Justin’s note: America can’t stop talking about Alexandria Ocasio-Cortez (AOC).

AOC, if you haven’t heard, is a 29-year-old democratic socialist. Earlier this month, she became the youngest woman ever elected to Congress.

And that concerns me. I say this because her platform is every socialist’s dream. She wants Medicare to be free. She wants college education to be free. She wants to cancel student debt. She wants to hike the minimum wage to $15. And she wants to replace oil and gas with green energy by 2030.

Now, I realize these ideas might sound good to some people. But none of this would come free. It would require massive tax hikes and a lot more national debt.

In short, she’s advocating for policies that often destroy entire economies.

Yet, she’s one of today’s most popular political figures.

I wanted to see what Casey Research founder Doug Casey thinks of AOC and her policies. So I got him on the phone to discuss his thoughts for this week’s Conversations With Casey…

Justin: Doug, AOC has been getting a lot of press lately. What are your thoughts on her? Specifically, what do you think of her platform and her idea for a Green New Deal?

Doug: Most likely she’s the future of the Democratic Party – and of the U.S. Why? She’s cute, vivacious, charming, different, outspoken, and has a plan to Make America Great Again. And she’s shrewd. She realized she could win by ringing doorbells in her district, where voter turnout was very low, and about 70% are non-white. There was zero motivation for residents to turn out for the tired, corrupt, old hack of a white man she ran against.

She’s certainly politically astute – but doesn’t seem very intelligent. In fact, she’s probably quite stupid. But let’s define the word stupid, otherwise, it’s just a meaningless pejorative – name-calling.

But in fact it doesn’t seem like she has a very high IQ. I suspect that if she took a standardized IQ test, she’d be someplace in the low end of the normal range. But that’s just conjecture on my part, entirely apart from the fact a high IQ doesn’t necessarily correlate with success. Besides, there are many kinds of intelligence – athletic, aesthetic, emotional, situational…

A high IQ can actually be a disadvantage in getting elected. Remember it’s a bell-shaped curve; the “average” person isn’t terribly smart, compounded by the fact half the population has an IQ of less than 100. And they’re suspicious of anyone who’s more than, say, 15 points smarter than they are.

However, there are better ways to define stupid than “a low score on an IQ test,” that apply to Alexandria. Stupid is the inability to not just predict the immediate and direct consequences of actions, but especially the indirect and delayed consequences of your actions.

She’s clearly unable to do that. She can predict the immediate and direct consequences of the policies she’s promoting – everybody getting excited about liberating all other people’s wealth that just seems to be sitting around. Power to the People, and Alexandria! But she’s unable to see the indirect and delayed consequences of her policies – which I hope I don’t have to explain to anyone now reading this.

If you promise people unicorns, lollipops, and free everything, they’re going to say, “Gee, I like that, let’s do it.” She’s clever on about a third grade level.

But there’s an even better definition of stupid. Namely, “an unwitting tendency to self-destruction.” All the economic ideas that she’s proposing are going to wind up absolutely destroying the country.

It’s as if she thinks that what’s happened recently in Venezuela, Zimbabwe – not to mention Mao’s China, the Soviet Union, and a hundred other places – was a good thing.

That’s my argument for her being stupid. And ignorant as well. But perhaps I’m missing something. After all, Karl Marx was both highly intelligent, and extremely knowledgeable; he was actually a polymath. The same can be said of many academics, left-wing economists, and socialist theoreticians.

So perhaps a desire for “socialism” isn’t just an intellectual failing. It’s actually a moral failing.

Justin: What do you mean?

Doug: Socialism is basically about the forceful control of other people’s lives and property.

I’m afraid Alexandria is evil on a basic level. I know that sounds silly. How can that be true of a cute young girl who says she wants just sunshine and unicorns for everybody? It’s too bad the word “evil” has been so compromised, so discredited, by the people who use it all the time – bible-thumpers, hysterics, and religious fanatics. Evil shouldn’t be associated with horned demons and eternal perdition. It just means something destructive, or recklessly injurious.

The world would be better off if she went back to waitressing and bartending.

Justin: Why do you think she’s resonating with so many people then? Is it because she represents something different from status quo, or is it because people actually like her ideas?

Doug: It really helps to be young, good looking, and have a nice smile. But there are immense problems in the U.S., at least just under the surface. Wouldn’t it be nice if everybody had a job paying at least $15 an hour, free schooling, housing was a basic human right, free medical, free food, and 100% green energy? I know it doesn’t sound evil – it just sounds stupid. But it’s actually both.

The problem isn’t just that she got elected on this platform in a benighted – but increasingly typical – district. The problem is that most young people in the U.S. have her beliefs and values.

The free market, individualism, personal liberty, personal responsibility, hard work, free speech – the values of western civilization – are being washed away, everywhere. But it’s hard to defend them, because the argument for them is intellectual, economic, and historical. While the mob, the capita censi, the “head count” as the Romans called them, is swayed by emotions. They feel, they don’t think. Arguments are limited to Twitter feeds. Or 30-second TV sound bites.

Justin: Can you elaborate?

Doug: When somebody says, for instance, “Why can’t we have free school for everybody? The university buildings are already built. The professors are already there. So why can’t everybody just go to class, and learn about gender studies?” The same arguments are made for food, shelter, clothing, entertainment, communication – everything in fact.

To counter that, you have to come up with specific reasons for why not. You end up sounding like a Negative Nelly because you’re telling people they can’t have something.

I guess I’ve given too much credit to the goodwill and the common sense of the average American. The proof of that is the success of AOC. The psychological aberrations of the average human are being brought to the fore.

It’s exactly the type of thing the Founders tried to guard against by restricting the vote to property owners over 21, going through the Electoral College. Now, welfare recipients who are only 18 can vote, and the Electoral College is toothless. Some want to totally abolish the College, and have even 16-year-olds and illegal aliens voting.

Justin: What are the chances that the U.S. adopts her Green New Deal plan or something similar? It seems increasingly likely that America will head in that direction in the coming years.

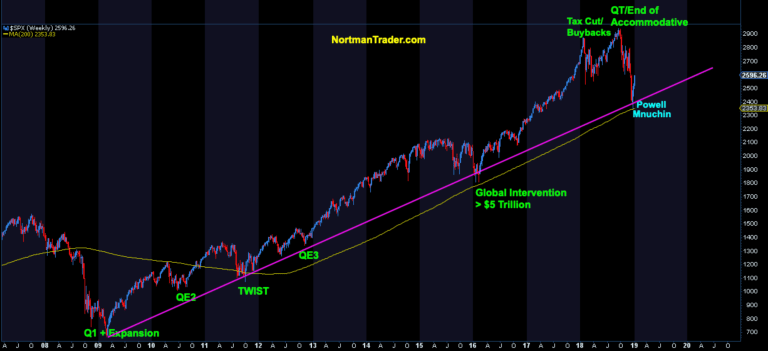

Doug: The U.S. will absolutely adopt something like that once Trump is out of office. They’ll do it for a half dozen cockamamie reasons that aren’t germane to this conversation. For the last couple of generations, everybody who’s gone to college has been indoctrinated with leftist ideas. Almost all of the professors hold these ideas. They place an intellectual patina on top of nonsensical emotion and fantasy-driven ideas.

Nobody, except for a few libertarians and conservatives, are countering the ideas AOC represents. And they have a very limited audience. The spirit of the new century is overwhelming the values of the past.

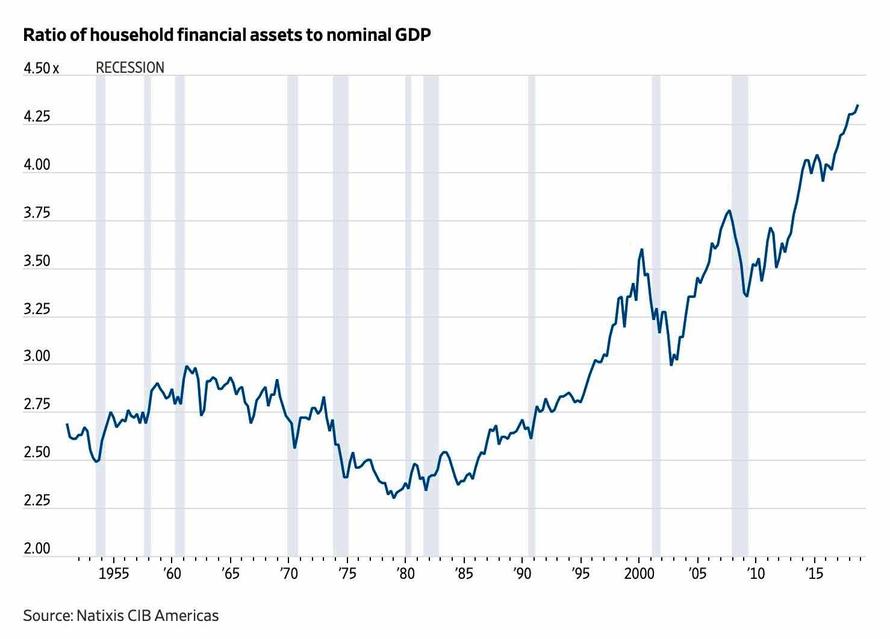

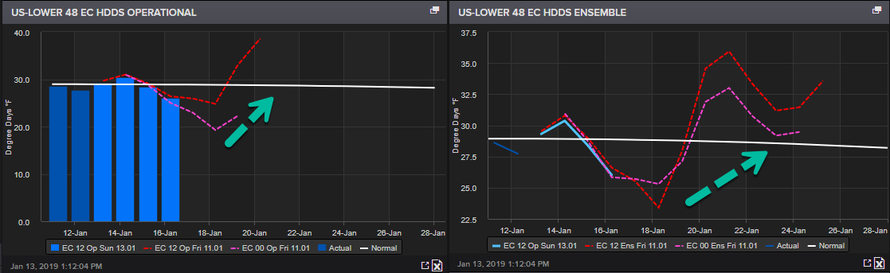

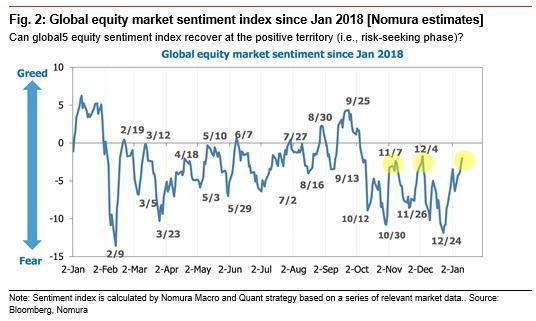

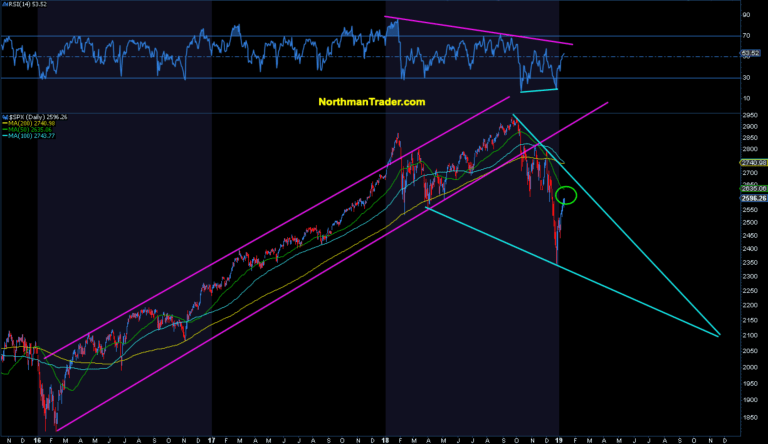

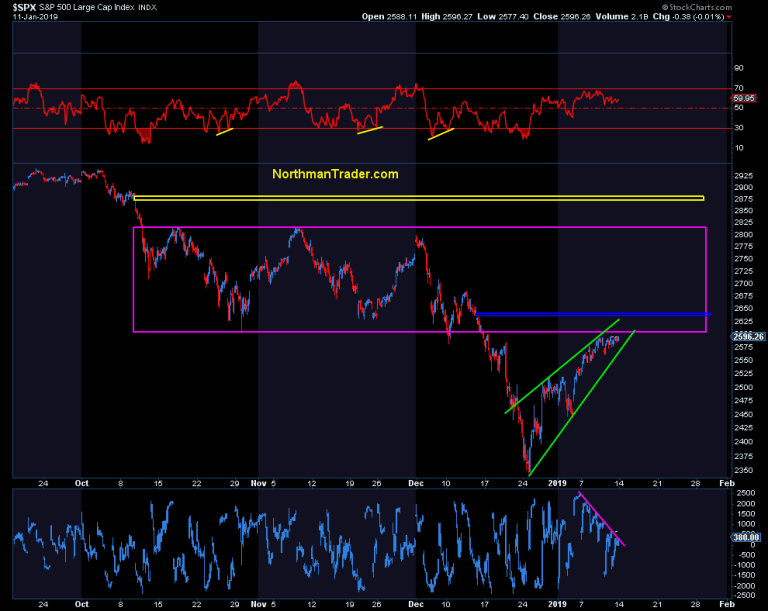

When the economy collapses – likely in 2019 – everybody will blame capitalism, because Trump is somehow, incorrectly, associated with capitalism. The country – especially the young, the poor, and the non-white – will look to the government to do something. They see the government as a cornucopia, and socialism as a kind and gentle answer. Everyone will be able to drink lattes all day at Starbucks while they play with their iPhones.

The people that will control the government definitely won’t want to be seen as “do nothings.” Especially while the ship of state is sinking in The Greater Depression. They’ll want to be seen as forward thinkers and problem solvers.

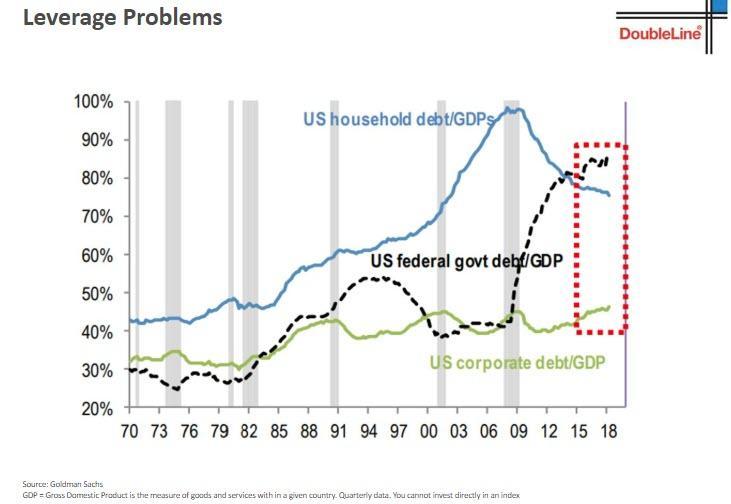

So we’re going to see much higher taxes, among other things. There’s no other way to pay for these programs, except sell more debt to the Fed – which they’ll also do, by necessity.

The government is bankrupt. But like all living things from an amoeba to a person to a corporation, its prime directive is to survive. The only way a bankrupt government can survive is by higher tax revenue and money printing. Of course, don’t discount a war; these fools actually believe that would stimulate the economy – the way only turning lots of cities into smoking ruins can.

I don’t see any way out of this.

Justin: Doug, AOC is proposing a 70% marginal tax rate to finance the Green New Deal? Could something like that actually happen?

Doug: Of course, you’ve got to remember that as recently as the Eisenhower administration the top marginal tax rate was 91%. The average person didn’t pay that because it was a steeply progressive tax rate. Nobody did, frankly, because there were loads of tax shelters, which no longer exist, including hiding money offshore.

In Sweden during the 1970s, the marginal tax rate, including their wealth tax, was something like 102%. So, almost anything is possible in today’s world.

Of course they’ll raise taxes. It’s time to eat the rich. But, perversely, many of the rich will deserve it, since many made their money as cronies during the long inflationary boom.

But look at the bright side. Look at this from AOC’s point of view. She doesn’t just get $200,000 a year plus massive benefits. That’s chicken feed. But lucrative speaking fees, director’s fees, consulting fees, emoluments from the inevitable Ocasio-Cortez Foundation, multimillion-dollar book deals, and sweetheart investment deals. Not counting undisclosed bribes. She’ll be worth $100 million in no time, like Clinton and Obama.

That’s not even the best part. She’ll be idealized, lionized, and apotheosized by an adoring public. The media will hang on her every word. That’s pretty rich for a stupid, evil dingbat. Other young socialist idealists will try – and succeed – in replicating her success. Congress will increasingly be filled with her clones.

Frankly, at this point, resistance is futile.

Justin: Thanks for speaking with me today, Doug.

Doug: You’re welcome.

via RSS http://bit.ly/2VRRhBZ Tyler Durden