Platts: 6 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

As COP25 kicks off in Madrid, S&P Global Platts editors take a look at the CO2 impact from OPEC oil production. European gas and nuclear, and IMO 2020’s impact on commodities as diverse as fuel oil and iron ore, are also on the agenda in this week’s pick of charts.

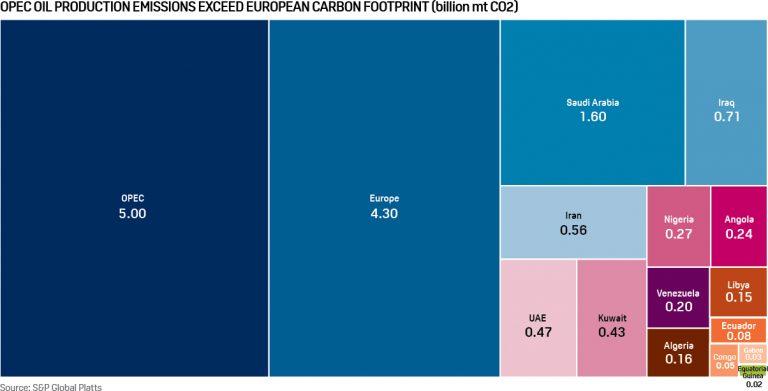

1. OPEC oil-only CO2 output dwarfs EU total emissions

Click to enlarge

What’s happening? OPEC is meeting this week to decide on output quotas, but climate change isn’t on the agenda for the group of 15 major oil producers. OPEC’s total crude output for 2018 would have been responsible for carbon dioxide pollution equal to 5 billion mt, calculated based on average emissions figures for oil from the US Environmental Protection Agency (EPA). That exceeds Europe’s total emissions of the greenhouse gas, from all sources, last year. The cartel currently has no plan in place to mitigate the impact its oil has on global warming despite the growing pressure from consuming nations and business to cut back investment in fossil fuels.

How did we get to these numbers? A barrel of crude weighs about 300 lb, or 136 kg. The CO2 from fuel weighs more than the fuel itself because the carbon element combines with oxygen in the air to form CO2 gas. Carbon-based fuels derived from oil give off CO2 which is on average 3.15 times the weight of the fuel. A standard barrel is 159 liters, and in the US gets refined into 44.1% gasoline, 20.8% distillate fuel oil, 9.3% kerosene-type jet fuel and 5.2% residual fuel oil. So an average barrel of oil will produce at least 317 kg CO2 for just the above four fuels, making the EPA’s average figure of 430 kg seem quite sensible.

What’s next? OPEC and its allies, which pump more than 45% of the world’s crude, are scheduled to meet on December 5 and December 6 in Vienna where a decision on a possible extension to the production cut deal could be taken. The gathering coincides with the 25th Conference of the Parties, or COP, held in Madrid where 200 countries will discuss climate change action as new figures released by the World Meteorological Organization show that green house gas levels reached their highest recorded levels last year.

2. European gas spot prices have risen but December turns bearish

What’s happening? Europe’s benchmark prompt gas contract, the Dutch TTF Day-ahead, crept to a seven-month high last week despite healthy supply. Lower temperatures, reduced storage withdrawals and continued buying combined to tighten the market. The contract has risen Eur6/MWh since October 31, when it dipped below Eur10/MWh. Utility traders are holding onto stocks in anticipation of a greater premium in Q1 2020.

What’s next? While Q1 2020 TTF gas remains over Eur16/MWh, front month December is coming under pressure as Europe’s gas glut looks set to continue. A deluge of LNG is expected to complement already comfortable Russian and Norwegian supply, while gas is seen by market participants as detaching from carbon, and temperatures forecasts have ticked up. Q1 2020 has been more resistant to bearish sentiment because of the risk that transit talks will fail between Russia and Ukraine.

3. French nuclear at record-low lifts December power prices

What’s happening? French nuclear generation is set for a record-low fourth quarter due to maintenance delays and safety inspections at the Cruas nuclear plant following an earthquake. November output averaged 40 GW, down 11% on year, the third month in a row with a double-digit on year decline.

What’s next? 17 of France’s 58 reactors won’t be available at the start of December. French spot power prices are set to hit their highest so far this winter this week despite a generally bearish market, characterized by cheap gas and growing wind output. Colder weather is set to boost demand above 80 GW on Tuesday for the first time this winter with a strike looming as well on Thursday. French gas and coal plants are poised to fill the nuclear shortfall, while stronger hydro and reduced exports should act to ease French price.

4. IMO 2020 sends high sulfur fuel oil cracks tumbling…

What’s happening? Global cracks for high sulfur fuel oil have weakened sharply over the past two months after a year of abnormal strength, reflecting the drastic change in oil products demand due to the International Maritime Organization‘s impending sulfur limit on marine fuels. This month regional prices for HSFO in Asia, Europe, Africa, and the Americas have all reached record discounts to crude as demand falls in the run-up to the IMO 2020 rule limiting sulfur content to 0.5% from January 1, although in some regions they have rebounded somewhat in the past two weeks.

What’s next? Most market watchers believe HSFO prices have now largely bottomed out and are set for a recovery next year. Uncertainty persists, however, over the extent of recovery as pricing economics and uptake of exhaust gas scrubbers – which allow ships to continue burning HSFO – will play a key role in determining HSFO demand. Looking ahead to 2020, the HSFO crack forward curve in Europe is in contango, suggesting regional prices are already set for a recovery.

5. …and complicates shipping costs for iron ore buyers

What’s happening? Iron ore contract buyers this year may be paying as much as $10/dmt more for FOB cargos using industry freight formulas, rather than pricing off spot freight rates. Freight rates are used for invoicing FOB iron ore prices based on benchmark China CFR indices such as Platts IODEX 62% Fe, and Platts 65% Fe fines index. Greater comparative volatility has emerged between spot and long-term industry freight formulas, for Brazil-China Capesize dry bulk rates used to reference contract FOB iron ore prices. Agreeing formulas rather than spot rates may be becoming more complex as bunker oil, a key component in determining long term freight rates under formulas, switches to use lower sulfur marine fuel under IMO 2020 fuel regulations.

What’s next? The extent to which IMO 2020 affects bunker fuel prices and demand for grades consumed, and continued use of industry longer-term freight formulas, remains to be seen. The changes in fuel oil and shipping rates may be discussed by iron ore buyers as they move into new iron ore pricing contracts for 2020 calendar year and fiscal 2020-2021 terms. Some suppliers are already moving contract pricing terms away from formulas to reference spot freight rates, to simplify pricing comparisons with iron ore delivered to markets in China and the rest of the world.

6. Corn prices shoot up in Brazil’s Mato Grosso

What’s happening? Corn prices in Mato Grosso, Brazil’s largest producer, are surging as supplies dwindle and domestic consumption rises, according to Mato Grosso Institute of Agricultural Economics. The state accounts for over 42% of second corn crop, or safrinha, produced in the country. Last week, corn prices in the state hit Reais 29.51 per 60 kg ($116.39/mt), up 53% from the same period a year ago. Strong domestic demand is mainly coming from the ethanol and animal protein industries.

What’s next? As Brazil is the world’s second-largest corn exporter, markets will be closely watching the price movements, as higher corn prices may encourage farmers to expand the crop area for second corn. The second corn planting in the state begins in February. Any increase in domestic consumption is also expected to reduce the supply for exports. The state exported 18.8 million mt of corn in January-October, 54% of Brazil’s total exports of the crop, up from 17.7 million mt in the full calendar year of 2018.

Tyler Durden

Mon, 12/02/2019 – 13:49

via ZeroHedge News https://ift.tt/2PiLP99 Tyler Durden