Documents leaked to Project Veritas by an insider at Pinterest reveal that the San Francisco-based social media company has blocked links from Zero Hedge and several conservative or religious-based websites – adding them to a ‘porn domain block list’ originally intended to keep the platform free of sexually explicit material.

Veritas has published the list and interviewed said insider, who explained how the company with nearly 300 million active monthly users censors pro-life and Christian content.

The leak reveals an aggressive campaign to censor conservative content under the guise of ‘hate speech’ and ‘fake news.’

Pinterest added a pro-life group website (@LiveAction) and @zerohedge to its porn list in order to prevent users for “pinning” or sharing the websites

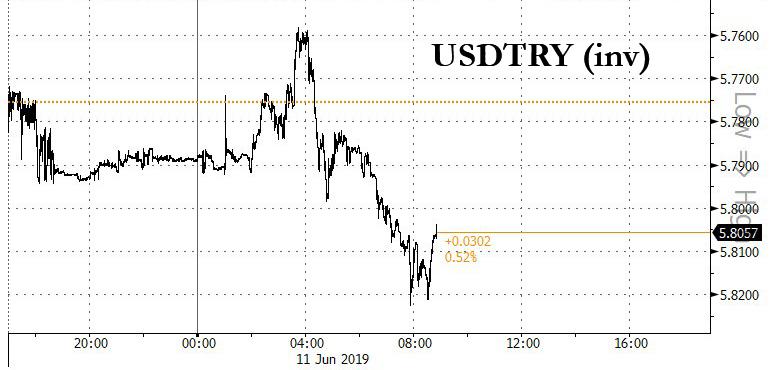

Consumers are being lied to. Terms of Services are being violated. Antitrust bullying everywhere. pic.twitter.com/XnEiRDnObN

— Ali Alexander (@ali) June 11, 2019

Links to the leaked documents can be viewed here, here, here, here, here and here. Of note, in February the social media platform made headlines for blocking searches related to anti-vaccination material. At the time, the company was criticized over their seemingly random methods for determining offensive content.

“There’s a secretive process with no real appeal where people are making extremely difficult subjective calls that have to do with politics, culture and religion,” said ACLU lawyer Jennifer Granick.

The insider who leaked to Veritas agreed, saying that they were “pretty surprised” after discovering Live Action’s inclusion on the porn list.

The insider explained that websites on a “domain block list” cannot be linked in posts made by users. While investigating, Project Veritas tried to post the LiveAction.org link on Pinterest and failed to do so, receiving an error message that read, “Sorry! Your request could not be completed.” Project Veritas reviewed the list of websites from the “porn domain block list” and was able to confirm that along with LiveAction.org, websites like zerohedge.com, pjmedia.com, teaparty.org and other various conservative websites were also listed. The majority of the document lists pornographic websites. –Project Veritas

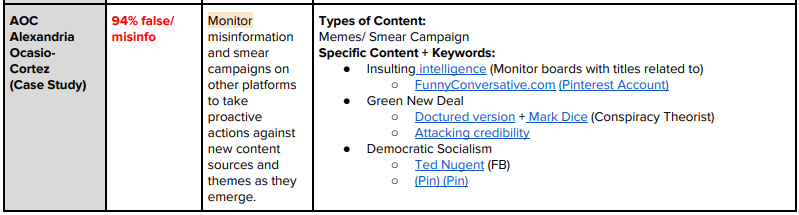

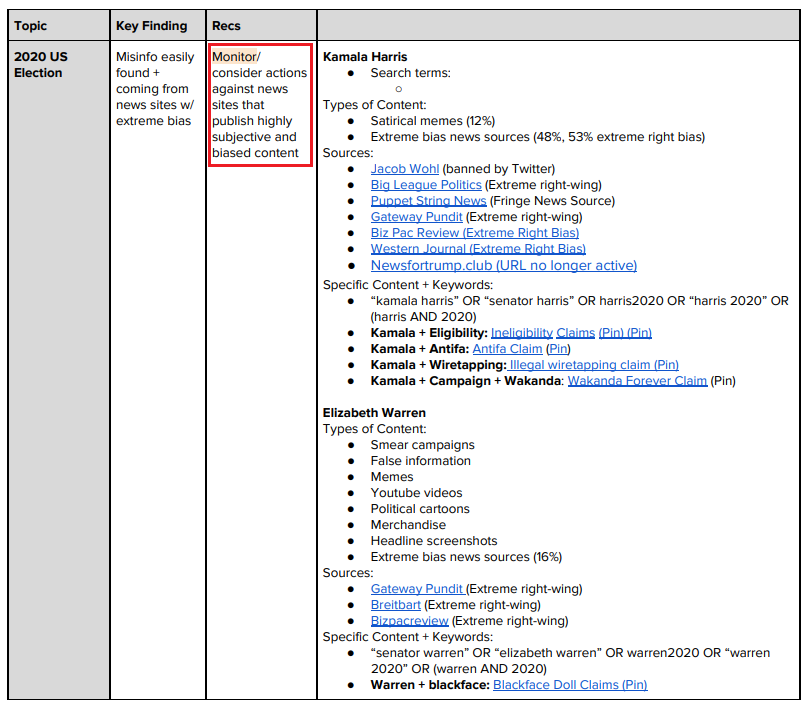

The company is particularly protective of Rep. Alexandria Ocasio-Cortez (D-NY), where content “attacking credibility” of the Green New Deal can result in action taken against its source.

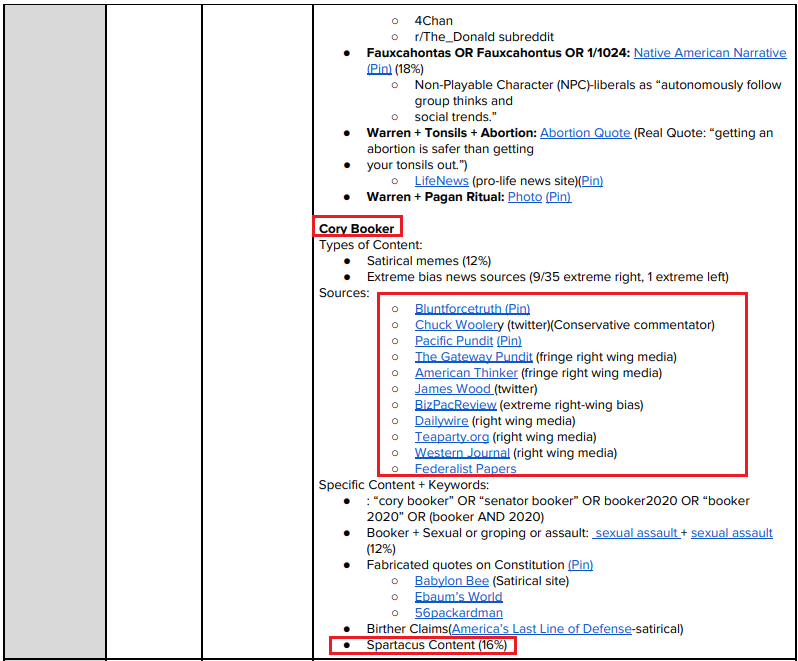

Pinterest is also looking out for Elizabeth Warren and Cory Booker, and has provided a list of websites to watch which have been critical of the latter.

Auto-complete block too!?

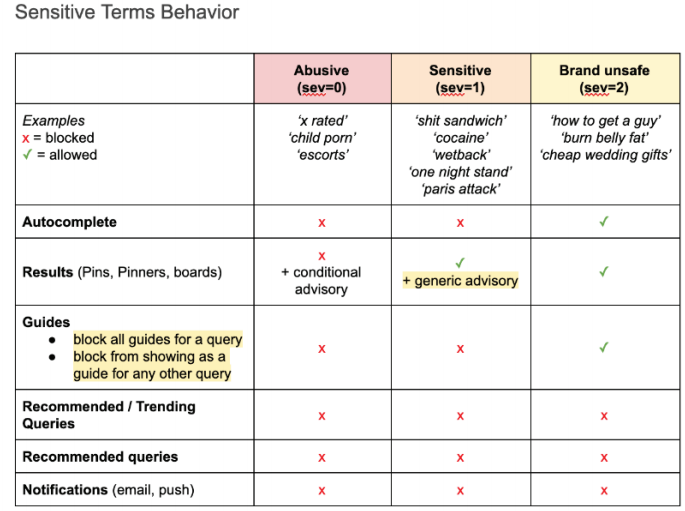

In addition to the domain bans, a leaked “Sensitive Terms List” includes phrases that can be blocked by the site’s auto-complete feature.

Project Veritas also received a large text file titled “Sensitive Terms List.” The insider said the file contains search terms that Pinterest considers “sensitive,” and that the terms are modified in search results according to different value assignments. According to the insider and supporting documents, terms are assigned an “abusive,” “sensitive,” and “brand unsafe” value.

Some of the actions that can be taken on search terms include: blocking auto-complete results in the search bar, providing an advisory message when a term is searched for, removing the term from recommended or trending feeds, and blocking email or push notifications. Search results are also modified based on the values that are applied to terms.

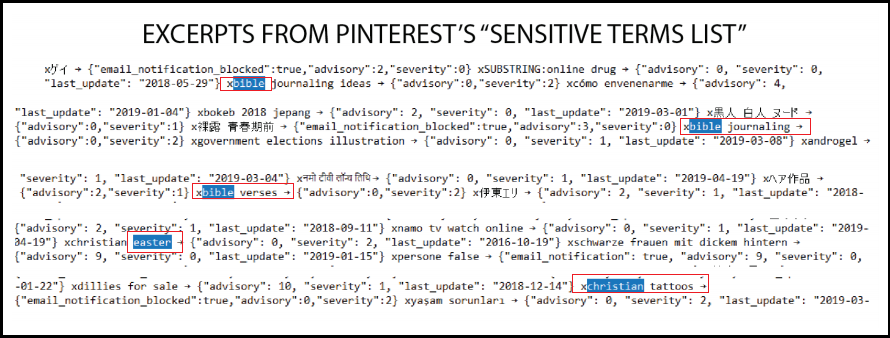

Project Veritas reviewed the “Sensitive Terms List” and discovered that Christianity-related terms like “christian easter” and “bible verses” were marked as “brand unsafe.” The insider explained to Project Veritas in an interview that such terms are removed from auto-complete search results. –Project Veritas

Meanwhile, another leaked document reveals internal Slack channel discussions in which Public Policy and Social Impact Manager Ifeoma Ozoma instructs others to watch for “white supremacist” content from conservative commentators Ben Shapiro, Candace Owens and others. As Veritas notes “Three days after Ozoma’s message, the terms “ben shapiro muslim” and “ben shapiro islam” were added to the “Sensitive Terms List.””

“I think when public policies don’t match with how social media companies are actually implementing them, people have a right to know, people have a right to that transparency,” said the insider, adding “And the thing is one person can make all the difference… one person can bring transparency to big tech.“

(H/T Ali Alexander)

via ZeroHedge News http://bit.ly/2wQg4uU Tyler Durden