken down over his relationship with the king of pedophilia – Jeffrey Epstein (who didn’t kill himself). Fauci is about to be thrown to the wolves over his funding of the Wuhan bio-weapon lab. All the pandemic superstars are being cast aside.

Why now? Crucial infrastructure is supposedly being hacked. War is breaking out in the Middle East. Saber rattling between China – Taiwan and Russia – Ukraine is provoking worries of global conflict. Raging commodity inflation, labor shortages, and financial markets giving signs of an imminent crash could be the trigger for the next leg down in this shitshow portion of the Fourth Turning. Something big is coming and I expect it will happen before the 2022 elections. If you thought the last year was bad, you ain’t seen nothing yet. But don’t worry, the planet will be fine.

“We’re so self-important. So arrogant. Everybody’s going to save something now. Save the trees, save the bees, save the whales, save the snails. And the supreme arrogance? Save the planet! Are these people kidding? Save the planet? We don’t even know how to take care of ourselves; we haven’t learned how to care for one another. We’re gonna save the fuckin’ planet? . . . And, by the way, there’s nothing wrong with the planet in the first place. The planet is fine. The people are fucked! Compared with the people, the planet is doin’ great. It’s been here over four billion years . . . The planet isn’t goin’ anywhere, folks. We are! We’re goin’ away. Pack your shit, we’re goin’ away. And we won’t leave much of a trace. Thank God for that. Nothing left. Maybe a little Styrofoam. The planet will be here, and we’ll be gone. Another failed mutation; another closed-end biological mistake.” ― George Carlin

* * *

The corrupt establishment will do anything to suppress sites like the Burning Platform from revealing the truth. The corporate media does this by demonetizing sites like mine by blackballing the site from advertising revenue. If you get value from this site, please keep it running with a donation.