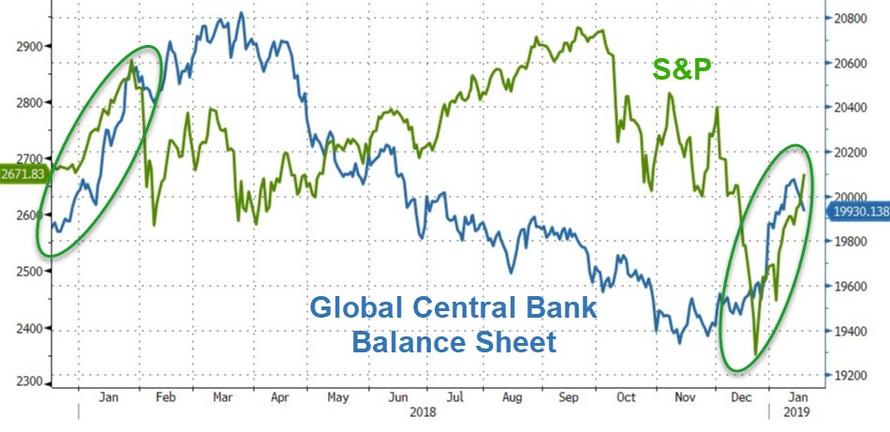

Wondering why stocks are soaring?

Simple really – Global Central Bank balance sheets are soaring again…

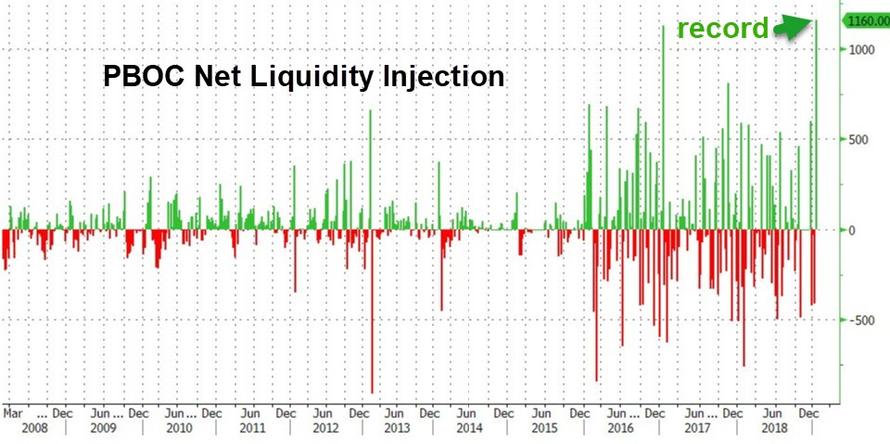

And China just injected a record 1.16 trillion yuan into the financial system… (yea trillion with a ‘t’)

Sigh…

Which lifted Chinese stocks handily…

And European stocks soared…

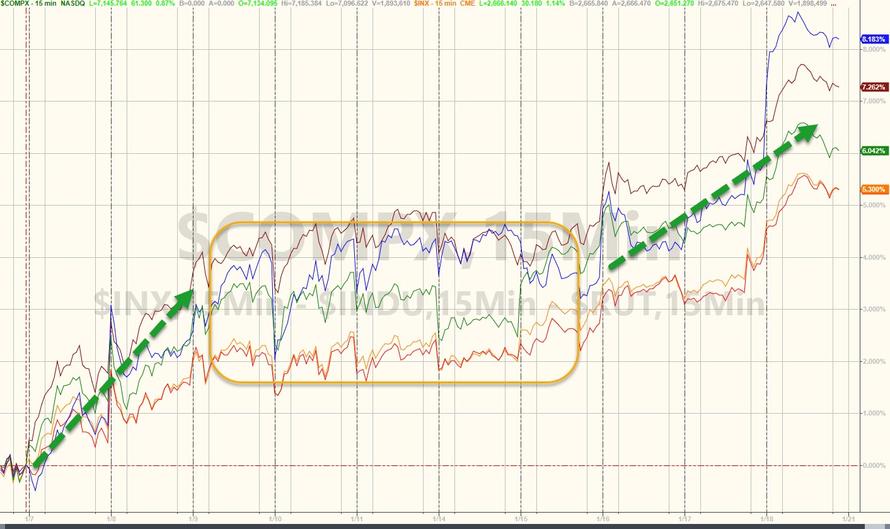

It seems the algos did not get the message the first time as Trade headlines pumped and dumped… and then they ripped…

Trannies are best this week…

Trannies are also the best performer of the US majors YTD, but the Russell 2000 is off to its best start to a year since 1987…

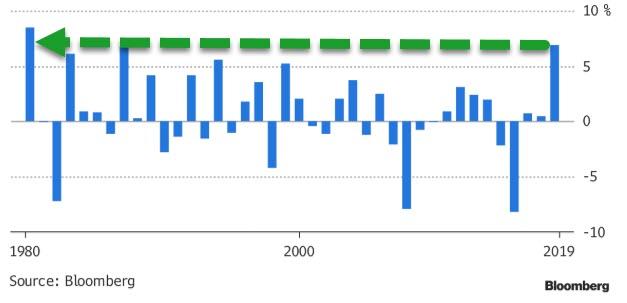

But Canada is better – up 7% YTD – the best start since 1980…

The S&P is up 4 weeks in a row – just like it was to start 2018…

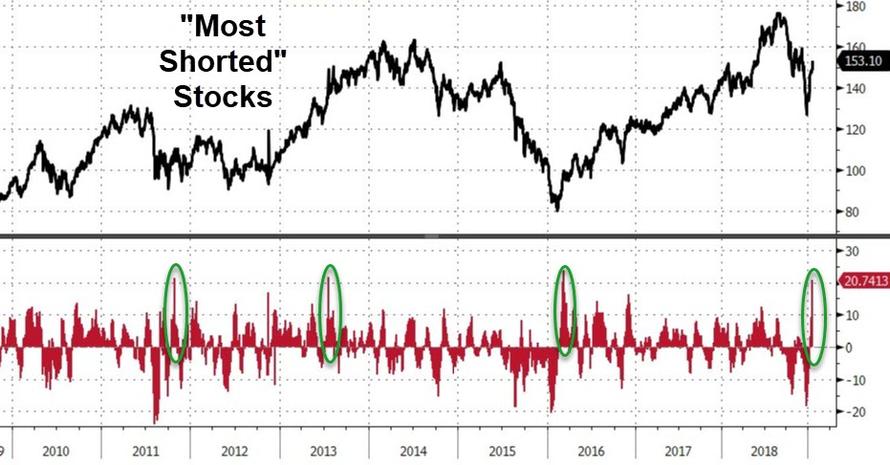

“Most Shorted” stocks continue to squeeze higher (up 14% YTD!)

“Most Shorted” Stocks are up (squeezed) 13 of the last 14 days

But, as Bloomberg noted, bearishness remains stubbornly high, judging by the SPDR S&P 500 ETF. At 5.4% as of a couple of days ago, short interest is roughly double the two-year average (with most of that span of time covering a steady grind higher).

“Bird Box Buying”

Fannie and Freddie exploded higher on headlines that Treasury is considering how to exit conservatorship…

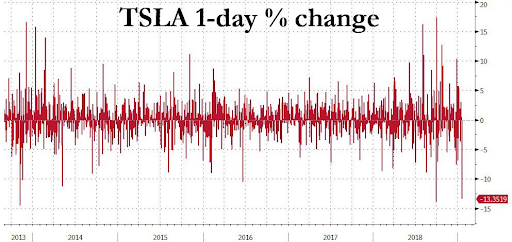

Tesla tumbled – catching down tot its bonds reality once again…

This was one of its biggest drops in history…

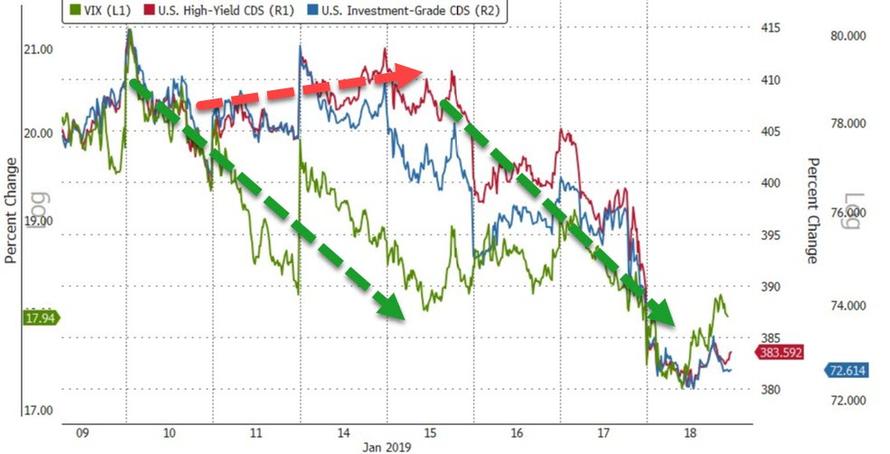

Credit Spreads collapsed again after decoupling initially from VIX…

Treasury yields surged across the curve this week with the belly underperforming (7Y +10bps)…

with 10Y yield at 2019 highs…

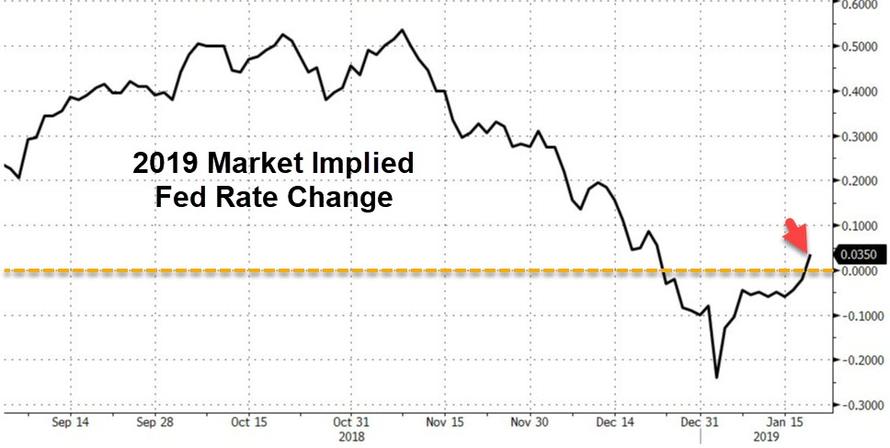

And investors should perhaps be careful what they wish for from stocks as the markets’ implied expectations for 2019 rate hikes has shifted back into hawk territory – now expecting 3.5bps of tightening…

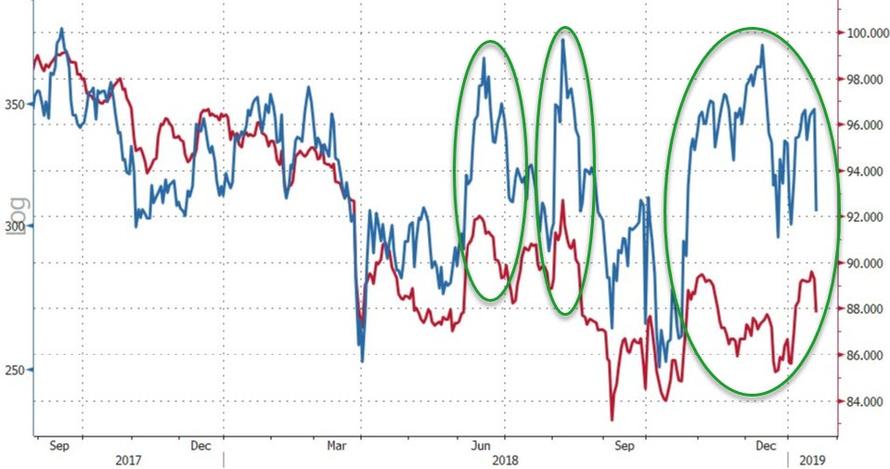

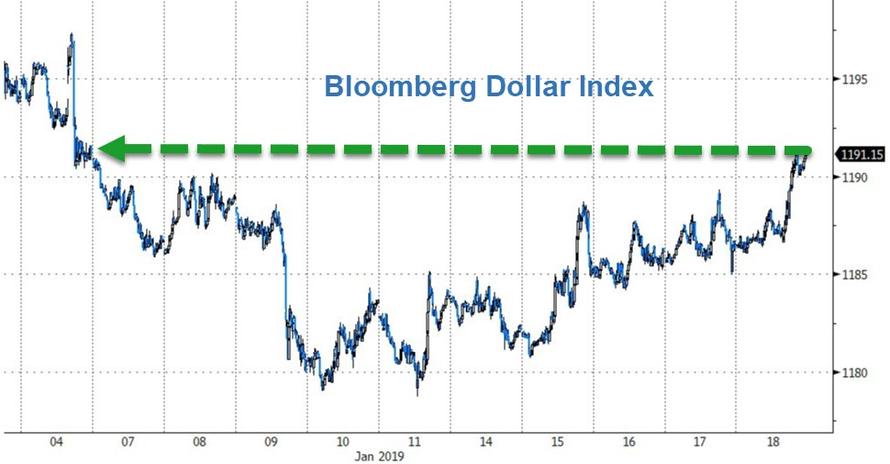

The dollar surged this week – its first weekly gain in 5 weeks – bouncing off significant support at around 1180…

Yuan tumbled on the week – biggest weekly drop in 3 months (accelerating as the dollar surged this afternoon on trade talks headlines)

Cryptos were down across the board in a very choppy week…

Despite dollar strength crude and copper surged on the week with PMs weak…

WTI neared $45 but faces serious resistance…

Silver’s demise at the same time as Oil’s surging seems to have found historical support working again…

Finally, US equity markets are right back where they were at the end of the year… the year 2017!

And with a big h/t top Gluskin Sheff’s David Rosenberg, we note that “More How fascinating to have seen on the same day a ripping production report on the back of the auto sector coinciding with consumer auto buying intentions falling to a five-year low.”

So if you bought the market today on the heels of great industrial production data – don’t hold your breath.

Spot The Odd One Out…

via RSS http://bit.ly/2TXEWdV Tyler Durden