Government data in the U.S. showed that the pace of business activity in the U.S. Midwest jumped in October, exceeding expectations and U.S. jobless claims declined somewhat last week.

Other real world facts regarding the very poor state of the U.S. economy are being ignored for now. One such important indicator regarding the health of the U.S. economy continues to flash red.

There are a record 47.6 million Americans, representing 23.1 million households, on food stamps today. The cost of the program will hit $63.4 billion in 2013 – less than what the Federal Reserve is printing every single month today. Yet, very tough benefit cuts to food stamp recipients kick in today. The move by Congress will siphon $5 billion from a program that helps one in seven Americans put breakfast, lunch and dinner on the table.

“If you look across the world, riots always begin typically the same way: when people cannot afford to eat food,” Margarette Purvis, the president and CEO of the Food Bank for New York said.

More ‘irrationally exuberant’ market participants are ignoring the poor fundamentals of the U.S. economy. Most market participants fear an improving economy could prompt the U.S. central bank to cut back its, very bullion friendly, money printing measures. This remains highly unlikely and far more likely is a double dip recession – potentially a very sharp one which will lead to even more quantitative easing and currency debasement.

The head of the eurozone finance ministers Jeroen Dijsselbloem said yesterday that governments need to prepare legislation for bail-ins. His important comments were not widely picked up, but they are important as they are another sign that bail-ins and deposit confiscation will be seen when banks get into difficulty.

Gold Seasonal – Monthly Performance and Average (10 Years)

China bought more than 100 tonnes of gold from Hong Kong for a fifth straight month in September as demand for bullion bars and jewellery stayed strong. Chinese demand appears to have fallen marginally in recent days but remains on track to overtake India as the world’s biggest store of wealth gold buyer this year.

Other News

* Barrick Gold Corp said it would stop development of its Pascua-Lama mine in South America indefinitely, a surprise reversal on a project that has already cost the world’s largest gold producer more than $5 billion. (Reuters)

* The volume of gold transferred between accounts held by bullion clearers fell 16.3 percent in September to an average 18.5 million ounces a day, its lowest since August 2012, the London Bullion Market Association said. (Reuters)

* South Africa’s AMCU union declared a wage dispute on Thursday with platinum producer Lonmin . The union also said its members in the gold sector were voting on whether or not to strike over wages and could do so from next week. (Reuters)

* American Eagle gold coin sales climbed from 13,000 oz in September, and they fell from 59,000 oz a year earlier, according to data today on the U.S. Mint website.

-July sales were 50,500 oz

-In the 10 months ended today, sales rose to 752,500 oz, compared with 753,000 oz for all of 2012

-American Eagle silver-coin sales were 3.087m oz in Oct., up from 3.01m oz last month and 3.153m a year earlier

-In the 10 months ended today, sales were 39.175m oz, compared with 33.743m for all of 2012. (Bloomberg)

* Dow Jones-UBS Commodity Index Boosts 2014 Weighting for Gold.

Gold will be the heaviest-weighted component next yr, making up 11.5% of the index, up from 10.8% in 2013, S&P Dow Jones Indices and UBS Investment Bank said in a statement today.

-Silver 2014 weighting 4.1% vs 3.9%

-WTI crude weighting cut to 8.5% vs 9.2%

-Natural gas weighting cut to 9.4% vs 10.4%

-Brent oil weighting raised to 6.5% vs 5.8%. (Bloomberg)

* World Gold Council Says Private Gold Stock Worth $1.8 Trillion

That compares with $90 trillion for debt markets, and $51 trillion for equity markets, World Gold Council says in report on website today.

-Debt markets grew threefold from 2000 to 2012 and equities increased from $20 trillion (Bloomberg)

* Global Gold Hedge Book Was 96 Tons by June, Lowest Since 2002

Net dehedging totaled 16t in 2Q, Societe Generale SA and Thomson Reuters GFMS say in report e-mailed today.

-Gold hedge book lowest since quarterly records began in 2002

-“Evidence of new hedging activity subsequent to the end of Q2 has been limited so far; producers have instead been seeking to protect margins through cost-containment measures”

-Says dehedging may persist through the rest of this year (Bloomberg)

Gold Is Seasonally Very Strong In November, Strong In January and February

Gold is range bound between $1,250/oz and $1,450/oz. The fundamentals including the current macroeconomic, systemic, geo-political and monetary conditions are positive for gold. These fundamentals in conjunction with the strong seasonals suggest higher gold prices are likely in the coming months.

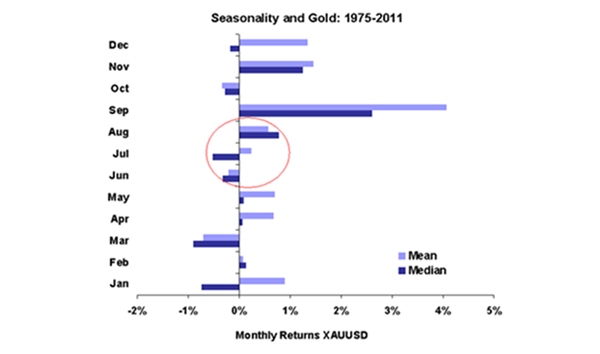

Seasonally, the months of November, December and January are positive months for gold and October is seasonally a weak month for gold. October often sees declines in the gold price followed by strong gains in November, December, January and February (see tables).

Yesterday saw the end of October trading. November is, after September, one of the strongest months to own gold. This is seen in the charts showing gold’s monthly performance over different time frames – 1975 to 2011, 2000 to 2011 and our Bloomberg Gold Seasonality table from 2003 to 2013 (10 years is the maximum that can be used).

November is gold’s strongest month in the last ten years and it has returned 4.93% on average since 2003. Since 1975, gold has returned nearly 1.5% on average in November.

December is a mixed month for gold in the last 10 years but since 1975, December has returned more than 1% on average.

January and February have also been gold for gold. Gold has returned 3.14% and 1.15% on average in January and in February respectively, in the last 10 years.

Over the longer time frame, since 1975, gold also shows seasonal strength in November, December and January.

Autumn and winter is the seasonally strong period for the precious metals. This is believed to be due to robust physical demand internationally and especially in Asia for weddings and festivals and into year end for Chinese New Year stocking up.

It may also be related to traders being aware of the seasonals and therefore contributing to price gains or price falls in certain months.

Given the bullish fundamentals and the fact that gold already looks oversold with very poor sentiment today, any further weakness is likely to be short term.

Ultra loose monetary policies are set to continue for the foreseeable future which is highly supportive of gold and should lead to new real record highs over $2,400/oz in the coming years.

Download GoldCore’s Essential Guide To Silver Eagles here.

Like Our Facebook Page For Interesting Breaking News, Insights, Blogs, Prizes and Special Offers

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/LiQxxcbaeZQ/story01.htm GoldCore