With the S&P trading just around 2,600, the risk of a wholesale short squeeze is imminent.

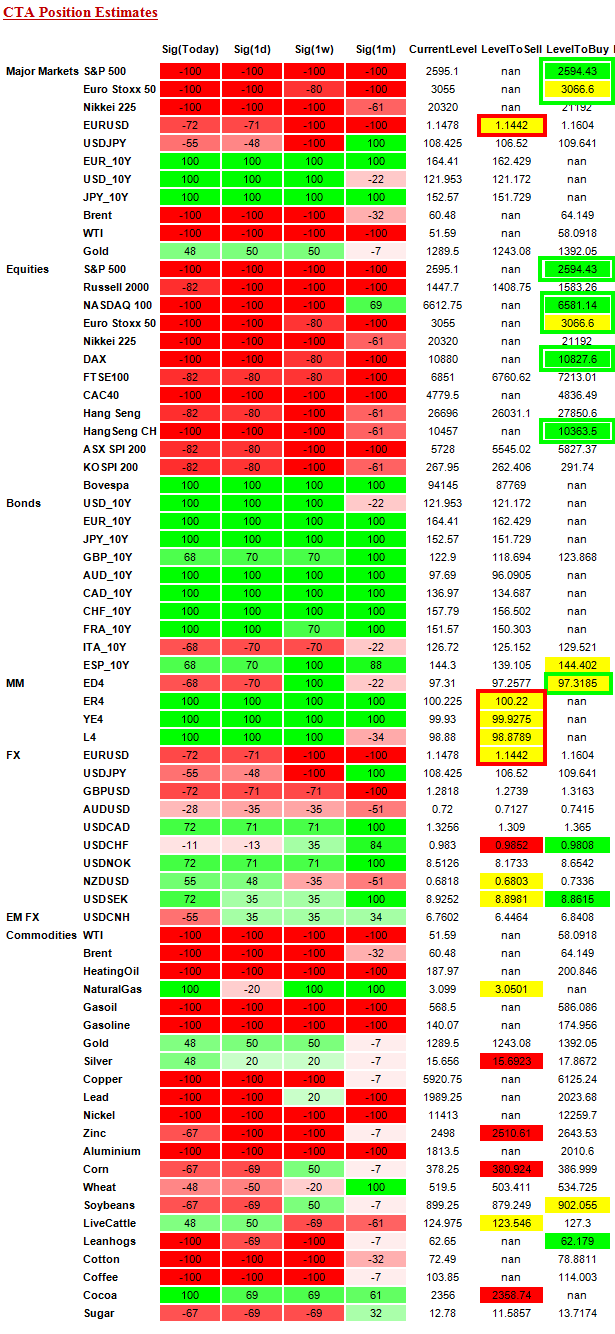

The reason: as we reported yesterday, according to Nomura’s Charlie McElligott who correctly called the December algo-driven rout which saw trend-following algos switch from net long to short for the first time in 3 years, whereas CTAs for the key equity indexes, the S&P, Stoxx and Nikkei are all still in the “Max Short” bucket, all that may be about to reverse, as the first “Buy to Cover” level is right where the S&P is trading now, or at 2,594 (however, it needs to close above this level for the short cover to be triggered).

Additionally, we listed several additional details from the Nomura analyst on where the max pain levels for algo shorts are, and where the market will almost certainly rise to before retesting if the short squeeze can push it even higher, or if a new wave of selling will emerge as Morgan Stanley predicted earlier:

- SPX at 2594, Nasdaq at 6581, Eurostoxx at 3066, DAX at 10827, Hang Seng CH at 10363—all would see current “Max Short” covered down to just “-82% Short” if today closes above those levels

As McElligott also added, late last week saw Russell, FTSE, Hang Seng, ASX and KOSPI all triggered modest short-covers from their prior “Max Short” positioning at the start of the week.

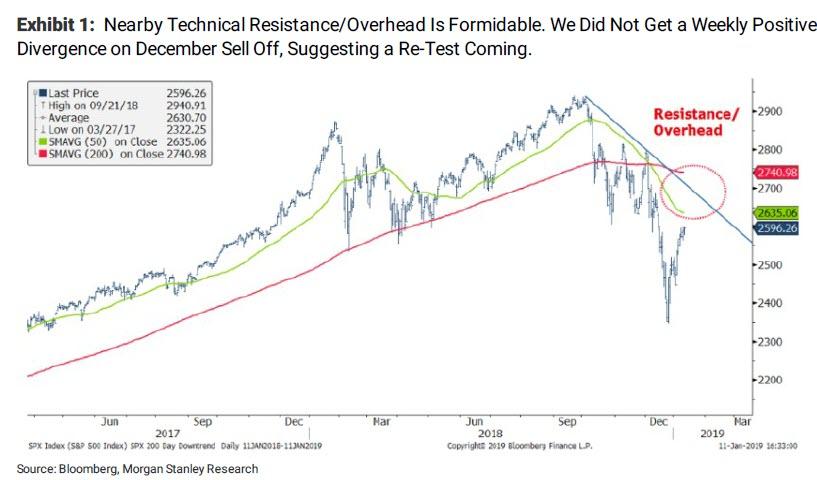

Ok, fine, but what happens after some modest short covering is initiated? After all, as Morgan Stanley’s Michael Wilson explained yesterday, there is “massive resistance” just overhead in the S&P, which is why “2600-2650 on the S&P 500 is a good level to start lightening up as we enter what is likely to be a period of negative news flow on earnings and the economy.”

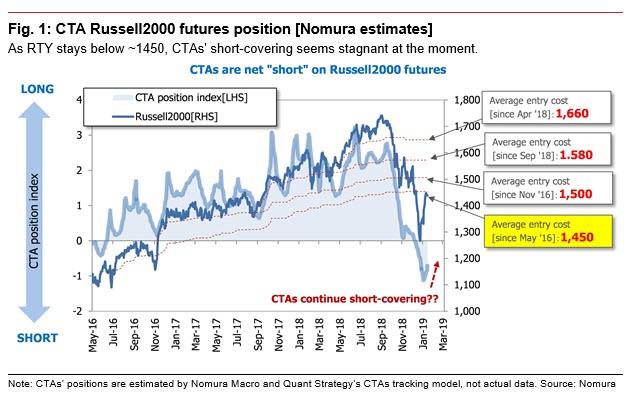

Ironically, one answer comes from Nomura’s “other” quant group, that headed by Masanari Takada, who echoes what McElligott said yesterday, and in a note sent overnight writes that “as a shortage of additional positive drivers and headlines has become evident, the improvement in US equity sentiment has solidified.” Even so, as all major stock price indexes approach technically important levels (e.g. ~2,600 of S&P500, ~1,450 of Russell 2000 etc), “CTAs are being gradually forced to cover their ballooned short positions for now.”

That said, not everyone is buying the rally, as some speculative players that retained a cautious stance due to deteriorating fundamentals – namely risk parity funds – have refused to increase their exposure to the market and may in fact be selling US equities on the rally.

Overall, Takada maintains a view that the current US stock market remains in “a stalemate in terms of the sustainability of the existing risk-on mood, with bullish and bearish players waging a heated offensive and defensive battle, and the US stock market should therefore remain in a struggle over the next few days.”

Meanwhile, going back to McElligott’s point, and the sharp spike in stocks this morning as the S&P finally breached the 2,600 level, Nomura adds otes that “some algo investors” could have started “to buy back US stocks in an automated response to the rebound of market trends as well as the decline in price volatility.” However, relative to the rebound in market momentum, the Nomura quant notes that “fundamental improvements have not been enough and we are somewhat wary of the lack of balance between them.”

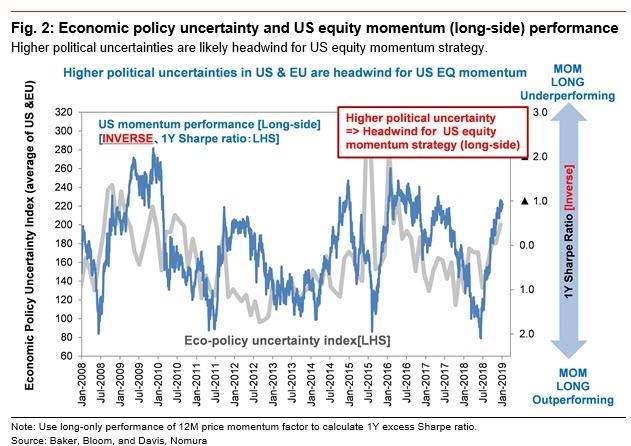

In particular, overall political uncertainty due to the US government shut-down and political conflicts are rising.

As a result, Takada concludes that if using past patterns between political uncertainty and US equity performance (long-side), “just systematically following the market uptrend will likely run of the steam under the gloomy US political situation.”

There are two more reasons why Nomura believes that the algo rally is about to fizzle:

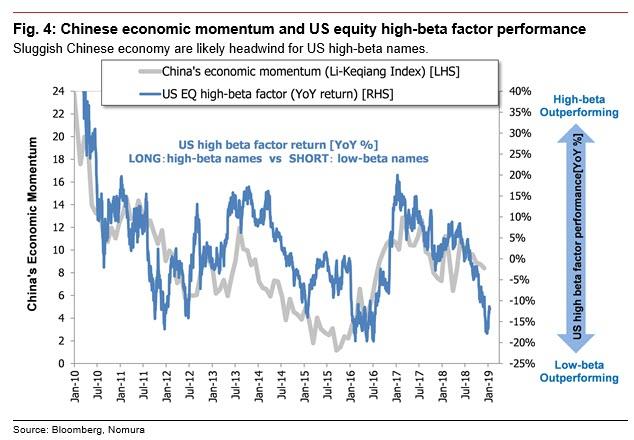

The first is that Chinese economic momentum, which the Japanese bank views as one of “reality check” factors, has remained sluggish so far, and “amid concerns over China’s economy, most investors in US equity markets tend to have no choice but to pick stocks using a process of elimination to avoid tilting their portfolio exposure to high-beta names.”

The second reason why an algo rally won’t last is that compared to the past typical market recovery phase, Nomura says that the current risk-rally lacks the sense of “euphoria” that belies the high-pitched rebound in stock prices. If the recovery of preference for momentum names or high-beta stocks comes to nothing, “algo-led buying of US stocks would less likely become spirited”, in Nomura’s view.

via RSS http://bit.ly/2SY1YRO Tyler Durden