Singapore Extends Lockdown Until End Of June As Outbreak Worsens: Live Updates

Summary:

- Singapore extends lockdown until end of June, longest in the world

- Demonstrators fill the streets of Paris

- Yonhap denies reports that NK’s KJU is dying

* * *

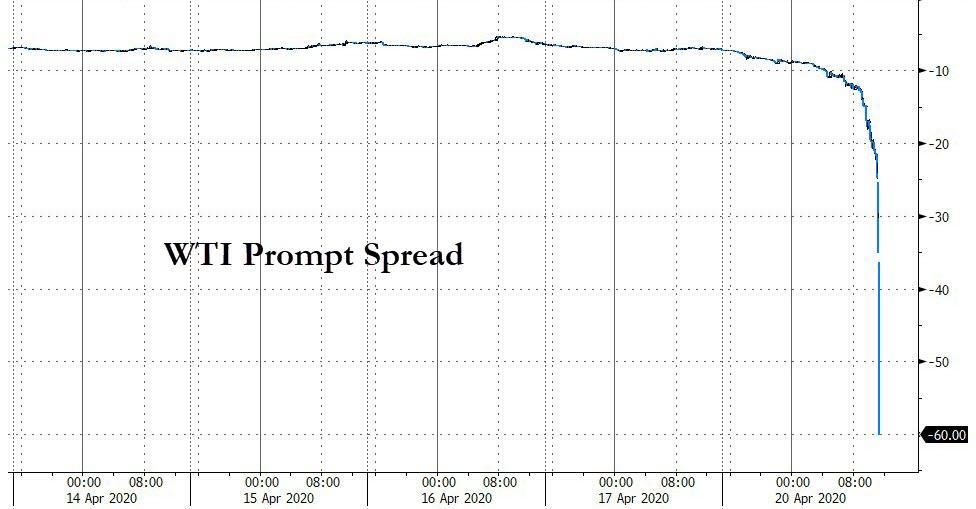

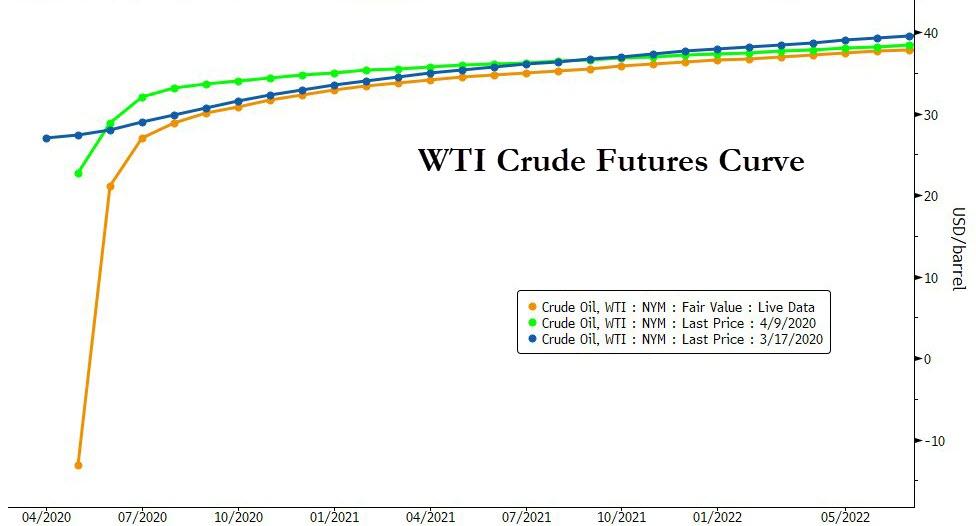

After a day of historic insanity in the American oil market, the Brent international oil benchmark is down more than 40% already Tuesday morning as investors continue to digest reports from late last night that North Korean leader Kim Jong Un might be in critical condition (a Trump Administration source said ‘yes’ while South Korea’s Yonhap said ‘no’) and a Tweet from President Trump that he would be “suspending” immigration into the US due to the coronavirus. The news prompted a whipsaw in equity futures late last night.

While liberals lose their minds, it’s worth remembering that immigration into the US is already effectively shut down. Refugee resettlement has been put on hold, visa offices have been shuttered, and citizenship ceremonies have been put on hold. CNN said it’s unclear how this will impact green-card holders.

In light of the attack from the Invisible Enemy, as well as the need to protect the jobs of our GREAT American Citizens, I will be signing an Executive Order to temporarily suspend immigration into the United States!

— Donald J. Trump (@realDonaldTrump) April 21, 2020

Meanwhile, in the latest indication that nobody really knows what’s going to happen with this outbreak, Singapore announced just minutes ago that it will extend its mandatory stay-at-home order until June, making Singapore’s lockdown the longest currently on record.

Singapore’s Straits Times reported that, in a televised national address, Singapore’s leader PM Lee Hsien Loong said that after yet another record jump in new cases – an outbreak that has been tied to camps of migrant workers who represent a ‘forgotten class’ in Singapore society – his government has decided to extend the densely-populated city-state’s lockdown for another month until June, making Singapore’s the longest lockdown extension in the world.

The city-state reported another 625 new cases on Tuesday, bringing its total case number to 7,213 according to BNO News.

While Lee insisted that Singapore’s ‘circuit breaker’ – don’t call it a lockdown – has been effective at suppressing the spread, Lee stressed that Singapore cannot be complacent, and that the number of “unlinked” cases has been stubbornly high, suggesting a “hidden reservoir” of cases in the community still.

Singapore was praised for its rapid and intense methods to combat the outbreak, rolled out back in February when the virus first started to spread outside Wuhan and mainland China. Among its toolkit was a protocol that required a team of investigators to trace contacts of newly positive patients within 2 hours to prevent further spread.

But the big flaw was that Singapore overlooked the densely populated camps of migrant workers who typically fill the lowest level of jobs in Singaporean society. The second round of Singapore’s outbreak has been largely centered around these camps, with thousands of migrant workers becoming infected.

During Lee’s fourth national address to the nation since the virus emerged, the PM explained that the current measures would remain in place until May 4, at which time the city-state will start trying to slowly reopen society, using some of the same cautious criteria adopted by New Zealand and Germany.

To accomplish this, workplaces will be closed to further reduce the number of workers keeping essential services going. Some hot spots, such as popular wet markets, remain a problem, as large groups of people continue to congregate there, Lee said.

Lee noted that while there will be some “privacy concerns”, ramping up contact tracing via the “TraceTogether” contact tracing app – which all residents of Singapore have been asked to download – is a critical priority for the government as it moves to stamp out the virus.

“There will be some privacy concerns, but we will have to weigh these against the benefits of being able to exit from the circuit breaker and stay open safely.”

And as far as migrant workers are concerned, Lee promised that “we will take care of you like we take care of Singaporeans.”

Roughly one-fifth of the world, led by India, is starting the painful process of reopening. And countries that are refusing to start lifting some restrictions are facing growing unrest, including in France, where protesters poured into the streets of Paris to protest the lockdown and alleged mistreatment of minorities under lockdown conditions.

Tyler Durden

Tue, 04/21/2020 – 06:48

via ZeroHedge News https://ift.tt/2RV4muh Tyler Durden