A month ago, we wrote about the bitcoin fork. We described the fork:

Picture a bank, the old-fashioned kind. Call it Acme (sorry, we watched too much Coyote and Road Runner growing up). A group of disgruntled employees leave. They take a copy of the book of accounts. They set up a new bank across the street, Wile E Bank. To win customers, they say if you had an account at Acme Bank, you now have an account at Wile, with the same balance!

This fork came about from a disagreement among the bitcoin miners, those who control the blockchain and hence the currency. The equivalent of the disgruntled Acme Bank group left to form bitcoin cash, the equivalent of Wile E. Bank. However, it has often been said that necessity is the mother of invention. Applied to bitcoin, that means that what happened due to irreconcilable differences in this case, could also occur deliberately later.

Why would someone do this deliberately? Well, as of this writing (Saturday afternoon), bitcoin cash is trading for $568.28. This copy of the original bank ledger is worth over fahv hunnert Benjahminns! Actually, not the ledger. Each record in the ledger. The ledger as a whole is worth $9.4 billion.

For anyone—or a cartel of someones—who can fork bitcoin, there are now 9.4 billion reasons to do so. Think about that. Take as long as you need.

Now, we don’t want to disparage anyone. We are absolutely certain that everyone who is speculating to get rich in bitcoin will turn away from forking. It just doesn’t feel right, and it couldn’t possibly be moral to create forks on purpose, to get richer quicker.

But if someone did wish to do it, there is a powerful incentive. Economics tells us that if a powerful incentive exists to do something, then someone will do it. For example, if the government subsidizes borrowers by pushing down the interest rate then there will be all sorts of borrowing that would otherwise not occur (to finance all sorts of activities that would otherwise make no sense). Or, if it subsidizes insurance for people who build in flood plains, then many people will build in flood plains.

We now live in a world where altcoins are proliferating. There is a crypto currency named for a set of Internet memes called Doge. There is PotCoin for the marijuana industry, and even PepeCash and PutinCoin. There is a coin named for the most popular four-letter word. By this standard, it makes sense to fork bitcoin as many times as one can. To fork and fork and fork until the marginal ForkCoin has value lower than the cost of forking.

Snark aside, and in all seriousness, the point of our article a month ago is that the fork shows the contradiction in a ledger of liabilities unbacked by assets. By dispensing with the need for assets, the liabilities can proliferate—fork—and there can be any number of alt liabilities too.

Our point in this article is that this contradiction creates a powerful perverse incentive, that someone sooner or later will take up. We prefer the term “perverse incentive” to “unintended consequence”, because it puts the focus where it belongs. We look at what is profitable for someone to do, rather than the real or alleged intentions of the designers. In some cases, the intention is obviously evil. For example, Obamacare was designed to destroy the insurers and drive America towards socialized medicine. In other cases, perhaps in bitcoin, the designer did not foresee much less intend the outcome.

However, here we are. Both the possibility to fork and the incentive are now obvious. We would not bet against it, as we would not bet against Boromir putting on the One Ring. In a Middle Earth minute.

We have not much focused on price, other than how rising price makes bitcoin unsuitable as money or how bitcoin does not have a firm bid. We do not subscribe to the view that bad means the price must go lower soon. However, let’s look at price of an asset in a bubble starting with the dollar.

The dollar, it is often and loudly asserted, has value only because of faith. As soon as the faith is pricked, the air will rush out of the bubble. This partly explains why the gold bugs latch on to every story about gold repatriation in Germany or Treasury Secretary Steve Mnuchin visiting Fork Knox. Mnuchin said, “I assume the gold is still there,” and thus began quite a tempest in a tea pot.

The belief is that as soon as the one-awful-fact-they-don’t-want-you-to-know becomes known, then the dollar will collapse. And gold will go to $65,000 (price measured in collapsed dollars). It’s a quest for the holy grail. Now, we enjoy tilting at windmills as much as Don Quixote, but this view is wrong. The dollar does not have value because of some fragile, collective faith.

The dollar has value because of the struggles of the debtors. What are you willing to sell, in order to avoid foreclosure on your house, repossession of your car, or bankruptcy of your business? Your labor and the products of your effort. As much as you need to sell, in order to service your debts and avoid default.

However, there is no real borrowing in bitcoin. What holds up the value of bitcoin?

There is a risk that a series of forks could prick this bubble of faith.

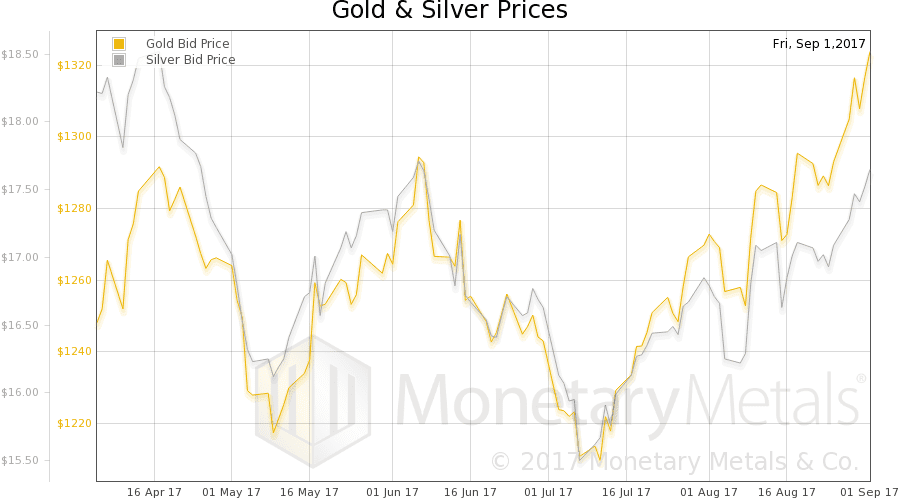

There were big moves in the metals markets this week. The price of gold was up $31 and that of silver $0.56. The price of gold hasn’t been this high in just about a year, which is another way of looking at the one-year low price of the dollar. From its high over 27.5mg gold in mid-December 2016, the dollar has dropped 11% to its current 23.5mg.

Will the dollar fall further? In the short term, anything is possible. Once speculators smell blood in the water (i.e. a strong looking chart pattern), they may enter bigger trades with leverage. We will, of course, see that as a rising basis which is a contrarian signal. In the longer term, prices cannot go up too far or remain high if there is not a renewed demand to hold gold metal.

One possible driver of this is portfolio rebalancing by those who bought a small allocation of bitcoin or Etherium which is now not-small. Will these folks sell their cryptocurrencies, which are anti-dollar plays, to buy more dollars? Or will some of them buy real money? This remains to be seen.

As always, we are interested in the fundamentals of supply and demand as measured by the basis. We will show intraday basis charts this week as there are some interesting features.

But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved down.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph (Dec contract), this time showing intraday resolution for the full week (here is the regular gold basis chart).

We have posted many graphs showing basis correlating with price. That is, as price rises so does basis. Basis is the spread between futures and spot. A rising basis means futures are rising faster than spot, which occurs if the buying pressure is occurring in the futures market. If the buyers are mostly speculators.

Something should immediately leap out at you on this graph. This relationship broke down Thursday afternoon (GMT). First there is a minor sell off seen in the price move from about $1,307 to $1,305. The basis drops from about 1.17% to 1.12%. The basis begins to rise with rising price after that, but it trails. It recovers the 1.17% level but only when price is about $1,317—ten bucks higher. Then as price keeps rising, basis is sideways until midnight. Basis makes one more rally approaching 7am (GMT), then falls back sharply as price continues to rise. Especially late in the day. Even if we ignore the last part below 1.11% as liquidity is dropping with the rest of the world offline and only whatever trading volume remains in the US Friday afternoon before a major holiday weekend (Monday is Labor Day), we still see a falling basis with rising price.

Demand for gold metal has picked up, even at this higher relative price. One of gold’s unique properties is that demand can rise as price rises, without any particular limit (even if it hasn’t happened much in recent years).

To put this into perspective, we would not characterize the current market state as a gold shortage. Every contract is in contango (Sep basis is over 0.5%). The continuous gold basis has been in a rising trend for two months. Gold is not exactly scarce, nor facing massive demand for physical metal and shortage. As our old buddy Aragorn would say, “today is not that day.”

However, the basis move is notable in contrast to the price move. The rise in basis has not been much, considering how much the price has risen—about $120 in two months. Now the December contract, which matures in under 120 days, has a basis below that of 3-month LIBOR (about 1.3%).

The calculated Monetary Metals gold fundamental price was up $25, to $1,355.

Now let’s look at silver, with a similar graph of the week’s action (here is the regular silver basis chart).

At the risk of turning these charts into Rorschach Tests, this one does not look the same to us at all. The silver basis tracks the silver price, though a skew occurred on Wednesday and widened on Thursday. The movement of both traces were a close fit on Thu and Fri. Note the spike down in the basis at the end of the day on Friday (as in gold, though gold had been falling all during the London day through the US day).

Our calculated Monetary Metals silver fundamental price increased $0.46. And, though our calculated Monetary Metals gold:silver ratio fundamental price has dropped a bit, it was rising the last three days of the week.

© 2017 Monetary Metals

via http://ift.tt/2vYWeuA Monetary Metals