“The world’s economy is growing more slowly than expected and risks are rising.”

– Christine Lagarde, IMF Managing Director

The recent market rally, which I had expected, has not surprisingly overshot many observers’ upside expectations.

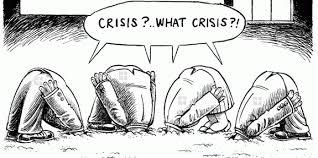

A possible explanation for the market’s extreme moves in the last two months or so is likely market structure in which the dominant force in the market (passive investors) worship at the altar of price momentum and are increasingly agnostic to balance sheets, income statements and “intrinsic values.” Indeed, in a market dominated by ETFs and quant trading (structured to “buy higher and sell lower”) and in which there is nothing like price to improve sentiment — investors seem to be ignoring the market’s shaky fundamental foundation.

The three core reasons to be bullish (and my responses) seem to be:

1. A more dovish Federal Reserve – I continue to believe the Fed, facing a disappointing domestic economy, will cease rate hikes in 2019. While many see this as positive, I think it reflects slowing growth. And with federal funds at only about 2.5% there are few monetary tools to stimulate growth going forward.

2. Confidence with regard to global economic growth – This view is unjustified based on high frequency economic data in the U.S. and by weakening growth in Europe and China. (See the quote from IMF’s Lagarde above) Even if interest rates are not increased, I don’t see it as a factor that will even stabilize U.S. growth. My baseline expectation is for +1% to +2% first half U.S. growth and a negative print in this year’s second half based on restrictive Fed policy (Quantitative Tightening), untenable debt loads, the widening national debt, political turmoil and a lapping of fiscal stimulus. The chances of a rate cut are increasing for this year (See my 15 Surprises for 2019).

3. The improving prospects for a resolution of our trade dispute with China – Over to my right, Jim “El Capitan” Cramer makes the case (which now seems to have become consensus) that China’s economic weakness improves the chance of a negotiated trade compromise with China. This is something I strongly disagree with – as I wrote in mid-January, 2019 in “An Optimistic View of Trade Talks With China May Not Be Justified”:

“If you are going to take them on, now is the time to take them on.

That was a prevailing sentiment I got from a surprising number of people in the tech world who do not like President Trump but do endorse his policy to get China to play fair or risk the consequences of losing our market to sell its wares.

Given the timing — Sunday night we learned that China’s exports were down 4.4% in December while imports were off 7.6%, the worst since 2016, while the trade surplus with the U.S. hit a record in 2018 — I think this harsher-than-expected-view may be more realistic than most investors think…

I think it’s because China has never been more vulnerable and we have rarely been as strong as we are right now.”–Jim “El Capitan” Cramer, It is Now or Never to Push Change With China

That makes sense.

However, I don’t see the “other side’s” sense of urgency — even as China’s economy continues to disappoint. Stated simply, China thinks in a time frame of decades while President Trump thinks in a time frame of a tweet.

While a superficial agreement with China is always possible, I don’t see anything meaningful that addresses the core issues of intellectual property, technology exchange, etc.

As well, I suspect President Trump has his hands filled with other issues (the government shutdown and the border wall dispute, personal issues, etc.), and though in need of a win or a distraction, may find it difficult to focus on China.

My guess is that China guts out its economic weakness and little progress is made on trade between the two parties over the next few months. (This is a consistent view I have had).

Bottom Line

“You’ll be swell! You’ll be great!

Gonna have the whole world on the plate!

Starting here, starting now,

honey, everything’s coming up roses!”– Ethel Merman, Everything’s Coming up Roses

The market’s market structure (and limited natural price discovery) means that equities will increasingly moves to extremes, in a new regime of volatility (which will likely continue until there is the next significant “Flash Crash”). And the list of possible outcomes (many of them adverse) has never been higher in an increasingly flat and interconnected world.

-

Excessive pessimism and poor price action contributed to a Christmas Eve low which provided an opportunity to go long.

-

Excessive optimism and good price action is now contributing to a late January high which might be providing an opportunity to sell stocks.

Sorry, Ethel, everything is not coming up roses.

via ZeroHedge News http://bit.ly/2RLNHLi Tyler Durden