Hours after the Wall Street Journal published a story speculating about who would be next to upend an equity rally with a warning about faltering sales in China (after Apple’s quarterly revenue guidance cut rattled markets during the opening days of the year) – citing Starbucks, Nike, Texas Instruments and a host of chipmakers and luxury retailers as potential culprits – the answer has arrived perhaps more swiftly than the paper’s editors had expected. And the answer is: None of these.

As it turns out, the latest warning about “near-term headwinds” in the Chinese market comes from a company that’s so deeply interwoven into the fabric of the Chinese economy, even the hint of a sales slowdown should be enough to trigger anxieties about slowing global growth – even as its CEO tries to put a positive spin on things. And that company is: Alibaba.

According to a separate story published by WSJ Monday afternoon, as the ramp in equities spurred by Trump’s positive trade talk faded into the close, the president of the Chinese e-commerce giant reportedly said during a presentation at the National Retail Federation’s trade show in New York that he’s still confident in the long-term potential of the Chinese economy despite data showing a deepening slowdown.

“This is a market that requires patience,” Alibaba President J. Michael Evans said in a presentation at the National Retail Federation’s annual trade show in New York on Monday. “But if you think about where the country is going in the long-term…The future I think looks very good, notwithstanding some troubling headwinds.”

As WSJ reminds us, Alibaba, whose Taobao and Tmall marketplaces are some of the most widely used e-commerce platforms by Chinese consumers and merchants, cut its full-year revenue forecast by 4% to 6% back in November over concerns about the slowing Chinese economy’s impact on sales growth, as well as the possibility that the burgeoning trade war could also hurt sales.

Alibaba President J. Michael Evans

Yes, China’s economy may be slowing – something that recently prompted the Communist Party to rethink its GDP growth projections – but it’s still growing much more quickly than its developed rivals in the West (economists expect the US economy expanded by an annualized rate of 2.5% during Q4, while China notched yoy growth of 6.5% during Q3). Over the next decade, China will likely surpass the US to become the world’s largest economy.

Unfortunately, that won’t do much to assuage the fears of equity investors who are growing increasingly anxious about the prospects for a recession in the near-to-medium term.

Still, over the next 10 years, China will probably become the largest economy in the world, Mr. Evans said, with consumption as a percentage of gross domestic product accounting for the biggest piece.

“China is the largest consumer market in the world, and the things that they want to buy are for the most part not produced in China,” Mr. Evans said. Alibaba has tens thousands of brands, including many from the U.S., that sell products directly to Chinese consumers.

That market is expected to grow as Chinese consumers gain wealth.

“There are 300 million today that are in the middle class,” he said. Over the next five years, “another 300 million to 400 million people will move into the middle class, and it will not be a market that most small businesses and retailers can afford to ignore…If you’re a retailer, it’s a great market for the future, but it will take time.”

A surprising 4.4% drop in exports during Q4 suggests that China’s stage-managed transition from an industrial, export-driven powerhouse to a more service-centric, consumption-dependent economy is in part responsible for the slowdown. And though China has imposed more tax cuts and monetary stimulus to try and fight the slowdown to reach its goal of doubling its GDP during the decade ending in 2020, investors are beginning to doubt whether the Chinese haven’t already exhausted these policy measures.

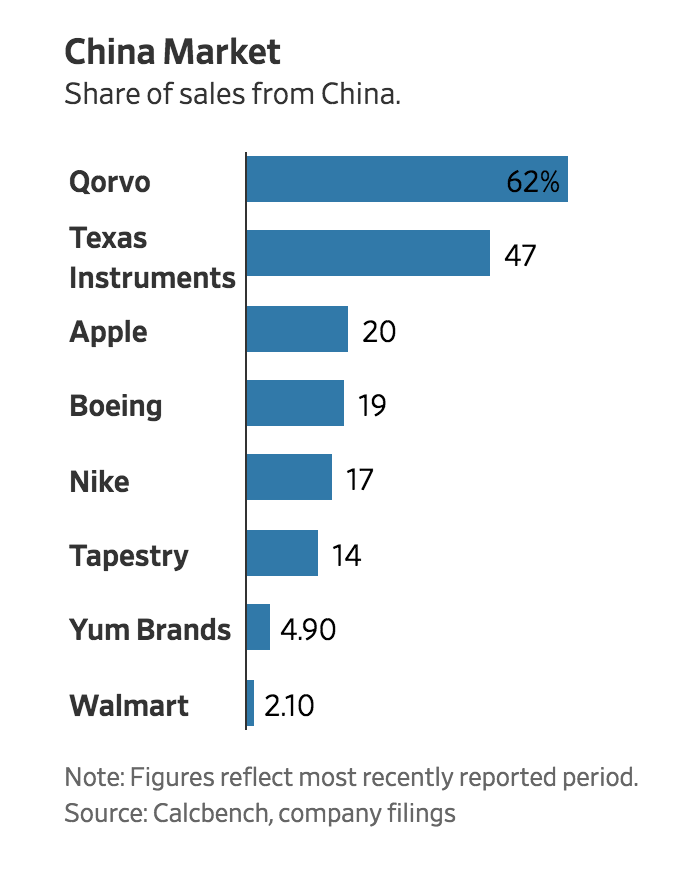

But with the trade war still in a state of suspension, and anxieties about growth at a fever pitch after last year’s abysmal equity market returns, analysts will be scanning every earnings report for signs that more bad news might be coming from the Middle Kingdom.

via RSS http://bit.ly/2RpM5qs Tyler Durden