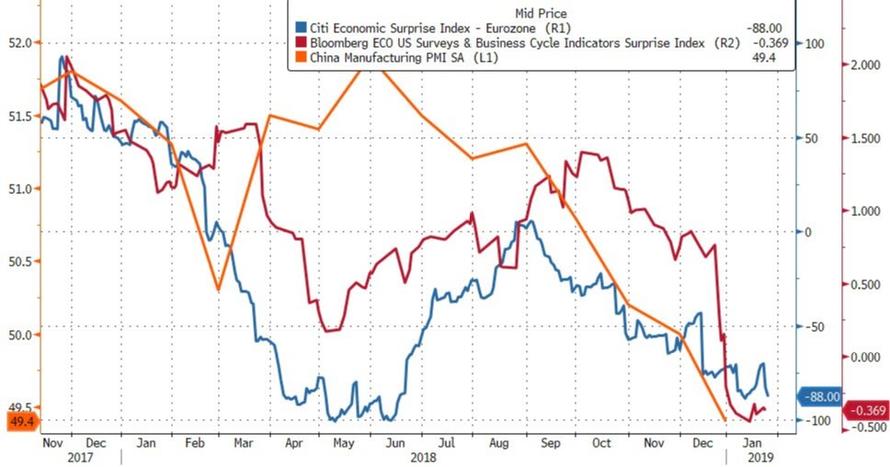

China Manufacturing, European Economy, and US Hope all plunging further… so buy stocks right? Bad global news is great stocks news?

And then there’s this…

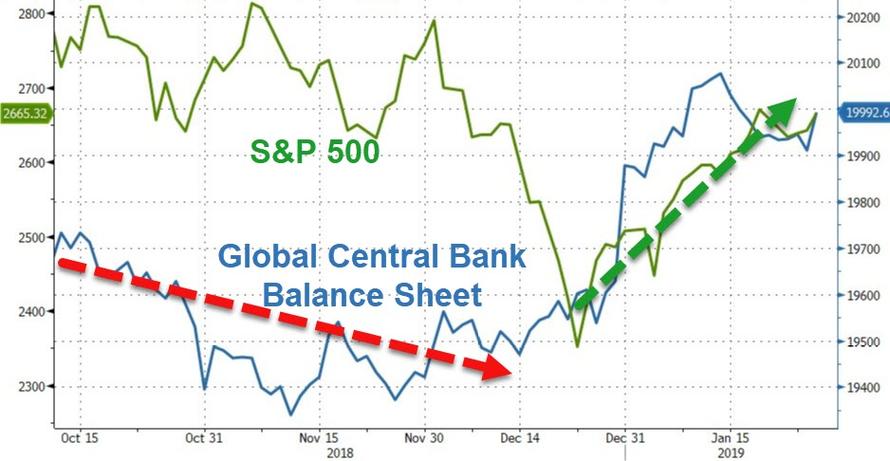

So what is lifting stocks? Well that’s easy…

How to trade it? Simple, don’t…

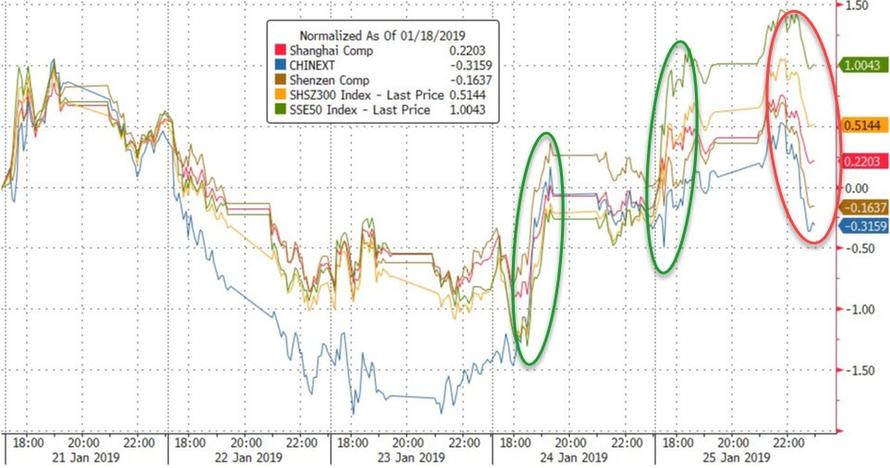

China let slip quasi QE but the early gains were erased into the close…

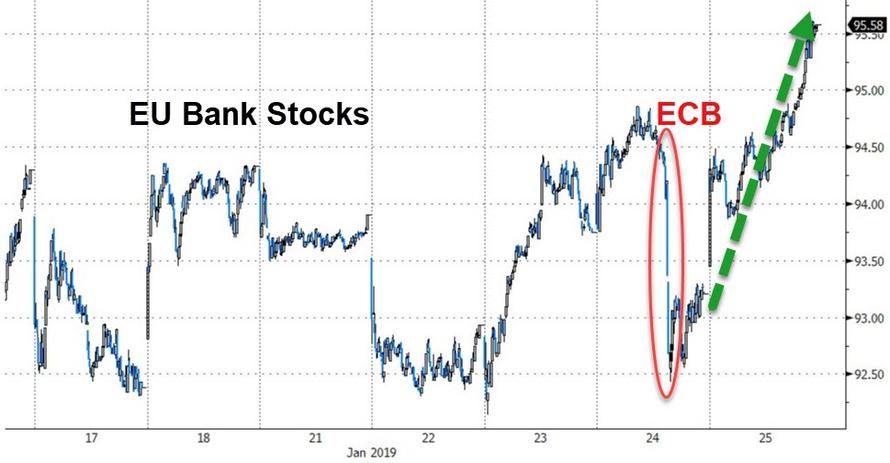

German business sentiment tumbled but EU stocks managed strong gains…except UK’s FTSE…

Led by European banks soaring today after dumping on ECB comments (and no, nothing changed)…

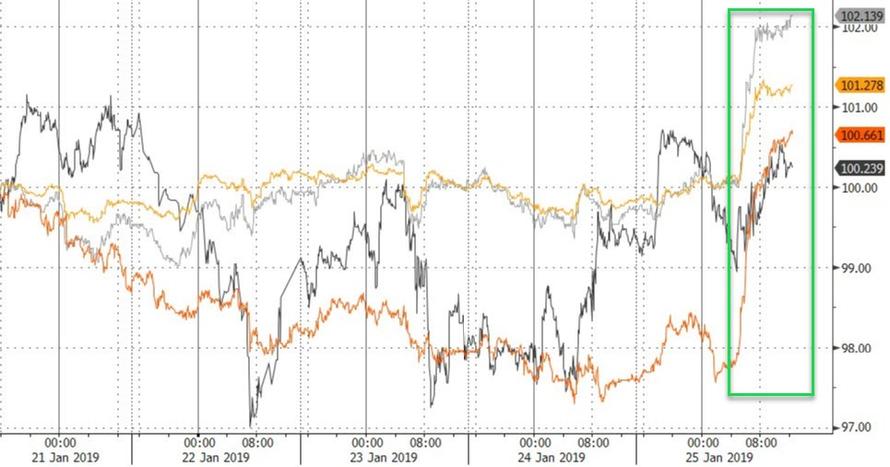

US equity futures surged overnight after Quasi QE from China and a WSJ headline on the end of QT. However, having tagged the week’s highs, stocks dipped on headlines of a shutdown deal (remember, End of Shutdown is negative for stocks as it means the economy won’t crash in Q1, meaning a lower probability that The Fed stops QT), but ended higher on the day and week…

The S&P ended red on the week (breaking its 4-week win streak) but Nasdaq and The Dow managed to hold tiny gains on the week…

Another major short-squeeze dragged markets higher after Tuesday’s tumble…

Credit and equity protection compressed notably on the day and week…

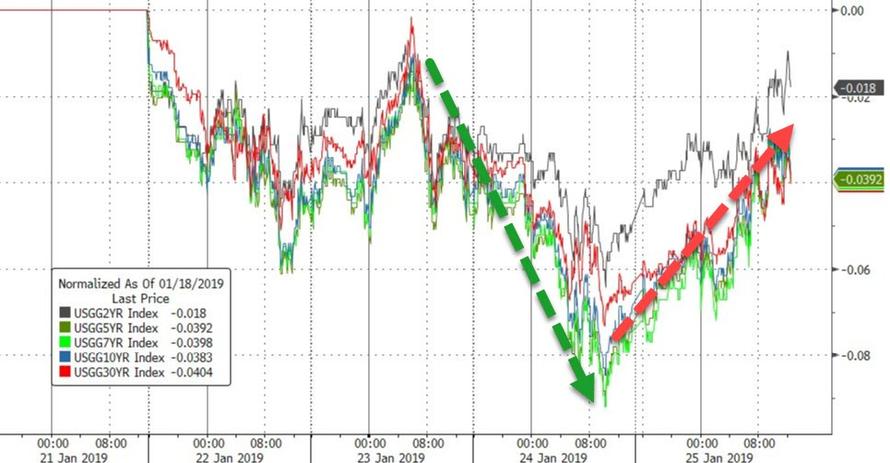

Treasuries were sold today, erasing yesterday’s gains but ending the week lower in yield still…

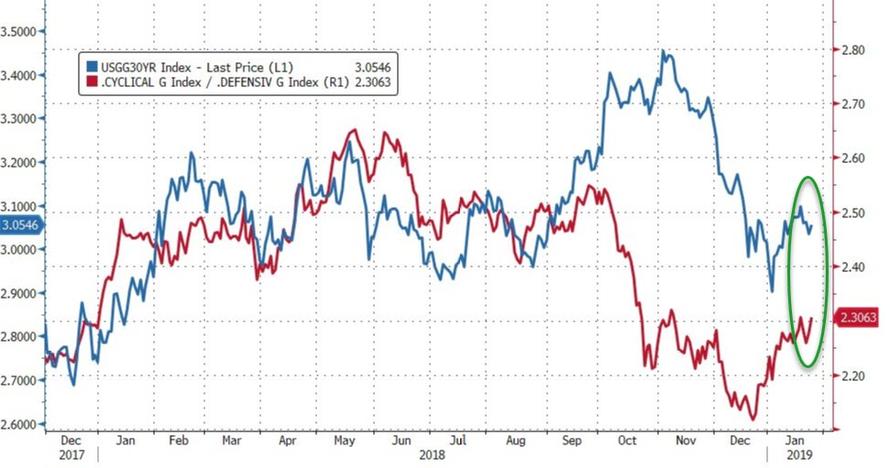

Bond yields still have room to fall if equity cyclicals are right…

The dollar puked today after WSJ reports a QT slowdown – this is the biggest drop since early November…

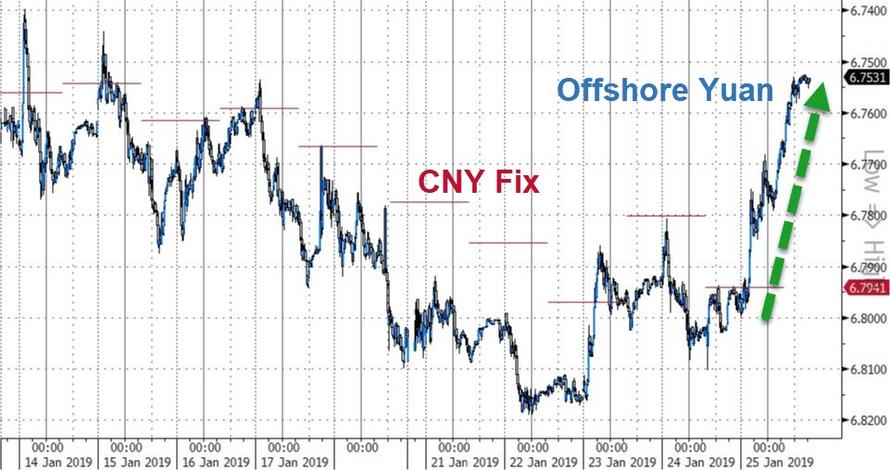

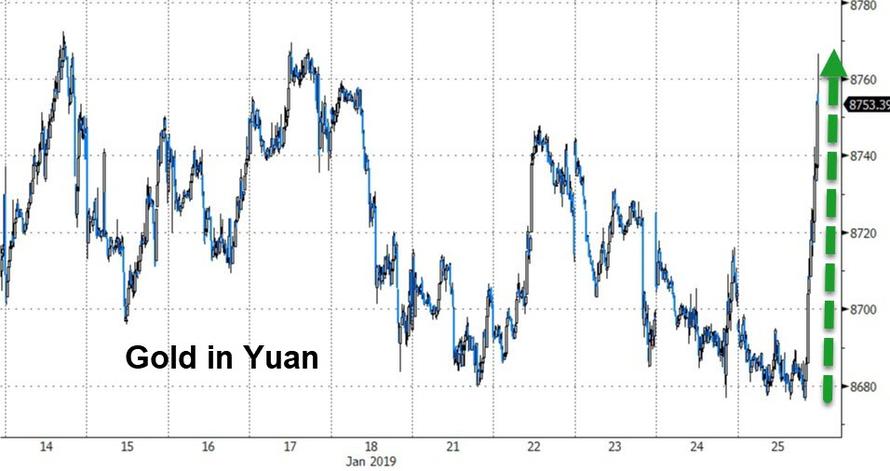

Yuan surged on the week… (today was biggest spike since Dec 1st)

EUR dumped on ECB yesterday and jumped today on WSJ’s Fed QT story, breaking up to the 1.14 technical support/resistance…

Despite the dollar weakness, bitcoin and Ether both fell on the week…

Commodities spiked on the day as the dollar dumped…Silver was best on the week…

WTI chopped around between various whole numbers…

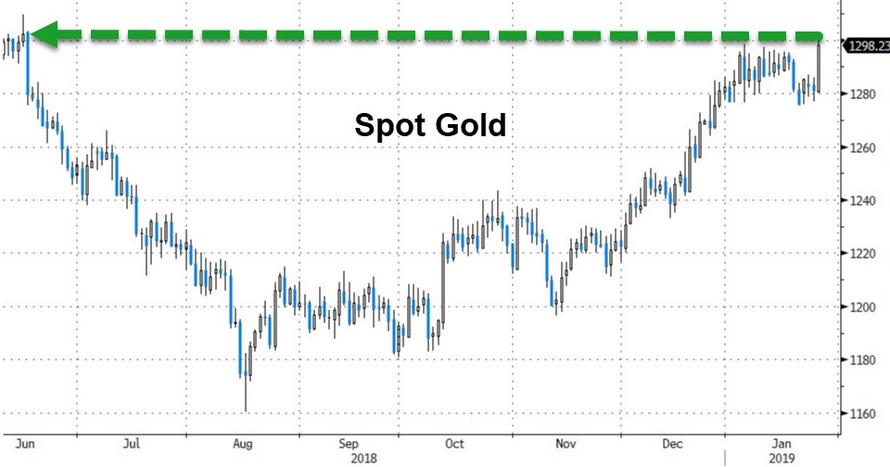

Spot gold spiked above $1300 intraday to its highest since June…

Silver surged on the day amid heavy volume…

Breaking above the 200DMA…

Gold is nearing a “golden cross” formation…

Gold surged in dollars and yuan (the biggest jump in the latter in over a month)…

And finally, since The Fed hiked rates in December, gold remains the leading asset class, just ahead of The Dow…

And we leave you with this from a decade ago – has anything really changed?… “wankingbankers”…

Still the greatest financial crisis explanation rant ever.

See if you note anything different 10 years later.#wankingbankers pic.twitter.com/FHutYeSJqD— Sven Henrich (@NorthmanTrader) January 24, 2019

via ZeroHedge News http://bit.ly/2ThcJyW Tyler Durden