After a brief hiatus in bond land driven by sharp stock market volatility, which saw a 40-day stretch without a single junk bond price in the primary market and a move wider in peripheral bonds, credit investors are again feeling the FOMO squeeze and expressed it vividly this morning in the form of record demand for sovereign bond offerings from italy, Spain and Portugal.

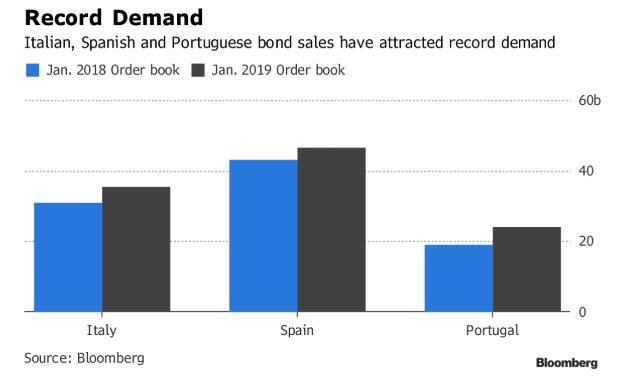

According to Bloomberg, sovereign bond offerings from Italy, Spain and Portugal in January have drawn unprecedented bid-side demand, for a total of €106 billion euros ($120 billion), up 14 percent from a year ago, helping a slide in peripheral euro-area yields in the past two weeks.

Spain saw by far the most demand, its offering nearly 5x oversubscribed, when it received €46.5BN in orders for €10BN, 10-year bond on Tuesday, following successful sales by Italy and Portugal earlier this month. The culprit behind the surge in demand: mostly Japanese pension funds and Mrs. Watanabe, as a breakdown of demand for Spain’s syndication showed Asian investors at 11.8%, up from 0.7% for the same offering in January 2018.

With investors once again scrambling to buy European paper, even with the ECB no longer officially in the picture except for reinvestments of maturing bonds, Spanish yields have fallen 17bps in the past two weeks, while Italian yields are down 21 bps alongside a broader surge in risk. Greece could also offer a medium-term bond soon, Danske Bank suggested.

As Bloomberg notes, the sales mark another step in the recovery for a region that saw sentiment weighed down by the risks of a deficit blow-out from Italy’s populist government. While rating companies downgraded Italy last year, Portugal was raised from junk status and Spain was upgraded. Now the nations are starting to benefit as investors are drawn to their relatively high yields.

“Volatility in Italy left tons of pent-up demand,” said Jaime Costero, a rates strategist at Banco Bilbao Vizcaya Argentaria SA in Madrid. There is also greater structural demand as the rating upgrades have drawn “new investors and wider credit lines,” he said.

Market sentiment has improved materially after Italy resolved a dispute with the European Union over its 2019 budget deficit, while weaker regional economic data spurred fears of a slowdown that may lead the European Central Bank to be more cautious about removing stimulus.

“There has been a widespread belief among investors that rates will likely remain low for longer, with central banks likely to be very cautious in pushing rates higher,” said SocGen strategist Jorge Garayo, quoted by Bloomberg. “Low volatility combined with a low level of rates has led investors to overweight periphery, more so with more market-friendly political posturing.”

Of course, it will likely be a different story should the recent return in market jitters spread, once again hitting the high-beta peripheral bond sector. For now, however, both Spain and Italy are delighted that even without the ECB’s backstop investors just can’t get enough of funding their deficit.

via ZeroHedge News http://bit.ly/2RKejwr Tyler Durden