Submitted by Jim Quinn of The Burning Platform blog,

“Five percent of the people think;

ten percent of the people think they think;

and the other eighty-five percent would rather die than think.”

– Thomas Edison

The kabuki theater that passes for governance in Washington D.C. reveals the profound level of ignorance shrouding this Empire of Debt in its prolonged death throes. Ignorance of facts; ignorance of math; ignorance of history; ignorance of reality; and ignorance of how ignorant we’ve become as a nation, have set us up for an epic fall. It’s almost as if we relish wallowing in our ignorance like a fat lazy sow in a mud hole. The lords of the manor are able to retain their power, control and huge ill-gotten riches because the government educated serfs are too ignorant to recognize the self-evident contradictions in the propaganda they are inundated with by state controlled media on a daily basis.

“Any formal attack on ignorance is bound to fail because the masses are always ready to defend their most precious possession – their ignorance.” – Hendrik Willem van Loon

The levels of ignorance are multi-dimensional and diverse, crossing all educational, income, and professional ranks. The stench of ignorance has settled like Chinese toxic smog over our country, as various constituents have chosen comforting ignorance over disconcerting knowledge. The highly educated members, who constitute the ruling class in this country, purposefully ignore facts and truth because the retention and enhancement of their wealth and power are dependent upon them not understanding what they clearly have the knowledge to understand. The underclass wallow in their ignorance as their life choices, absence of concern for marriage or parenting, lack of interest in educating themselves, and hiding behind the cross of victimhood and blaming others for their own failings. Everyone is born ignorant and the path to awareness and knowledge is found in reading books. Rich and poor alike are free to read and educate themselves. The government, union teachers, and a village are not necessary to attain knowledge. It requires hard work and clinging to your willful ignorance to remain stupid.

The youth of the country consume themselves in techno-narcissistic triviality, barely looking up from their iGadgets long enough to make eye contact with other human beings. The toxic combination of government delivered public education, dumbed down socially engineered curriculum, taught by uninspired intellectually average union controlled teachers, to distracted, unmotivated, latchkey kids, has produced a generation of young people ignorant about history, basic mathematical concepts, and the ability or interest to read and write. They have been taught to feel rather than think critically. They have been programmed to believe rather than question and explore. Slogans and memes have replaced knowledge and understanding. They have been lured into inescapable student loan debt serfdom by the very same government that is handing them a $200 trillion entitlement bill and an economy built upon low paying service jobs that don’t require a college education, because the most highly educated members of society realized that outsourcing the higher paying production jobs to slave labor factories in Asia was great for the bottom line, their stock options and bonus pools.

Instead of being outraged and lashing out against this injustice, the medicated, daycare reared youth passively lose themselves in the inconsequentiality and shallowness of social media, reality TV, and the internet, while living in their parents’ basement. They have chosen the ignorance inflicted upon their brains by thousands of hours spent twittering, texting, facebooking, seeking out adorable cat videos on the internet, viewing racist rap singer imbeciles rent out sports stadiums to propose to vacuous big breasted sluts on reality cable TV shows, and sitting zombie-like for days with a controller in hand blowing up cities, killing whores, and murdering policemen using their new PS4 on their 65 inch HDTV, rather than gaining a true understanding of the world by reading Steinbeck, Huxley, and Orwell. Technology has reduced our ability to think and increased our ignorance.

“During my eighty-seven years, I have witnessed a whole succession of technological revolutions. But none of them has done away with the need for character in the individual or the ability to think.” – Bernard M. Baruch

The youth have one thing going for them. They are still young and can awaken from their self-imposed stupor of ignorance. There are over 80 million millenials between the ages of 8 and 30 years old who need to start questioning the paradigm they are inheriting and critically examining the mendacious actions of their elders. The future of the country is in their hands, so I hope they put down those iGadgets and open their eyes before it is too late. We need many more patriots like Edward Snowden and far fewer twerking sluts like Miley Cyrus if we are to overcome the smog of apathy and ignorance blanketing our once sentient nation.

The ignorance of youth can be chalked up to inexperience, lack of wisdom, and immaturity. There is no excuse for the epic level of ignorance displayed by older generations over the last thirty years. Boomers and Generation X have charted the course of this ship of state for decades. Ship of fools is a more fitting description, as they have stimulated the entitlement mentality that has overwhelmed the fiscal resources of the country. Our welfare/warfare empire, built upon a Himalayan mountain of debt, enabled by a central bank owned by Wall Street, and perpetuated by swarms of corrupt bought off spineless politicians, is the ultimate testament to the seemingly limitless level of ignorance engulfing our civilization. The entitlement mindset permeates our culture from the richest to the poorest. Mega-corporations use their undue influence (bribe

s disguised as campaign contributions) to elect pliable candidates to office, hire lobbyists to write the laws and tax regulations governing their industries, and collude with the bankers and other titans of industry to harvest maximum profits from the increasingly barren fields of a formerly thriving land of milk and honey. By unleashing a torrent of unbridled greed, ransacking the countryside, and burning down the villages, the ruling class has planted the seeds of their own destruction.

When the underclass observes Wall Street bankers committing the crime of the century with no consequences for their actions, they learn a lesson. When billionaire banker/politicians like Jon Corzine can steal $1.2 billion directly from the accounts of farmers and ranchers and continue to live a life of luxury in one of his six mansions, they get the message. Wall Street bankers are allowed to commit fraud, reaping profits of $25 billion, and when they are caught red handed pay a $5 billion fine while admitting no guilt. No connected bankers have gone to jail for crashing the worldwide financial system, but teenage marijuana dealers are incarcerated for ten years in our corporate prison system. The message has been received loud and clear by the unwashed masses. Committing fraud and gaming the system is OK. Only suckers play by the rules anymore. A culture of lawlessness, greed, fraud, deceit, swindles and scams was fashioned by those in power. Reckless disregard for honesty, truthfulness, fair dealing, and treating others as you would like to be treated, has permeated the beliefs and behavior of our society.

The ever increasing number of people in the SNAP program along with abuses committed by retailers and recipients, the skyrocketing number of people faking their way into the SSDI program, billions of taxpayer dollars lost to Medicare fraud, billions more lost paying out earned income tax credit refunds based on non-existent children, public schools falsifying test scores, students cheating on SAT tests, credit card fraud on a grand scale, failure to report income and falsifying tax returns, and a myriad of other dodges and scams are just a reflection of a moral and cultural collapse. The dog eat dog mentality glorified by the media, with such despicable men as Dimon, Greenspan, Corzine, Clinton, Trump, Rubin, Bernanke and Bloomberg honored as pillars of society, has displaced honesty, compassion, humanity, shared sacrifice, and caring about our descendants. Self-interest, self-indulgence, and a narcissistic focus on what is in it for me today has led to an implosion of trust and an attitude of “who cares” about our fellow man, morality, right or wrong, and the fate of future generations. We ignored the warnings of our last President who displayed courageousness and truthfulness when speaking to the American people.

“As we peer into society’s future, we — you and I, and our government — must avoid the impulse to live only for today, plundering for our own ease and convenience the precious resources of tomorrow. We cannot mortgage the material assets of our grandchildren without risking the loss also of their political and spiritual heritage. We want democracy to survive for all generations to come, not to become the insolvent phantom of tomorrow.” – Dwight D. Eisenhower

The Me Generation has devolved into the Me Culture. While the masses have been mesmerized by their iGadgets, zombified by the boob tube, programmed to consume by the Madison Avenue propaganda machines, enslaved in chains of debt by the Wall Street plantation owners, and convinced by their fascist government keepers that phantom terrorists are hiding behind every bush, they surrendered their freedoms, liberties and sense of self-responsibility. There will always be evil men seeking to control and manipulate the ignorant and oblivious. A citizenry armed with knowledge, critical thinking skills, and moral integrity would not passively submit to the will of a corporate fascist oligarchy. Well educated, well informed citizens, capable of critical thinking are dangerous to rich men of evil intent. Obedient, universally ignorant, distracted, fearful, morally depraved slaves are what the owners of this country want. As the light of knowledge flickers and dies, we sink into the darkness of ignorance.

“No people will tamely surrender their Liberties, nor can any be easily subdued, when knowledge is diffused and virtue is preserved. On the Contrary, when People are universally ignorant, and debauched in their Manners, they will sink under their own weight without the Aid of foreign Invaders.” – Samuel Adams

Cult of Ignorance

“There is a cult of ignorance in the United States, and there has always been. The strain of anti-intellectualism has been a constant thread winding its way through our political and cultural life, nurtured by the false notion that democracy means that “my ignorance is just as good as your knowledge.” – Isaac Asimov

“While every group has certain economic interests identical with those of all groups, every group has also, as we shall see, interests antagonistic to those of all other groups. While certain public policies would in the long run benefit everybody, other policies would benefit one group only at the expense of all other groups. The group that would benefit by such policies, having such a direct interest in them, will argue for them plausibly and persistently. It will hire the best buyable minds to devote their whole time to presenting its case. And it will finally either convince the general public that its

case is sound, or so befuddle it that clear thinking on the subject becomes next to impossible.

In addition to these endless pleadings of self-interest, there is a second main factor that spawns new economic fallacies every day. This is the persistent tendency of man to see only the immediate effects of a given policy, or its effects only on a special group, and to neglect to inquire what the long-run effects of that policy will be not only on that special group but on all groups. It is the fallacy of overlooking secondary consequences.” – Henry Hazlitt

America’s cult of ignorance, combined with the selfish interests of various constituencies, the character weakness of the people elected to office, a lack of understanding or interest in basic mathematical concepts, and inability to comprehend the long term and unintended consequences of every piece of legislation, have brought the country to the brink of fiscal disaster. But still, the vast majority of Americans, including the supposed intellectuals and economic “experts”, are basking in their ignorance, as the stock market reaches a new high, the local GM dealer just gave them a 7 year $40,000 auto loan at 0% on that brand new Cadillac Escalade, Bank of America still hasn’t foreclosed on their McMansion two years after making their last mortgage payment, and they just received three pre-approved credit card notices from Capital One, American Express and Citicorp. As long as Bennie has our back printing $1 trillion new greenbacks per year, nothing can possibly go wrong. Our best and brightest economic minds are always right:

“Stocks have reached what looks like a permanently high plateau.” – Irving Fisher, Professor of Economics, Yale University, 1929

“Many of the new financial products that have been created, with financial derivatives being the most notable, contribute economic value by unbundling risks and shifting them in a highly calibrated manner. Although these instruments cannot reduce the risk inherent in real assets, they can redistribute it in a way that induces more investment in real assets and, hence, engenders higher productivity and standards of living.” – Alan Greenspan – March 6, 2000

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” – Ben Bernanke – July 2005

The profound level of ignorance displayed by economists, politicians, business leaders, media personalities, and the average American, regarding the mathematically unsustainable path of our fiscal ship is perplexing to me on so many levels. If the Federal government was a family, the budget ceiling debate would be put into the following terms. Our household earns $28,000 per year, but we spend $38,000 per year and add $10,000 to our credit card balance, which stands at the limit of $170,000. In addition, we owe our neighbors $2 million we don’t have because we promised to pay if they voted for us as Treasurer of our homeowners association. We celebrate our good fortune of getting approved for another credit card with a $30,000 limit by increasing our spending to $39,000 per year. Intellectuals scorn such simplistic analogies by glibly pointing out that the family has a crazy uncle with a printing press in the basement and can pay-off the debt with his freshly printed dollars. And this is where the deliberate and calculated ignorance by the highly educated Ivy Leaguers regarding long term and unintended consequences is revealed. They ignore, manipulate, cover-up and obscure the facts because their wealth, power and influence depend upon them doing so. But ignorance doesn’t change the facts.

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

Nothing exposes the ignorance of various factions within our society better than a debate about budgets, spending, and unfunded liabilities. This is where every party, group, special interest, and voting bloc ignore any and all facts that are contrary to their selfish interest. They only see what they want to see. The fallacies, errors, omissions and mistruths of their positions are inconsequential to people who only care about their short-term self-seeking interests. When I question the out of control spending on entitlements and our impossible to honor level of unfunded liabilities, those of a liberal persuasion lash out with accusations of hating the poor, starving children and throwing granny under the bus. Anyone suggesting we should slow our spending is branded a terrorist by the overwhelmingly liberal legacy media.

When I accuse Wall Street bankers of criminal fraud and ongoing manipulation of the financial markets, the CNBC loving apologists for these felons bellow about the market always being right. When I rail about the military industrial complex and our un-Constitutional invasions of other countries, the neo-cons come out in force blathering about the war on terror and imminent threats. When I point out the horrific results of our government run educational system and how mediocre union teachers are bankrupting our states and municipalities with their gold plated health and pension plans, I’m met with howls of outrage about the poor children. The common thread is that facts are ignored because each of their agendas requires ignorance on the part of their team’s fans.

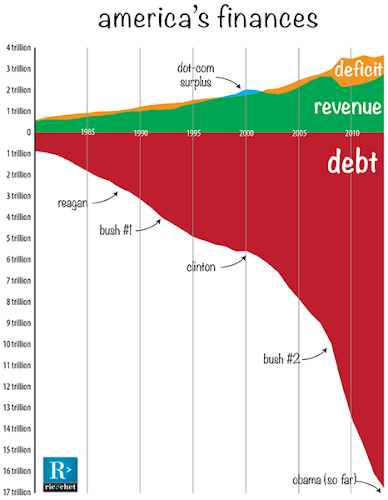

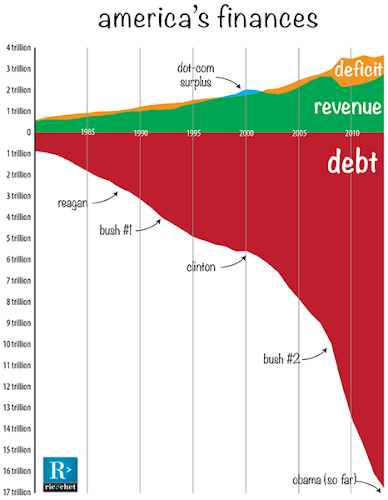

The following chart of truth portrays an unsustainable path. Ignoring the facts will not change them. This isn’t a Republican problem or a Democrat problem. It’s an American problem.

“There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: “In the long run we are all dead.” And such shallow wisecracks pass as devastating epigrams and the ripest wisdom.” – Henry Hazlitt

Henry Hazlitt may have written these words six decades ago, but they aptly describe Paul Krugman and the legions of Keynesian apostles whose bastardized interpretation of Keynes’ theory has led us to this fiscal cliff. How anyone can truly believe that borrowing to consume foreign produced goods versus saving and making job creating capital investments is a rational and sustainable economic policy is the height of ignorance. One look at this chart exposes the political party system as a sham. When it comes to the fiscal train wreck, set in motion thirty years ago, the ignorant media pundits peddle a narrative about politicians failing to compromise as the culprit i

n this derailment. Nothing could be further from the truth. Compromise is what has gotten us to this point. The Republicans compromised and allowed the Democrats to create a welfare state. The Democrats compromised and allowed the Republicans to create a warfare state. The Federal Reserve compromised their mandate of stable prices and preventing financial calamities by inflating away 95% of the dollar’s purchasing power in 100 years, while creating bubbles every five or so years, like clockwork. There are a myriad of facts related to the chart above that cannot be ignored:

- It took 192 years for the country to accumulate $1 trillion in debt. It has taken us 30 years to accumulate the next $16 trillion of debt. We now add $1 trillion of debt per year.

- If the Federal government was required to use GAAP accounting, the annual deficit would amount to $6.7 trillion per year.

- The fiscal gap of unfunded future liabilities for Social Security, Medicare, Medicaid, and government pensions is $200 trillion.

- Using realistic growth assumptions adds another $6 trillion of state and local government unfunded pension benefits to the equation.

- The Federal government has increased their annual spending from $1.8 trillion during Bill Clinton’s last year in office to $3.8 trillion today, a 110% increase. The population has increased by 12% over that same time frame, and real GDP has advanced by 25% since 2000.

- Defense spending has increased from $358 billion in 2000 to $831 billion today, despite the fact that no country on earth can challenge us militarily.

- The average Baby Boomer will receive $300,000 more than they contributed to Social Security and Medicare over their lifetime. Over 10,000 Boomers per day will turn 65 for the next 17 years.

- The Social Security lockbox is filled with IOUs. The funds collected from paychecks over the last 80 years were spent by Congress on wars of choice, bridges to nowhere, and thousands of other vote buying ventures.

- A normalization of interest rates to long-term averages would double or triple the interest on the national debt and increase our annual deficits by at least 30%.

- Obamacare and the unintended consequences of Obamacare will add tens of trillions to our national debt. The initial budget projections for Medicare and Medicaid showed only a modest financial impact on the financial situation of the country. How did that work out?

- Entitlement spending in 2003 was $1.3 trillion. Entitlement spending in 2008 was $1.7 trillion. Entitlement spending in 2013 was $2.2 trillion. Entitlement spending in 2018 will be $2.8 trillion, as these programs are on automatic pilot.

When you consider the facts in a rational manner, without vitriolic denials, bitter accusations, acrimonious blame, and rejection of the entire premise, you come to the conclusion that we’ve passed the point of no return. Decades of bad choices, bad leadership, bad men in important positions, bad education, bad governance, and bad citizenship have led to bad times. But very few people, across all socio-economic classes, have any interest in understanding the facts or making the tough choices required to save future generations from a life of squalor. We willfully choose to ignore the facts.

“Most ignorance is vincible ignorance. We don’t know because we don’t want to know.” – Aldous Huxley

Our degraded and ignorant society is incapable of comprehending their dire circumstances or acting for the common good of the country. We are a nation on the take. Greed really is good. Everyone needs to play the game. From the top floor corporate CEO suite to the decaying urban wastelands, we have chosen comforting ignorance to uncomfortable knowledge. Our warped form of democracy enriches the few at the top, while dispensing enough subsistence payments to the lower classes to keep them from revolting, while enslaving the middle class in debt and convincing them it’s really wealth. Mencken understood the pathetic impulses of the American populace decades before we reached our point of no return.

“Democracy is a pathetic belief in the collective wisdom of individual ignorance.” – H.L. Mencken

The only way a democracy can survive is if the population is knowledgeable, vigilant, skeptical, educated, individually responsible, self-reliant, moral, capable of critical thinking and willing to accept the consequences of their actions. A nation of takers, fakers and blamers will not last long. We’ve degenerated into a nation of knowledge hating book burners. Our culture of ignorance will lead to the destruction of our culture and the ignorant masses will wonder what happened.

“But you can’t make people listen. They have to come round in their own time, wondering what happened and why the world blew up around them. It can’t last.” – Ray Bradbury – Fahrenheit 451

In Part Two of this examination about our culture of ignorance I’ll explore the roles of technology, family breakdown, government, and propaganda in creating the ignorance that is consuming our system like a mutant parasite. If you are seeking a happy ending, I suggest looking elsewhere.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/1auvwWmhhso/story01.htm Tyler Durden

![]()