Years ago, before everyone had in-car navigation systems, I held on to an amusing little thought about traveling on the freeways: when you witnessed a huge backup on the other side (that is, traveling the other direction), and it went on for mile after mile, and then it finally cleared, you were put in the unusual position of actually knowing the short-term future of all the poor souls who, farther up the road, were zipping along, blissfully unaware of the hellacious backup that would soon face them. I would glance at the dozens of drivers enjoying their 70 MPH care-free spin, knowing that their lives were about to get worse really soon. As tragedies go, it doesn’t exactly rank, but it was still an amusing realization of the power of fortune-telling.

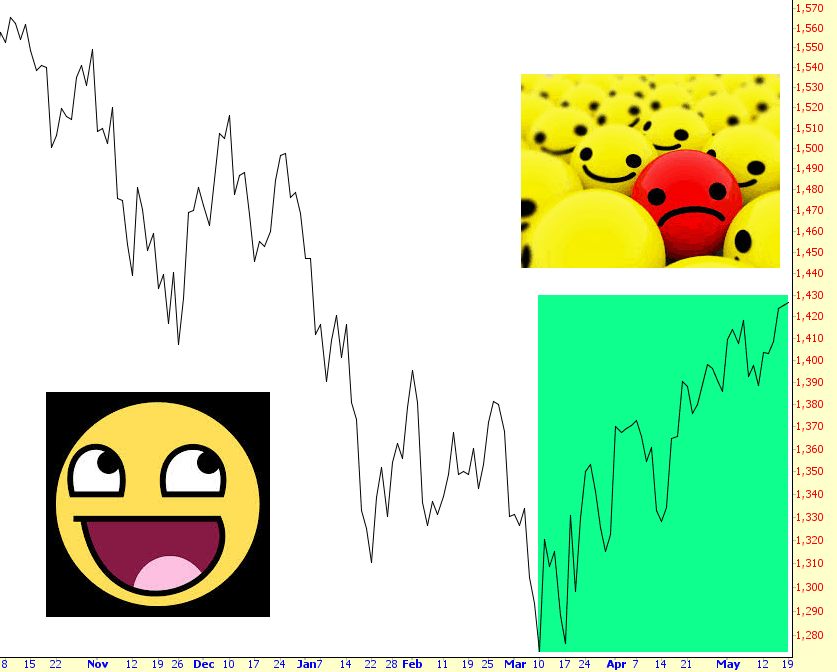

I am going through precisely that same experience now, except it’s with myself. For a variety of reasons, I am going through all the posts I’ve ever written for Slope. I am presently up to May 2008, and that is a particularly fascinating point in time, because the market had experienced a rather hearty slump (which I enjoyed immensely) and then began an unrelenting and inexplicable recovery higher, which I’ve tinted in green.

So my “driving on the highway” experience in this case is that I am both the observer (that is, Tim Knight doing this in late October 2013) and the observed (the Tim from over five years ago, expressing his increasingly-frustrated thoughts about the market’s climb, after having tumbled over 300 S&P points earlier). I sound like a kid whose favorite toy had been snatched away……..probably because that’s exactly what it felt like.

On my post from May 13, I wrote, “I have no index exposure at this time. I simply find the potential for a breakout too disturbing, and the reluctance of the market to fall, no matter what the news.” (Please note that these old posts lack graphic images, because they didn’t survive the move from Typepad to WordPress).

A couple of days later, I had become so disgusted with the market that I decided to only write one post on my blog per day which, for a blogoholic like myself, is pretty extreme: “Until the markets get enjoyable (e.g. bearish) again, I’ll be returning to my “one post a day” format after the close. A lot of folks have become accustomed to my frequent intraday posts, and I’ll do that again if sanity returns, but until then, it’s back to the old routine.”

On May 15, I was really approaching the breaking point: “It’s hard to remember a time that I felt so disenchanted with the market. I enjoy charting, and I enjoy trading, but when the world seems turned upside down like it is, the whole affair loses its charm………..You can tell from my tone I’m feeling pretty miserable about the market. I can deal with markets, be they up or down, as long as they make some kind of sense to me. This one doesn’t. So it’s discouraging for someone who wants to analyze price action to be faced with what appear to me to be baffling contradictions. So I’m sorry I don’t have anything more inspiring to say.”

And the next day, I openly mused about whether one should just throw their hands up and buy, just like everyone else was doing: “Does one simply dive into these stocks? Some do. And they have, by and large, profited handsomely from doing so. The difficulty is figuring out when the music is going to stop playing. Was today the top for these stocks? Or is the top several years and many hundreds of percent away?”

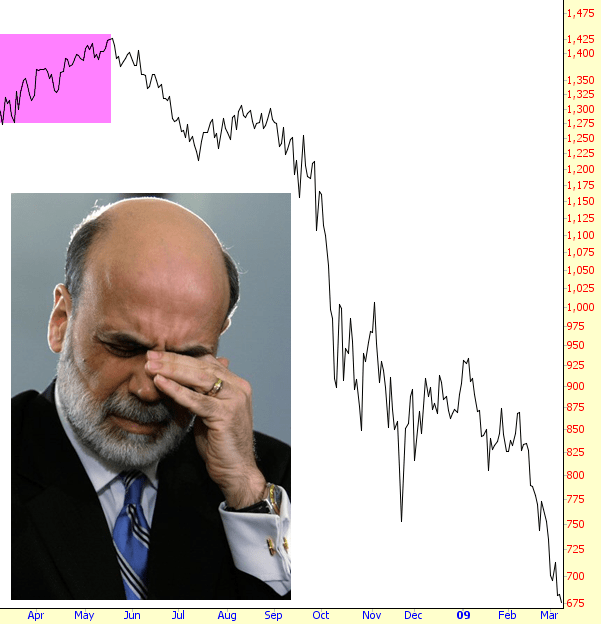

On the exact day of the recovery top, I had become so morose that readers started sending me emails to try to buck up my spirits: “I’ve been deluged with emails from folks telling me that the top is in and everything is going to start plunging again. While I genuinely appreciate the heartfelt sentiments – – – I know they are from true believers, and I know they are offered to make me feel better – – the grotesque fact of the matter is that the U.S. Government, whose principal drivers are colluding directly with their Wall Street buddies, has mortgaged the future of the country in order to bail out the zillionaires in Manhattan. This sounds like aluminum-hat-wearing type drivel, and I’m sorry that it does, but I truly believe this to be the case. Were it not for all of Bernanke’s meddling, the meltdown would have continued in all its full glory. As it is now, the day of reckoning has been simply delayed.”

Well, the “day of reckoning” started happening at that very moment. But just like those folks driving on the road at the top of this post, there was just no way to tell at the time what was about to take place. (I’ve tinted the “when will this rally end?” whining period in the chart below).

Of course, the “relentless” rise hasn’t been for two months this time…….it’s been for nearly five years. And I can tell you, reporting directly from the heart of the Silicon Valley, the zeitgeist around here is 1999 and 2007 compressed together and supercharged. I present you a snapshot I made of the magazine sitting at the grocery store a few days ago:

A baby. Wearing Google Glass. Good God. And in a fitting exhibition of the total lack of self-awareness, the words chosen are as close to “It’s Different This Time!” as they could muster (Specifically, “This time, the tech explosion doesn’t have to end in tears.“) People never learn. Ever. Even the really smart ones.

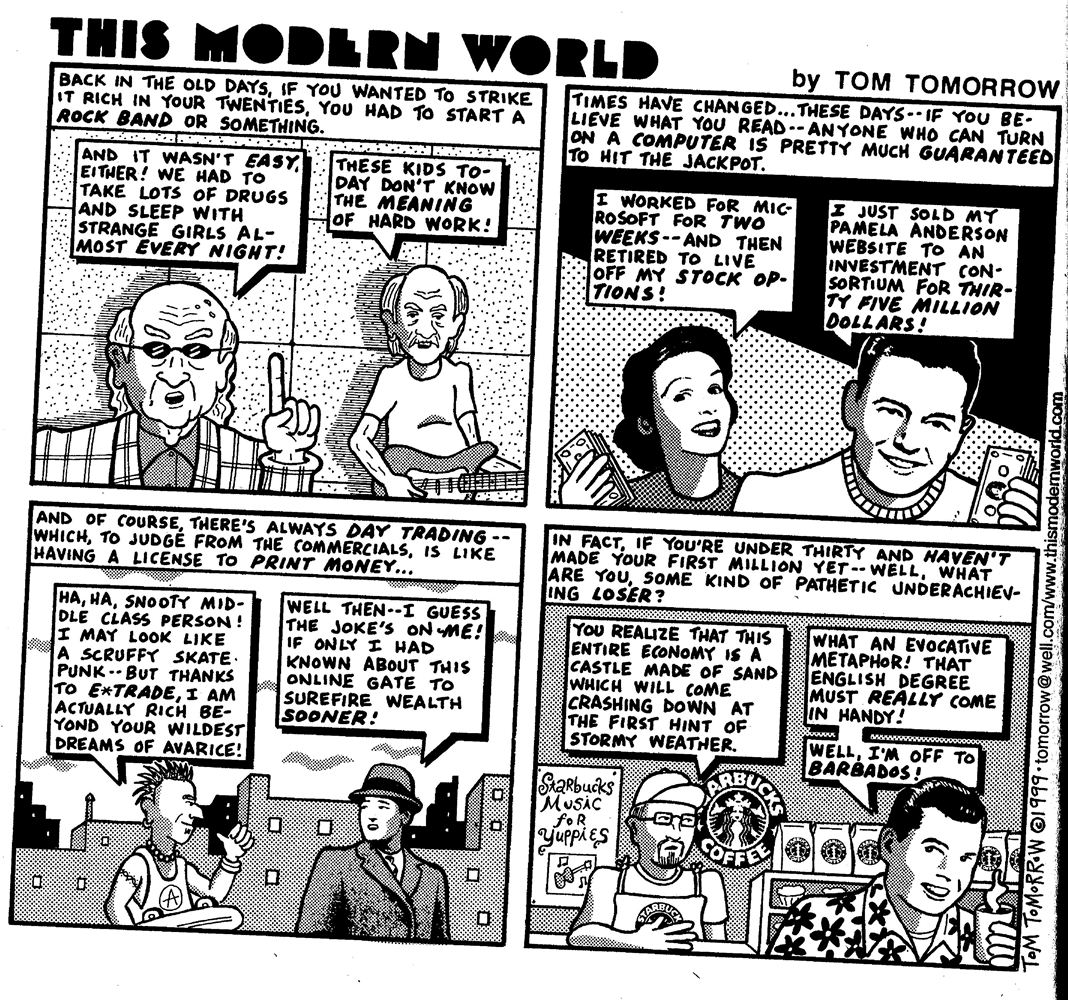

I’ll close with this blast from the past. I scanned for you a comic from late 1999 from This Modern World. The same people reveling in the present bubble (which dwarfs the Internet bubble) would still find this little snippet amusing, particularly since they would figure the world has become a lot wiser since then. (Click on it to give yourself a better chance of actually making out the words).

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/48uQDrU9DgM/story01.htm Tim Knight from Slope of Hope