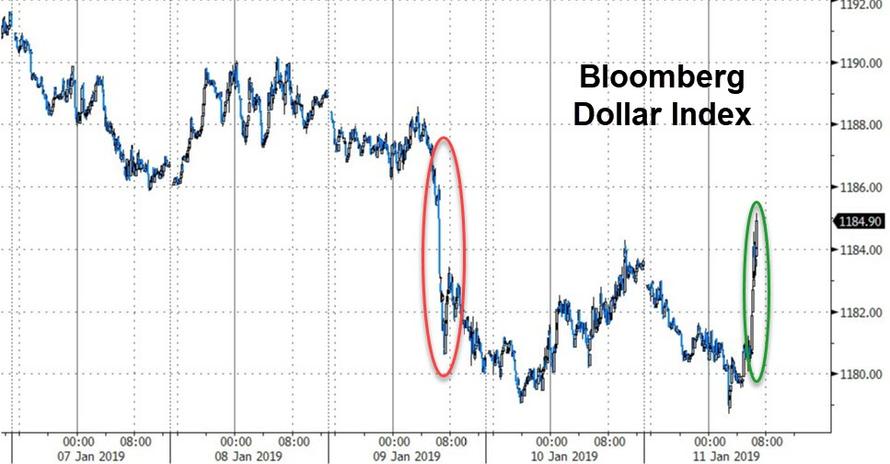

And just like that – with no catalyst – everything reverses…

As Richard Breslow noted earlier, “The dollar has gone from chump to champ as Turkish troop movements on the Syrian border have caused a quick flight to safety.”

The dollar’s abrupt rally against the euro and the yen may have been fueled by investors trimming positions heading into the weekend, said Mazen Issa, senior foreign-exchange strategist at TD Securities.

“After a week that saw the dollar trade on its backfoot by an appreciable degree, there may be some lightening of positions,” Issa wrote in an email. “These markets are different, and carrying risk into the weekend may not be prudent — especially when obvious, though consequential, risks with unknown outcomes are around the corner.”

And it seems everyone is unwinding the momo trades across all assets too…

Stocks retested a critical resistance level…

And failed…

After a mini-bloodbath, bonds are suddenly panic-bid – double-topping at 2.75%…

And WTI hit $53 and tumbled…

Will Trump quickly tweet that “trade talks are going well”? Will A few head subtlely suggest QE5 is coming? Sadly, that is all that matters.

via RSS http://bit.ly/2FlUIvS Tyler Durden