Authored by Pater Tenebrarum via Acting-Man.com,

US Money Supply and Credit Growth Continue to Slow Down

Not to belabor the obvious too much, but in light of the recent sharp rebound, the stock market “panic window” is almost certainly closed for this year.* It was interesting that an admission by Mr. Powell that the central planners have not the foggiest idea about the future which their policy is aiming to influence was taken as an “excuse” to drive up stock prices. Powell’s speech was regarded as dovish. If it actually was, then it was a really bad idea to buy stocks because of it.

Jerome Powell: a new species of US central banker – a seemingly normal human being in public that transforms into the dollar-dissolving vampire bat Ptenochirus Iagori Powelli when it believes it is unobserved.

We say this for two reasons: for one thing, the Fed is reactive and when it moves from a tightening to a neutral or an easing bias, it usually indicates that the economy has deteriorated to the point where it can be expected to fall off a cliff shortly.

In this case it seems more likely that Mr. Powell has tempered his views on tightening after contemplating the complaints piling up in his inbox and looking at a recent chart of 5-year inflation breakevens. After all, there is no evidence of an imminent recession yet, even though a few noteworthy pockets of economic weakness have recently emerged (weakness in the housing sector is particularly glaring).

Recall that the last easing cycle began with a rate cut in August 2007. This first rate cut was book-ended by a double top in the SPX in July and October. Thereafter the stock market collapsed in the second-worst bear market of the past century – while the Fed concurrently cut rates all the way to zero (and eventually beyond, in the form of QE).

For another thing, regardless of what Mr. Powell says, quantitative tightening continues at full blast for now. There is little to offset it, as growth in inflationary bank credit remains anemic. Mind, we do not see this as a negative development, on the contrary. It will hasten structural improvement of the economy by discouraging further malinvestment of scarce capital. Nevertheless, it is definitely bad news for overvalued “risk assets” and existing malinvestments.

Our friend Michael Pollaro has provided us with the table shown below, which tracks outstanding Fed credit and the components contributing to changes in the total. It shows that QT has really grown some teeth in recent months; as expected, the year-on-year decline in net Fed credit is accelerating of late. It is bound to accelerate even further in coming months, as several difficult y/y comparisons are directly ahead.

Developments in outstanding net Fed credit (as of 01 November). A year ago Fed credit was still growing at 8.9% q/q and 4.6% y/y, despite QT already being underway. The decline in securities held outright was primarily offset by the rundown of reverse repos with domestic banks. These are now completely unwound – what remains are reverse repos with foreign institutions, which usually do not change much over time. As a result changes in outstanding Fed credit are now almost exclusively driven by the rundown of the QE portfolio.

Growth in the broad true US money supply (TMS-2) has resumed its slowdown in concert with the decline in Fed assets. The temporary boost from repatriation flows already appears to be subsiding (this is indirectly reflected by the Treasury’s general account with the Fed, which peaked at $403 billion in April – it stands at $332 billion as of the end of November; still elevated, but no longer rising. We have discussed the mechanics of this in previous updates – see here and here).

Various other factors supporting domestic US money supply growth jumped into the breach during pauses in the three iterations of QE. These included foreign investors moving euro-dollar deposits to US banks when the FDIC temporarily granted unlimited deposit insurance, money market funds repatriating euro-dollars to comply with new regulations (instead of funding dollar-denominated commercial paper in Europe, they switched to buying t-bills) and the recent repatriation of funds held by US-based multi-national corporations on account of the tax reform.

Moreover, total bank credit growth tended to accelerate as well during pauses in QE, initially mainly driven by non-mortgage loans. This has changed rather noticeably since the late 2016 interim peak in TMS-2 growth: Since then growth in total bank lending has also slowed quite dramatically. Regardless of the reasons for this slowdown in lending, it directly affects money supply growth.

Note though in this context that commercial & industrial loan growth has in fact continued to accelerate lately. As we discussed previously, this phenomenon is often encountered in the late stages of a boom, as companies begin to scramble for increasingly scarce free capital (see “A Scramble for Capital” for the details).

The chart below shows the year-on-year growth rate of TMS-2 with its 12-month moving average and the y/y growth rate in total US bank credit until the beginning of November:

US TMS-2 y/y growth (blue line) has slowed to 3.8% at the end of October – from an interim peak of 4.66% recorded just two months earlier. Lower readings were so far only recorded from September 2017 to February 2018, before the repatriation effect became detectable. Total bank credit growth has slowed to 3.4% at the end of October, a pace last seen in April of 2014 (on the way up at the time). This is far from the high single-digit to low double-digit annual expansion rates in total bank credit normally associated with boom periods.

Just How Tight is Fed Policy to Date?

Looking at the hikes in the federal funds rate to date, many observers note that it remains very low both compared to historical levels and relative to recent CPI and GDP data. While this is true, one also has to take into account the amount of debt growth that has occurred in the meantime. For many borrowers servicing their much larger debt may become problematic at much lower rates than previously.

Since ZIRP (zero interest rate policy) was in force for several years, it is fair to assume that many of the long term investments that were undertaken in this time period have exceptionally low profitability hurdle rates, i.e., the interest rate threshold at which they become unprofitable is probably very low.

As we have mentioned in earlier updates, there have been attempts to translate the effect of QE into the equivalent of cuts in the federal funds rate. A chart recently published in the FT shows an estimate of the cumulative effect of the QE unwind and the FF rate hikes implemented to date, known as the “Wu-Xia shadow federal funds rate”.

Readers can find updates and details on the Wu-Xia model at the Atlanta Fed here; also available is a 2015 working paper on the topic entitled “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound” (PDF), which Jing Cynthia Wu and Fan Dora Xia penned for an IMF research conference.

Based on the Wu-Xia “shadow federal funds rate”, the extent of implied tightening by the Fed has already surpassed the extent of the three previous major tightening cycles. We have doubts about that conclusion and the idea that the hypothetical effect can be modeled with such precision, but we do agree that the unwinding of QE has effects that very closely resemble those exerted by rate hikes.

The cumulative effect includes the tapering period, this is to say, the entire move from a theoretically negative FF rate (ZIRP + QE translates into a negative rate based on the model) to the zero bound and then back above it. The article explicitly mentions the “unwind that started in 2014” in this context (i.e., the tapering period).

We obviously have reservations with respect to whether the effects of QE can really be quantified in this manner. At the same time we acknowledge that the idea has merit in principle – the effects of QE are no doubt akin to those of additional rate cuts. We only doubt that they are really measurable or can be modeled with any precision.

Nevertheless, if one accepts the premise in principle, then it is clear that the cumulative impact of QT and the eight rate hikes to date is greater than the relatively low nominal FF rate would suggest. We also believe that given that QT is now finally “fully on track”, its effects should be felt with a considerably shorter lag time than that normally associated with rate hikes.

Rate hikes tend to affect money supply growth indirectly by curbing credit demand – and it takes considerable time for this to percolate through the system. The impact of “QT” is far more direct – debt repayments the Fed no longer reinvests immediately result in a commensurate decrease in the money supply.

Conclusion – A Dangerous Environment for Overvalued “Risk Assets”

Preliminary data for November suggest that TMS-2 growth has likely decelerated further to around 3.6% y/y. In short, Mr. Powell’s speech notwithstanding, the data indicate that the removal of the punch bowl remains in full swing.

Despite the recent verbal backtracking, monetary conditions continue to become tighter – presumably until something breaks. Experience suggests that something will. [ed. note: the punch bowl cartoon was adapted from a late 2013 Danziger original that had Ben Bernanke as the punch bowl repo-man – which seems absurd in retrospect, but he did announce the “taper” of 2014 at the time].

In short, the environment continues to become ever more challenging for stocks and bonds. The recent increase in market volatility is unlikely to remain an exception and should actually be seen as a serious warning sign. Note that credit spreads have recently begun to break out across a broad range of rating categories as well.

Lastly, the activities of foreign central banks are no longer as supportive as they used to be – the slowdown in money supply growth is not confined to the US, it has become a global phenomenon. We plan to post a missive discussing the situation in the most important currency areas in detail soon; for now, here is a recent update illustrating the slowdown in G3 central bank balance sheet growth (via Topdown charts/ Reuters):

While the Fed’s balance sheet is already shrinking, balance sheet growth at the ECB and BoJ has concurrently slowed substantially and seems set to eventually go into reverse as well (unless the next crisis strikes first, which seems increasingly likely to us). Note that this has in fact also resulted in a noteworthy slowdown in money supply growth in both the euro area and Japan. Meanwhile, broad money supply growth (M2) in China is currently at its lowest level in at least 20 years, with narrow money supply growth falling rapidly as well. Overall, the monetary backdrop is diametrically opposite from the one that was in place around the market lows of early 2009 and during the subsequent recovery.

* * *

Footnote:* December crashes are extremely rare – in fact there has been just one as far as we know, and it happened when the NYSE reopened in December of 1914 after having been closed for about three months. World War I was raging at full blast by then and the market quickly tanked by around 40%. Market weakness in December is as such unusual as well, but has definitely happened on a number of occasions.

via RSS https://ift.tt/2Pe90z2 Tyler Durden

The weird thing about George H.W. Bush’s term in the White House, looking back a quarter-century later, is that back then I thought he was the worst president of my lifetime. Bear in mind that I was born when Richard Nixon occupied the Oval Office, so worst president of my lifetime was a pretty high bar to clear. But I was in college in the Bush years, old enough to pay attention to what was happening in the world and young enough to lack perspective on just how bad things could get. There’s a certain sort of apocalypticism that comes easily to you when you’re 20 and you want to stop a war.

The weird thing about George H.W. Bush’s term in the White House, looking back a quarter-century later, is that back then I thought he was the worst president of my lifetime. Bear in mind that I was born when Richard Nixon occupied the Oval Office, so worst president of my lifetime was a pretty high bar to clear. But I was in college in the Bush years, old enough to pay attention to what was happening in the world and young enough to lack perspective on just how bad things could get. There’s a certain sort of apocalypticism that comes easily to you when you’re 20 and you want to stop a war.

Former President George H.W. Bush, who served one term in office from 1989 through 1993,

Former President George H.W. Bush, who served one term in office from 1989 through 1993,

Needless to say, it didn’t turn out that way. The United States

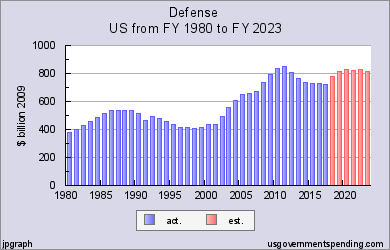

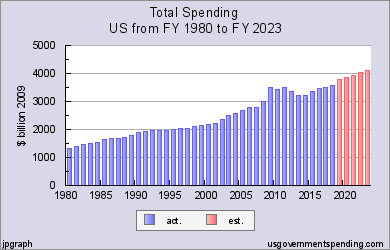

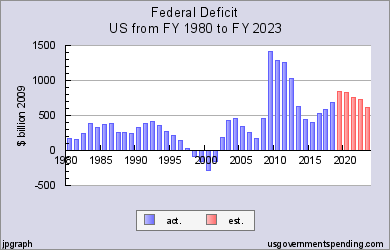

Needless to say, it didn’t turn out that way. The United States  This much is certain, and should resound today, when our budget situation is much more dire in terms of spending, revenue, and deficits. On the spending side, the plan constrained the rate of spending growth but didn’t actually propose year-over-year cuts. As Reason‘s Charles Oliver

This much is certain, and should resound today, when our budget situation is much more dire in terms of spending, revenue, and deficits. On the spending side, the plan constrained the rate of spending growth but didn’t actually propose year-over-year cuts. As Reason‘s Charles Oliver