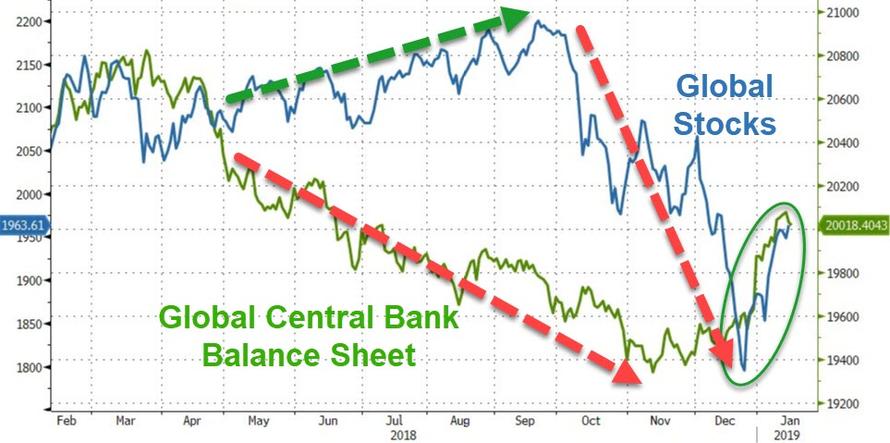

As we noted yesterday, a funny thing happened again at the start of January… global central bank balance sheets suddenly (and mysteriously) began to surge higher (despite ‘talk’ of tightening and normalization and a year of declines)…

Just like in 2018, 2017, and 2016, the start of the year has prompted a resurgence in the size of global central bank balance sheets… and just like in 2018, 2017, and 2016, global stocks (with US being the most liquid attractor of that flow) are soaring…

And it has prompted another chorus among the asset-gatherers and commission-takers that this rebound is all fundamentally-driven, it’s a reflection of reality and December was a ‘one off’ overshoot… in fact – we are in the “goldilocks” market once again.

Well, firstly, fundamentals have continued to disappoint – notably…

And, secondly, as former fund manager and FX trader Richard Breslow notes, a strong January does not make it 2017 (in fact it’s more like 2018…)

Traders are trying their hardest to convince themselves that, with some newfound help from central banks, they can retrace the path followed by markets in 2017. History is very unlikely to repeat itself, especially when we are starting from very different price points. But for the moment, no one seems to care.

This stock rally is causing too many people to run back to the old charts and get those trades on that worked so well during the good old days.

Via Bloomberg,

I’m really interested to see how this works out for them. I just can’t help shake the feeling that this could be a typical January head fake. And sometime soon we’ll all be asking just what we were thinking?

There are three things, among others, that leap out to me as problematic for a seamless return to the Goldilocks scenario:

-

We used to marvel at how markets were willing and able to ignore geopolitical events. I don’t think that’s any longer possible let alone likely. Populism and cross-border distrust has only gotten worse. And elections loom. Sanctions and tariffs are accepted as a normal part of international diplomacy. It’s hard to believe that the various electorates, especially in Europe, will be mollified by seeing their national equity indexes get through resistance. It’s telling, but unconvincing, that arguments are being made that rising stock prices will find their way into the real economy through greater high-end luxury purchases. Analysts are talking trickle-down while we watch the French police use water cannons on the weekends.

-

Two years ago volatility was actively suppressed and you were able to, if you cottoned on to what was going on, set your portfolio on autopilot. I don’t think the central banks have the firepower anymore to pull this off and the impetus to supplement with fiscal stimulus just isn’t there. Furthermore, whether you are talking about currently popular themes, like buying emerging markets or the euro, asset prices aren’t starting from the same crisis levels. The ECB was happy not to have the currency flirting with parity to the dollar. It’s another thing entirely to believe they would be indifferent to seeing it reach the heights called for in so many forecasts.

-

There is also more credible discussion of the probability of recessions. Forward-looking indicators in the U.S. have disappointed. In 2017, the Fed was able to slip in three rate hikes without the market batting an eye. Now the discussion has swung around to policy mistakes and inverting yield curves. The focus on China is just how little the economy is really growing. The debate is no longer between 6.5% or 7%. We have to wonder how they will balance liquidity injections with combating over-leverage. And who would ever have thought back then there would be genuine concern about Germany?

As a bonus worry, government dysfunction in general is appalling and getting worse. It’s much harder to be optimistic we are just going through a rough patch for the global order of things. Shutdowns and fraying coalitions seem to have become the norm. Remember when we mused about all sorts of neat infrastructure projects? And even though I swore not to mention the U.K. today, the mayhem at the House of Commons yesterday should have been considered a national disgrace. I wonder why so many of the participants looked like they were having fun.

None of this might be today’s actionable news. But it’s important to keep reminding yourself that there is nothing static about global realities nor what, in the long run, are reliable correlations and havens. While not learning from the past is folly, forgetting the context of the moment is equally dangerous.

via RSS http://bit.ly/2RApFmq Tyler Durden