With homeowners in blue states bracing for a higher federal tax burden now that their mortgage interest and property tax deductions have been capped thanks to the Trump tax reform plan, many are being reminded that this added burden comes on top of already disproportionately high taxes in many states – particularly on east coast (though California also struggles with a notoriously high tax burden).

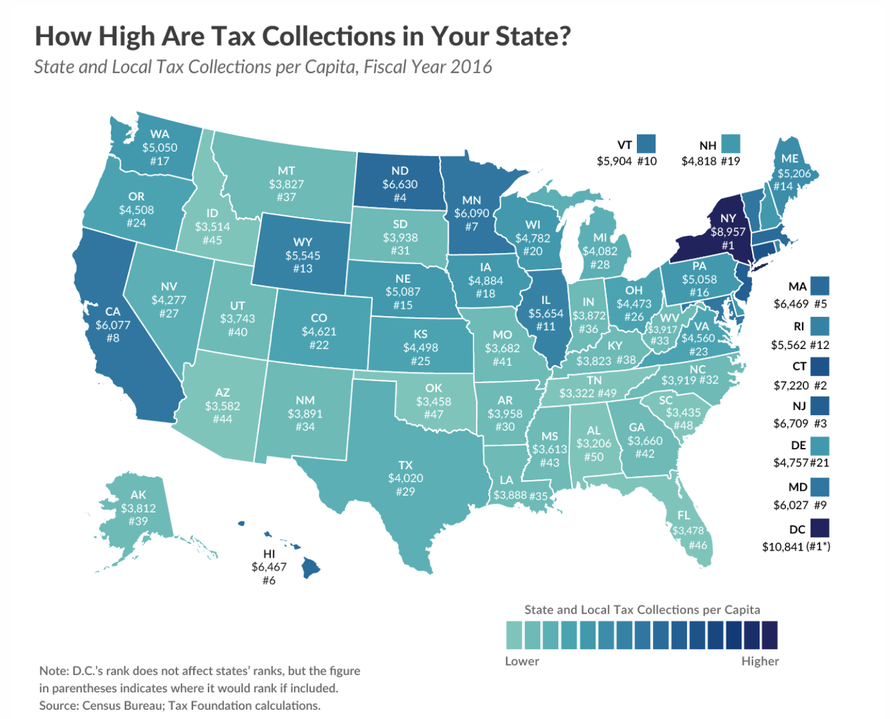

A new analysis by the Tax Foundation revealed the five states with the highest per capita tax burden. While Washington, D.C.’s per-capita tax burden ($10,841) is higher than in any state, the five states with the highest tax burden per capita are New York ($8,957), Connecticut ($7,220), New Jersey ($6,709), North Dakota ($6,630), and Massachusetts ($6,469).

The states with the lowest tax burden per capita are Alabama ($3,206), Tennessee ($3,322), South Carolina ($3,435), Oklahoma ($3,458), and Florida ($3,478).

While some of these entries might seem intuitive (Connecticut, New York and New Jersey), the presence of other states on this list like North Dakota might seem surprising. But as the Tax Foundation explains, states like North Dakota, with its vibrant energy industry, collect taxes from out-of-state residents on the energy products it produces.

via ZeroHedge News http://bit.ly/2sL7VWM Tyler Durden