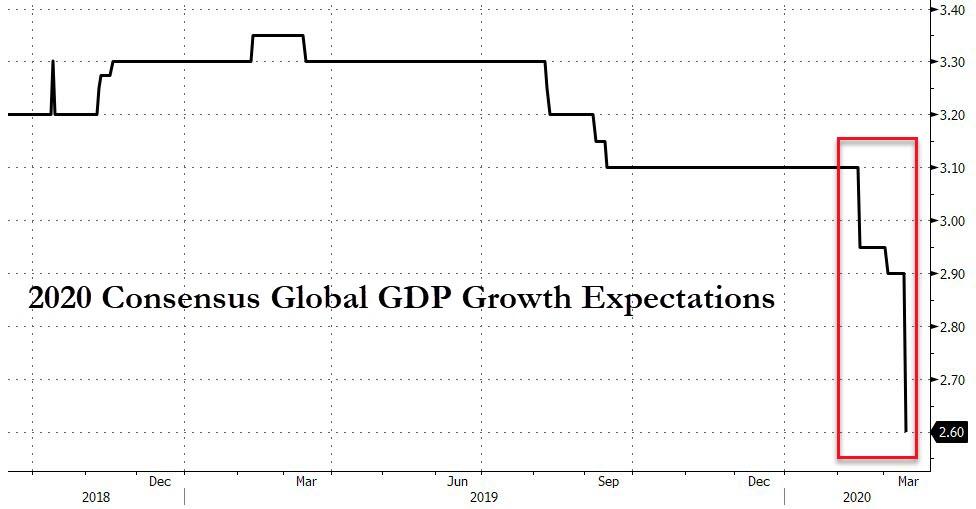

Global GDP Growth Estimates Are Plummeting

In February, the general consensus between large investment banks and supranational entities was that there would be a one-time hit on GDP in the first quarter from the coronavirus impact, followed by a stronger, V-shaped recovery. IMF expected a modest correction of global GDP of 0.1%, and the largest cut on estimates for 2020 growth was 0.4%.

Those days are gone.

The latest round of global growth revisions includes a slash of growth estimates for the first and second quarters and a very modest recovery in the third and fourth.

Average GDP estimates are now down 0.7%, and JP Morgan expects the eurozone to enter into a deep recession in the next two quarters (-1.8% and -3.3% in the first and second quarters) followed by a very poor recovery that would still leave the full-year 2020 estimate in contraction. The investment bank also assumes a slump in the United States of 2% and 3% respectively, but a full-year modest growth. Capital Economics estimates a hit on the U.S. economy for the full-year that would cut 0.8% off previous estimates, with the U.S. still growing, but a larger impact on the eurozone, with full-year 2020 growth at -1.2%, led by a -2% in Italy. This, unfortunately, looks like just the beginning of a downgrade cycle that adds to an already slowing economy in 2019.

The decision to shut down air travel and close all non-essential businesses is now a reality in major global economies. The United States has banned all European flights at the same time as Italy enters into a complete lockdown, Spain declares state of emergency and France closes all non-essential activity. These decisions are key to contain the spread of the virus and try to prevent the collapse of healthcare systems, and our thoughts are with all of those infected and the victims. Shutting down travel and businesses generates a negative ripple effect on the economy. It is an important measure to avoid rapid spread and there will be more cancellations of events and activity.

By now, we can at least get a clearer picture of the severity of the pandemic and in this blog we discuss economic consequences, so I believe it is important to remind of a few important factors:

-

We cannot assume that the above-mentioned estimates are too pessimistic. If we have learned anything from the history of global growth estimates is that most of us tend to be more optimistic than realistic even in crisis periods. Most analysts did not see a crisis in 2008 and, even more importantly, a majority still did not see it in 2009, when it was evident. It is true that 80% of estimates at the beginning of any given year have to be revised, but not because they are too pessimistic, rather the opposite.

-

Calls for large fiscal packages to offset the pandemic may be useless Allen-Reynolds at Capital Economics warned that “even if governments agreed on a larger tax and spending package, the economic impact would be much smaller than it would have been in the past, particularly if the fiscal stimulus was concentrated in Germany”, because output gaps are almost inexistent. This is not a demand problem, it is a supply shock, and you don’t address supply shocks with bricks, mortar and deficit spending.

-

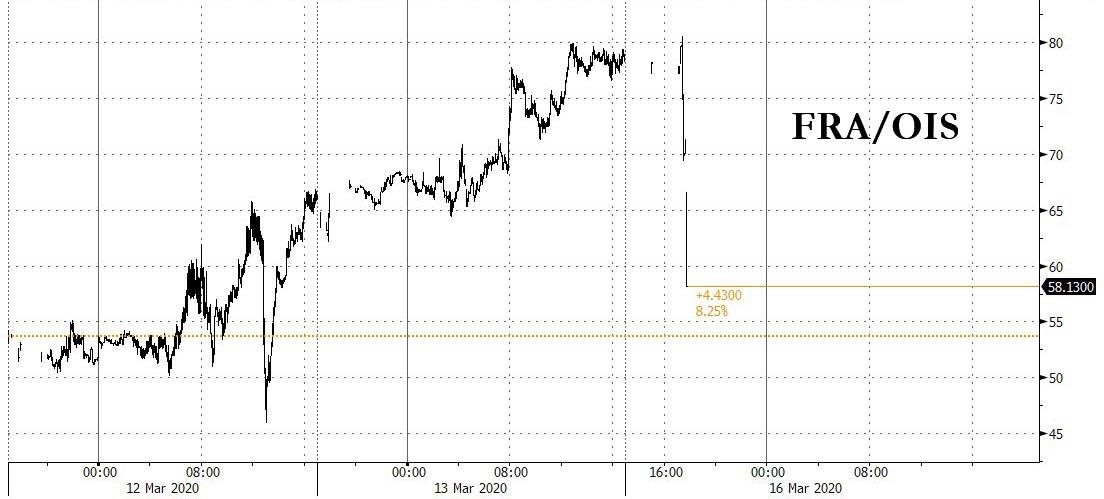

A third-quarter rapid recovery is now virtually impossible. The shutdown of developed economies is now granted and will likely take us more than a couple of weeks. The shutdown of emerging economies is likely to start in May, and impact 2020 and 2021 estimates. Every analysis we have seen so far only factors a 2020 recession, not a crisis and even less a 2021 large hit to the economy, but the financial implications in an already over-leveraged world add a strong of credit events to an economic shutdown.

-

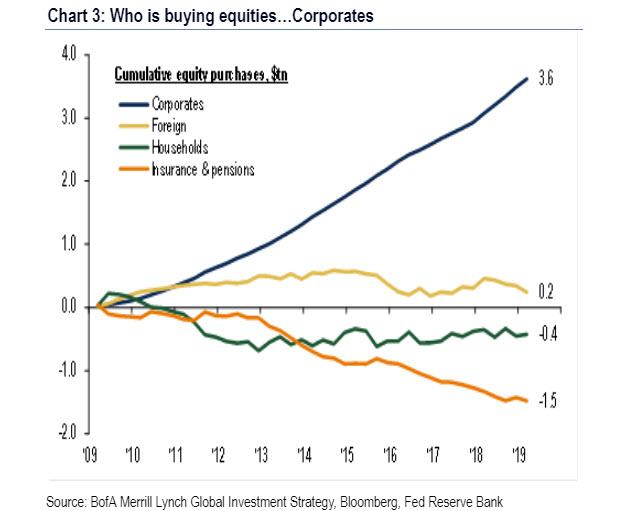

The latest wave of downgrades already assumes a large-scale stimulus, rate cuts, and quantitative easing. The diminishing returns of monetary easing were already evident in 2018 and especially in 2019, with global manufacturing PMIs in contraction and growth estimates that came down significantly throughout the year. Average growth downward revisions by country averaged 20% between January and December in the middle of a massive coordinated central bank injection operation that injected up to 170 billion USD a month in the economy (considering PBOC, BOJ, ECB, and Fed) and saw widespread rate cuts.

-

The economic implications of a pandemic are not solved with massive spending increases. Governments will implement large demand-side policies that are the wrong answer to a shutdown of the economy. Most businesses will suffer from the collapse in sales and subsequent working capital build and none of that will be solved with deficit spending. You cannot mitigate a supply shock with demand policies, which increase debt and overcapacity in the already indebted and bloated sectors and do not help the sectors that suffer an abrupt collapse in activity.

-

A forced temporary shutdown must also include a shutdown of the tax collection system. Governments already finance themselves at negative rates. They must eliminate (not defer) tax payments for companies in the period of crisis to avoid a massive unemployment increase and a domino of bankruptcies, and facilitate working capital lines at zero rates to allow businesses and self-employed workers to navigate a shutdown. Governments that make the mistake of maintaining the current tax structure or just prolong the payment period for six months will see the massive negative consequences of a shutdown in the next nine months.

If, as expected, the shutdown is extended to more countries every week, the negative effects on the economy will be longer and exponential, and the mirage of a third-quarter recovery even more difficult.

It is very likely that the shutdown of the major developed economies will be followed by a shutdown of emerging markets, creating a supply shock as we have not seen in decades. Taking massive inflationary and demand-driven measures in a supply shock is not only a mistake, it is the recipe for stagflation and guarantee of a multi-year negative impact generated by rising debt, weakening productivity, rising inflation in non-replicable goods while deflation creeps in official headlines, and economic stagnation.

Tyler Durden

Sun, 03/15/2020 – 20:35

via ZeroHedge News https://ift.tt/3b0xCGK Tyler Durden