Back in 2011 Srinivas Dhulipala was a successful prop trader for Bank of America, so successful in fact that he decided to branch off on his own and that year launched Kildonan Castle Asset Management, a credit hedge fund which at its peak, managed $550 million. Eight years later, after averaging a respectable 5% annual return, Dhulipala has decided to call it quits, unable to handle “the pain of running a modern credit hedge fund” according to Bloomberg.

“To do this day after day was just not fun anymore,” Dhulipala told Bloomberg in an interview. “It’s been eating away at me. You’re constantly feeling the pressure to perform on a monthly basis.”

The 48-year-old is throwing in the towel at a particularly tough moment for the broader hedge fund industry, when his peers just posted their worst returns since the financial crisis. Specifically, Dhulipala cited the near impossible challenge of outperforming the market while investing in a relatively illiquid asset class like credit while still offering quarterly redemption windows to clients.

As a result, with still some $300 million in AUM after a couple of years of tepid returns, his credit hedge fund will finish payouts at the end of the quarter and become the latest causality of the collapsing hedge fund sector as the money tsunami shifts away to cheaper and more efficient, for now, “passive” and “smart beta” alternatives.

Dhulipala, who will probably not have to work for a living every again, had some parting words for his peers: it would be better to run a hedge fund exactly opposite of how firms like his typically do, only instead of blaming the Fed, the former prop trader was envisioning the challenges of maintaining liquidity in an increasingly illiquid market.

“The best way to make money in this market is to do the reverse of what liquid credit hedge funds do,” he said. “You have concentrated bets and you have a long lockup to see it through any noise.”

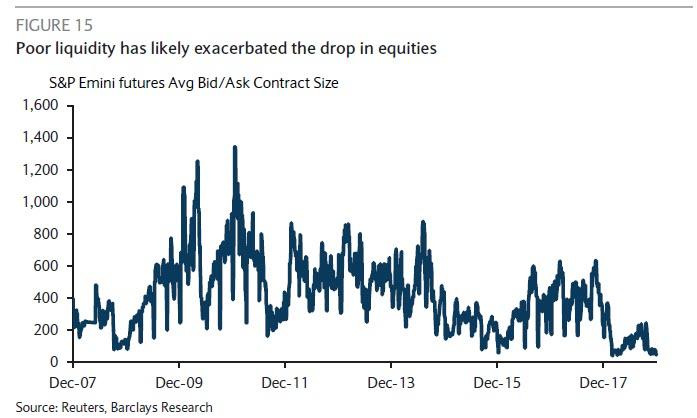

In Dhulipala’s perfect world, hedge funds would be paid 2 and 20, however they would have private equity-type lockups and massive redemption penalties. The alternative – in a world where liquidity just hit an all time low…

… is that slowly every hedge fund morphs into the S&P.

“Without the crutch of longer lockups, hedge funds must be ready at a moment’s notice to liquidate positions and accommodate redemptions. They end up having a widely diversified portfolio, which then look a lot like the broader market” he said, echoing sentiment that countless other hedge funds, and their LPs, have been voicing quietly for years.

Of course, as there is no reason to pay someone 2 and 20 for the “skill” of recreating the S&P, it explains why the $3 trillion hedge fund industry is, in its current form, doomed to go extinct unless central banks step away and allow risk to come back, alongside return.

As for Dhulipala, who designed airbags as an engineer before making the switch to Wall Street in 1999, he still hasn’t decided what he’ll do next.

“Flow of funds and top-down macro factors became more important than underlying fundamentals to make money over a short period,” he said. “You want to come to work and feel productive. In this type of a market you just don’t feel that way.”

Thank the central bankers for making the centrally-planned “market” no fun for anyone.

via RSS http://bit.ly/2RvlkB6 Tyler Durden