For anyone who followed Donald Trump’s advice on December 26, when the president said that “it’s a tremendous opportunity to buy. Really a great opportunity to buy”, the returns have been stellar: the S&P is up 12% just three weeks later. Indeed, as BMO’s Russ Visch writes, the S&P 500 has its their steady march higher and has now recovered nearly half of its total bear market decline.

Underneath the surface though, the BMO analyst cautions that “things really aren’t that great.”

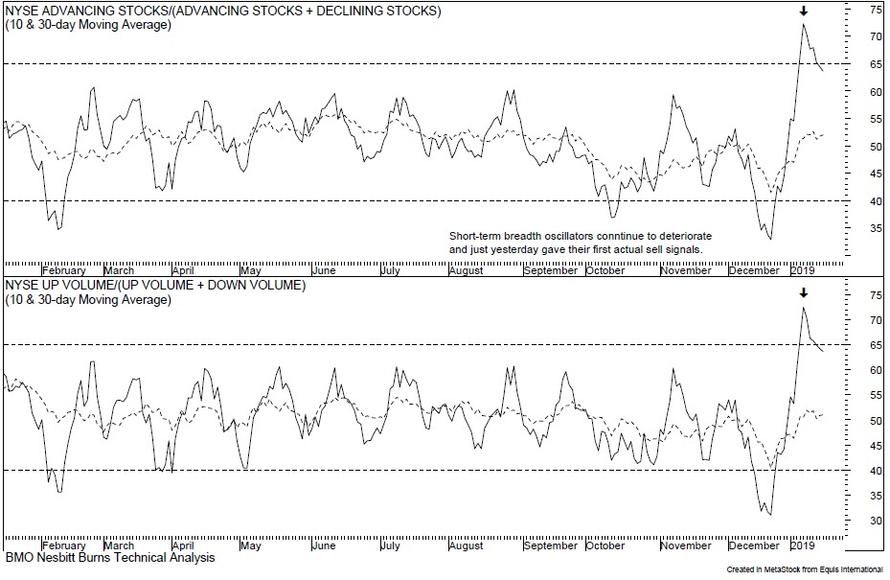

For one, NYSE breadth has essentially flatlined since last week’s “breadth thrust” buy signal as shorter timing-based breadth oscillators have been deteriorating for quite a few days now.

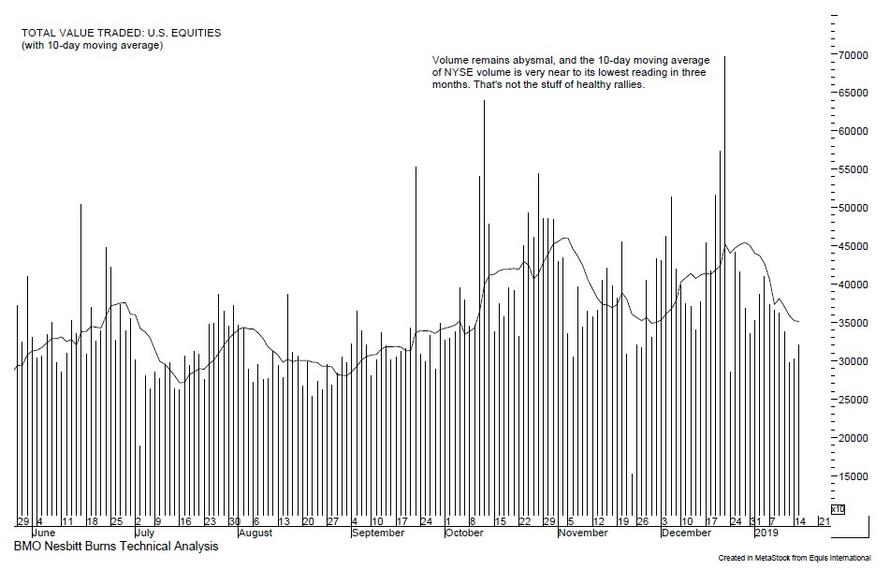

Visch also warns that volume continues to run “abysmally” light too.

As the strategist concludes, “we like to use the analogy of Wile E. Coyote running off a cliff and not knowing there’s no ground underneath him anymore quite a bit, and that’s what the latest action in the major averages feels like to us right now. i.e. – sooner or later the deterioration underneath the surface is going to bite.”

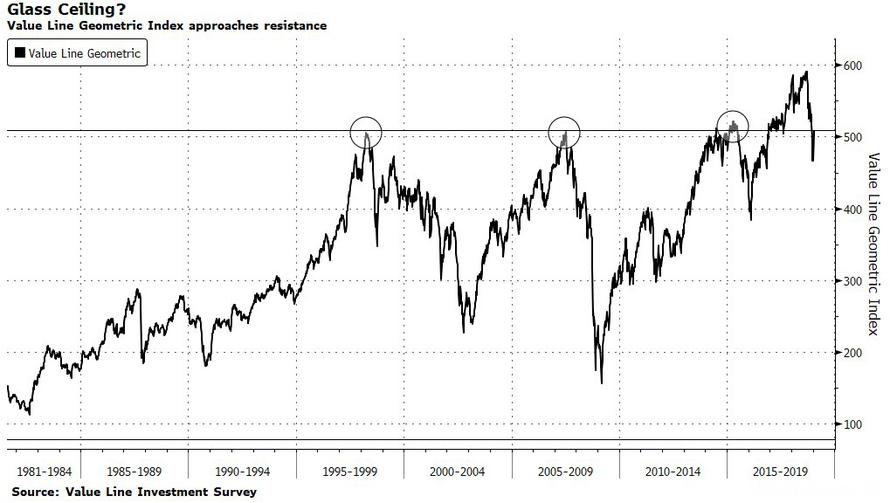

Finally, echoing Visch’s caution, Bloomberg Markets Live commentator Ye Xie agrees that “it’s going to get tougher for equities” to keep rising, and as evidence shows a chart of the Value Line Geometric Index: This equally-weighted measure of the companies covered by the Value Line Investment Survey is often read as a reflection of the “average” stock. It’s notable because just like the S&P, which remains below the recent resistance level, “it is approaching a dicey level which repeatedly marked previous market peaks, after falling below it during the current rout.”

via RSS http://bit.ly/2AOxAlS Tyler Durden