Authored by Kevin Muir via The Macro Tourist blog,

I am sure many of you are sick of my yield curve talk. I have been babbling about the curve for far too long. I guess it’s a little understandable as I believe a steepener position will be “the” trade during the next crisis.

Yet there can be no denying that so far, I am wrong and the yield curve keeps going down faster than the plate of drinks at the end of David Hasselhoff’s table after a taping of Britain’s Got Talent.

It’s not an expensive position to carry, so it’s not like I am bleeding profusely from the position, but there can no denying the call has been a dud.

However, lately, I have noticed an abnormal amount of yield curve talk from the financial press and other ‘tourists like myself who jump from asset class to asset class. Suddenly everyone is talking the 2-10 spread, or for those with a little longer time horizon, the 5-30 spread. For real bond traders, this must be maddening. Most of these supposed yield curve experts have probably never even traded the FV/US spread. Heck, most of them likely don’t even realize there is a specific contract combo listed on the CBOT (I know it’s now the CME, but in my mind, bonds will always trade at the CBOT).

Yield curve talk obsession – perception or reality?

Wondering if it was merely my perception, or if there really was more interest in the yield curve, I queried Google Trends. Thinking maybe it was like when you are about to buy a new car and all of a sudden notice a huge uptick of those cars on the road, I worried my brain was distorting the market’s interest in the yield curve.

Nope. I was right. Interest in the yield curve has been shooting through the roof. Of no great surprise were the areas that registered the most increase in yield curve searches. After NY and Connecticut, it was Washington and then Boston. Basically, the finance states are worried about the flattening yield curve.

But of course there is more yield curve talk within the financial press – we are at that point in the cycle when it is used as a timing signal for the onset of a recession. So maybe I should be comparing the yield curve interest to this point during the previous economic cycle. Did we also see an uptick in yield curve talk last time?

Much to my surprise, there were more people googling “yield curve” in 2005 than today. Would have never guessed that.

My take? All the “real” bond traders will become even more frustrated in the coming months as yield curve talk continues to dominate the airwaves. Watch for even more “yield-curve-disaster-in-the-making” articles.

Markets never set up so neatly

Let’s have a look at why so many seem obsessed with watching the yield curve. During the past three recessions, the 2-10 year US Treasury yield spread went negative about a year before the onset of the economic slowdown.

What a perfect signal. You wait for the 2-10 spread to go negative, give it a year, and then bet on a recession. It’s that easy.

Well, I might not know much, but one thing that has gotten me into more trouble is to assume markets will play out neatly according to a schedule. By the time everyone is talking about an indicator as a “can’t miss” signal, it’s time to think about finding a new one.

I admit it – I’m a yield curve apologist

One of my favourite fixed-income strategists is Janney’s Guy LeBas. Lately I have been having a good laugh at Guy’s labeling of pundits as “yield-curve-apologists.” If I may paraphrase his argument, Guy believes the world’s largest market’s collective wisdom is the best signal out there and for those that somehow find a way to convince themselves they know better than the market are arrogant beyond belief. Yeah, I get it. We all know the most expensive four words in the history of investing.

Guy has little time for the central banking academic sect who warn the yield curve might no longer be a reliable economic signal, ironically, due to the quantitative easing programs central banks themselves instituted. From the FT:

At the risk of taking the other side of Guy’s rant and being tarnished a ‘yield-curve-apologist”, I respectfully caution Bernanke & Co. might be correct. Yeah, I know – I threw up a little in my mouth as I wrote that, yet Bernanke might be right that the yield curve has lost its predictive power, but not for the reasons he believes.

Most “yield-curve-apologists” believe the gargantuan Quantitative Easing from the Bank of Japan and the ECB is distorting the long end of the US bond curve. They argue the recent flattening is little more than capital seeking to pickup some yield by venturing out the US yield curve. Why invest in Japanese 10-year JGBs at 0.11% when US 10s are yielding almost 3%? This incessant QE bid has kept the US long-end much lower than would otherwise be the case and thus rendered the yield curve signal less effective.

Well, I think Guy would argue that the US bond market is bigger than the BOJ and the ECB and there have always been different forces at work, yet the yield curve has consistently provided a signal for the onset of the next recession. The market is smarter than any one of us. Don’t try to outguess what it is telling you.

But what if the Fed is influencing the yield curve in another way?

As I have mentioned before, I believe the exponentially growing amount of sovereign debt and government’s willingness to inflate it away will eventually cause the yield curve to hit all-time wides.I find it perplexing that often those market participants most worried about the growing government debt are the very same ones advocating owning long-dated “supposedly safe” sovereign bonds. The more debt that is created, I believe the more likely it will be inflated away.

No sense going through all the arguments about whether governments and central banks can accomplish this feat – I firmly believe that history suggests they can, but that’s a story for another time.

What is most interesting is the market’s perception of this growing debt, and how the Fed’s reaction function affects the yield curve.

I have had the good fortune to talk to a lot of people way smarter and knowledgeable than myself. The other day I was chatting with the head long-bond trader for a big bank and we were chatting about the curve. I told him how I was bullish on rates (with a curve steepening) and he asked how I could square that with the fact that R* was falling. He asked me my estimate for R* and I told him that I didn’t bother trying to estimate the short-term economic equilibrium interest rate as I felt it was too much of a guesstimate even from economists who practice the dismal science full time. Instead, I look at the direction of the trend, which in this case is higher inflation and a stronger economy, and measure the risk-reward of it either getting stronger or weaker. With real rates still firmly negative, fiscal policy more stimulative than any time in a decade, and most importantly, an absolute monster pile of monetary fuel just waiting to be lit, I thought the risks were that the economy would propel higher than most were expecting.

The long-bond trader politely listened to my argument, but then proceeded to teach me how “real bond traders” created their forecast. He argued R* (the natural level of interest – the equilibrium rate) was crucial to calculating the terminal point of the Fed Funds hiking cycle, and that this estimate reverberated throughout the curve. If a fixed income portfolio manager’s R* estimate was 2%, then with 2% inflation the economy would most likely stall if short rates were raised above 4%. As the Federal Reserve hikes Fed Funds closer to 4%, the portfolio manager is willing to increase his duration (buy more longer dated bonds) because he/she views the Fed’s restrictive monetary policy as likely to slow down the economy and cause rates to be lowered. Guessing the terminal point of the Federal Reserve hiking cycle becomes the most important game in town.

Obviously, it is more complicated than that, so I don’t mean to suggest that if you could predict the last Fed hike that you could determine the right price for the US 10-year Treasury yield, but there can be no denying that this exercise is one of the most important influences on the US treasury curve.

Falling natural level of interest

This R* or the natural level of interest has been falling for quite some time.

There are plenty of different reasons for this phenomenon, but all you need to do is look at a long-term graph of interest rates to realize that the economy has stalled at progressively lower and lower levels of Fed Funds.

Back to my long-bond trader buddy, his argument came down to the fact that Fed Funds have peaked at decreasing levels, and that on this cycle, the Fed had taken the rate close enough to the level at which the economy would stall, and therefore it was time to head out the curve. This is why the curve has been flattening. It is the collective judgment of all market participants that the Fed is increasing the chances that the economy stalls due to higher short-term rates.

The question then becomes, who am I to suggest that I know better than the market?

Well, although I don’t pretend to have all the answers, I don’t buy for one second that the market is some sort of all-knowing signal that never gets it wrong. The DotCom bubble, “real estate never goes down on a national level” mania, Japan in the 1980s – there are plenty of times when markets have been spectacularly wrong.

So I don’t think that just because the yield curve is flattening that we must accept the economy is slowing. Especially when the actor that sets the short-term interest rates (the Federal Reserve) can influence R* by simply stating their estimate.

As the Federal Reserve has lowered their long-run estimates of the natural level of interest rates, investors have responded by flattening the curve. After all, if the Federal Reserve believes that long-run growth will be limited, that equates to a lower terminal fed funds rate. This, in turn, makes longer dated bonds more attractive and encourages investors to extend duration.

Yet does the Fed really know any better than anyone else what is R*? If the Fed came out tomorrow and said that they believed the natural rate of inflation was 50 basis points lower, would that actually cause the natural level of interest to fall 50 bps? Yet this admission by the Federal Reserve would flatten the curve without anything actually changing in the real economy.

So I call bullshit on the fact that anyone really knows R*, or that anyone can predict when the Fed funds rate hike will stop. The truth of the matter is that there are so many different variables, it is unknowable.

But maybe I am making Guy’s argument for him. Maybe no one can tell, but the wisdom of the largest market in the world is the best guess. Sure, I buy that.

Yet what I am even more sure of is that at major turning points in market cycles, old paradigms die hard. Did the bond market believe Volcker would kill inflation? Not a chance. Even when he cranked short-term rates, markets assumed inflation would continue rising aggressively. So where was the “collective wisdom” of that market reaction?

The bond market might be deeper, more liquid and ultimately more efficient than any other market in the world, but it’s still a reflection of human beings. And human beings get it wrong. All the time.

Fading history and the “smart money”

Here is my prediction – there is a good chance the yield curve has become a less reliable economic signal. I understand that I am not only fighting history with that statement, but going against the likes of Gundlach and Rosenberg (and even more scarily – LeBas!) So be it. I have made bad calls before, and this won’t be the first, nor the last.

But I refuse to believe that R* is anything more than a made up estimate prone to massive errors. The yield curve is flattening because everyone is convinced they know that level. Well, what happens if the economy doesn’t roll over on cue?

My suspicion is that the yield curve will get increasingly more volatile as we progress through this next change from a dis-inflationary to inflationary environment. Although I think the 2-10 will eventually hit record wides, it also wouldn’t surprise me if the curve plunges to weird negative levels that convinces the majority of participants that a recession is right around the corner, yet the signal ends up being false.

I realize I am being mopey and not firmly stating a forecast. I get it. Five years from now the yield curve will be much, much steeper, but how we get there, I don’t know. When Volcker raised rates and killed inflation, the curve became super volatile. It bounced around like a bunch of squirrels chasing each other in spring. But the end result was that bonds were a screaming buy. Just the opposite situation to today. Central banks and governments are determined to create inflation and bonds are a screaming sell. Just don’t ask me for specific timing.

Now I have to run. LeBas wants to scold me on twitter for my idiocy of joining the #yieldcurveapologists…

via RSS https://ift.tt/2v5UXnX Tyler Durden

Accusations of sexual misconduct and nepotism have come out against former Federal Emergency Management Agency (FEMA) personnel chief Corey Coleman just weeks after Coleman resigned in June. The Washington Post reports that Coleman, whose $177,150 salaried, senior-level role began in 2011, allegedly used his position to hire and promote both personal friends and women with whom he had a personal interest, despite their lack of qualifications. He also allegedly instituted practices that placed certain female employees in close proximity to certain male employees for sexual purposes.

Accusations of sexual misconduct and nepotism have come out against former Federal Emergency Management Agency (FEMA) personnel chief Corey Coleman just weeks after Coleman resigned in June. The Washington Post reports that Coleman, whose $177,150 salaried, senior-level role began in 2011, allegedly used his position to hire and promote both personal friends and women with whom he had a personal interest, despite their lack of qualifications. He also allegedly instituted practices that placed certain female employees in close proximity to certain male employees for sexual purposes.

More than 450 Floridians have been ordered to surrender their firearms since the state’s “red flag” law took effect in March, according to a new report.

More than 450 Floridians have been ordered to surrender their firearms since the state’s “red flag” law took effect in March, according to a new report.

Venezuelan President Nicola Maduro took to television last week to announce his solution to the country’s monetary woes: eliminating five zeros on all new Venezuelan bolivar bills.

Venezuelan President Nicola Maduro took to television last week to announce his solution to the country’s monetary woes: eliminating five zeros on all new Venezuelan bolivar bills. The death penalty is surfacing as a key issue in Louisiana’s upcoming gubernatorial election, in 2019. With execution drugs unavailable, the state’s top prosecutor is proposing the use of new drugs, nitrogen-induced suffocation, or “hanging, firing squad, or electrocution,” if necessary.

The death penalty is surfacing as a key issue in Louisiana’s upcoming gubernatorial election, in 2019. With execution drugs unavailable, the state’s top prosecutor is proposing the use of new drugs, nitrogen-induced suffocation, or “hanging, firing squad, or electrocution,” if necessary. But Louisiana Attorney General Jeff Landry (R) is not convinced that the problem is legitimate, nor that a solution is really out of reach for Edwards. In a late July

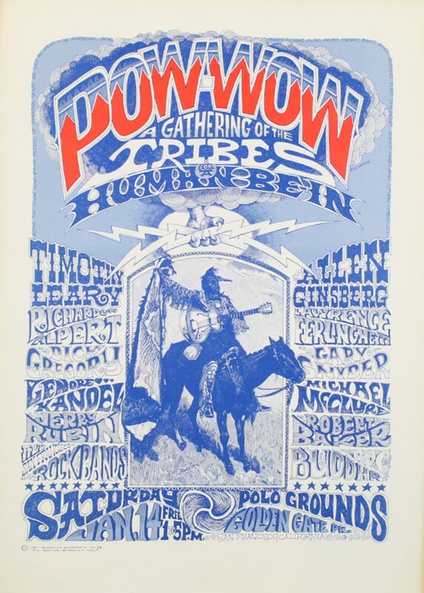

But Louisiana Attorney General Jeff Landry (R) is not convinced that the problem is legitimate, nor that a solution is really out of reach for Edwards. In a late July  Back in San Francisco in 1967, there was an event that helped catalyze the “Summer of Love” and was variously billed as

Back in San Francisco in 1967, there was an event that helped catalyze the “Summer of Love” and was variously billed as  The Koch’s sins are that they disagree with Trump on many issues, including criminal-justice reform, trade, and immigration. They want more of it than the president and his supporters, who have managed in just a few years to utterly transform the GOP into the party of protectionists and xenophobes. It wasn’t always this way, as anyone who remembers Ronald Reagan and George H.W. Bush

The Koch’s sins are that they disagree with Trump on many issues, including criminal-justice reform, trade, and immigration. They want more of it than the president and his supporters, who have managed in just a few years to utterly transform the GOP into the party of protectionists and xenophobes. It wasn’t always this way, as anyone who remembers Ronald Reagan and George H.W. Bush