One wouldn’t know it looking at today’s surge in stocks, but as of this moment no less than three indicators suggest the world now finds itself in either an economic or earnings recession.

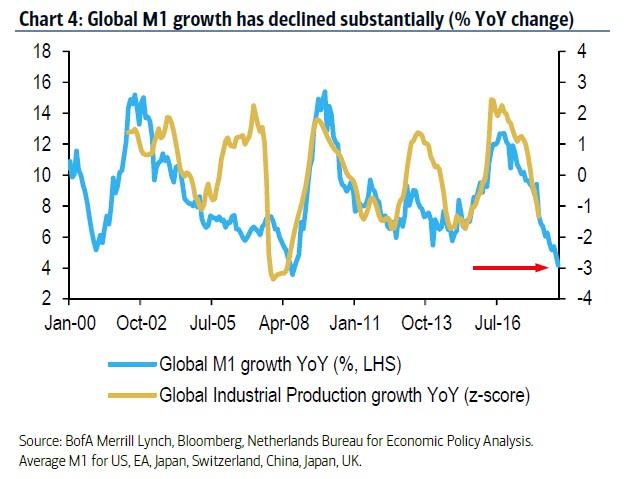

Two weeks ago, we showed a chart from Bank of America, according to which the ongoing collapse in global M1 growth strongly suggested that global industrial production was not only negative, but contracting at a rate last seen during the financial crisis.

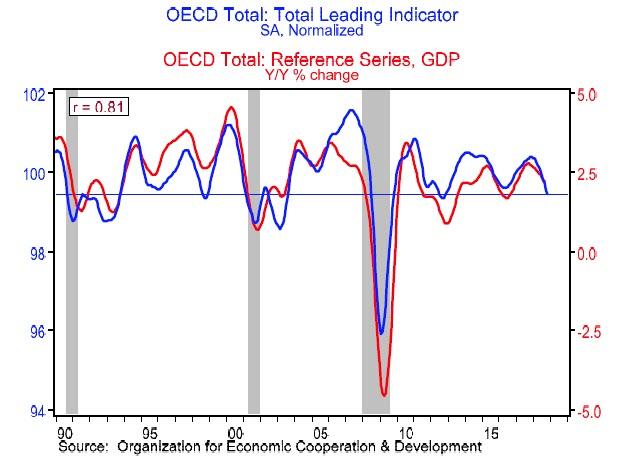

Then, one week ago, BMO economist Douglas Porter observed the OECD’s leading indicator – which is a good guide post of what is coming just around the corner – and which dipped for the 11th month in a row—it peaked in December 2017—clearly signaling a cooldown.

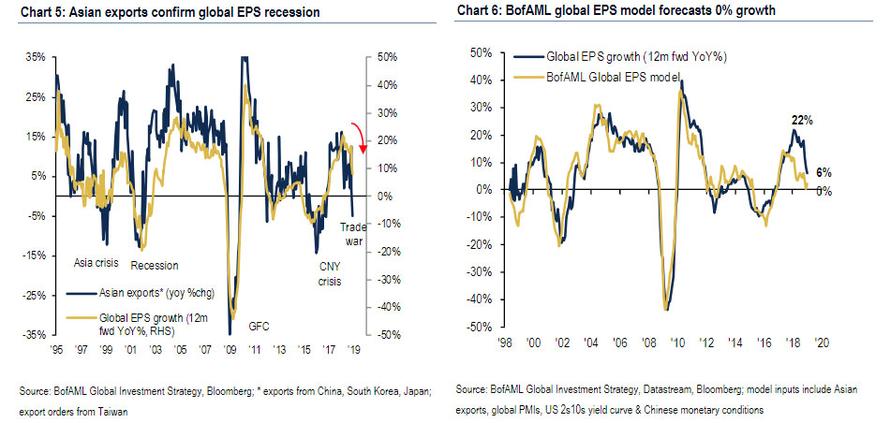

Now, according to the latest BofA Flow Show report, the bank’s chief investment strategist Michael Hartnett also confirms that “we are in a global EPS recession” by observing the plunge in Asian export growth, which tumbled -4% YoY most recently, a number “consistent with negative global EPS growth.” This is shown in the left chart below, and is is in line with BofA’s own global EPS model forecast, which is currently at 0% EPS growth in the next 12 months (versus 6% consensus) according to Hartnett, who notes that “no new highs for stocks, lows for spreads without inflection point higher in corporate profits.”

Having declared a global EPS recession, BofA then lays out the signs to keep an eye on that the global EPS recession is over, which include:

- US 2s10s yield curve steepens (> 50bps);

- global PMI up from 51 to 53;

- Asian export growth rebounds (signaled by ADXY >108, KOSPI 2300, copper >$300);

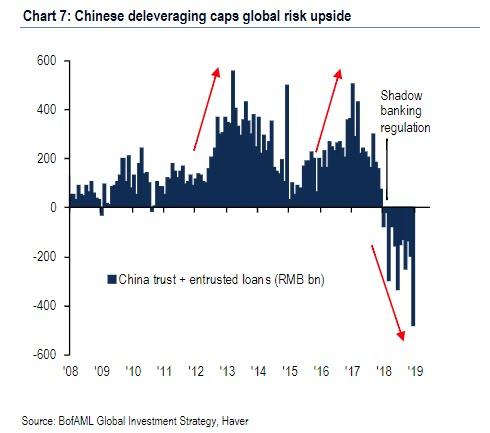

And most importantly: China financial conditions ease more substantially (i.e. CHBGMCI >100) as policy makers U-turn on deleveraging of $20tn shadow banking system & stop rising defaults in $3tn corporate bond market.

On the other hand, considering articles such as this one, “China Quietly Announces Quasi QE To “Keep Ponzi Scheme Afloat””, it may be just a matter of time before China’s easing efforts finally spur a material rebound in China’s credit impulse, signaling the key inflection point that will serve to bounce global EPS from their negative bottom.

via ZeroHedge News http://bit.ly/2RQ25T1 Tyler Durden