While much of Wall Street breathed a sigh of relief yesterday when the Fed Chair Powell fully threw in the towel to any last trace of hawkishness in the central bank’s monetary policy, boosting asset prices and crushing the dollar now that the Fed’s hiking cycle appears to be effectively over, and making “financial analysis” once again a simple exercise in binary liquidity flows – is the Fed tightening or is it not – there were a handful of scathing critiques to emerge in the hours that followed.

Earlier, we presented the most “aggressive” one, authored by Rabobank’s Michael Every, who wrote that “the Fed did what every cynic must have known in their heart of hearts that the Fed would do: totally capitulate… Considering that our house view is that we are likely to see a US recession in 2020, we can start the clock until rate cuts, not rate hikes, and towards more QE and a larger Fed balance sheet, not a smaller one.”

Besides merely opining on the tactical implications of the Fed’s capitulation, Every also laid out some brutal criticism of what the Fed’s announcement meant strategically, and it wasn’t good: “In short, our global institutions, like central banks, are in serious trouble even before we have to deal with a trade war, Hard Brexit, geopolitical risk, the May EU elections, or the next US recession, any of which could happen. Populism is rising, and the Establishment has no idea what to do. Epic market volatility is assured.”

His conclusion, one which we were almost surprised to see make it past Rabobank’s compliance department, needed no clarification:

Naturally, markets love it today though. More drugs, what’s not to like! Stocks up, bond yields down, and the USD down – for now. Because don’t think this means good things for the rest of the world. That Chinese stimulus had better arrive soon. What used to be capitalism is waiting patiently for what is still closer to communism than the used-to-be capitalists will admit.

Yet while Every was an outlier in his scathing takedown of the Fed, other sellside staregists were just as brutal, if somewhat more diplomatic. One among them was Barclays’ Michael Gapen, who said that “it is difficult to read the outcome of the January FOMC meeting as anything other than the Fed capitulating to recent market volatility.”

According to Gapen while the Fed does have time to be patient before proceeding on any further policy rate hikes, “the unwillingness to provide upward bias in its policy rate guidance seems at odds with the evolving outlook, which has not weakened, in our view, by nearly as much as Fed communication has changed in the span of a month.”

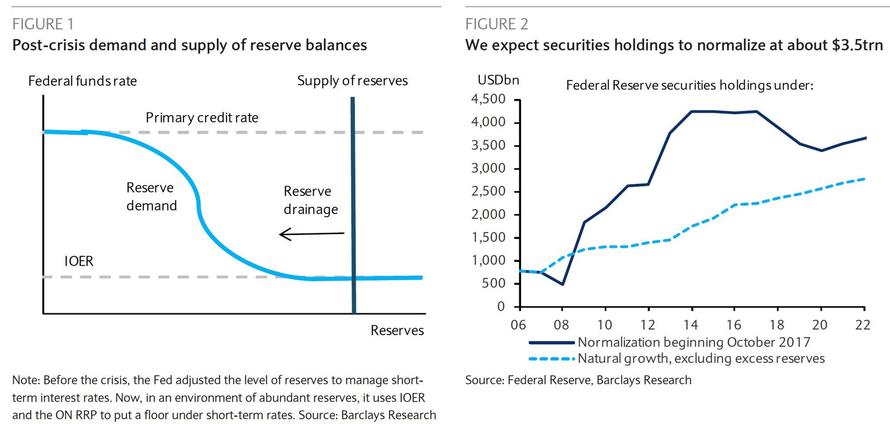

Following the January FOMC meeting, Barclays now expect only one 25bp rate hike this year in September and one additional 25bp rate hike in March 2020 implying a terminal target range of 2.75-3.0% for this tightening cycle. The bank also expects the balance sheet to normalize at around $3.5trn of securities holdings, which would imply excess reserves in the neighborhood of $1.0trn, a level Gapen expects to be reached in late Q1 20 or early Q2, with the key forecast risk being an earlier end to run-off should demand for reserve balances be larger than expected (and confirming that the US banking system is in far worse shape than comments about “fortress” balance sheets suggest).

But where Gapen was harshest was in his criticism of the Fed’s communication policy, which the Barclays strategist said was “in tatters” explaining as follows:

During the onset of the financial crisis and, for several years thereafter, the Fed augmented its traditional communications policy with an extended statement, forward guidance, the introduction of press conferences, participant projections that extend three years into the future (SEPs), and participants’ projections of the appropriate policy path (eg, the “dot plot”), among others. While we may have preferred this communication to come in a different format (eg, a consensus FOMC forecast versus individual participant projections), we never doubted the importance of the added information. We viewed the SEPs, in particular, as containing invaluable information. The first year of the SEP, in our view, represented an honest forecast of where FOMC participants saw the US economy heading and how policy was likely to evolve. The outer years of the SEP were not likely to prove accurate from a forecasting perspective, but they contained important information about the Fed’s framework. In other words, if monetary policy works with long and variable lags, the outer years of the SEP tell a lot about how the Fed thinks the US economy works and how policy is likely to evolve over time as data come in and Fed forecasts are updated. The SEPs are about intuiting the Fed’s framework and its reaction function.

One of Chairman Powell’s objectives since taking the helm of the Fed has been to de-emphasize forward guidance. This has been accomplished in several steps, including removing any language from the statement that says something about the Fed’s future intentions; the discounting of estimates of the neutral rate of interest, potential growth, and the natural rate of unemployment – the so-called “star variables”; and persistent recommendations that investors not look to participants forecasts for guidance about monetary policy. Reducing the extent of forward guidance and communication is one thing – we agree that the state of the cycle warrants that much – but eliminating forward guidance and communication altogether is something different.

Baclays’ concern is that the communications framework that played an essential role in the conduct of monetary policy “has been discarded, leaving us to wonder about the Chair’s policy framework and reaction function.”

Is it a world where the Phillips curve is perfectly flat and some combination of rising participation and low NAIRU mean that the Fed can let the economy run hot for longer than previously anticipated? Is it a world where incoming data and movements in financial markets have convinced the Fed that r* is lower than previously thought and monetary policy risks over-tightening? Or is it a world where things have not changed much about how the Fed sees the workings of the US economy, but external factors are providing headwinds that policy should offset temporarily? Without insight into the Fed’s framework, we have little to go by.

This leads to Gapen disclosing his main concern namely that the hyper-data dependence (with the data in question now seemingly on the market), “means a reactive Fed, potentially whipsawed by market movements and absent clear direction.”

We see recent Fed actions as providing some confirming these fears, from statements as recently as October that potential growth may be rising and the economy was a long way from neutral to today’s decision whereby the Fed feels that it cannot provide any guidance on further policy rate hikes only one month after staying that it judged that “some further rate increases” will be consistent with sustaining the economic expansion.

Yet while many of the risks to the US outlook remain in place, Barclays repeats a frequent lament from other analysts, namely that there is little to suggest that the outlook has changed by as much as Fed communication says it has.

As a result, Barclays worries “that the Fed has traded near-term support for financial markets and the economy for another round of volatility later this year if it is forced to lift rates higher, which remains more likely than not, in our view.“

Or, as a far less politically correct Michael Every predicted, “Epic market volatility is assured.”

via ZeroHedge News http://bit.ly/2UtToKY Tyler Durden