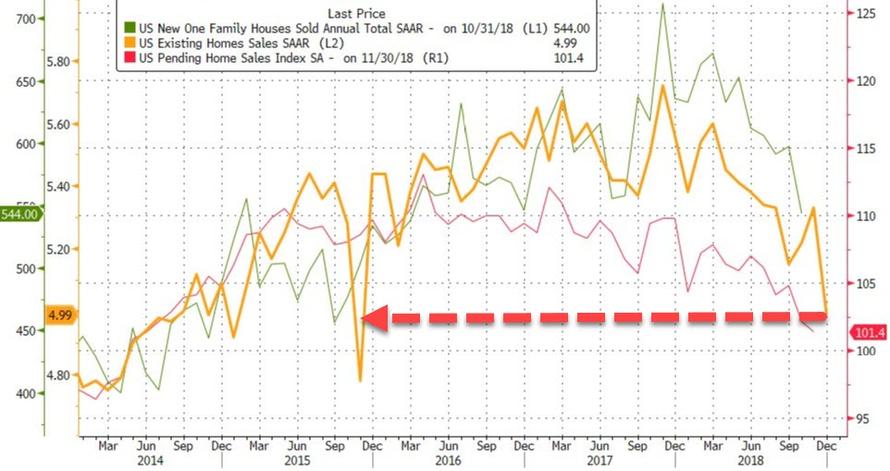

After NAHB’s optimism rebounded earlier in the month, all eyes are on this morning’s existing home sales data for any signs of optimism.

With some expecting a crash (and consensus expecting a modest 1.5% MoM drop), after rebounding in October and November (in the face of declining new and pending home sales), December existing home sales did indeed collapse – down a shocking 6.4% MoM..

With SAAR crashing below 5mm for the first time since 2015…

Regional breakdown:

-

December existing-home sales in the Northeast decreased 6.8 percent to an annual rate of 690,000, 6.8 percent below a year ago. The median price in the Northeast was $283,400, up 8.2 percent from December 2017.

-

In the Midwest, existing-home sales fell 11.2 percent from last month to an annual rate of 1.19 million in December, down 10.5 percent overall from a year ago. The median price in the Midwest was $191,300, unchanged from last year.

-

Existing-home sales in the South dropped 5.4 percent to an annual rate of 2.09 million in December, down 8.7 percent from last year. The median price in the South was $224,300, up 2.5 percent from a year ago.

-

Existing-home sales in the West dipped 1.9 percent to an annual rate of 1.02 million in December, 15 percent below a year ago. The median price in the West was $374,400, up 0.2 percent from December 2017.

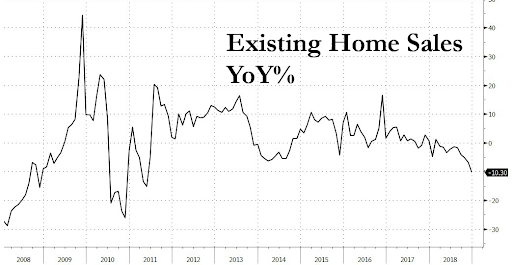

The latest results brought the 2018 tally to 5.34 million, the weakest pace since 2015. This is the biggest annual drop in existing home sales in 8 years…

The median sales price rose 2.9 percent from a year earlier, the least since February 2012, to $253,600, while inventory increased.

“Affordability is more important than jobs,” NAR Chief Economist Lawrence Yun said at a briefing in Washington, referring to the softer results despite the strong labor market.

“The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring.”

Yun noted that the shutdown had no r4eal effect yet and offered some optimism for when it reopens…

“The partial shutdown of the federal government has not had a significant effect on December closings, but the uncertainty of a shutdown has the potential to harm the market,” said NAR President John Smaby, a second-generation Realtor from Edina, Minnesota and broker at Edina Realty.

“Once the government is fully reopened, I am hopeful that housing transactions will increase.”

With existing-home sales accounting for about 90% of U.S. housing, it would seem Jay Powell’s dovish tilt just got more support, but at what point does bad news flip to being ‘bad news’ as growth hopes get hammered.

via ZeroHedge News http://bit.ly/2Rafyju Tyler Durden