Months of extreme volatility have taken their toll on the pound, with traders declaring the G10 currency “untradeable” during the worst of the withdrawal-deal related chaos last year, as daily swings of multiple percentage points became increasingly common, prompting some traders to muse once again about how the pound – one of the world’s most liquid, heavily traded currencies, was behaving more like the Turkish lira than a designated global reserve currency (as its membership in the IMF’s SDR basket would suggest).

Now, after months of wrangling in Brussels and Westminster, Theresa May’s supremely unpopular Brexit withdrawal deal is finally coming up for a vote Tuesday night.

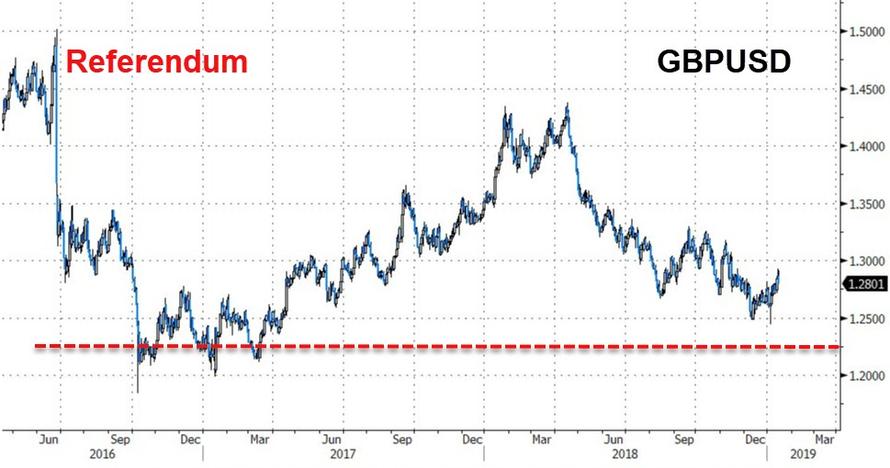

On Monday, optimism ahead of the vote, spurred by reports that May might quietly support amendments to put a time limit on the Irish Backstop (which, again, ideally would never take effect in the first place), briefly pushed the pound above $1.29, its highest level since November.

Given the widespread opposition to the deal across party lines, May’s deal has almost no chance of passing. Rather, currency traders will be keeping a close eye on the vote count, with 225, the margin by which May is expected to lose the vote, seen as the crucial demarcation.

In a roundup of comments from currency traders and strategists at some of the big banks that have been paying close attention to Brexit, traders warned that the deal’s defeat wouldn’t necessarily provoke a strong response in GBP. But a massive defeat of a magnitude that could raise the possibility of Theresa May facing – and losing – a no-confidence vote tabled by the opposition could send the pound back toward $1.22 (it was trading around $1.28 on Tuesday ahead of the vote).

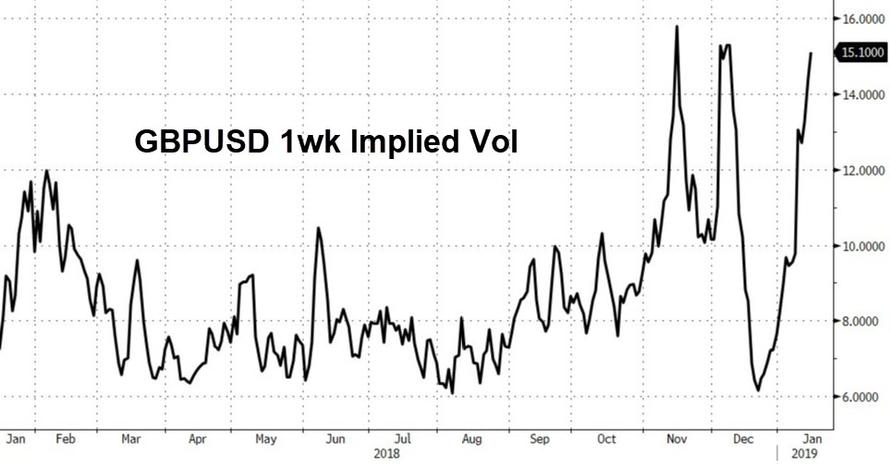

Of course, that cuts against the fact that one-week volatility in the pound has surged in recent days, suggesting that traders are bracing for some unruly action before, during and after the vote.

Though others argued that the pound might not react much no matter the outcome of the vote:

- The U.K. currency may not trade anywhere near its cycle lows even if Theresa May faces a big defeat, while any gains should be contained as uncertainty will remain the name of the game even if the prime minister survives the vote with a narrow defeat.

In a story about May’s government facing possibly the worst defeat for a ruling party in nearly a century, Bloomberg included a quote by Neil Jones, head of hedge-fund currency sales at Mizuho Bank, that a defeat by more than 220 votes could send the pound back toward $1.2250.

And many political analysts are still worried that a resounding defeat could topple May’s government.

“I’m not sure a rejection of the prime minister’s deal is a victory for anybody,” Citigroup chief global political analyst Tina Fordham says.

“If the prime minister is wiped out tonight in Parliament, her deal is dead and probably her premiership along with it.”

Below is a guide to the position, technicals and expectations ahead of Tuesday’s note (text courtesy of Bloomberg):

POSITIONING

-

Short-term accounts have either trimmed shorts or put on small long positions on the pound, according to two traders in London and Europe, as a more positive outcome for the pound is steadily being priced in.

-

Risk reversals have reversed or greatly narrowed the premium in which pound puts trade over calls in the front- end. The move comes as cable stands 0.9% stronger since Jan. 1 and 3.6% higher since December lows. The vol skew shows investors see pound troubles rising after the current official Brexit deadline expires.

-

Options trades this year are almost equally split between upside and downside exposure, data from the Depository Trust & Clearing Corporation show.

-

While the market remains structurally short the pound, it is unclear at what spot level long-term players would unwind their holdings, traders say.

TECHNICALS

-

Following Jan. 3 flash crash, the pound is sending one bullish signal after the other: Trendstall is no longer bearish on the weekly, cable closes comfortably above its 55-DMA, bulls take control of price action as Fear-Greed indicator shows, DeMark studies have yet to signal bullish bias is to revert.

-

Sustaining an extended rally won’t be an easy task as a series of resistance levels lie ahead, with the upper trendline of a channel since September coming near 1.3000.

EXPECTATIONS

-

There is almost unanimous agreement by market participants that Theresa May won’t be able to see her Brexit deal approved and thus face the biggest Parliamentary defeat for a British government in almost a century.

-

Analysts see a 100-vote loss as the line in the sand for pound longs, with anything bigger than that risking a move south for sterling; a general election could see cable dropping to 1.2000, according to ING, while Credit Agricole sees 1.2500 as a key level.

-

One-day volatility in the pound suggests that a large move may be in store – the gauge has risen to its highest level since the U.K. June 20147 elections – yet by no means envisages such deep losses; breakeven on the vote stands at around 160 USD pips, according to single-bank platform pricing.

-

Mizuho sees a rally to 1.3350 as possible on a loss by a margin of 20 to 100 votes while Rabobank targets 1.3000 under a similar scenario.

-

Pound bulls would have a hard time taking out strong resistance at 1.3175-81, the Nov. 7 high and the 38.2% Fibonacci retracement of cable’s losses since April.

-

Demand for tails over the one-week tenor reveals that investors aren’t convinced the pound is up for a wild move in either direction until it gets clarity over whether an Article 50 extension, a second referendum or fresh elections are the next step forward.

-

Bloomberg’s FX pricing model suggests there is a 18% chance the pound touches 1.2500 in a week’s time, with 10% for a move to 1.3300.

* * *

Meanwhile, retail brokerages and currency exchanges – with the painful losses from the upset Brexit vote in June 2016 still fresh in their memories, are taking steps to limit any spikes in volatility around Tuesday’s vote. According to Bloomberg, London-based TransferWise is placing a 10,000 pound ($13,000) limit on transfers to and from the UK during a 24-hour period starting 9 am on Tuesday ahead of the House of Commons’ vote on Prime Minister Theresa May’s deal to leave the European Union. That’s far below the usual limit of 1 million pounds ($1.28 million).

Switzerland-based Dukascopy Bank SA is lowering leverage to just 30 times capital on pound trades until any market volatility subsides. Other brokerages and money changers say they will be staffing the office late to field client calls and put out any fires.

via RSS http://bit.ly/2Dc8qzd Tyler Durden