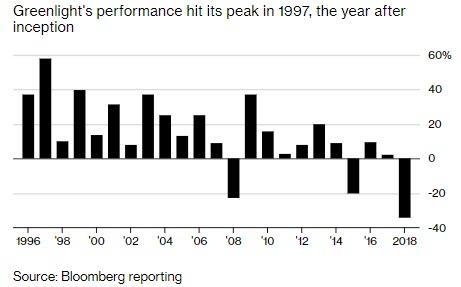

After a year where nothing went right for David Einhorn’s Greenlight Capital (the firm’s main fund lost 34% in 2018, its worst year on record) the dramatic rebound in equities has led to a dramatic reversal of fortunes. The fund is now up 11% YTD, inspiring Einhorn to start taking on new money again, according to Reuters. The fund posted positive returns during only two months last year, May and October.

Einhorn reportedly announced his plans at the firm’s annual investor day on Tuesday, which it held at the Museum of Natural History in New York. Maybe some of the investors who pulled money out at a rapid clip last year (shrinking the firm’s assets to $2.5 billion from $12 billion in 2014) might want to reconsider. The fund hasn’t taken on new money in years. It won’t embark on a marketing drive; instead, any would-be investors will need to contact Greenlight directly. Einhorn’s fund wasn’t alone in its poor returns last year: the hedge fund industry suffered its worst quarterly outflow in more than two years during Q4, when investors yanked $23 billion from hedge funds. As an industry, they underperformed the benchmarks with a 7% drop, compared with a -4.4% return for the S&P 500.

While Einhorn was one of the outliers on the down side, some funds still posted stellar performance, including Bridgewater’s Pure Alpha fund and a handful of other computer driven strategies.

Much of Einhorn’s abysmal performance heading into year-end was due to massive losses on Green Brick Partners, Brighthouse Financial and AerCap Holdings, all of which suffered 25%+ drops during Q4.

In a letter to investors, Einhorn said covering shorts on Mylan, Perrigo and Bayer had contributed to his performance in the new year. He also revealed that he has continued to bet against Tesla, which he said would face “a shortage of demand” (though, going off the work of some analysts, one could argue that’s already true).

via ZeroHedge News http://bit.ly/2S7v1VK Tyler Durden