Why Mexico Fears Shutting Down Its Economy To Combat COVID-19

Authored by Ryan McMaken via The Mises Institute,

Mexico’s president Andrés Manuel López Obrador has been reluctant to impose mandatory “social distancing” orders on the Mexican population. According to USNews, López Obrador “has maintained a relaxed public attitude” toward COVID-19, and the Mexican government did not impose a ban on “nonessential” work until March 30, long after health officials in other countries insisted Mexico must do so.

According to Dr. Miguel Betancourt, president of the Mexican Society of Public Health, those measures are “too late” and “should have come weeks earlier.” But, even with legal measures in place, it’s hard to say how many Mexicans can afford to follow them. The Financial Times has described what is likely a common attitude in Mexico:

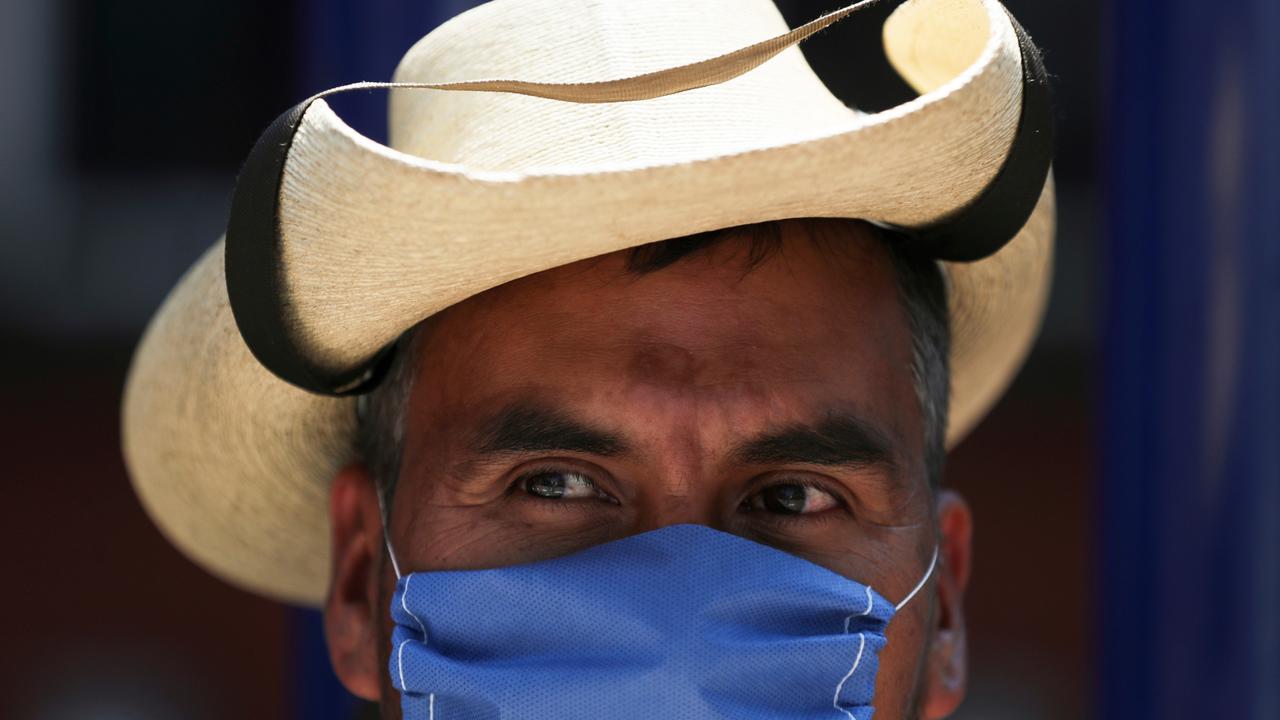

Salvador Almonte has been doing a roaring trade in antiviral citrus cocktails at his stall in Iztapalapa, a sprawling working-class district of Mexico City. He makes about $9 to $13 a day selling juices and sandwiches and—like his customers—cannot contemplate staying at home to slow the spread of Covid-19. “We live day to day,” he said. “If we don’t work, we don’t eat.”…

Cuauhtémoc Rivera, head of the Association of Small Businesses, warned that a quarter of a million corner shops could close, with the loss of 500,000 jobs….If this goes on for a long time, I don’t know how we’ll all survive,” said Enrique Rosas, who has a fleet of 20 taxis.

The Mexican government is right to be hesitant to shut down Mexican businesses. The distance between a “normal” economy and grinding poverty is a lot smaller in Mexico than in a wealthy country like the United States or Germany. While mandatory lockdowns in rich countries will cause mass impoverishment—complete with all the usual mental and physical health problems that accompany it—the stakes are even higher in a middle-income country like Mexico.

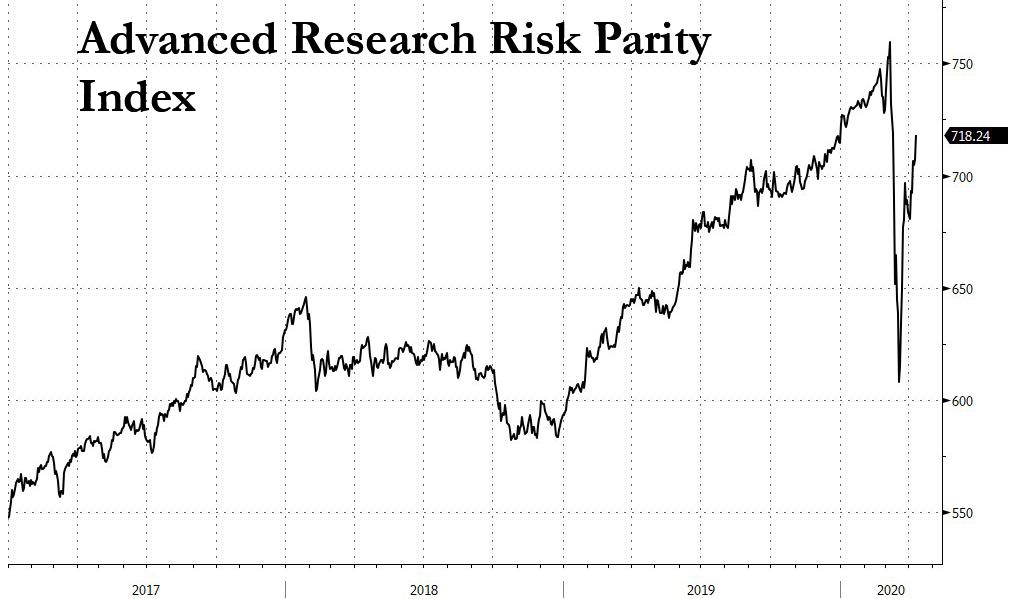

Moreover, many Mexicans are already suffering from the mandatory shutdowns in the US. In 2019, for example, Mexicans working in the United States sent more than $39 billion back to Mexico. This is a vital lifeline for many Mexicans, and these remittances are likely to be decimated by the government-forced shutdown.

The Financial Times continues:

Balancing the competing needs to keep citizens healthy without devastating the economy is particularly tricky in Mexico….almost 50 per cent of Mexicans live below the poverty line, another 30 per cent are vulnerable to sinking into poverty and 30m work in the informal sector, where they receive no social benefits.

What Mexico Learned from the H1N1 Panic

This isn’t the first time Mexicans have been commanded to lock down their economy to battle a disease.

During the H1N1 pandemic of 2009, Mexican officials closed schools for a week, locked down various businesses, canceled movies, concerts, soccer games, and “virtually forced the entire population to wear ineffective face masks.” Mexico experienced 390 deaths out of a population of 120 million.

This had devastating effects for Mexico’s economy, especially its tourist industry. According to the Atlantic Council:

The cost of the pandemic was estimated at 1 percent of Mexico’s GDP in 2008….The A(H1N1) outbreak particularly impacted tourism—an important component of the Mexican economy due to its magnitude and its importance as a source of foreign currency; the tourism industry lost an average of 80 percent of its sales. After the first weeks of the quarantine, 90 percent of the country’s hotel and transportation reservations were canceled, along with 290 cruise ship arrivals. It was estimated that in 2009, Mexico lost $3.4 billion from touristic activities due to the pandemic.

In the immediate aftermath, the Mexican government was praised and congratulated for its actions, but many later admitted the Mexican government had overreacted. According to Jorge Castañeda Gutman, former Mexican Secretary of Foreign Affairs,

One year later the WHO acknowledged it had exaggerated, and the Mexican government was moderately criticized for the type of measures it took….The government didn’t know, or didn’t acknowledge, that this response would prove to be undoubtedly more onerous for the country than the epidemic itself.

This disastrous impact on the Mexican economy informs the debate today in Mexico. According to Physician’s Weekly,

The lesson is not lost on the officials running Mexico’s response in 2020, many of whom were also involved in fighting the influenza epidemic. Mexico’s economy last year suffered its first recession since 2009. [Deputy Health Minister Hugo] Lopez-Gatell said on [March 17] countries around the world were repeating Mexico’s mistake in 2009, making decisions based on anxiety and social pressure rather than science….The lesson from the flu epidemic is that acting too soon is counterproductive, he said. “Acting responsibly, we can’t and should not take measures that exhaust our society. Let’s not use up all the interventions too soon. Let’s keep our calm.”

With the implementation of last week’s order, the business shutdowns have now begun. Unemployment will soon follow, but it’s unclear how many Mexicans can sit at home and wait things out. Many will be forced in the the informal economy to bring in at least a little income. Since far fewer Mexicans than Americans have jobs that lend themselves to “working at home,” keeping food on the table will require flouting demands that Mexicans practice “social distancing.”

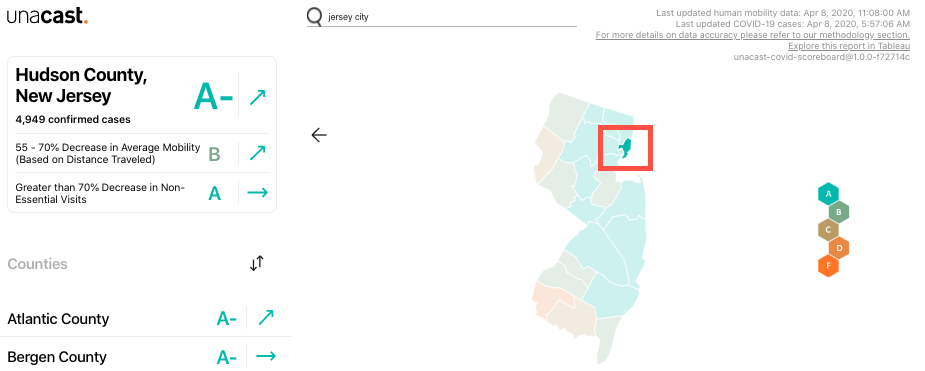

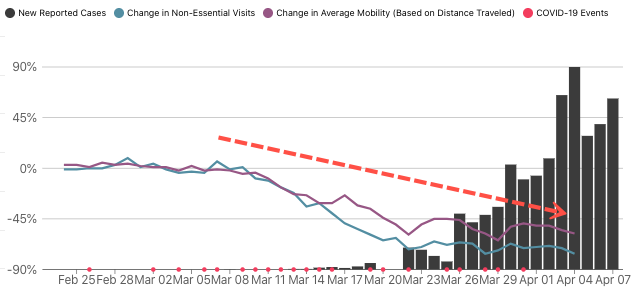

This isn’t the say things are proceeding as normal. At least one study claims ridership on public transport in Mexico has fallen by 50 percent, and traffic congestion has fallen by even more. But even big declines in usually traffic-choked Mexico City hardly signal a situation in which streets are deserted.

How many will studiously avoid human contact outside the home? Mexican business and political culture suggests many will not. The number of annual hours worked per worker is higher in Mexico than any other country. Moreover, according to Castañeda, Mexicans react with “skepticism with regard to anything derived from government,” and this “individualistic, incredulous attitude” applies to public health orders as well.

It may be that many Mexicans will fear COVID-19 more than they feared H1N1. But in Mexico, many are also familiar with the hardships poverty brings, and fear of being destitute may trump fears about the disease. Although wealthy Americans with secure employment and luxurious lifestyles like Anthony Fauci continue to insist mass unemployment is merely “inconvenient,” few Mexicans have the luxury of such blasé thinking.

Tyler Durden

Fri, 04/10/2020 – 18:45

via ZeroHedge News https://ift.tt/2VhtBI4 Tyler Durden