No one wins today…

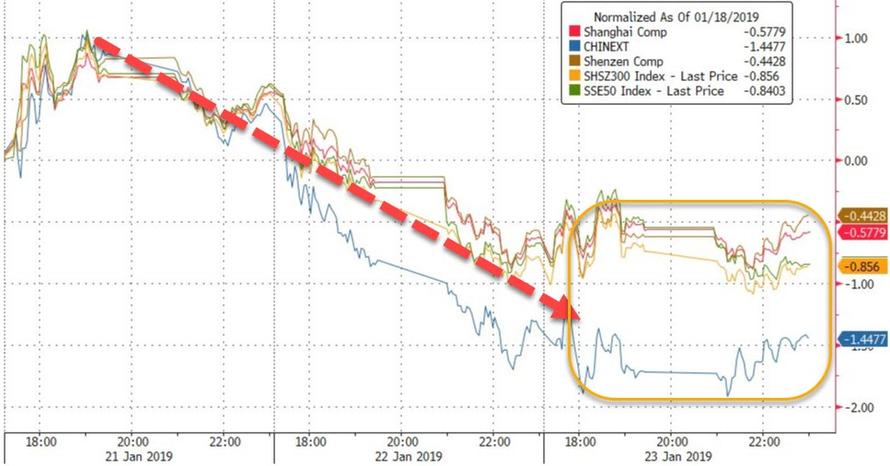

Chinese stocks trod water overnight…

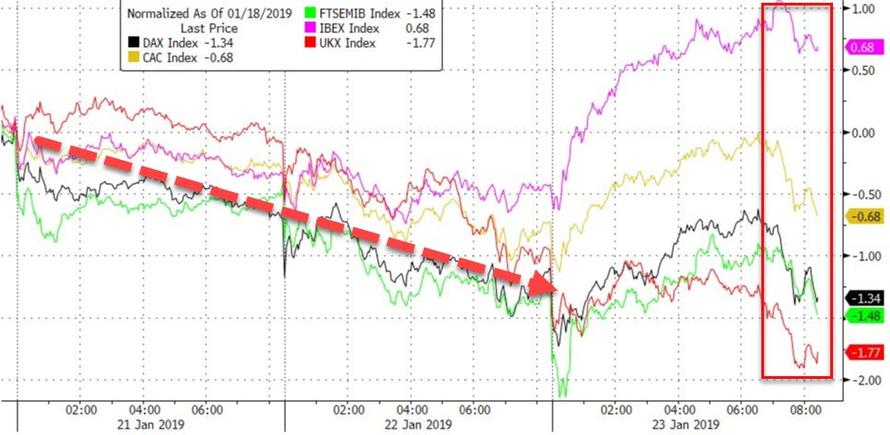

European markets pumped and dumped…Spain is leading on the week and UK’s FTSE the laggard…

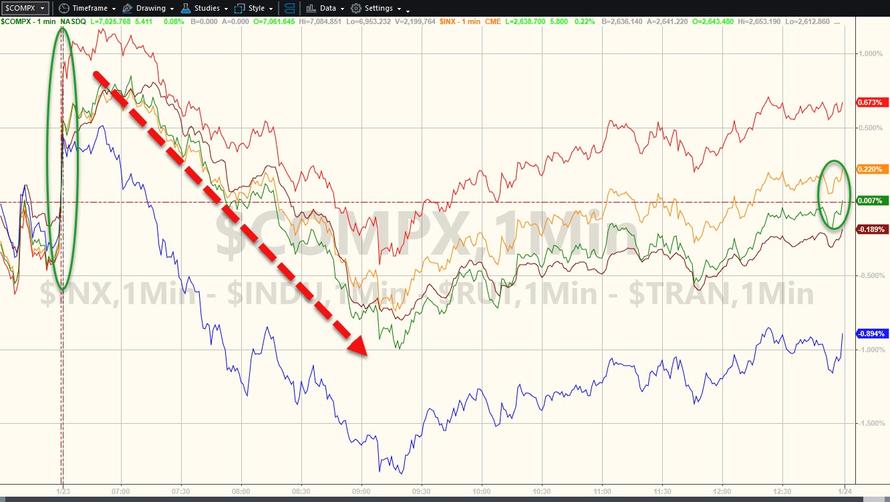

US Markets were a mixed bag as earnings beats mixed with multiple macro headlines leaving the indices notably dispersed…

In cash markets, Dow outperformed thanks to IBM, UTX, and P&G (as FDX and UPS dragged on other indices after a downgrade)…

White House Council of Economic Advisers Chairman Kevin Hassett said that if the partial government shutdown extends through March, there’s a chance of zero economic expansion this quarter, though “humongous” growth would follow once federal agencies reopen. Oil’s retreat weighed on energy producers and service providers.

“The broader concern that I think will continue to creep in here is, leaving trade aside, is how weak is global growth? How weak is China’s growth?” said Liz Ann Sonders, chief investment strategist at Charles Schwab & Co.

Trade-talks rhetoric ratcheted up with China warning that US markets would crash if Trump did not do a deal (therefore suggesting he is under pressure to do a deal since he lives and dies by the stock market). However, later in the day, Trump responded by threatening that more tariffs will be unleashed if the Chinese do not come towards his goals.

Overall the score seems to be Kudlow 1 – 0 Hassett…

This headline hit at 1435ET TRUMP’S OUTSIDE CHINA ADVISOR SAYS THERE WON’T BE BREAKTHROUGH IN TRADE TALKS SOON – CNBC – and stocks dipped but only enough for algos to BTFD.

VIX had a wild ride – from a 19 handle to over 21 and all the way back down again…

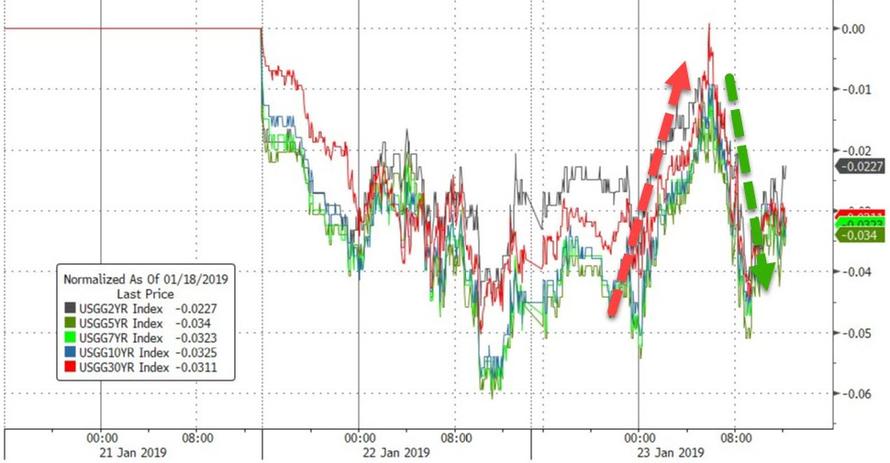

Treasury Yields ended the day marginally higher across the curve (but well off the day’s yield highs)…

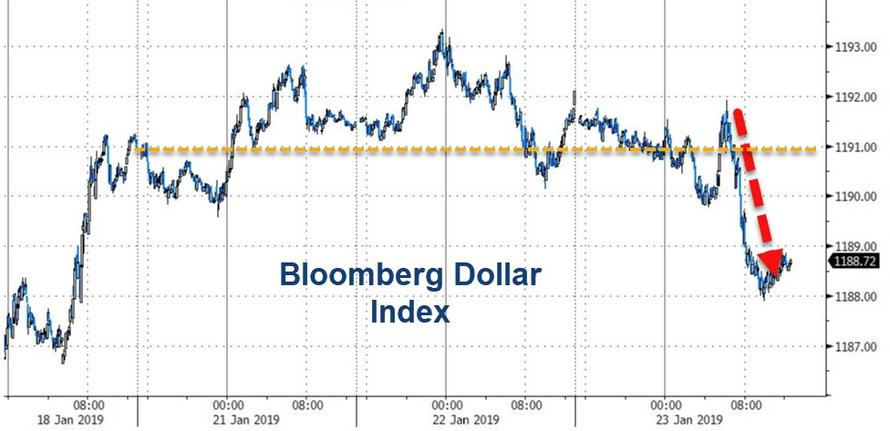

The dollar dropped into the red for the week…

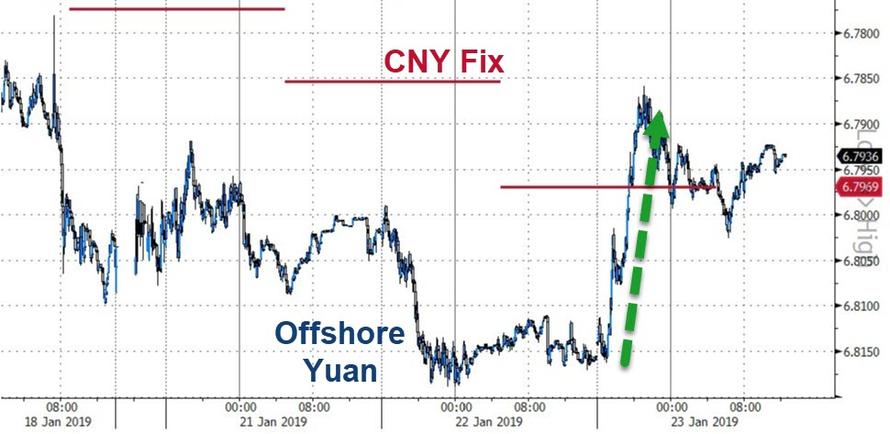

Offshore Yuan surged overnight up to the Fix…

Ether, Bitcoin, and Ripple dipped in the afternoon after CBOE withdrew its Bitcoin ETF request…

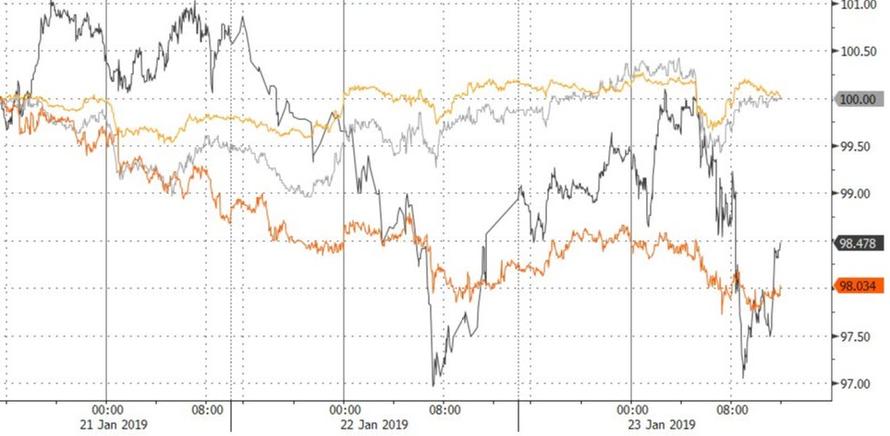

Another chaotic day in crude along with copper on China growth concerns and PMs managed to hold unchanged on the week…

WTI ranged between $52 and $53.50 on the day ahead of tonight’s API inventory data…

Finally, earnings expectations continue to slide…(S&P Fwd EPS is at the lowest level in 5 months)

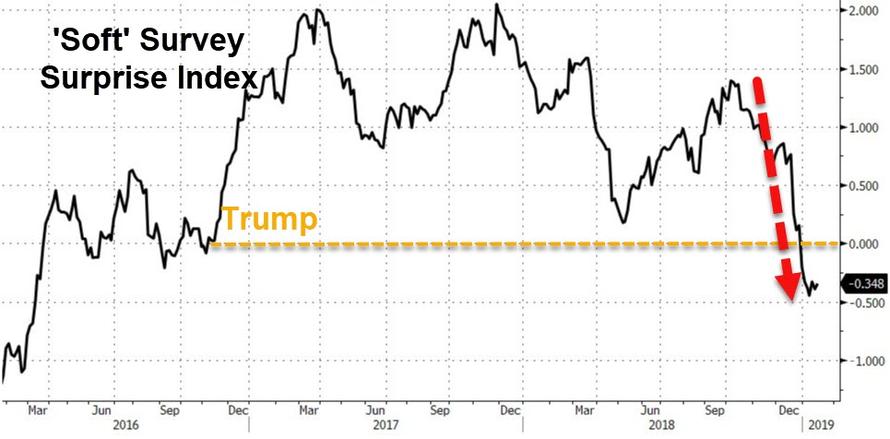

‘Soft’ survey sentiment has collapsed…

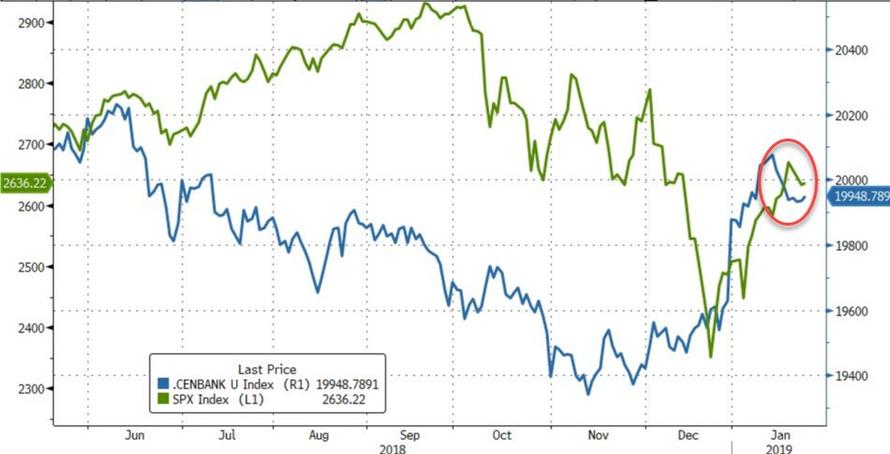

And the lifeblood of the rebound – central bank balance sheet expansion – has stalled once again…

And there’s one more thing…

Someone should ask the bank CEOs as they all put on politician-like smiling faces, why if the economic outlook is so bright, T-notes & bonds are the fastest growing item on their balance sheets — the YoY pace is running at +14.5%.

— David Rosenberg (@EconguyRosie) January 23, 2019

via ZeroHedge News http://bit.ly/2FSUfkg Tyler Durden