Authored by Kevin Smith and Tavi Costa via Crescat Capital,

Two diverging schools of macro thoughts are prevalent today. One calls for a “Roaring 20s” redux while the other believes in a forthcoming liquidity crisis. Both narratives have valid points and flaws. To be clear, we find ourselves right in between the two. Let us elaborate.

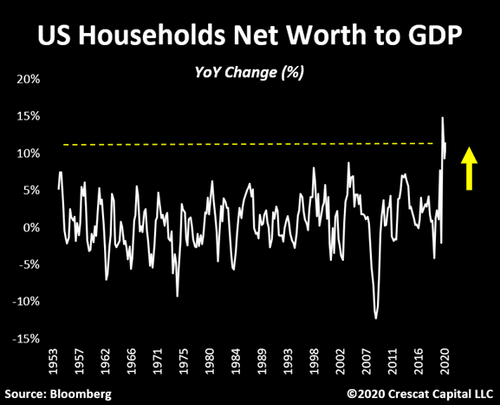

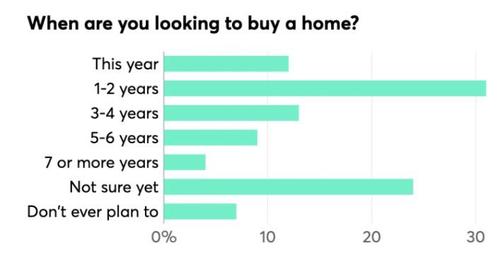

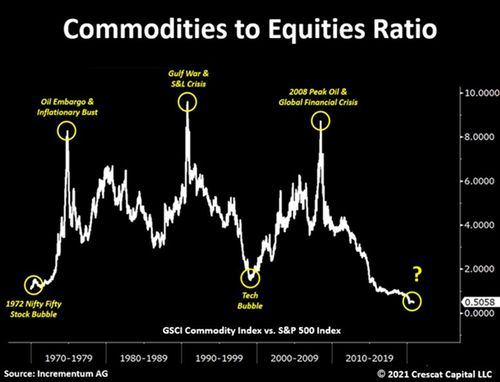

The central argument of the reflationary thesis is that a pent-up demand from consumers will likely cause explosive growth in the economy similar to the early 1920s. To be fair, financial conditions for US households have significantly improved. As shown in the chart below, their net worth is rising at the fastest pace since 1953, which also includes the largest wealth increase by the bottom 50% in history. Balance sheets also look the healthiest in a decade with the consumer deleveraging considerably, while savings rate remains elevate. This also means there is plenty cash on the sidelines. However, while we believe there is a strong probability that the re-opening of the economy will boost personal spending considerably, that is just one part of the story. By effectively creating the largest wealth transfer ever to the population, the US government now faces its own debt conundrum. The debt imbalances that restrain long-term economic growth were never resolved. Instead, they were transferred from the private sector to the government. In the wake of the pandemic, overall US debt to GDP has soared to record levels at the same time as the stock and credit markets have soared to new extremes. These are not the preconditions for a healthy reflationary environment nor the typical signs of an economy in the early stages of its business cycle.

We have yet to see a major reckoning for financial markets with asset valuations at record levels across virtually all asset classes aside from commodities. This brings us to the opposing bearish narrative. The dollar bull ‘deflationistas’, as they like to be called, have some important points to consider. Throughout history, speculative bubbles have always ended with brutal financial resets. Also, the dynamics behind “QE” are much more complex than the idea that money printing must always lead to higher consumer prices. In a deflationary reset, the debt burden tends to suck the liquidity out of the financial system causing a stock market crash, rising unemployment, and depressed consumer prices while money velocity collapses.

However, what we believe most, and what the deflationary camp fails to comprehend today, is that the economic and social impact of the current fiscal and monetary policies are completely different than what we experienced coming out of the last recession, which indeed was a deflationary one. From 2008 to 2011, the lower classes lost over 84% of their wealth, a clear deflationary backdrop. Since this time, on the other hand, the US bottom 50% just had its largest annual increase in net worth in history. Such is a force that would be hard not to have inflationary repercussions. Ultimately, a deflationary bust is a risk if one believes policy makers will undershoot their stimulus. Clearly, given the level of commitment and size of the monetary and fiscal policies, we believe overshooting is a much greater probability. We clearly have a ‘money party’ going on and no one can afford it to stop, especially the Fed.

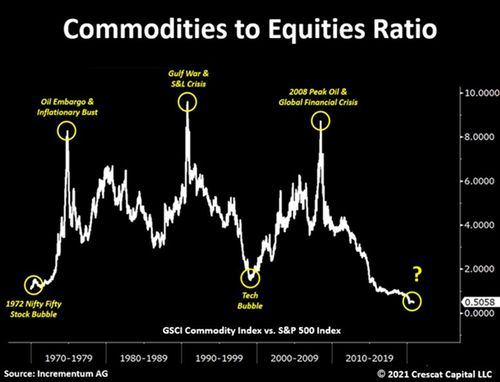

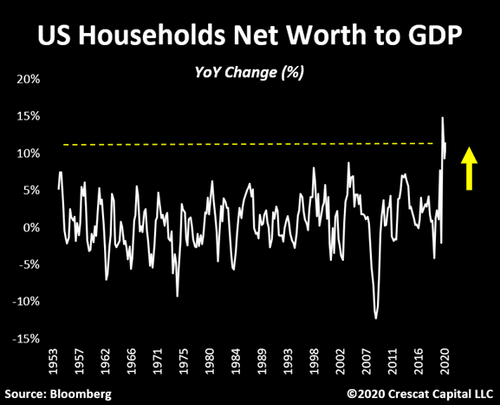

Today’s deflationary debt imbalances are being met with a truly unprecedented inflationary response. So, how do we bridge the reflation and deflation narratives to find the appropriate middle ground? It is called the inflation camp. Yes, it is a bear camp, but it is not a deflationary one for consumer prices. It is important to point out that world history is full of inflationary financial market meltdowns as a consequence of too much debt. These include both hyperinflationary and stagflationary episodes where both stock and bond markets decline simultaneously, particularly when outright debt monetization is involved like we effectively have today. It is not all doom and gloom. We are bulls too. Bulls on commodities and basic resource stocks. We are raging bulls on precious metals exploration companies.

The combined stock and bond market is a speculative bubble and has been more than fully reflated already during the Covid-19 economic shutdown. As a result, the creative destruction process that we normally see at the depths of a business cycle, especially for traditionally cyclical companies, never happened. In 2020, we witnessed the first ever recession where stock prices soared. Without the economic purging that normally takes place in an economic downturn, the idea that we are poised for a robust and sustainable recovery is highly suspect. In terms of portfolio positioning, what is the logical way to be exposed? It comes down to our primary macro call: long commodities and short equities, but especially long precious metals.

The short equity side of our portfolio can also perform well in a deflationary environment in case the Fed decides to tighten as the economy heats up. That was essentially the trigger of the last two recessions. We think the probability of this scenario happening again is significantly smaller. In terms of long commodities, we favor precious metals because they can work in both deflationary and inflationary environments, though they perform best under inflation when real interest rates are falling. In terms of the short equity side, we prefer overvalued large cap growth and technology stocks, the darlings of the last cycle, but also overvalued and overindebted zombie cyclicals that were not properly disassembled in the recession and do not represent value at all.

The need for extreme fiscal spending to mask the impairments in the economy entails a flood of Treasury issuances. With no sufficient buyers, the Fed must step in by expanding the monetary base to ensure subdued interest rates and allow the government to finance its debt and continue its wealth transfer and spending spree. This new demand is met with scarce supply due to underinvestment in the basic commodity resources of the forgotten old economy. Rising prices for food, energy, lumber, metals, etc. lead to cost push inflation throughout the supply chain. Some investors may be interpreting this macro dynamic as a healthy reflationary recovery. We believe there is a much greater probability that the economy is entering a disruptive long-term inflationary cycle.

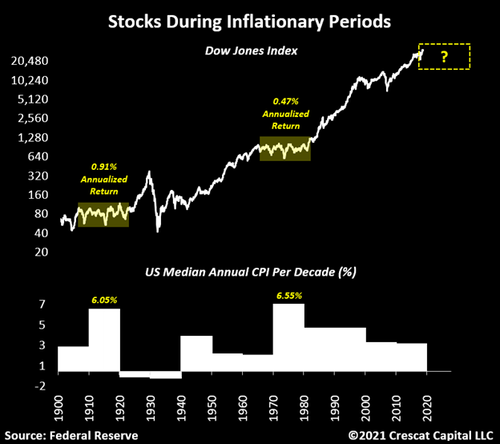

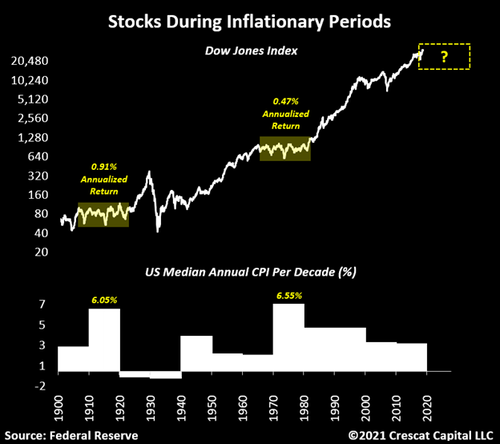

Since 1900, the US economy had two important inflationary periods, the 1910s and 1970s. Both times were marked by unique macro and geopolitical developments in which the median monthly YoY Consumer Prices Index (CPI) stood above 6% for an entire decade. The 1940s also had some sporadic spikes in CPI but, different than what most like to think, consumer prices did not consistently persist at high levels for the full 10-years. These inflationary periods were also marked by exceptionally low US equity returns. From January 1910 to December 1919, the Dow Jones had delivered a 0.91% annualized return. Similarly, from 1970 to 1980 stocks delivered a 0.47% annualized return. Considering the CPI index rates, real returns were negative for both decades. These were also very volatile periods accompanied by severe market crashes and major monetary developments. In December of 1913, President Woodrow Wilson signed the Federal Reserve Act into law. President Richard Nixon announced the end the dollar convertibility to gold in August 1971. With today’s mix of QE to infinity, “helicopter money”, 0% short-term interest rates, and World War II sized deficits, our base case is that this is the dawn of another long-term inflationary cycle. To recall, even though equities did not perform as well during the 10s and 70s, commodities did exceptionally well.

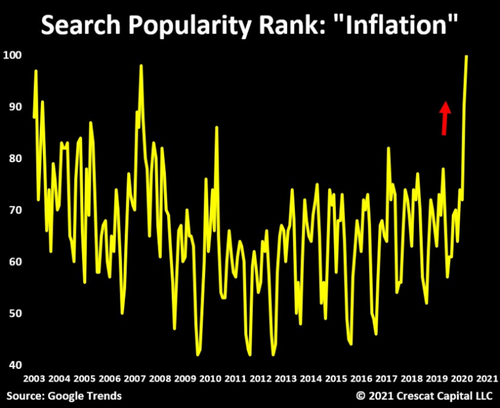

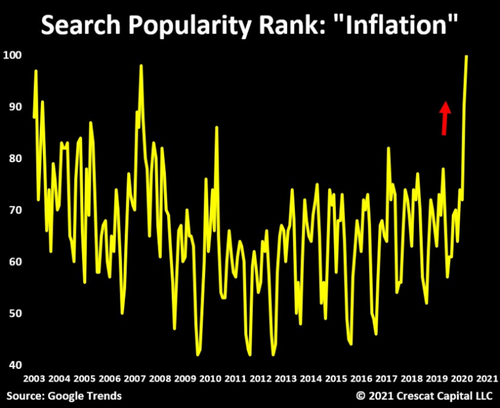

The popularity of the word “inflation” in Google searches has recently spiked to all-time highs as the monetary debasement narrative continues to gain momentum. While this surge may seem overextended, long-term inflationary cycles are often initiated by a general concern of the population in holding cash. By hoarding hard assets, investors create a self-reinforcing loop where higher prices of tangible assets lead to higher inflation expectations that then result in higher consumer good and service prices. Given the magnitude of the asset bubbles and debt imbalances in the economy today, we believe the Fed and the government will be forced to keep their aggressive stimulative policies in place for longer while being tolerant of an inflation overshoot.

A “Transitory” 13-Year High

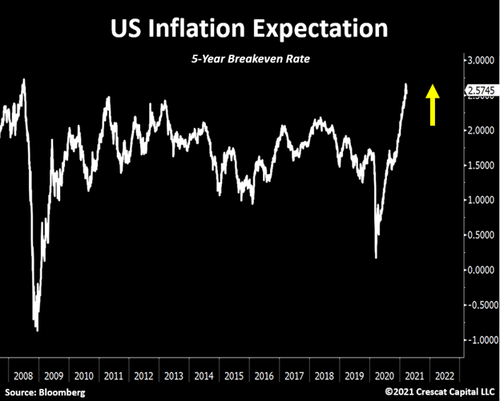

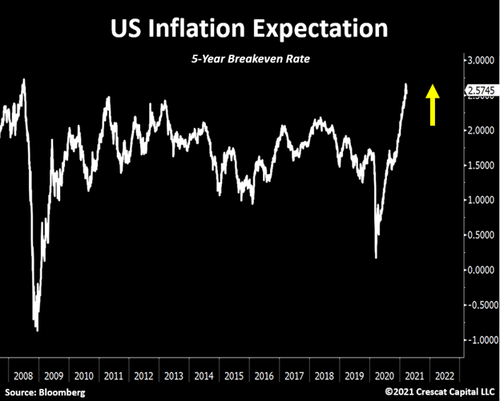

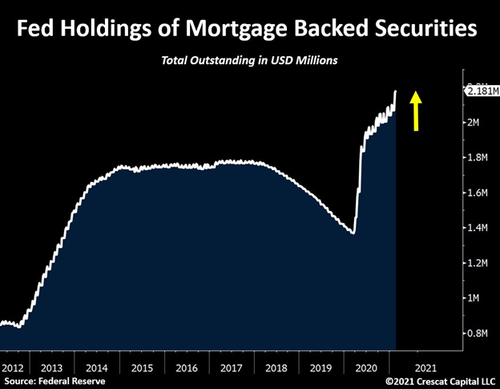

The Fed’s policy tools were originally designed to control money supply at times when economic conditions were either accelerating or decelerating. Today’s 5-year inflation expectation is reaching a 13-year high, but every monetary and fiscal policy in place is still pedal to the metal. M2 money supply just expanded by half a trillion in the last 8 weeks, the largest 2-month increase since June. The Fed’s QE pace is picking up significantly, now close to $300 billion worth of Treasury and mortgage-backed security in the last 2 months. The Fed Funds Rate also looks the same. As Jerome Powell likes to say, “We’re not even thinking about thinking about raising rates”. Fiscal spending, lastly, is even more radical with government deficits just reaching their worst level in 70-years. On the other hand, the overarching message from policy makers is essentially: Move along, nothing to see here. Sure, inflation is coming. We welcome it. But do not worry. It is just “transitory”.

It is true that central banks were able to get away with extreme stimulative packages without creating rising prices for most goods and services after the global financial crisis. We saw some inflation in medical costs, college tuitions, and other living expenses, but it was nothing close to what we experienced in a true inflationary period like the decade of the 1970s. In the easy money post the global financial crisis, inflation found its way into the domain of financial assets. Instead of a surge in consumer prices, aggressive monetary stimulus drove speculative asset bubbles in stocks and bonds. Now, in the Covid-19 recession and recovery, policy makers have added massive fiscal stimulus and direct wealth transfer (aka helicopter money) to the equation, or full modern monetary theory, creating a markedly different social and economic dynamic. We believe the stage is set for a substantial new inflationary cycle.

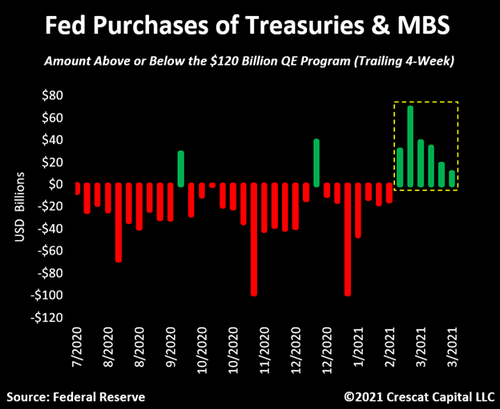

QE Re-accelerating

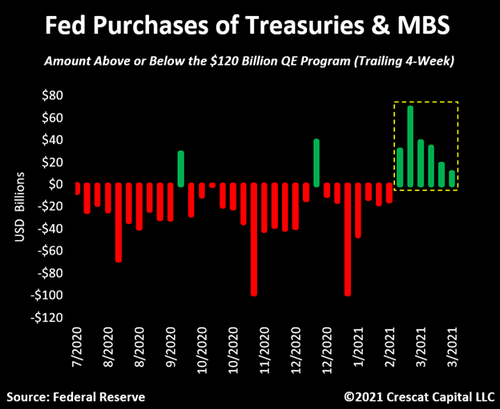

US 10-year yields have increased by 70 basis points in the last two months and the Fed had to engage in its largest buying spree of US debt since June 2020. For the sixth week straight, the Fed exceeded its minimum QE program amount of 120 billion, which consists of $80 billion of Treasuries plus $40 billion of mortgage-backed securities. Keep in mind that 90% of all Treasury purchases were longer duration Treasuries, mainly 5 to 7-year maturities. In other words, a non-trumpeted attempt at yield curve control (YCC) has already been underway. However, this stealth attempt has not been successful so far in preventing long dated yields from rising, therefore illustrating the liquidity sucking force of the massive debt pile and its thirst for more and more QE.

A House of Cards

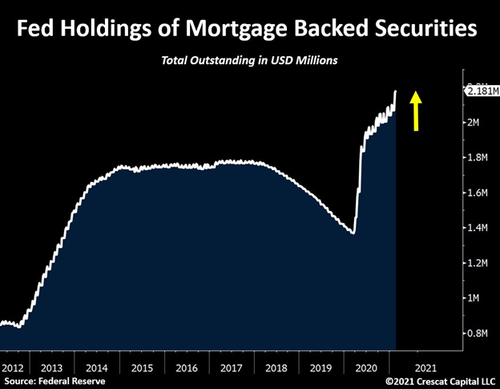

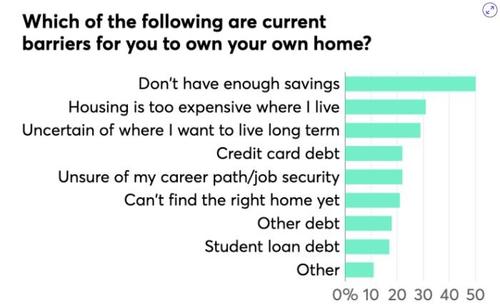

Central banks are as trapped as they can be. Since the beginning of the year, 10-year yields have moved from 1.6 to 2.4% and, therefore, creating significant pressure on mortgage rates to rise. To tamp down these forces, the Fed also had to increase its purchases of mortgage-backed securities (MBS). It has bought over $60 billion of MBS since February. If long-term interest rates continue to rise, the housing market could come under pressure. Remember, the bottom 50% own over 51% of their overall assets in real estate. It is critical for the Fed to suppress rates and prop up the housing market.

Tax Payers on the Hook

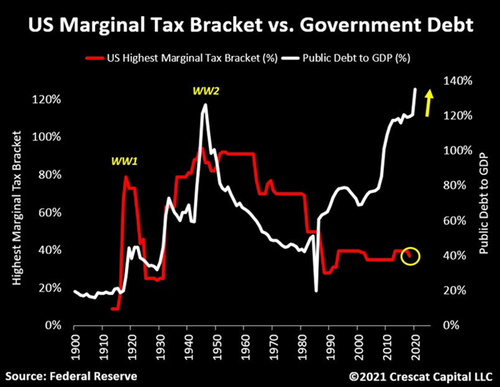

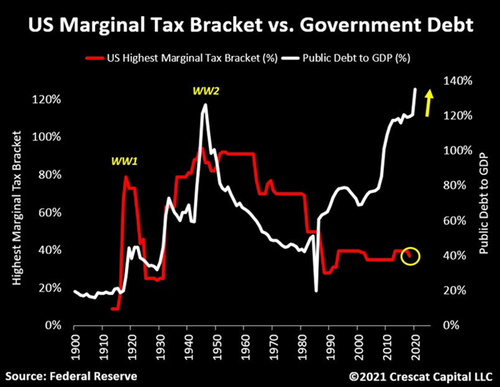

This is perhaps one of the most important charts today. Tax rates have followed government debt almost perfectly throughout history. Fiscal excess leads to higher income taxes, like it or not. The divergence between the two lines below is unsustainable. The Fed will not be able to pay for this wall of debt alone. Individual and corporate tax rates will rise. But because new tax legislation is not official yet, most Wall Street analysts have not factored it into their earnings estimates, leaving them too optimistic.

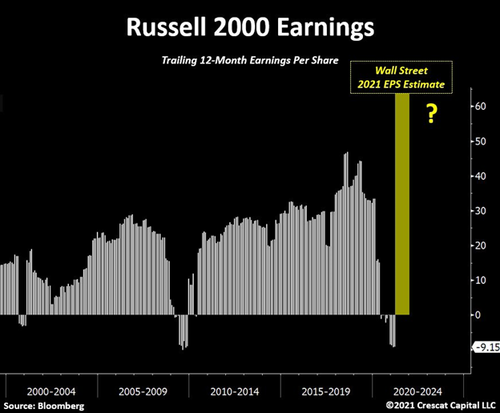

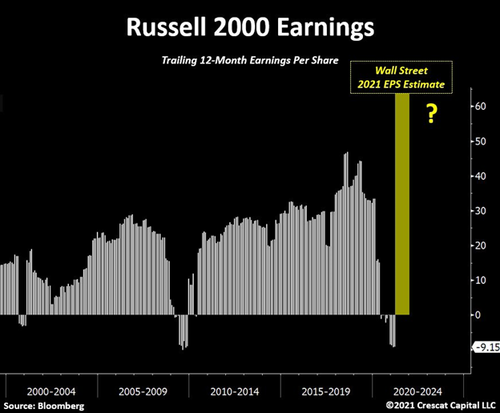

Another Disconnect

There is a high probability that the same disconnect between financial markets and the economy we had last year might redevelop in 2021. However, instead, the roles will likely be reversed. We believe most of the good news about the reopening of the economy is already priced in. Wall Street analysts are now estimating that small cap earnings for 2021 will be almost 40% higher than the previous highs in 2018. This level of optimism perfectly reflects the euphoric environment we are in.

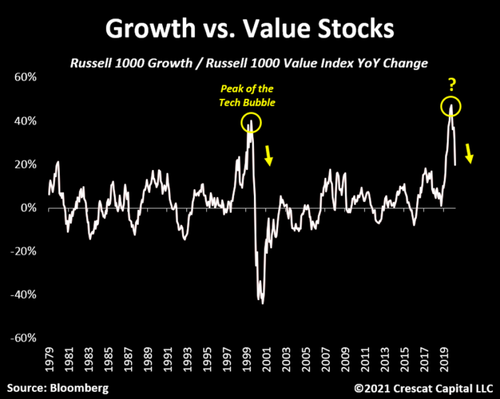

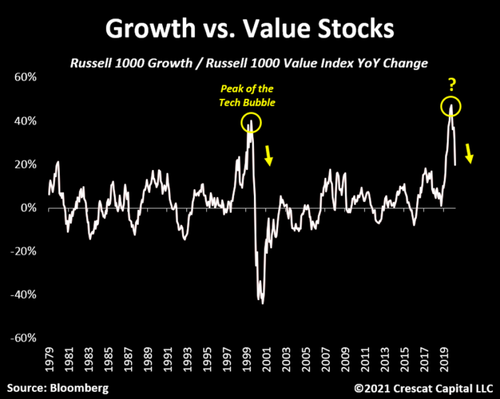

The Great Rotation

A major shift away from growth stocks and into value stocks is underway. In a similar fashion, the same underperformance of high-flying large cap growth and tech stocks relative to value stocks marked the beginning of the tech bust from 2000-02 which turned into a major economic downturn and overall crash for stocks at large.

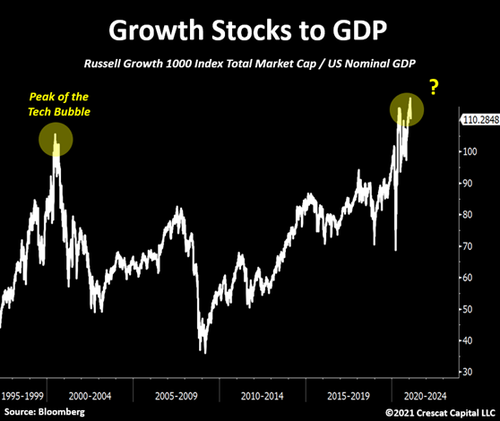

According to our models, the entire universe of stocks is more overvalued than it was at the height of the tech bubble. The area of true value today is narrow and much more likely to be found in the commodities, energy and materials sectors of the stock market. What we call “The Great Rotation” is about financial asset bubbles that have progressively built up for four decades finally being reconciled in reflexively self-reinforcing inflation. The US equity and fixed income markets have experienced an unsustainable four straight decades of declining interest rates and inflation. In this span, we have had five economic expansions and recessions with ever greater overall debt to GDP persistently growing throughout to the point we are perversely exiting this latest recession with the highest debt and largest valuation imbalances yet.

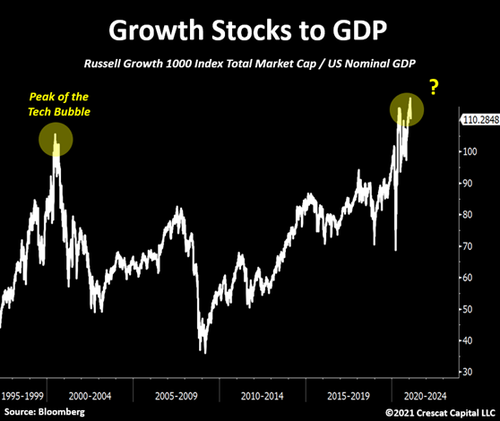

Growth stocks, composed by 45% of tech companies, represent a larger part of financial markets today than any other time in history. The total market cap for the Russell Growth 1000 Index relative to US nominal GDP is now at 110%, which compares with 105% at the very peak of the tech bubble.

More Signs of a Top

Last year’s darlings are now under pressure. Look at the headlines surrounding the recent peak in the NASDAQ 100 and NADSAQ Composite. We don’t think the bitcoin will ever replace gold as a central bank reserve asset. Crypto enthusiasts have some valid macro agruments against fiat currencies that we share. However, we also believe that speculation in the crypto space is excessive and creating additional risks in the financial markets today.

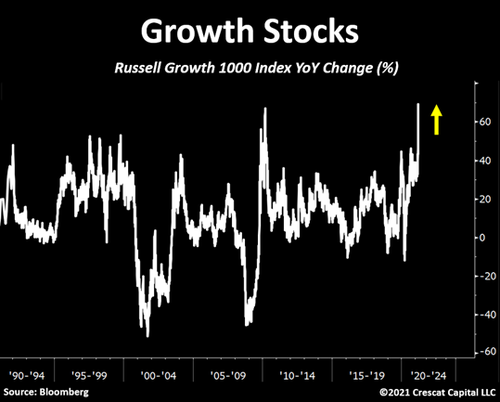

Late Stages of the Business Cycle

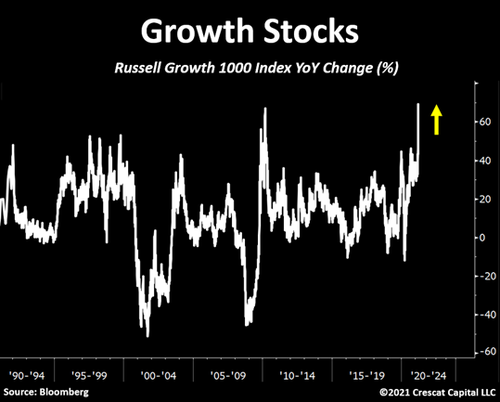

Here is another example of the level of speculative excesses in the market. Growth stocks just had their strongest year-over-year appreciation in history. Such large moves tend to happen at either the early or the late stages of the business cycle. Valuation factors should serve as a guide when trying to identify which one of these two parts of the cycle we are in. Given the fact that the Russell Growth 1000 Index currently trades at 30 times its aggregate earnings estimate for 2022, we think it is more probable that equity markets are much closer to the peak than the bottom.

A Looming Public Debt Crisis

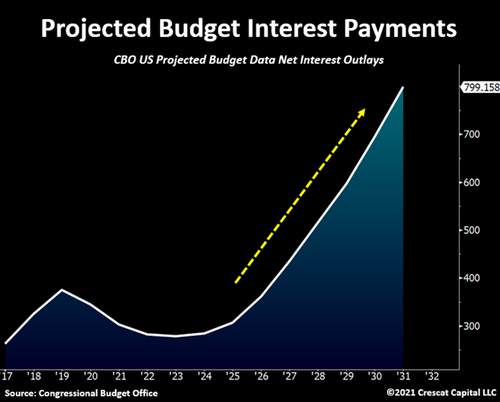

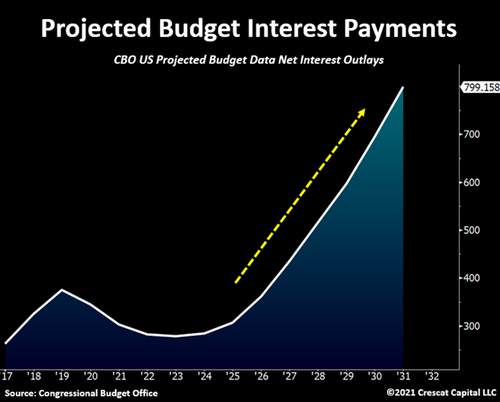

The government also recently increased its spending pace significantly. In January and February alone, it spent over $1.1 trillion, or the largest two-month amount since July. In comparison, it collected less than 60% of that amount in taxes. Long story short, public debt continues to grow at an unprecedented pace. Meanwhile, the Congressional Budget Office (CBO) projects that the Federal budget net interest expense will soar by $800 billion per year over the next decade. To clarify, the CBO’s estimate does not factor in another economic downturn along the way. We believe the estimate will fall short. The rising Treasury debt burden and deficits are necessarily forcing the Fed into the position of debt monetization which drives real interest rates lower and lower in negative territory and allows the Treasury to effectively collect an inflation tax. Systematic tamping down of the CPI plays a role given our government’s enormous off balance sheet Social Security and Medicare liabilities which are cost-of-living adjusted.

With the recent increase in long-term interest rates, financial conditions tightened slightly from a record loose state. Stocks, at historic valuations, suffered as a result. Nominal rates moved even higher than the move up in inflation expectations, causing real rates to rise slightly which added short term pressure on gold. In our view, the fact that financial markets are being impacted by 10-year yield that is still sub 2% speaks volumes about the fragility of the US economy.

Miner’s Free-Cash-Flow on the Rise

Gold and silver companies continue to report exceptionally strong fundamentals. Free-cash-flow estimate for miners keeps improving despite the recent correction in precious metals. As we have seen throughout history, stocks tend to follow fundamental growth. We believe there is a major catch up in prices ahead of us.

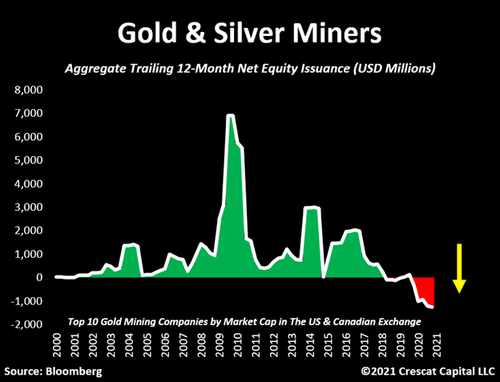

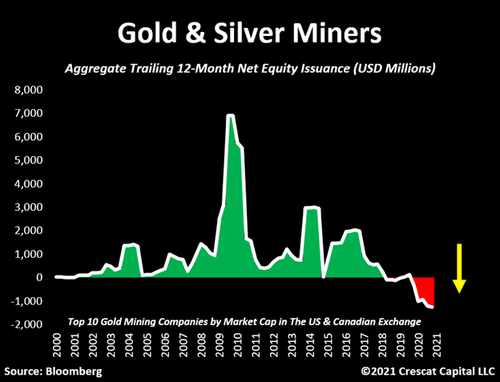

There used to be a time when all gold and silver miners would do was to invest in unproductive assets and dilute their capital structure to pay for it. Those days are over. For the first time in history, aggregate net equity issuance for the top 10 precious metals mining companies is now falling. In other words, these companies are buying back stock like we have never seen before. These are fundamentally cheap stocks that continue to benefit from this macro environment.

Commodity Inflation

Inflation is coming. Cost-push inflation starts with rising commodity prices. An equal weighted commodity basket is already up 23% from pre Covid-19 highs. Imagine what it will look like when the economy re-opens.

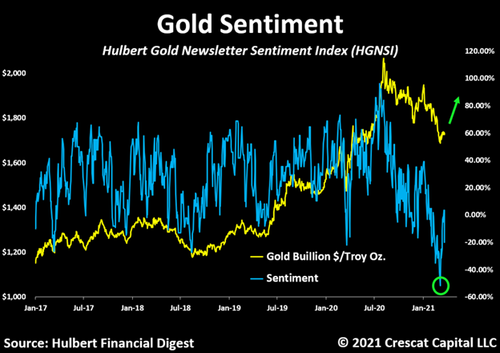

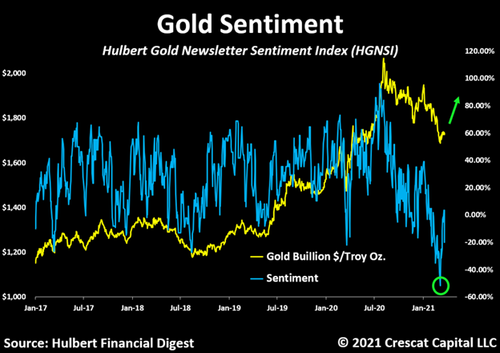

Gold Sentiment Buy Signal

Gold sentiment became extremely negative recently, pulling gold prices down with it, a contrarian buy signal early in a new long-term inflation cycle. The precious metals bull market only began a year ago according to silver and junior miners. If it were after a 10-year run up already, a shift to negative sentiment would be a different story. Bull markets climb a wall of worry. We see it as a great opportunity to buy the pullback.

NASDAQ Divergence Sell Signal

The Nasdaq 100 is rolling over while the S&P 500 is still making new highs. Inflationary forces are picking up driving investors out of long duration growth stocks with excessive valuations. This is similar to the beginnings of the 1973-74 bear market and 2000-02 tech bust.

Crescat Activist Gold Strategy

We are positioned for a rising macro precious metals price environment through a handpicked portfolio of predominantly exploration focused mining companies. These companies are focused on aggressive resource growth in viable mining jurisdictions around the world and have outstanding management teams. They own mining claims and are actively exploring many of the most prospective new high-grade gold and silver deposits around the world, according to Crescat’s proprietary research. The portfolio is thoroughly vetted by the Crescat investment team including its Geologic and Technical Advisor, world renowned exploration geologist, Quinton Hennigh, PhD.

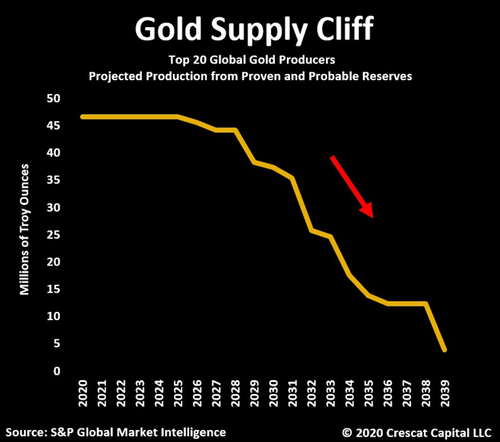

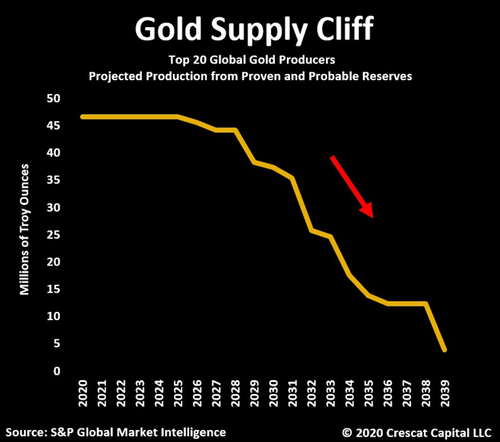

We strongly believe there will be a high demand from the majors for our companies to continue overall industrywide production growth.

Such is the scale of what we believe we have already accomplished with our current portfolio in the last year. We plan to continue to grow our overall target resource through activist investing and technical advice to build high grade gold ounces in the ground. This is the opportunity that Crescat has already seized on the last year to surgically pick up the best prizes among global exploration assets after a ten-year bear market.

The majors have underinvested in replacing their reserves creating an industry supply cliff that is extraordinarily bullish for gold and silver prices. At the same time, investor demand for hard assets is poised to strengthen substantial under a macro backdrop of rising inflation. The major gold producers are enjoying record free cash flow today, but it is a short-sighted fix due to underinvestment in exploration and CAPEX. They are coasting off existing reserves with dwindling mine lives. Their party will end because remaining mine lives and reserves have been running down. They will need to replace their reserves. They will have very few places to go to do that. Because they choose not to invest organically, we believe they will be looking to our portfolio companies as acquisition candidates.

The macro outlook for a new secular bull market for mining companies is in the early innings. Our goal is to create the premier new gold and silver deposits of the next decade. We know what the majors want and need. They are not interested in the passed over old low grade deposits of the last cycle that will not be viable under almost any gold price environment. They need the large high-grade new deposits in mineable regions around the world. These are companies that the majors will pay a premium to acquire and this is what we believe to be in our portfolio. Our strategy is not solely dependent on acquisition, however. These companies can go into development and production on their own. In fact, many of them are on that path and some are already producing.

The setup today for precious metals is outstanding given supply constraints, rising inflation expectations, asset bubbles in traditional financial assets, record debt to GDP, double barreled fiscal and monetary stimulus, negative and declining real interest rates. The new bull market only started in March of 2020 after a ten-year bear. That is when junior miners and silver successfully made a double bottom retest of the 2016 lows with silver making a lower low. The last two major gold bull markets have similarly lasted 10 years, essentially the decade of the 1970s and the decade of the 2000s. We expect our activist precious metals portfolio to lead to substantial returns for our limited partners over the next three to five years.

We believe the recent pullback in the precious metals asset class since August 2020 presents an excellent entry point for new and existing investors to add money to our most important macro theme today. We call it Global Fiat Debasement and it is expressed across all Crescat strategies today.